Jefferies analyst Suneet Kamath has re-opened a buying and selling pair of Maintain-rated MetLife (NYSE:MET) over Underperform-rated Prudential Monetary (NYSE:PRU).

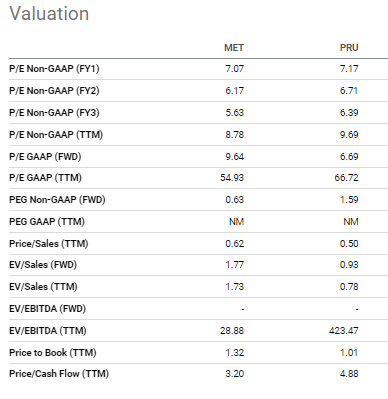

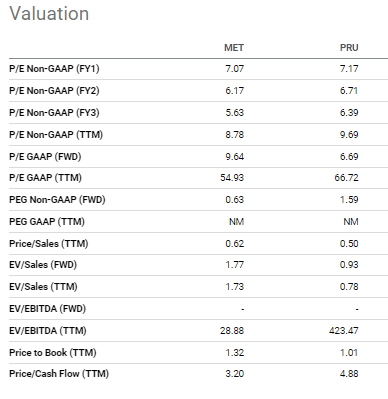

Gaps in each valuation and year-to-date relative efficiency of the 2 shares seem unwarranted primarily based on underlying fundamentals, Kamath mentioned in a notice to purchasers. 12 months-to-date, MetLife (MET) shares have dropped 24%, whereas Prudential’s (PRU) have slipped 13%.

Whereas MetLife (MET) has extra publicity to CMLs, notably in workplace, “we view its stronger extra capital place as a significant offset,” the analyst mentioned. Jefferies additionally expects MetLife to learn extra when sentiment improves to the extent that financial issues start to say no.

In enterprise combine, Kamath expects excessive P/E segments will make up a bigger portion of MET’s earnings (27%) relative to low P/E operations (9%) by 2026. And whereas PRU’s enterprise combine will shift towards larger P/E operations, he estimates they’re going to solely make up 13% of PRU 2026 earnings, with low P/E operations accounting for 20%.

He estimated MetLife (MET) might be in a a lot stronger place concerning extra capital than Prudential (PRU).

On credit score high quality, the 2 shares display screen equally. “At a excessive degree, there doesn’t look like materials variations between the 2,” Kamath mentioned.

Evaluate MET’s metrics with PRU right here.

Notice that the SA Quant system charges MetLife (MET) and Prudential (PRU) each as Holds.