Folks store at Lincoln Market on June 12, 2023 within the Prospect Lefferts Gardens neighborhood within the Brooklyn borough of New York Metropolis.

Michael M. Santiago | Getty Photographs Information | Getty Photographs

Inflation slowed in Might to the bottom price in two years, largely on the again of declining costs for power like gasoline and electrical energy, the U.S. Bureau of Labor Statistics mentioned Tuesday. However some areas of family budgets have not seen a lot enchancment in current months, a possible concern.

Inflation measures how shortly costs are altering throughout the U.S. economic system.

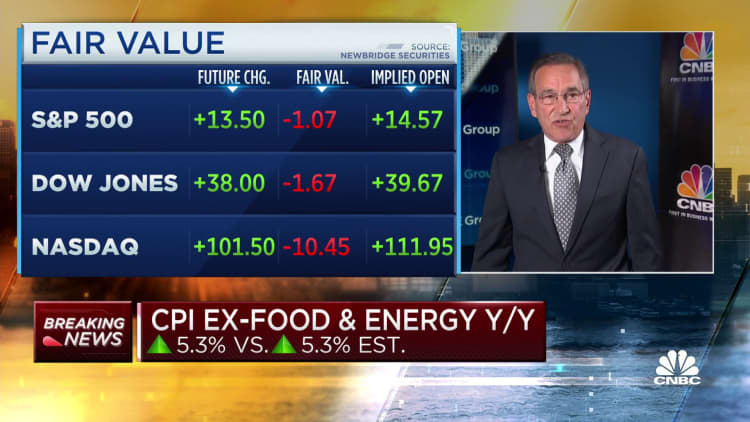

The patron worth index elevated 4% in Might relative to a 12 months earlier, a slowdown from 4.9% in April.

The CPI is a key barometer of inflation, measuring costs for something from vegatables and fruits to haircuts or live performance tickets.

The place customers noticed inflation, deflation in Might

Customers noticed gasoline costs decline 5.6% between April and Might, in response to the CPI report.

Costs have fallen dramatically from a spike within the first half of 2022 that was a results of Russia’s invasion of Ukraine. Costs on the pump are down 20% up to now 12 months.

“Power costs right now final 12 months have been simply absurd,” Leer mentioned.

Grocery costs rose barely from April to Might after declining through the two months prior. The “meals at residence” index is up 6% up to now 12 months.

However meals and power costs may be risky. That is why economists use a measure that strips out such classes to get a greater sense of inflation’s trajectory going ahead. The measure — so-called “core CPI” — has considerably plateaued because the fall.

“The progress on core inflation has stalled out in current months,” mentioned Greg McBride, chief monetary analyst at Bankrate.

Housing is the largest expense for the common shopper. Shelter prices have been the most important contributor to core CPI in Might, in response to the BLS.

Shelter costs rose 0.6% in Might, up from 0.4% in April. They’re up 8% up to now 12 months. Nonetheless, economists anticipate housing costs to begin falling within the second half of the 12 months.

Month-to-month costs for used vehicles and vans, motorcar insurance coverage, attire, private care and training additionally elevated notably in Might, the BLS mentioned.

When measuring will increase over the previous 12 months, notable classes embrace motorcar insurance coverage (which noticed costs bounce by 17.1%), recreation (4.5%), family furnishings and operations (4.2%), and new autos (4.7%).

Apart from power, many shopper classes additionally deflated from April to Might, together with airline fares, communication, new autos and recreation, in response to the BLS. The month-to-month 0.6% decline in family furnishings and operations was the class’s first decline since June 2021 and the most important since August 2009.

Over the previous 12 months, there was deflation in classes like airline fares, automobile and truck leases, citrus fruits, contemporary entire milk, and used vehicles and vans.

Why inflation surged within the pandemic period

Inflation through the pandemic period has been a “sophisticated phenomenon” stemming from “a number of sources and sophisticated dynamic interactions,” in response to a current paper co-authored by Ben Bernanke, former chair of the U.S. Federal Reserve, and Olivier Blanchard, senior fellow on the Peterson Institute for Worldwide Economics.

Shopper costs started rising quickly in early 2021 because the U.S. economic system reopened after its Covid-induced shutdown. Individuals unleashed a flurry of pent-up demand for eating out, leisure and holidays, aided by financial savings amassed from authorities reduction, months of curbed spending and rock-bottom borrowing prices.

In the meantime, the speedy financial restart snarled world provide chains. That dynamic was exacerbated by Russia’s invasion of Ukraine, which additionally fueled increased costs for meals, power and different commodities.

Fed coverage acts with a lag, one which impacts totally different sectors of the economic system in several methods and at totally different instances.

Greg McBride

chief monetary analyst at Bankrate

In different phrases, provide could not sustain with customers’ willingness to spend.

Inflation, which elevated in economies around the globe through the Covid-19 pandemic period, was initially siloed in classes of bodily items similar to used vehicles and vans.

However the dynamic has considerably modified. Now, the labor market seems to be taking part in an even bigger position than a scarcity of bodily items, economists mentioned.

Because the economic system reopened after the pandemic, companies rushed to rent employees and job openings surged to report highs. That demand tilted the job market in favor of employees, who had ample alternatives. They noticed wages develop at their quickest tempo in many years as employers competed to rent them.

That sturdy wage development has nudged employers, particularly labor-intensive service companies, to boost costs to assist compensate for increased labor prices, economists mentioned.

There are indicators that labor dynamic is easing, although — which ought to put downward stress on total inflation.

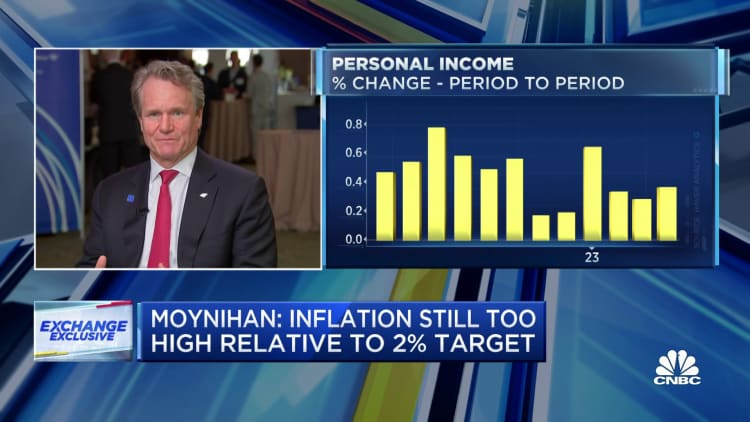

The Federal Reserve has been elevating borrowing prices aggressively since early 2022 to rein in demand amongst customers and companies, and finally deliver inflation again to its 2% annual goal. Fed officers are assembly this week and are anticipated to announce a pause of their marketing campaign to boost rates of interest, no less than in the meanwhile.

“Fed coverage acts with a lag, one which impacts totally different sectors of the economic system in several methods and at totally different instances,” mentioned McBride. Leaving rates of interest unchanged would permit officers to judge the cumulative impact of coverage thus far and “see whether it is having the specified influence,” he added.