Pgiam/iStock by way of Getty Photos

Funding Abstract

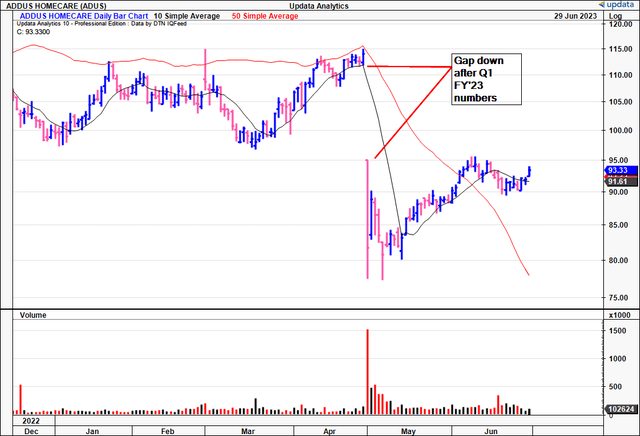

Following my April publication on Addus HomeCare Company (NASDAQ:ADUS) traders have exited the inventory en masse with the corporate now buying and selling again in early FY’22 vary.

The agency’s Q1 FY’23 numbers have been the catalytic occasion for the newest repricing, implying a diminished set of expectations from the market on ADUS going ahead. I had pared again my place on ADUS to carry in April, noting a sequence of potential headwinds, that wanted extra clarifications to keep away from uncertainty. Particularly, the 2 areas recognized consolidate to:

- Pressures to present operations;

- Challenges to future progress.

If a agency’s worth is made up of its steady-state operations plus the contribution from its progress initiatives, then ADUS hasn’t handed this funding examination. Turning to the current day, not a terrific deal has modified on the elemental outlook on the agency.

Internet-net, primarily based on the fruits of findings introduced on this report, there’s inadequate proof to counsel that ADUS is a purchase at its present ranges. Not even a pullback to earlier lows would have me , as there’s nigh a motive to consider ADUS may commerce above earlier highs with out the financial traits to again it up. Alas, I reiterate that ADUS is a maintain.

Determine 1.

Information: Updata

Important info to ADUS maintain thesis

Primarily based on the newest information, there isn’t any problem in reiterating ADUS as a maintain in my funding view. Findings from this evaluation counsel there are basic, financial and valuation components for consideration. Evaluation of every issue is telling on what traders can anticipate from the corporate going ahead.

1. Elementary components to the maintain thesis

Shut inspection of the corporate’s unit economics and Q1 financials, introduced in Might, reveal a lot concerning the funding info. It is very important analyse this due to the market’s response afterwards [just take a look at Figure 2]. Take into account these further information factors.

Unit economics

- Identical-store income progress was up 11.4% YoY. Notably– this progress excludes the income generated from entry to the New York CDPAP and American Rescue Plan Act (“ARPA”) funds.

- Over the previous 3 years, most of ADUS’s same-store progress within the private care phase has been pushed by charge will increase.

- Therefore, the positive factors are largely worth vs. quantity (demand) associated.

- Regardless of the above, ADUS booked positive factors in same-store hours per day (“HPD”). In Q1 FY’23, ADUS clipped a 5.3% acquire in HPD, with the identical exclusions as above. Sequentially, this was up 1.7% from This autumn FY’22.

-

On the conclusion of Q1, days gross sales excellent (“DSOs”) stood at 43.7 days, a sequential lower from 45.1 days.

Monetary outcomes, together with progress percentages

- Internet service income got here to $251.6mm in Q1, an 11% YoY progress, on adj. EBITDA of $26.1mm. The breakdown on this reveals that:

- Private care revenues contributed ~75.5% ($190mm, or $11.87/share) to the highest line

- Hospice care revenues stood at $49.1mm or 19.5% of gross sales, and

- Dwelling well being revenues amounted to $12.5mm (5% of turnover). Notice the agency’s long-term income and operational progress beneath.

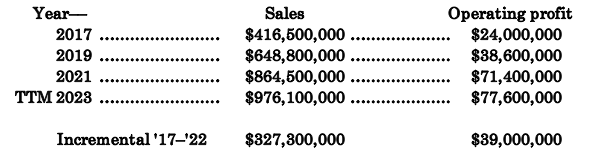

Desk 1.

Information: Creator, ADUS 10-Okay’s

- It pulled this to gross margin of 31.2%, up 20bps YoY. in comparison with 31% in the identical quarter of the earlier 12 months. Historic gross is 29.18%, so there’s upside on this at 31.2 factors, nonetheless that is nonetheless effectively beneath the sector’s 55.8% median gross.

- Additional, this spells some troubling arithmetic for the corporate’s enterprise economics. Say it grows revenues by one other 10% this 12 months, the agency clips 68–70% COGS margin, which means you are unlikely to see any of the ten% in turnover end in working leverage. For profitability to show off its lows going forward, income prices and working prices have to be addressed in whole to drive worth for shareholders, for my part.

- Furthermore, the corporate’s gross profitability has wound again off 5-year vary, though it has proven affordable uptick since FY’19. Nonetheless, on absolute values, you are getting 33% gross return on property for the capital that has been dedicated to after which by the enterprise. These aren’t engaging economics for my part, and warrants a impartial view.

Determine 2.

Information: Creator, ADUS 10-Okay’s

2. Financial components associated to ADUS’ operations

The agency is driving funding into its private care phase, the division the place it sees progress potential down the road. It booked a rise in hiring in Q1, with a median of 84 new hires per enterprise day. That is a 9.1% progress from the identical interval final 12 months, and up from 77 hires in This autumn.

I might additionally level out the speed will increase ADUS acquired in Illinois, its largest market. I had lined these intimately final evaluation, so these have been anticipated. It acquired a statewide charge enhance of $0.70 per hour on January 1 of this 12 months (once more, as anticipated). In the meantime, again in December, Illinois introduced an additional enhance of $1.26 per hour– therefore, the $0.70 is on prime of this. Consequently, the corporate’s Illinois state reimbursement charge now stands at $26.92 per hour. The agency believes this enhance will covers upcoming wage will increase on July 1.

Along with the above, take into account the next factors concerning the financial traits of ADUS’ enterprise:

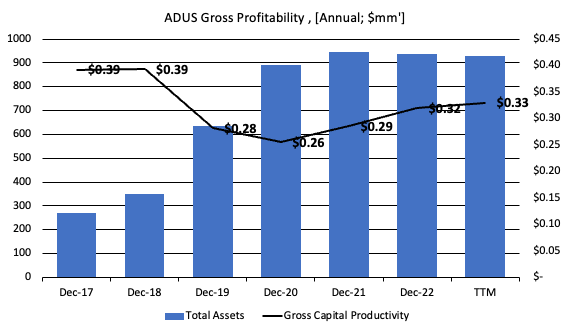

- Taking a long-term view, it is apparent ADUS has had a tough time assembly its value of capital, and, extra importantly, a tough time in beating the market return on capital.

- The annual return on ADUS’ capital has tightened in to 9% within the TTM.

- You is perhaps forgiven to assume this was a pandemic–induced affair, however these tendencies have been effectively in situ from 2017 not less than, and thus have been unlikely brought about from the identical.

- Most significantly to this funding thesis, is the very fact none of those returns have crushed the market’s hurdle charge ––12% on this evaluation–– indicating there’s been completely zero financial revenue generated for ADUS shareholders during the last 5 years so far. By all means, my evaluation suggests these tendencies will proceed going ahead.

These are tremendously unattractive enterprise economics. How will you anticipate ADUS to compound its intrinsic valuation, when traders can trip the benchmark at a ten–12% long-term common, while ADUS brings residence a return lower than this by itself (i.e. the shareholders) capital? The straightforward reply is, you’ll be able to’t. Too many different profitable alternatives exist, the place the worth of $1 is extra worthwhile within the firm’s palms than available in the market’s palms. Consequently, this helps a impartial view for ADUS.

Determine 3

Information: Creator, ADUS 10-Okay’s

3. Valuation components clamping future worth

If it weren’t sufficient of an ask from the info raised up to now, traders are promoting their ADUS inventory to you at 30x ahead earnings and 17.5x ahead EBIT, while the corporate trades at 2.3x e book worth of fairness.

Every of those are fairly the premium to sector friends, and I simply can’t get to advocating that ADUS ought to commerce at a premium to friends, primarily based on what’s been mentioned right here. Predominately, it hyperlinks again to the substandard returns on dedicated capital. The market is an correct decide of honest worth over time and can weight itself in the direction of corporations the place capital is appreciating of their palms. This is not the case for ADUS, as talked about. It does not compound capital greater and quicker than the market return, and so traders are unlikely ––extremely, extremely unlikely for my part–– to be bullish on any agency presenting with these financial traits.

What this says in valuation phrases is telling. You are being requested to pay c.18x ahead, but the prospect of this score greater is proscribed by ADUS’ incapacity to supply further earnings. Therefore, it’s my agency opinion the corporate ought to commerce again according to the sector at ~17x ahead and this will get me to $67.6 per share on my FY’23 EBIT estimates [these were presented in the last publication, with no changes to date, see: Fig 12.]. Even at 18x, you are attending to $71.30. You will notice that is effectively off earlier estimates of mine. To this, additionally notice 1) I’m utilizing a a lot greater low cost charge right here [12% vs. 7% previously, to account for the risk], and a pair of) when the info adjustments, so too should the evaluation.

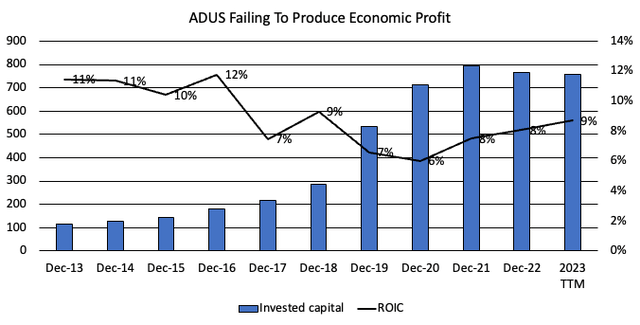

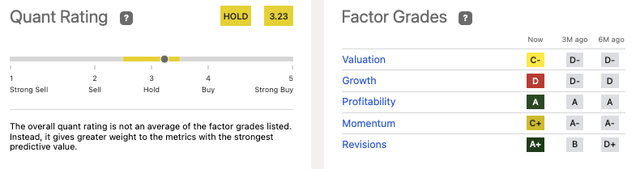

These findings are objectively supported by information proven within the quant system, additionally advocating ADUS as a maintain. It too identifies weak factors on valuation and progress, according to my very own findings. This provides a layer of confidence to the assumptions.

Determine 4.

Information: Looking for Alpha

Briefly

There’s been no change to the funding advice on ADUS following the newest crucial findings. Numerical and data-based proof corroborates the agency has a gargantuan effort forward of itself in an effort to reverse the sentiment image, and appeal to severe funding. With out the financial traits although, i.e., driving greater returns on capital invested, there’s issue seeing ADUS charge greater. In my opinion, this could be the crucial issue clamping the corporate’s market worth at current. As was mentioned within the final publication, given the way in which ADUS books revenues, the capital produces its earnings, which means returns on capital are completely integral to see it buying and selling at greater market valuations. Alas, with none catalytic factors to work from, the funding case is clamped by basic, financial and valuation components. Internet-net, reiterate maintain.