A stockphoto

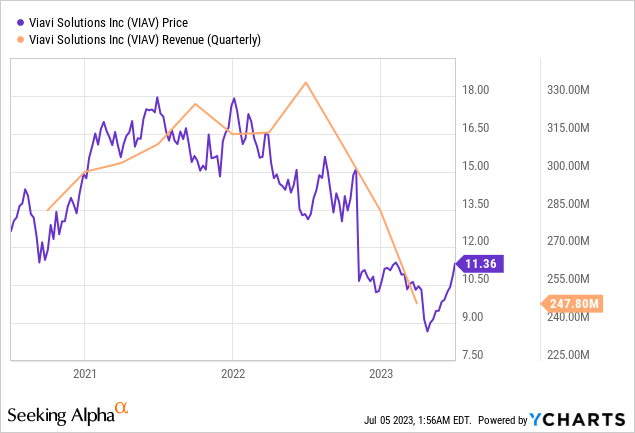

There’s a frequent saying that “the market is forward-looking”, signifying that whether or not it’s equities or bonds, the present value displays what traders anticipate to occur sooner or later. Making use of this saying to Viavi Options (NASDAQ:VIAV) whose share value is now on an uptrend as proven by the blue chart signifies that its revenues which at the moment lag (orange chart) also needs to comply with swimsuit.

Thus, my goal is to evaluate whether or not the market is correct to suppose that Viavi’s gross sales have already dipped in its fiscal third quarter for 2023 (FQ3’23) and that to any extent further they need to rise. For this goal, I’ll primarily scan its earnings transcripts and funds.

I begin by portray an image of the providers provided and the way these have been impacted by decrease demand.

The Take a look at Tools Producer’s Revenues

As a telecom testing tools producer, Viavi offers the kind of testers which can be utilized by communications providers suppliers in addition to tools producers to respectively qualify their networks and merchandise. As such, the variety of gross sales that the testing play can drive relies on demand from these corporations, and, any pullback is more likely to translate into income shortfalls.

That is precisely what occurred in FQ3’23 (ending in April) when gross sales of $247.8 million represented a 21.5% year-over-year decline. Nonetheless, this determine is $0.8 million above the midpoint of the administration steerage which signifies that whereas there have been expectations of a shortfall, this was much less unhealthy than anticipated. The identical was the case for the working revenue margin which at 11.4% was 0.4% above the expectation. This was partly as a result of a restructuring train involving the realignment of the enterprise with the expansion areas, in addition to job cuts. Now, to encourage workers to depart the corporate should compensate them an quantity of $10 million to $50 million however in return, this could translate into $25 million of annual price financial savings from the second half of this 12 months. This represents about 4% of FY’22 whole working bills.

Now, progress in managing price bodes effectively for profitability however is just not enough a cause to spend money on an organization as in the end it’s the topline that drives margins. For this goal, after the dip in gross sales, I have a look at potential restoration.

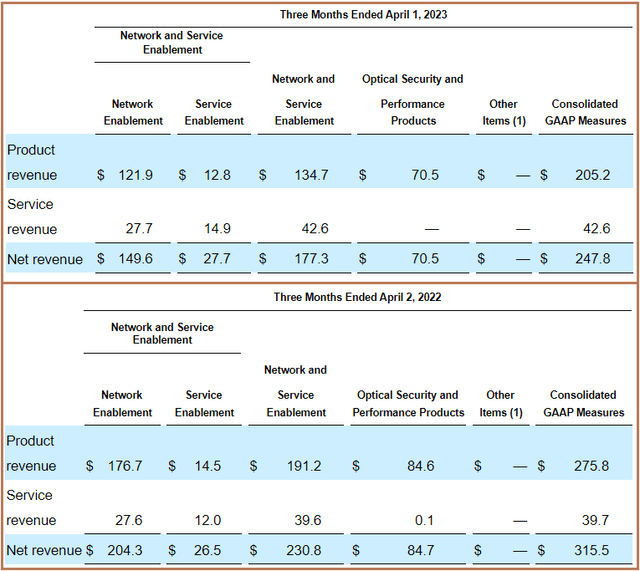

On this respect, the corporate operates with three segments, NE (Community Enablement), SE (Service Enablement), and Optical Safety and Efficiency Merchandise as illustrated beneath. The one most impacted by market softness was NE whose gross sales contracted by double digits figures, from $204.3 million in FQ3’22 to $149.6 million through the newest reported quarter.

Segmental Revenues (seekingalpha.com)

Then again, a decrease diploma of demand destruction impacted Optical Safety and Efficiency merchandise utilized in establishing high-speed fiber tools. Persevering with on a constructive word, SE grew by 4.5% y-o-y. Moreover, the administration expects its NSE (Community and Service Enablement) enterprise which is the mix of the revenues of NE and SE segments, to have “bottomed out in Q3”, which will be interpreted as an indication of restoration.

Now, for the reason that NSE constituted $177.3 million out of the entire revenues of $247.8 million for FQ3’23, or 71.5%, any restoration on this enterprise may drive up the topline in FQ4’23, which ends in July.

Assessing the Outlook

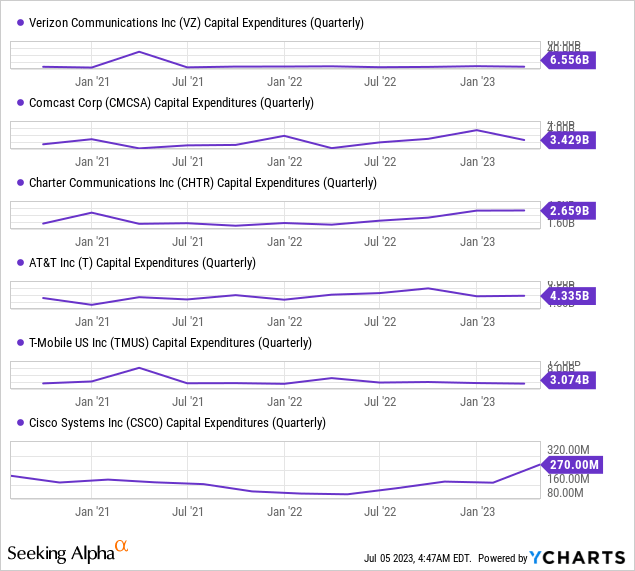

In an effort to confirm that this constructive outlook is achievable, I’ve charted the quarterly capital expenditure of the nation’s fundamental carriers as charted beneath. Now, Viavi’s buyer base spans the world and these corporations don’t essentially supply check tools from Viavi, however, the charts nonetheless present a basic indication of the spending pattern. On this case, since for many of the corporations, it’s both an upward or horizontal pattern as to their capital spending, this reveals that they’re nonetheless investing cash in constructing their networks and are subsequently seemingly to purchase testing gear, both from Viavi or its opponents. I’ve additionally drawn the chart for Cisco (NASDAQ:CSCO) which is a community tools producer.

Wanting extra particularly on the product software areas, the corporate testing gears are used each for testing fiber and cable networks, in addition to for 5G wi-fi. Right here, in distinction to what’s generally believed, it’s not testing demand for the fifth technology wi-fi which is seeing power, however somewhat cable networks from the likes of Comcast (CMCSA) or fiber deployment by Constitution Communications (CHTR) pushed by funding from the FCC’s Rural Digital Alternative Fund.

As for wi-fi, a contraction in gross sales for the lab check tools generally used for R&D-oriented duties accounted for many of the income hunch. Then again, demand for testing gear used for discipline work has been comparatively sustained, which is aligned with the truth that cell community operators are increasing protection throughout the U.S.

Due to this fact, whereas investments in increasing community protection proceed (above charts), it’s extra of a blended image in relation to Viavi’s merchandise, which can additionally counsel some aggressive strain.

A Historical past of Beating Estimates however Be Lifelike

Nonetheless, the executives are optimistic that issues will enhance in This autumn as I discussed earlier. To help their place, they supply a topline steerage of $242 million to $262 million whose midpoint of $252 million would characterize a $4.2 million improve over FQ3’23’s gross sales. Furthermore, avionics had been highlighted as being a shiny spot with the corporate having a strong product within the type of the AVX-10K flight line check set which is accredited for Boeing (BA) plane.

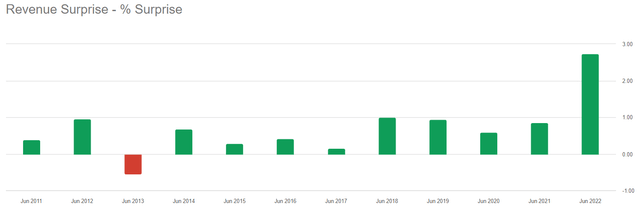

Now, to confirm if this steerage may change into a actuality, I checked the income shock as pictured beneath, and located that over the past twelve years, the corporate missed analysts’ expectations solely as soon as (as illustrated in purple), with interprets to successful price of 91.7%. This implies that there’s a very excessive likelihood of the corporate assembly and even beating analysts’ income estimates of $252 million (mid-point) for the ultimate quarter. This could in flip outcome within the annual revenues for the fiscal interval ending in June 2023 beating the estimates of $1.12 billion.

seekingalpha.com

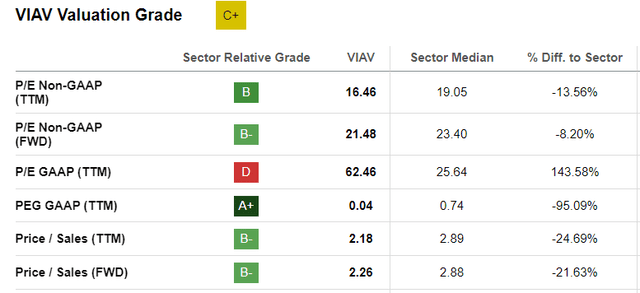

This can be the rationale for traders’ optimism in regards to the inventory for the reason that earnings name on Could 2. After the next upside of about 20%, the valuation grade now stands at “C+” with one of many contributing components being the trailing GAAP P/E having reached “D” as proven beneath. This implies wealthy valuations based mostly on earnings because of the firm’s increased profitability scores.

Then again, the trailing Worth-to-Gross sales a number of of two.18x stays effectively beneath the sector median’s 2.89x. Thus, the corporate could also be buying and selling at a reduction of 24.69%. Adjusting the share value of $11.21 accordingly, I’ve a goal of $13.98, signifying that the upside could also be sustained.

Valuations metrics (www.seekingalpha.com)

Nonetheless, adopting a dose of realism, issues couldn’t work out as anticipated and the restoration may take longer. Thus, trying on the broader financial image, there’s sometimes an 18-month lag between the time rates of interest have been raised on the most aggressive tempo round June final 12 months, and the time when the complete results are felt by companies basically. Thus, regardless of the U.S. economic system proving to be resilient thus far, one can not exclude a light recession by the tip of this 12 months.

In consequence, with borrowing prices remaining excessive, companies may reduce capex, albeit quickly, and even contemplate cheaper various testing tools in case the financial outlook will get dimmer. To complicate issues, the Fed doesn’t have the posh to chop charges quickly as, regardless of being on a downtrend, inflation nonetheless stays increased than its 2% goal.

Extra of a Maintain

In conclusion and going in opposition to market optimism, I’ve a maintain place on the inventory provided that we nonetheless should see indicators of a restoration in gross sales. Nonetheless, I’m optimistic for the long run as Viavi serves two fundamental markets, that are fastened line (cable and fiber) and wi-fi, the place service suppliers compete with one another. This basically signifies that they must each develop and enhance the standard of their networks in flip implying extra purchases of check and high quality assurance tools. Furthermore, its steadiness sheet stays wholesome with money and equivalents of $586.6 million with debt totaling $847.4 million. That is enough to redeem about $107 million of convertible notes due subsequent 12 months.