Stefan Lambauer/iStock by way of Getty Pictures

Non-public fairness funds related to Appian Capital Advisory have been avid buyers in base metallic mines in recent times, choosing up and turning round distressed producing belongings, and remodeling growth initiatives into working mines. The acquisition of the Rosh Pinah mine in Namibia is simply the most recent level in case in a string of comparable transactions. Nevertheless, Appian’s efforts to promote the Serrote and Santa Rita mines in Brazil have marked a notable shift in the direction of monetizing components of the fund’s portfolio. These efforts hit an early snag when Sibanye Stillwater (SBSW) terminated a purchase order settlement concerning these two mines firstly of this yr (leaving it as much as the British Excessive Court docket to resolve whether or not Sibanye’s declare of fabric adversarial results has advantage). However this snag, it hasn’t taken lengthy for an additional purchaser to step up and purchase these two mines, for the very same circumstances as quoted within the terminated Sibanye settlement. The brand new purchaser goes by the identify of ACG Acquisition Firm, a car backed by Glencore (OTCPK:GLCNF), La Mancha, and car-makers Volkswagen (OTCPK:VWAGY) and Stellantis (STLA).

ACG will buy the Serrote and Santa Rita mines for a complete of $1.065B, rename itself into ACG Electrical Metals, and launch a public providing to lift $300M with a $50M backstop from Appian within the wake of this transaction. All this to reach, in a long-winded approach, on the closing piece of this transaction — specifically the proposed $250M royalty settlement between ACG and Royal Gold (NASDAQ:RGLD) — to finish the funding for this transaction.

We’re Royal Gold shareholders, and thus our curiosity on this deal stems primarily from the angle of the brand new royalty package deal to be included in Royal Gold’s portfolio (which isn’t to say, that we cannot be following the ACG IPO very rigorously). And with out a lot additional ado, right here is our tackle this deal from the attitude of Royal Gold.

Technical studies on the 2 mines in assist of the described deal can be found for obtain from the ACG web site, and far of the next issues are taken from these two studies. Each mines have been held privately by subsidiaries of Appian with out the necessity for NI43-101-compliant disclosure, and thus these studies are known as “Competent Individual’s Reviews”. Nonetheless, these studies signify feasibility-level of element to the most effective of our judgment, until in any other case said.

The Serrote Mine

The Serrote copper-gold deposit is situated in northeast Brazil within the State of Alagoas. As with most Brazilian initiatives, Vale (VALE) had owned the venture in some unspecified time in the future, however left growth to a collection of junior miners, a few of them with present public data. Digging by means of some historic paperwork filed on SEDAR we have now pieced collectively the next: in 2012 Aura Minerals (OTCQX:ORAAF) launched a feasibility research for the Serrote venture, outlining annual open pit manufacturing of 66M lbs of copper and 13Koz of gold. Additional growth encountered varied obstacles, and in 2015 growth of the Serrote venture was suspended when Aura discovered it was “unable to lift extra financing to take care of the continued growth standing or to fund the development of the Serrote Venture“. Aura Minerals bought the Serrote venture to Appian in 2018 for $40M, i.e. kind of at value contemplating the e book worth of $24.5M on the time of the sale and the impairment expenses registered in opposition to the venture.

Appian re-engineered the venture, constructed the mine, and reached industrial manufacturing in early 2023, guiding for the manufacturing of 55M lbs of copper and 9K oz of gold in 2023 based on this information report.

The 2021 mineral reserve of 46.7M tonnes at a copper grade of 0.58% and a gold grade of 0.10g/t helps a mine life till 2034 for an NPV(8%) of $540.3M; nonetheless, with a useful resource of greater than twice the reserve tonnage future mine life extensions are extra than simply far-fetched hypothesis. In truth, a pit enlargement research is outwardly in progress, and early research for sure satellite tv for pc deposits are additionally within the works. Value steering for 2023 is for C1 money value of $1.50/lb and $1.60/lb, and all-in sustaining prices of $1.85/lb, pointing to a extremely worthwhile operation. Q1 manufacturing already considerably exceeded steering, and beat value steering by a wholesome margin.

Royal Gold is buying a gross smelter return (or GSR) royalty of 85% of the payable gold from the Serrote mine till achievement of a royalty income threshold of $250 million from this royalty, and 45% thereafter; plus a GSR on the copper manufacturing ramping to 1.1% in 2025, and dropping to 0.55% after reaching a income threshold of $90M.

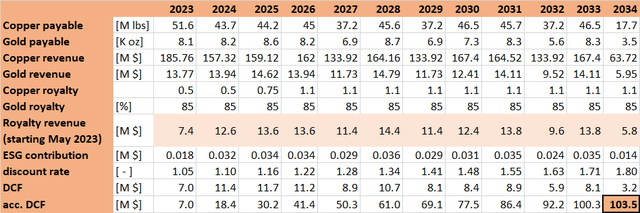

Utilizing the info gleaned from the mine plan within the technical report, and plugging these knowledge factors right into a DCF spreadsheet yields an NPV(5%) of $103.5M for the royalty (utilizing the worth deck proven within the caption).

Serrote royalty DCF mannequin @ $1,700/oz gold & $3.60/lb copper (Writer’s work)

The Santa Rita Mine

The Santa Rita venture was labored by a collection of Brazilian firms, and put into manufacturing in 2009 by an Australian mining firm going by the identify of Mirabela Nickel. This firm went into voluntary administration in 2015, and operations on the Santa Rita mine have been suspended in 2016. Appian purchased Mirabel out of chapter in 2018, renamed its newly acquired subsidiary into Atlantic Nickel, and recommenced mining operations in 2020.

The Santa Rita mine is a big open pit nickel mine, with vital gold, copper, and PGE metals by-products. The technical report outlines an open pit mine life till 2028 for an NPV(8%) of $570M; plus there’s additionally a PEA-level research accessible documenting an underground operation with an extra 27 years of mine life and an NPV(8%) of $812M. Pleasingly, Q1/2023 efficiency was properly forward of the predictions within the technical report (and on this context, we will not assist however surprise about Sibanye’s declare of fabric and adversarial impacts affecting the mine).

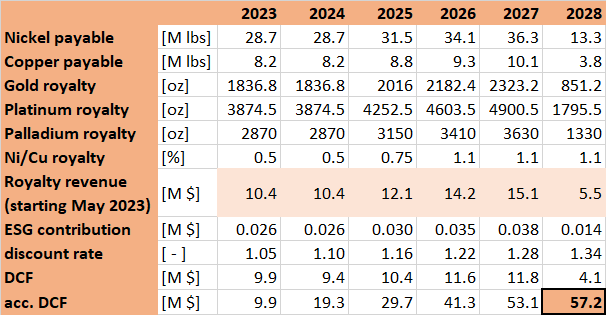

Royal Gold will obtain 64oz of gold, 135oz of platinum, and 100oz of palladium for every 1M lb of payable nickel produced from the Santa Rita mine. The platinum and palladium royalty will terminate after the achievement of a royalty income threshold of $100M. Moreover, the identical base metallic royalty as for the Serrote mine will apply. The spreadsheet beneath places numbers to this royalty settlement, once more utilizing the mine plan outlined within the technical report (open pit solely) and the worth deck proven within the caption. The ensuing NPV(5%) quantities to $57.2M.

Serrote royalty DCF mannequin @ $1,700/oz Au, $3.60/lb Cu, $8/lb Ni, $800/oz Pt & $1000/oz Pd (Writer’s work)

Royalty Valuation

If we use the numbers computed within the two spreadsheets above, the entire NPV(5%) of the royalty package deal bought by Royal Gold involves ~$160M. Royal Gold is paying $250, or a 56% premium. On floor, this seems to be like a expensive acquisition. Nevertheless, we consider that on this case, it is value circling again to the corporate’s April 2023 Traders’ Day, reminding ourselves of a remark made by Vice President Mr Alistair Baker:

DCF is our precept valuation instrument, but it surely does have some limitations. These limitations are most blatant when taking a look at Day 1 evaluations of belongings with multi-decade potential, and people are the belongings that we covet probably the most. Not solely does the time worth of cash idea understate the intrinsic worth of lengthy reserve lives on the day the funding is made, it additionally minimizes the affect of mine life extensions and manufacturing will increase. And since these belongings present long-term publicity to a unstable commodity worth, DCF valuations with flat pricing assumptions disregard the worth of a worth variability, which will increase with time.

Sure certain, speak of “Blue Sky exploration potential” and “leverage to metallic costs” is ubiquitous in convention calls following royalty acquisitions in a sellers’ market. And we normally give little credit score to those assertions, particularly when the royalty is on a small mine, operated by a cash-strapped miner. Nevertheless, the above argument good points credibility with regards to giant operations with a transparent runway to a protracted mine life, and when entry to capital essential to develop and increase the mine is just not an issue. In such circumstances, we consider that valuation by money stream multiples is extra applicable. Judging from the accessible technical knowledge we have now a really robust suspicion that the current deal represents precisely such a case. And noting the money stream projections detailed within the tables above, the acquisition comes at ~10x ahead money stream — a really cheap price ticket, and a deal we will wholeheartedly commend Royal Gold’s administration workforce on.

Abstract & Funding Thesis

The Serrote and Santa Rita mines have been right-sized and introduced again into industrial manufacturing by Appian. They’re about to be bought to a newly minted base metallic miner which is able to IPO within the close to future. This mid-tier miner to be will likely be well-capitalized, and will probably be led by a revered administration workforce properly able to working these two belongings, and crystallizing the underlying worth.

Alternatives for the creation of such royalties are uncommon. In our view, Royal Gold has recognized such a possibility with the going-public preparations of ACG, and Royal Gold has been capable of negotiate very cheap circumstances so as to add one other potential flagship asset to its portfolio. We’re very glad shareholders certainly, and we consider this deal will likely be considered as extremely accretive within the fullness of time.

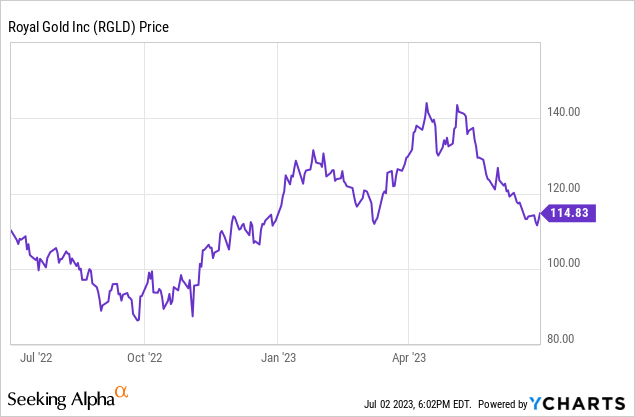

The share worth has come down ~20% from the current excessive and appears enticing at $115 on the time of writing. It might properly drop additional within the brief time period, relying on cues taken from the gold worth, however we submit that beginning a place on the present worth will most probably signify a worthwhile funding in the long run.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.