shapecharge

Each two weeks we plan to summarize what buyers anticipate over the intermediate to long run by compiling funding surveys and by measuring investor exercise.

Investor Surveys

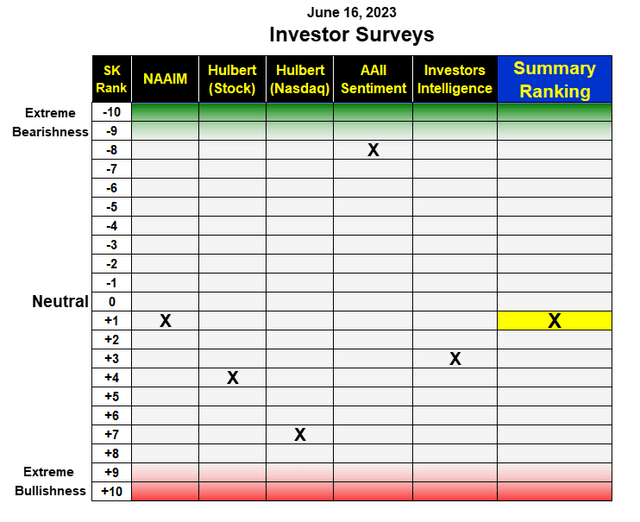

We monitor 5 funding surveys and graph them on the Sentiment King rating scale. The size goes from “very bullish” to “very bearish” and you will find a full clarification on this earlier article. Nevertheless it’s considerably intuitive for those who research the desk under and skim the abstract of every survey.

The surveys level to a continuation of the rally and better inventory costs.

Desk of Main Funding Surveys (Sentiment King)

The AAII Member Sentiment Survey – Final week’s survey of the American Affiliation of buyers had 45.2% of members bullish, 32% impartial and 22.7% bearish. Whereas the p.c is quickly transferring towards extra bulls, our intermediate time period rankings of this survey is –7, which remains to be slightly bearish.

Traders Intelligence Publication Survey – Final week the granddaddy sentiment indicator discovered 53.4% of publication writers bullish, 20.6% bearish and 26% anticipating a correction. This once more is the very best bullish p.c in over a yr. The Sentiment King Rating of this survey is +3, which is the bullish aspect of impartial.

NAAIM Publicity Index – The publicity index represents the common funding place of the American Affiliation of Energetic Funding Managers. The present studying is 80.6, which suggests they’re on common 80% invested. Our rating places this index at +1, which is simply previous impartial.

Hulbert Inventory Survey – Our rating of the Hulbert inventory market survey is +4, which places it midway between impartial and intensely bullish.

Hulbert Nasdaq Survey – Our rating of the Hulbert Nasdaq survey is +7, which places it simply two items shy of utmost bullishness. That is to be anticipated due to the sturdy rally in Nasdaq shares.

The abstract rating of all 5 surveys is +1. That is barely on the bullish aspect of impartial and is way from being “too bullish.” This low rating after a seven month rally is a constructive signal for even greater inventory costs.

Investor Exercise

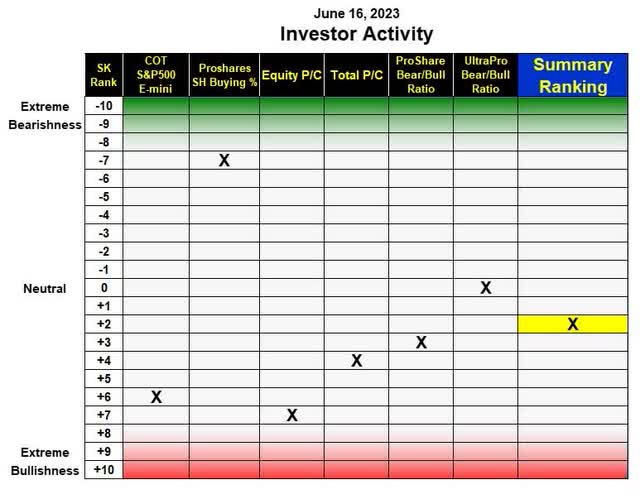

We additionally analyze what buyers are shopping for and promoting to find out what they anticipate the inventory market to do. We monitor six metrics; 5 are calculated every day.

Investor Exercise Desk (Sentiment King)

Whole Places and Calls Ratio – Increased costs is encouraging extra name shopping for and fewer put purchases, which lowers the places to calls ratio. Our transferring common of the ratio of all CBOE choices is now .88. This places it at +4 on the SK rating scale, which is midway between impartial and really bullish.

Fairness Places to Calls Ratio – The identical is true of the ratio of fairness “places to calls.” The present ratio is .56, which places it +7 on the SK rating scale. It is quickly approaching ratios which are related to excessive bullishness up to now. Historical past exhibits that is the most suitable choice indicator of market path.

S&P 500 E-mini COT – Brief positions of asset managers of E-mini S&P futures fell once more final week to 23.3%. This places it as +6 on the rating scale and solely two notches away from the very bullish purple zone. It deserves to be watched very rigorously going ahead.

ProShares S&P 500 brief fund (SH) – Buy ranges of this brief fund, which have been declining, had been unchanged final week at 12%. It’s nonetheless close to the inexperienced zone as numerous buyers proceed to brief this market as costs transfer greater. This indicator is constructive for the inventory market

ProShares Bear/Bull Ratio – The ratio of ProShares buyers shopping for brief funds versus lengthy funds fell to 75%. That is +3 on the rating scale and simply barely the bullish aspect of impartial. Whereas many buyers at the moment are bullish, there’s nonetheless a major sum of money going into brief funds. That is constructive for a continuation of the rally

ProShares Extremely Professional Bear/Bull Ratio – The ratio of the cash going into Extremely Professional brief funds versus Extremely Professional lengthy funds is presently 63%. That is zero on the rating scale, which is totally impartial.

The abstract rating of all six metrics of investor exercise is +2. That is another than the funding survey rating. However it is usually removed from being too bullish. That is one other constructive signal for greater inventory costs.

The Grasp Sentiment Indicators

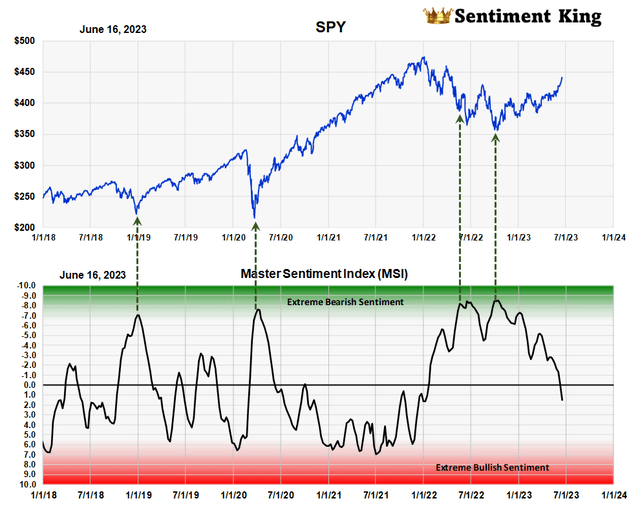

We created two grasp sentiment indicators. Every is a composite indicator made by combining a few of the indicators you’ve simply seen into one.

The grasp sentiment indicator, known as the MSI, is for long run traits and is up to date weekly.

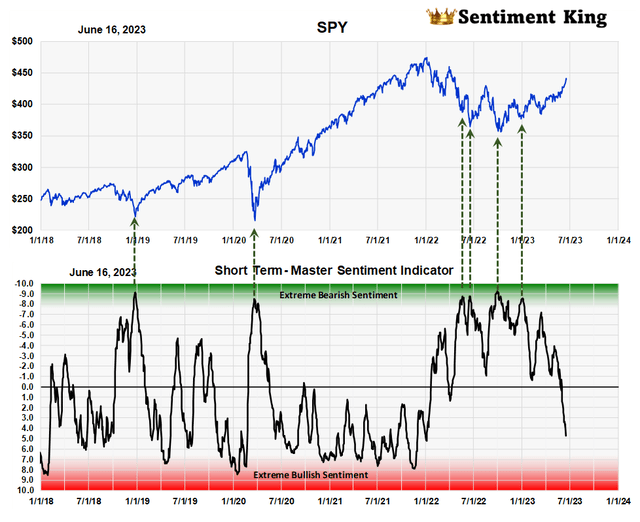

The opposite, known as the brief time period grasp sentiment (ST-MSI), consists of seven indicators. It’s up to date every day.

Let’s first take a look at the long run MSI.

The Grasp Sentiment Indicator (Sentiment King)

After reaching extraordinarily bearish readings final summer season and in October, as indicated by the 2 proper arrows, the indicator has lastly handed into the impartial space and is transferring in the direction of the purple zone, which represents excessive bullish sentiment.

As you may see, nevertheless, we’re not there but. It is a sturdy indication that costs will proceed to maneuver greater. There’s by no means been a serious decline since 2007 with out this composite indicator first transferring into the purple zone.

The ST-MSI

The chart under is a graph of the brief time period grasp sentiment indicator (ST-MSI). It measures shorter time period adjustments in investor sentiment.

This chart at +5 is extra bullish than the long run MSI nevertheless it nonetheless has a methods to go earlier than it turns into worrisome. So proper now it too is pointing to greater costs just like the MSI.

Brief Time period Grasp Sentiment Indicator (Sentiment King)

Conclusion

Investor surveys and buying and selling exercise level to rising bullishness, however the readings are nowhere close to the acute readings that usually happen earlier than costs start a serious correction. We get the identical bullish message from the MSI and ST-MSI composite indicators. We might expertise a 5% correction, however we should always not start a major worth decline from right here.

The Sentiment King

On the Sentiment King we measure how bullish or bearish buyers are. No financial indicator correlates higher with finding market tops and bottoms than investor sentiment.