Editor’s take: Intel faces three sequential issues: repair manufacturing, begin designing aggressive merchandise once more, and win some prospects for IFS (Intel Foundry Providers). Then they need to hold all that going. Not unimaginable, simply very difficult.

We have been receiving many inquiries recently concerning the present state of Intel. Since this matter appears to be of nice fascination for a lot of the semiconductor world, we thought it’d assist to place our ideas down right here.

Intel is presently going through a sequence of sequential issues. Sequential within the sense that every problem should be resolved earlier than the subsequent will be successfully tackled. The corporate is engaged on all of them, however they’re interdependent in such a approach to confound the corporate’s prospects till every one is resolved.

Editor’s Word:

Visitor writer Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed development methods and alliances for corporations within the cell, networking, gaming, and software program industries.

The primary downside Intel should overcome is its manufacturing course of. The corporate is structured round its IDM mannequin (Built-in Gadget Manufacturing), with internally managed fabs. Whereas they’ve outsourced a few of their manufacturing to TSMC, roughly 70% of their income nonetheless originates from their very own fabs.

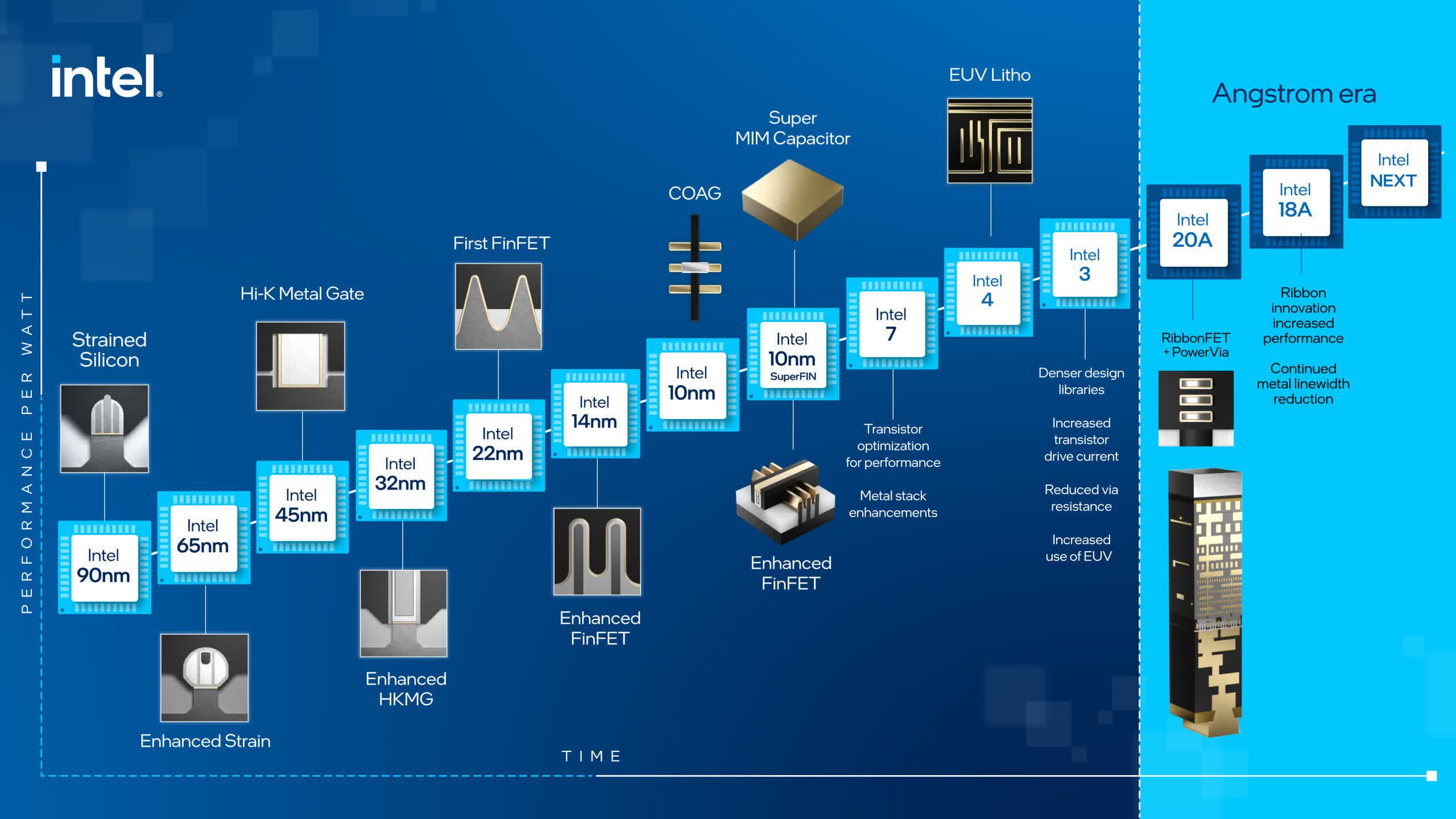

The corporate fell off the Moore’s Regulation path a number of years in the past, and is now racing to catch up. The formidable aim of advancing 5 nodes in 4 years has change into the corporate’s official slogan. This problem is of existential significance to Intel, and failure to handle it may spell a bleak future for the corporate.

So far as we will inform from the surface, they’re on observe to succeed in that aim, however greater than a yr stays earlier than these developments will be totally carried out. Attaining that is extremely difficult, but when we needed to make a prediction at present, we consider they’ll attain a stage that can permit their merchandise to regain competitiveness, although outpacing TSMC within the close to time period appears much less doubtless.

This brings us to the second downside. Assuming Intel’s manufacturing course of achieves a suitable stage, they may then face competitors from their merchandise. Right here they face a litany of difficulties. On the prime of that record is AMD, which has been executing just like the proverbial machine. AMD’s newest CPU portfolio appears to be like very compelling to prospects.

They’ve launched important improvements within the CPU market, equivalent to their chiplet structure and related packaging. AMD argues that their present merchandise are extra performant and provide a greater Complete Price of Possession (TCO) than Intel. This hole will doubtless widen as Intel continues to handle its manufacturing points, a course of that most likely will not conclude till late 2024 on the earliest.

Moreover, the market is present process a shift. In information facilities, prospects are transferring away from CPU-centric programs in the direction of heterogeneous computing involving CPUs, GPUs, and accelerators. Whereas Intel provides GPUs and AI accelerators, their impression available in the market is modest, to say the least. It appears Intel is exerting a lot effort to outlive that they are not updating their roadmap to adapt to those new realities. We’re being beneficiant right here, as many consider the scenario is way extra dire.

Put merely, when Intel entered its present funk in the course of the final decade, that they had one CPU competitor, however at present they face a dozen. A revived Intel can face off all these challenges. They nonetheless have a strong place within the PC market and long-established relationships with the entire ecosystem, however they want merchandise which may stand on their very own.

After which we attain the third downside – they need to hold all of this going. Meaning investing closely in advancing their manufacturing course of. Even when they’ll obtain some model of 5 nodes in 4 years, they need to hold transferring past that. The economics of Moore’s Regulation are punishing, solely corporations with large revenues can maintain the tempo of funding required.

The third problem is the continued dedication to enchancment. This entails closely investing in advancing their manufacturing course of. Even when they’ll obtain their goal of 5 nodes in 4 years, they need to proceed to evolve past that. The tough actuality of Moore’s Regulation is that solely corporations with substantial revenues can maintain the required tempo of funding.

This downside is deepened by the truth that Intel’s fabs produce a lot lower than TSMC. To ensure that Intel to maintain the R&D tempo it must refill its fab with extra than simply their very own merchandise. This can be a matter of compounding. A part of the explanation TSMC has change into the chief in semis manufacturing is that they produce a lot quantity, which implies they be taught quicker than everybody else, a essential element of all of this.

So, to ensure that Intel to maintain itself, sooner or later it has to construct Intel Foundry Providers (IFS) right into a bona fide foundry competitor. Clients will solely take into account IFS in the event that they consider it will probably compete with TSMC. Because of this we see Intel’s challenges as sequential. Regardless of persistent rumors of fabless corporations contemplating IFS, we do not foresee this changing into substantial till Intel proves its manufacturing course of is each aggressive and sustainable. We consider IFS will not considerably contribute to income till the top of the last decade.

Basically, Intel’s biggest problem is cultural. The corporate should acknowledge the altering world and adapt accordingly. Through the years, Intel created immense blind spots by focusing inward excessively, dropping sight of its diminished stature in comparison with its glory days. Due to this fact, it was considerably disconcerting to listen to Intel declare throughout their current analyst replace that IFS is “The world’s second-largest foundry,” a calculation that included their inner merchandise. That is akin to taking your sizzling older sibling to promenade. Technically it is true, however it would not convey the picture they assume it does.

Whereas this might sound insurmountable, a couple of elements favor the corporate. They’ve immense inner expertise, which seems to be each dedicated and invigorated. Moreover, they need not excel in each side. For manufacturing, they need not surpass TSMC, merely get shut sufficient so the method now not undermines their merchandise. They do not should be the second-largest foundry on this planet (excluding their very own product), they only have to safe a couple of fabs’ value of exterior prospects.

Robust, however not unimaginable.