Dragon Claws

For my part, the market is basically mispricing the worth proposition of actual property funding belief W. P. Carey Inc. (NYSE:WPC).

The REIT is well-diversified and maintained robust portfolio traits all through the primary (and possibly second) quarter. W. P. Carey’s workplace publicity has harm the REIT’s valuation within the final couple of month, along with the banking disaster, however the REIT’s robust portfolio and pay-out metrics make WPC a relatively low threat guess within the REIT market, for my part.

I believe passive revenue traders have grown too fearful of business REITs, largely due to considerations over the state over the U.S. workplace actual property market.

Why The Market Is Flawed

In my article about Alexandria Actual Property Equities Inc. (ARE), I discussed how the market falsely related the belief with different workplace REITs (regardless of proudly owning largely life science actual property) which has resulted in a mispricing that passive revenue traders can exploit.

The identical is true for W. P. Carey.

Workplace actual property has been pummeled in 2023 because of the central financial institution’s fee hikes, the rising reputation of distant work (resulting in greater workplace vacancies) and rising stress on workplace valuations.

Moreover, delinquencies within the sector are on the rise which has spooked traders. These fears mixed have resulted in a valuation haircut of 18% since February for W. P. Carey.

Simply with Alexandria Actual Property Equities, I believe that the market unjustly punishes W. P. Carey for its workplace publicity, though the industrial REIT owns solely a reasonable quantity of such actual property. With that stated, W. P. Carey provides a really protected dividend for passive revenue traders, for my part.

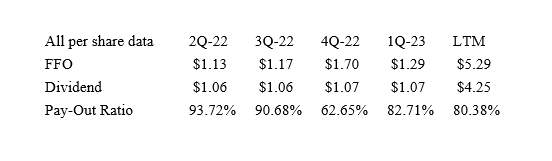

The REIT earned a complete of $5.29 per share within the final yr in funds from operations whereas paying out solely $4.25 per share which implies that the dividend is each nicely supported and sustainable.

W. P. Carey’s dividend pay-out ratio within the final twelve months (the interval between 2Q-22 and 1Q-23) was solely 80% and the belief raised its dividend by ~1% as nicely.

Dividend (Creator Created Desk Utilizing Belief Info)

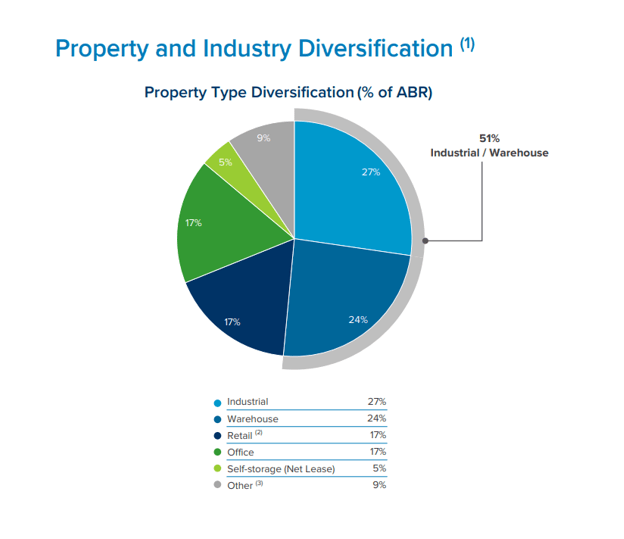

However extra essential for passive revenue traders than simply trying on the pay-out ratio is the truth that the belief has a reasonable allocation of funds to the troubled U.S. workplace actual property market. Now, W. P. Carey does have publicity to workplace actual property and has roughly 17% of its revenues tied to the sector.

It’s, nevertheless, not the most important sector. Industrial properties account for 27% of annual base hire whereas warehouses produce 24% of the REIT’s hire. Briefly, the workplace publicity of W. P. Carey is relatively restricted and the REIT provides a relatively well-diversified portfolio as a complete.

Property And Business Diversification (W. P. Carey Inc)

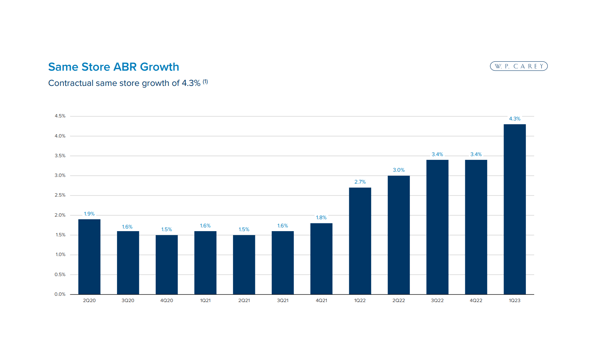

What I believe helps make the case for the robustness of W. P. Carey as an funding is that the REIT is experiencing strong demand for its actual property, leading to greater rents. W. P. Carey’s same-store rental development in 1Q-23 was 4.3%, reflecting a 0.9 share level improve QoQ. Rents rise when landlords have pricing energy and sure actual property sorts, like industrial, warehouse and retail, are in excessive demand.

ABR Development (W. P. Carey Inc)

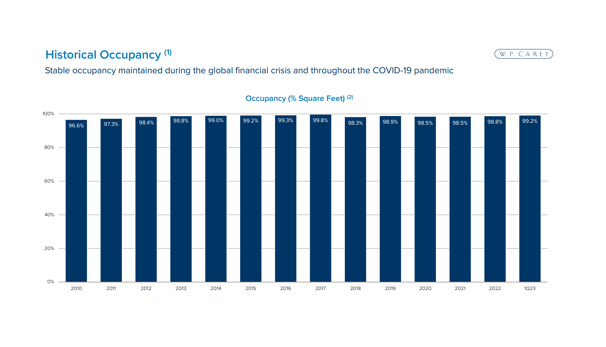

Considering that the REIT’s valuation has declined by 18% since February, one would assume that the belief has main portfolio points, equivalent to excessive vacancies or hire assortment issues. Nevertheless, neither is the case, and the portfolio is as robust because it has ever been. W. P. Carey’s portfolio has been well-leased prior to now and the belief’s occupancy truly went up by 0.4 share factors in 1Q-23 to 99.2%.

Historic Occupancy (W. P. Carey Inc)

Low AFFO A number of Signifies WPC Is A Cut price

W. P. Carey reaffirmed its steerage for 2023 within the first quarter and continues to see $5.30 to $5.40 per share in adjusted funds from operations.

The REIT’s inventory has fallen to $69.09 which interprets into an AFFO a number of of 12.9x.

Earlier this yr, W. P. Carey’s inventory traded at a 15.7x AFFO a number of. The implied AFFO yield for WPC is 7.7% immediately in comparison with 6.4% in February which, I believe, makes the industrial REIT a cut price.

W. P. Carey Has Workplace Dangers, However Traders Are Too Fearful

Clearly, W. P. Carey has publicity to the troubled workplace actual property market, however it isn’t a dominating actual property class within the belief’s portfolio.

Furthermore, W. P. Carey had nice portfolio metrics on the finish of the primary quarter together with 99% portfolio occupancy (which incorporates workplace actual property), maintained its general diversification and paid out nearly 80% of its funds from operations.

A downturn within the U.S. workplace actual property market is a threat, however it’s none, I believe, that ought to preclude passive revenue traders from investing into W. P. Carey. Traders have turn into too scared of REITs basically, creating quite a lot of bargains within the sector, WPC being considered one of them.

My Conclusion

I believe that the market makes the identical mistake with W. P. Carey that it makes with Alexandria Actual Property Equities which is to punish them for workplace actual property publicity though the portfolio fundamentals are strong.

Alexandria Actual Property Equities is extra centered on life science actual property whereas W. P. Carey has broad industrial actual property publicity and solely a reasonable diploma of workplace actual property investments. But, each REITs have seen giant valuation declines since February.

W. P. Carey’s portfolio is performing very nicely because it has strong occupancy and rents are rising. For my part, these details do not justify the appliance of an 18% valuation haircut and I believe passive revenue traders have a possibility right here to use W. P. Carey’s low AFFO valuation for his or her profit.