[ad_1]

I watch the information channels, however largely for leisure. A few years in the past, I realized that markets disclose extra helpful data than speaking heads.

I had that realization within the Nineteen Nineties whereas serving within the Air Power the place I had the possibility to go to the Center East and South Korea as tensions rose in these areas.

At first, I attended the intelligence briefings considering officers should know every thing. However I shortly grasped that there was plenty of guesswork of their evaluation. (To notice, strategies are higher now than they had been then, and I’m certain the evaluation has improved.)

Again then, there gave the impression to be a bias towards escalation. Nearly every thing appeared like hostile intent.

I used to be additionally a dealer at the moment and watched markets from these areas. There was typically a disconnect between the information introduced and the way costs moved. If there was going to be conflict within the Center East, I anticipated oil costs to rise. After they fell, I believed the problems may very well be resolved peacefully.

However information and costs don’t at all times transfer collectively in that approach, and there’s a easy cause for that. Giant companies dedicate staggering quantities of assets to researching the markets. They danger billions of {dollars} primarily based on their evaluation. They received’t at all times be proper, however they have a tendency to have extra perception into the gravity of the state of affairs than the information. If massive companies had been nervous about conflict, we’d definitely see oil costs rise.

I thought of this on Saturday morning. We woke to the information that there was a possible coup underway in Russia. Wagner Group tanks had been pushing towards Moscow as an alternative of Kyiv. These are well-trained mercenary forces that threatened Russian President Vladimir Putin’s maintain on the Kremlin.

Inside hours, the hazard handed. Wagner’s chief, Yevgeny Prigozhin, introduced that he wished to keep away from bloodshed. He was heading to exile. His troops had been heading again to Ukraine.

Analysts are nonetheless making an attempt to make sense of Prigozhin’s actions. If it was an try to overthrow Putin, he didn’t have the help he wanted from different officers. Some speculate it was deliberate to provide Putin a cause to purge his enemies from authorities.

All of the hypothesis is attention-grabbing. However the market is saying it wasn’t a lot of something.

Inventory markets are likely to make massive strikes throughout coups. Turkey offers a latest instance.

A Coup That Shook International Markets

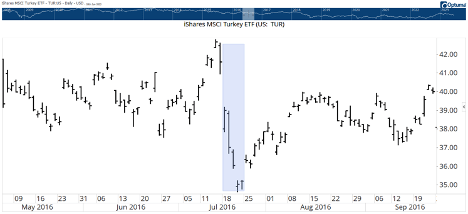

In July 2016, the armed forces moved towards President Recep Erdoğan. The coup try lasted two days. Tons of had been killed. When Erdoğan repelled the assault, he arrested tens of 1000’s of plotters and potential plotters.

The unrest began on July 15, a Friday, simply because the inventory market was closing. iShares MSCI Turkey ETF (Nasdaq: TUR) plunged virtually 9% when buying and selling opened the following Monday. TUR fell 16.8% earlier than bottoming later within the week.

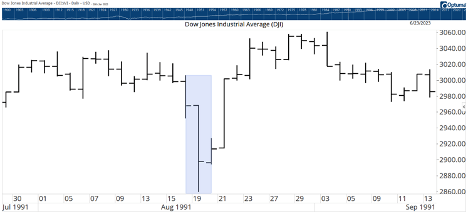

Russia, really the previous Soviet Union, additionally gives an instance of the market’s response to a coup. In August 1991, hardline Communists seized management of the Kremlin. Underneath the Soviet Union, there was no inventory market. So we have to have a look at how merchants in different international locations responded to the information.

That coup shook world inventory markets. The Dow Jones Industrial Common dropped 4.6% in two days as merchants assessed the state of affairs.

Giant strikes are anticipated round occasions like that. Surprising information isn’t priced into markets.

Merchants have to act shortly to maneuver costs to a brand new stage primarily based on the occasions. We see this sample after earnings are launched. Analysts replace their basic fashions primarily based on the information, and merchants push costs up or right down to mirror these adjustments.

Now, let’s have a look at how merchants dealt with this weekend’s coup.

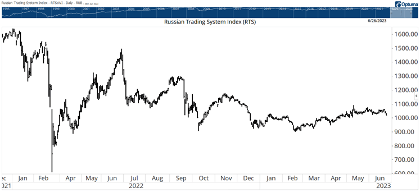

The Russian Buying and selling System Index (RTS) is proven within the chart under. It’s a neighborhood foreign money index of Russian shares, so it displays how Russian merchants reacted.

RTS fell about 3%, lower than the transfer seen in earlier coups. The response additionally appears particularly muted in comparison with the sell-off in response to the conflict in Ukraine.

The market isn’t at all times proper. Nevertheless it does an excellent job displaying the pattern of essential occasions. Its verdict is that we shouldn’t anticipate any adjustments in Russia within the quick time period.

Regards, Michael CarrEditor, Precision Earnings

Michael CarrEditor, Precision Earnings

Fed Chairman Jerome Powell fired a warning shot at Wall Road.

On Wednesday, on the European Central Financial institution Discussion board on Central Banking, he successfully informed traders to not assume he was loosening coverage any time quickly.

Nonetheless, Powell was fast to throw a moist blanket on the prospect of getting extra sporadic charge hikes, following the “pause” in June.

When he was requested whether or not the Fed would increase charges each different assembly, Powell replied:

“We now have not decided to go to that. It might work out that approach. It might not work out that approach. However I wouldn’t take, you recognize, shifting at consecutive conferences off the desk in any respect.”

There’s a phrase for this. It’s referred to as “jawboning.” Powell is hoping that he can have an effect on coverage by merely hinting at it, with out really having to do something.

Does Jawboning Work?

Nicely, I’d argue that Fed’s jawboning misplaced its efficiency as soon as Wall Road found the “Greenspan put,” named after former Fed Chairman Alan Greenspan.

Greenspan set an terrible precedent of dashing to the rescue with a flood of liquidity on the first trace of stress.

Now, at any time when a Fed chair threatens to go “nuclear,” and uber restrictive, traders typically shrug it off. They know that as quickly as issues get ugly, the Fed will merely reverse course and reflood the capital markets with recent liquidity.

Powell additionally did himself no favors by suggesting that inflation wouldn’t be hitting his 2% goal this 12 months, and even subsequent 12 months. That tells us they’re actually not all that dedicated to slaying inflation.

So plainly Powell is huffing and puffing and threatening to blow the home down, however nobody is taking it critically.

It might make extra sense for Powell to return out forcefully now, and make an effort to interrupt inflation earlier than we get yet one more inventory bubble. As a result of that’s precisely what’s taking place at the moment…

that I’m wildly bullish on synthetic intelligence and its coming impression on our economic system. However at the moment, we’re seeing traders piling right into a small core of mega-cap tech shares, without any consideration of worth, simply on the concept that they’ll profit from AI.

That’s no solution to run a inventory portfolio.

Once more, I’m bullish on AI. Wildly bullish on AI. However I’m not going to easily purchase Nvidia and hope for the most effective. That’s not a technique.

If you wish to spend money on the AI house intelligently, watch Ian King’s newest webinar breaking down the most effective funding alternatives this trade has to supply. He additionally reveals his #1 AI inventory to purchase.

And should you’re involved in how AI can be utilized that can assist you commerce smarter and extra effectively, take a look at what Mike Carr is doing in his Commerce Room. He’s engaged on integrating this know-how into his buying and selling technique.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link