pabst_ell

Introduction

Transocean Ltd. (NYSE:RIG) launched its first quarter 2023 outcomes on Could 1, 2023.

Additionally, Transocean printed its final fleet Standing Report on April 19, 2023. The contract backlog was $8.6 billion as of the April 2023 Fleet Standing Report.

Notice: I’ve adopted RIG quarterly since 2014. This new article updates my article printed on April 18, 2023.

Since then, on Could 10, 2023, Transocean introduced that (emphasis added):

Transocean Equinox was awarded a five-well contract in Australia by a serious operator, representing roughly $137 million in agency backlog, excluding full cost for mobilization and a demobilization charge. The estimated 300-day contract is predicted to start within the first quarter of 2024. The contract additionally gives for a one-well choice, doubtlessly conserving the cruel atmosphere semisubmersible in Australia by the primary quarter of 2025.

1 – 1Q23 outcomes snapshot

Transocean got here out with a disappointing quarterly lack of $465 million, or $0.64 per share, in comparison with a lack of $0.26 a 12 months in the past. The adjusted loss was $0.38 per share. The outcomes had been under analysts’ expectations.

Transocean’s disappointing efficiency this quarter was because of a weaker outcome from Harsh Setting floaters.

Money from operations was a lack of $47 million, and quarterly free money move was a lack of $128 million in 1Q23.

Working and upkeep expense was $409 million, in comparison with $412 million within the prior interval.

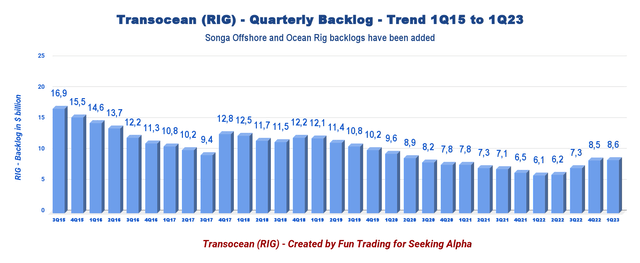

The backlog has dropped constantly regardless of two acquisitions (Songa Offshore and Ocean Rig) and has reached a all-time low of $6.1 billion in 1Q22.

Nevertheless, the corporate is now turning round, and contracts are lastly exhibiting length and each day charge enhancements. The backlog is now $8.6 billion as of April 18, 2023.

Under is the backlog historical past since 2015.

RIG Quarterly Backlog Historical past (Enjoyable Buying and selling)

Nevertheless, plainly Q1 2023 is exhibiting a prime, and we might even see some draw back once more. Up to now, new contracts introduced after April 18 totaled solely $137 million, far under the alternative charge.

Transocean’s Extremely-deepwater floater revenues characterize 74.7% of contract drilling revenues ($485 million). Harsh Setting floaters accounted for the remaining 25.4% ($165 million). That is in contrast with the year-ago quarter’s reported figures of $390 million and $196 million.

Transocean owns or has partial possession pursuits in and operates a fleet of 37 cell offshore drilling models, consisting of 27 ultra-deepwater floaters and 10 harsh atmosphere floaters. As well as, Transocean is setting up one ultra-deepwater drillship and holds a noncontrolling possession curiosity in an organization that’s setting up one ultra-deepwater drillship.(FSR April 18)

CFO Mark Mey mentioned within the convention name:

Money move from operations was a unfavorable $47 million ensuing from decrease collections from prospects reflective of lowered income because of sure rigs finishing their contracts through the earlier quarter, disbursements incurred getting ready a number of rigs for our subsequent contracts and the timing of tax and curiosity funds.

2 – Funding thesis

I’ve adopted Transocean for almost a decade on Looking for Alpha, and I’ve decided that the corporate will at all times battle as a result of unpredictable and expensive nature of the offshore enterprise.

Transocean is a good firm, however it can not generate enough money move regardless of the numerous enhance in enterprise lately. As I’ve mentioned quite a few instances, the enterprise mannequin connected to offshore drillers is essentially flawed as a result of extreme CapEx requirement, the price of doing enterprise, and the anticipated low-profit margin in comparison with the danger.

Concerning the funding thesis, it’s almost unattainable to suggest RIG as a long-term potential. The corporate is extremely indebted and has generated recurring losses in free money move for so far as I keep in mind. Additionally, the corporate isn’t paying a dividend.

Thus, RIG isn’t fitted to each investor’s portfolio however suits solely a particular form of dealer searching for high-risk/reward potential. With the precise buying and selling LIFO technique, you’ll be able to revenue handsomely and keep away from sleepless nights whereas rising a pleasant recurring acquire that you should utilize to construct a protracted place risk-free.

Subsequently, I recommend short-term buying and selling LIFO, about 80%-85% of your RIG place, and conserving solely a tiny long-term core place for an eventual larger goal.

This twin technique entitles you to take full benefit of the offshore drilling sector’s excessive volatility and inherent cyclicity. It’s what I recommend in my market, “The Gold and Oil Nook.”

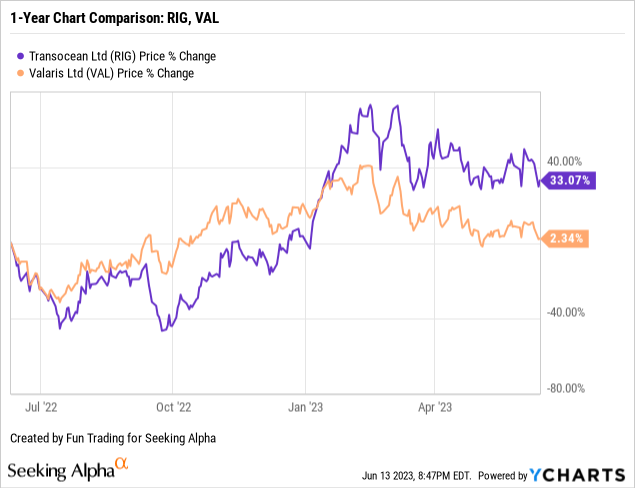

3 – Inventory efficiency

Transocean has considerably underperformed Valaris Restricted (VAL) on a one-year foundation. RIG is now up 2% on a one-year foundation.

4 – Common day charges and utilization for 1Q23

The primary quarter common day charge elevated to $364.1k/d from the year-ago degree of $334.5k/d, up 8.8%. Nevertheless, the typical each day charge elevated extra sequentially, which is encouraging. Utilization barely raised from the identical quarter a 12 months in the past and reached 51.9%.

| Day charges | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| The common each day charge is $okay/d | 334.5 | 358.1 | 343.4 | 348.6 | 364.1 |

| Common Utilization | 52.7% | 58.2% | 59.4% | 49.4% | 51.9% |

Transocean – 1Q23 and Chosen Financials Historical past – The Uncooked Numbers

| Transocean | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Whole contract drilling in $ Billion | 0.586 | 0.692 | 0.691 | 0.606 | 0.649 |

| Web Earnings in $ Million | -175 | -68 | -28 | -350 | -465 |

| EBITDA $ Million | 165 | 249 | 284 | 153 | 35 |

| EPS diluted in $/share | -0.26 | -0.10 | -0.04 | -0.50 | -0.64 |

| Money from working actions in $ Million | -1 | 41 | 230 | 178 | -47 |

| Capital Expenditure in $ Million | 106 | 115 | 87 | 409 | 81 |

| Free Money Circulate in $ Million | -107 | -74 | 143 | -231 | -128 |

| Money and short-term investments $ Billion | 0.911 | 0.729 | 0.954 | 0.683 | 0.747 |

| Lengthy-term debt in $ Billion (together with present) | 7.011 | 7.223 | 7.201 | 7.347 | 7.625 |

| Shares excellent (diluted) in Million | 664 | 692 | 714 | 726 | 728 |

| Backlog | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| RIG Backlog in $ billion | 6.1 | 6.2 | 7.3 | 8.5 | 8.6 |

Supply: press launch.

* Estimated by Enjoyable Buying and selling.

Evaluation: Revenues, Earnings Particulars, Free Money Circulate, and Web Debt

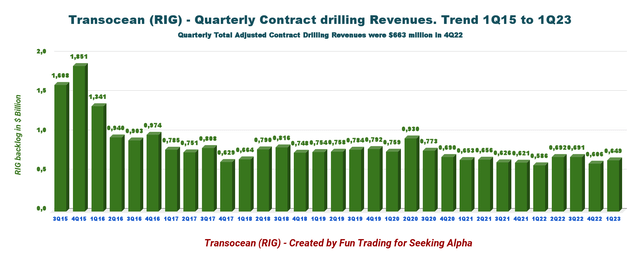

1 – The corporate posted quarterly revenues of $649 million in 1Q23

Notice: The full adjusted contract drilling revenues had been $667 million, from $730 million in 3Q22.

Notice: RIG had $18 million in contract intangible property amortization.

RIG Quarterly Income Historical past (Enjoyable Buying and selling)

Transocean’s revenues in 1Q23 had been $649 million, up from $586 million in 1Q22, a rise of 10.8%. Whole adjusted contract drilling revenues had been $667 million in 1Q23. Income effectivity was excessive this quarter at 97.8%, in comparison with 98.0% within the prior quarter.

The web loss within the first quarter of 2023 was $465 million or $0.64 per diluted share.

The adjusted EBITDA was $217 million this quarter.

Contract drilling revenues for the three months ended March 31, 2023, elevated sequentially by $43 million to $649 million, primarily because of elevated exercise for rigs that returned to work after being idle within the fourth quarter and elevated dayrate for 2 rigs, partially offset by two fewer calendar days within the first quarter.

CEO Jeremy Thigpen mentioned within the convention name:

Throughout the quarter, we booked almost $900 million of contract backlog, disrupting the primary quarter low noticed in years previous. Actually, that is greater than double the backlog added within the first quarter of 2022 and greater than seven instances what we added within the first quarter of 2021. We consider that is one other clear indication of the sustainability of this constructive market atmosphere, notably in gentle of the file backlog we booked final 12 months.

I’m at all times amazed by the optimism demonstrated by CEO Jeremy Thigpen, which contrasts with the recurring and disappointing quarterly outcomes that we’ve skilled prior to now ten most up-to-date quarters, with the web “revenue” turning to a staggering loss. Hopefully, this disappointing development will change in 2Q23.

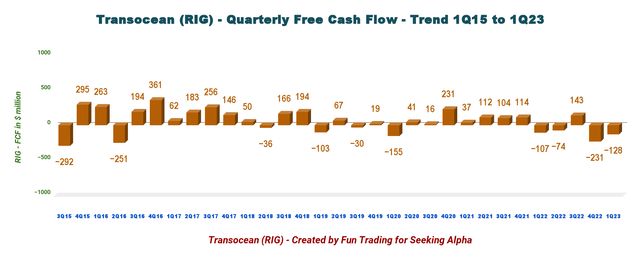

2 – Free money move was a lack of $128 million in 1Q23

RIG Quarterly Free Money Circulate Historical past (Enjoyable Buying and selling)

Vital Notice: The generic free money move is the money from working actions minus CapEx.

The money from operations was a lack of $47 million in 1Q23, whereas CapEx dropped to $81 million from $409 million within the previous quarter. RIG had a free money move lack of $128 million in 1Q23. Trailing 12-month free money move loss was $290 million.

CFO Mark Mey mentioned within the convention name:

Our free money move of unfavorable $128 million within the first quarter displays the contract preparations above and $81 million of capital expenditures, which had been largely associated to our eighth era drill strips the Deepwater Atlas and Deepwater Titan.

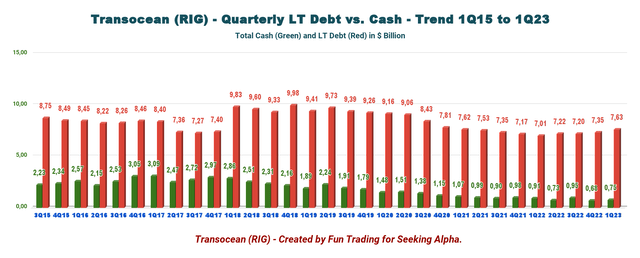

3 – Web debt (gross debt minus complete money) elevated once more sequentially to $6.878 billion in 1Q23

RIG Quarterly Money versus Debt Historical past (Enjoyable Buying and selling)

Web debt is about $6.88 billion as of March 31, 2023, in comparison with $6.10 billion in the identical quarter a 12 months in the past. Whole liabilities, together with present, had been $9.87 Billion in March 2023 in contrast with $9.64 billion in 4Q22.

Nevertheless, the whole money was $747 million, up sequentially (please see the chart above).

The shares excellent diluted for 1Q23 jumped to 728 million shares, up 9.6% on a one-year foundation.

CFO Mark Mey mentioned within the convention name:

We ended the primary quarter with complete liquidity of roughly $1.7 billion together with unrestricted money and money equivalents of roughly $747 million roughly $175 million of restricted money for debt service and $774 million from an undrawn revolving credit score facility.

4 – 2Q23 and 2023 steering

- For the second quarter of 2023, Transocean expects adjusted contract drilling revenues of $735 million, with O&M bills of round $460 million. Some progress is anticipated in 2Q23 in comparison with 1Q23. The corporate is indicating a rise of 10% QoQ. Sadly, the CapEx enhance might eat a lot of the advantages.

- RIG indicated web curiosity bills for the second quarter between $118 million and $479 million.

- Lastly, CapEx is estimated at $100 million, which incorporates $70 million associated to new builds and $30 million for upkeep capex within the second quarter.

- For FY23, the corporate forecasts O&M bills of $1.9 billion and expects adjusted contract revenues between $2.9 and $3 billion.

CFO Mark Mey mentioned within the convention name:

This quarter-over-quarter enhance is primarily attributable to a full quarter of utilization of the Transocean Barents and DD3, we began contracts within the prior quarter and the contract graduation of the Deepwater Titan and Transocean Norge through the second quarter, partially offset by in between contract auto [ph] time had been Transocean Endurance in Norway.

Technical Evaluation and Commentary

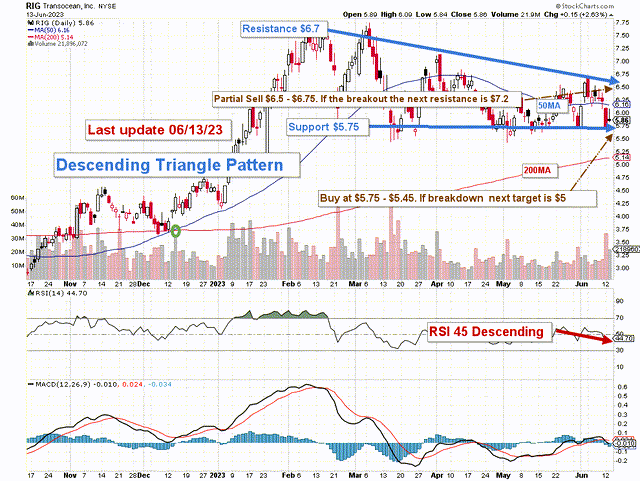

RIG TA Chart Quick-Time period (Enjoyable Buying and selling StockCharts)

RIG types a descending triangle sample, with resistance at $6.7 and help at $5.75.

The descending triangle is a bearish formation that normally types throughout a downtrend as a continuation sample. There are cases when descending triangles kind as reversal patterns on the finish of an uptrend, however they’re usually continuation patterns.

I like to recommend conserving a tiny long-term Transocean Ltd. place and utilizing about 80%-85% to commerce LIFO whereas ready for a better ultimate worth goal in your core place between $7 and $8.

In my previous article, I indicated that I bought my long-term place at $7.10 and have traded RIG short-term since then. This technique has not modified, and I’ve finished particularly nice enjoying the waves based mostly on oil and fuel worth fluctuations. Thus, regardless of a weak and regarding stability sheet, I like to recommend RIG as a wonderful buying and selling car.

I recommend promoting ~40% between $6.50 and $6.75 and one other 40% above $7.20. I like to recommend ready for a retracement between $5.75 and $5.45 to build up once more, with potential decrease help at $5.00 if help can not maintain.

Warning: The TA chart have to be up to date ceaselessly to be related. It’s what I’m doing in my inventory tracker. The chart above has a potential validity of a couple of week. Keep in mind, the TA chart is a device solely that can assist you undertake the precise technique. It isn’t a strategy to foresee the long run. Nobody and nothing can.