Anna Webber

Funding Thesis

Block (NYSE:NYSE:SQ) has confronted downward stress on its inventory value since early FY2022, primarily because of a major deceleration in top-line progress ensuing from many elements, akin to pull-forward demand, a decline in B2B spending, and elevated competitors. Regardless of delivering respectable 1Q FY2023 outcomes, the inventory’s efficiency was muted, with solely a 2% rally within the aftermarket. SQ’s lackluster YTD return (not too long ago exhibited some upside momentum as a result of decline in CPI knowledge) clearly signifies that it missed out on the hype surrounding the current AI thematic rally. This mediocre efficiency was beneath each the S&P500 and Nasdaq, as the corporate didn’t impress traders with its long-term AI roadmap.

I admit that SQ’s fundamentals, notably its bottom-line, have considerably deteriorated over the previous yr. Nevertheless, the corporate is now specializing in bettering margins and driving earnings progress in FY2023. Though the valuation remains to be not at a discount, even after a 72% pullback from its pandemic peak, I imagine that traders will respect the corporate’s efforts to prioritize profitability and FCF profile. Moreover, we’ve got seen a powerful restoration in cryptocurrencies in current months, which might enhance its Bitcoin Gross Revenue line. Subsequently, I stay optimistic in regards to the inventory, because the worst could also be behind us.

Look By means of Close to-Time period Headwinds

The corporate mannequin

Buyers could also be curious in regards to the causes behind SQ’s sharp 75% drop in early FY2022 and why its upward momentum has been restricted since then. Some might argue that contemplating the corporate’s FY2023 adjusted EBITDA outlook, SQ has maintained a powerful 34.4% CAGR in adjusted EBITDA from FY2019 to FY2023E.

The corporate mannequin

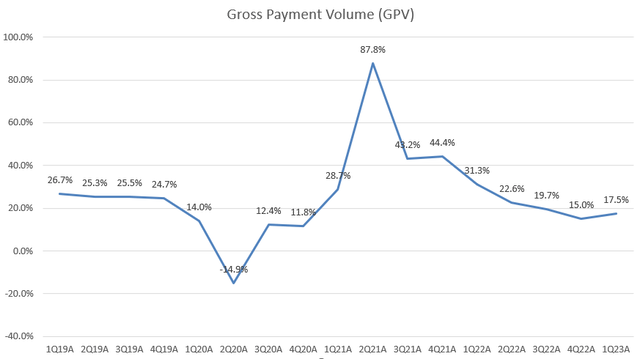

In actuality, there have been each macro and micro challenges in FY2022. Firstly, SQ’s fundamentals noticed a major decline. The corporate skilled a pointy lower in transaction-based income because of sluggish progress in GPV. The purpose-of-sale (POS) trade has turn into more and more aggressive, with some main gamers increasing their market shares akin to Apple Pay. Because of this, SQ’s adjusted EBITDA progress declined by -2.2% YoY in FY2022, resulting in a -41.5% YoY progress in adjusted EPS. This indicated that the inventory value might simply drop 41.5% with out impacting its valuation.

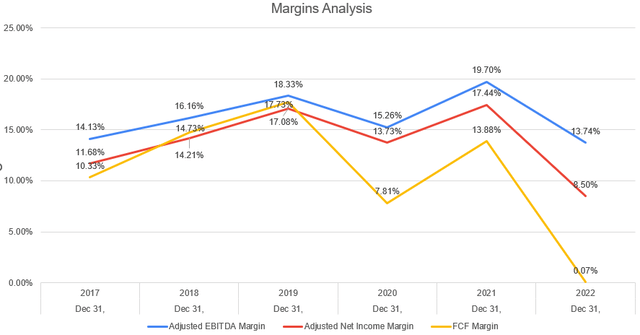

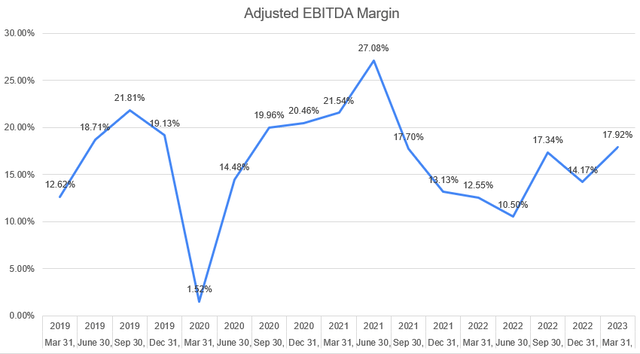

Moreover, when analyzing the chart, we will see that three key margins (adjusted EBITDA margin, adjusted web revenue margin, and FCF margin), which most traders deal with, had been at their lowest ranges since FY2017.

From the Macro perspective, the federal fund price has sharply elevated in FY2022 because the fed grew to become hawkish to fight 40-year excessive inflation. Beneath this backdrop, excessive progress shares with deteriorating fundamentals like SQ had been notably susceptible. Subsequently, I would not be stunned to see the inventory skilled a major selloff.

However, as a long-term investor, we should always look by the corporate’s near-term headwinds and centered on its secular progress catalysts. For instance, the pandemic has undoubtedly accelerated the digital transformation, with extra retailers and prospects counting on fintech transaction services and products.

Connecting Sq. Ecosystem and Money App

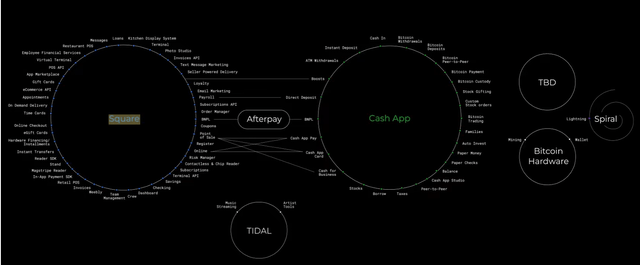

2022 Investor Day

In the course of the Investor Day in 2022, it was highlighted that Sq.’s enterprise mannequin has undergone vital modifications over the previous few years. In 2015, a majority of their gross revenue was derived from retailers utilizing Sq. for Funds. Nevertheless, by 2021, the most important income stream has shifted to software program and built-in funds, which, together with banking and worldwide operations, have been rising at a sooner tempo than funds income. Because the screenshot indicated, the corporate is presently centered on integrating Afterpay into its ecosystem, aiming to ascertain a connection between Sq. and Money App. This integration is predicted to be helpful when it comes to buyer acquisition and growing the lifetime worth to buyer acquisition value (LTV/CAC) ratio over the long run.

However, the administration has cautioned that the mixing of Afterpay might quickly impression margins. Nevertheless, they continue to be optimistic in regards to the future synergies and potential advantages related to the deal.

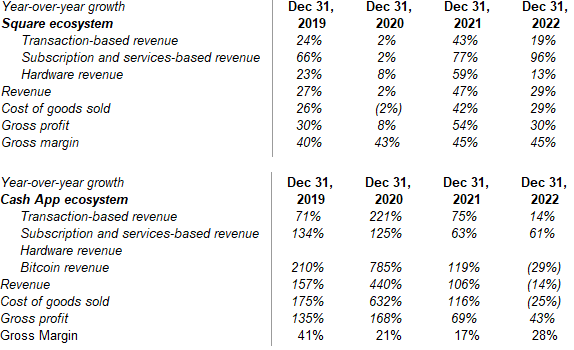

We are able to observe in Historic Monetary Info that Money App’s margins are presently decrease than these of Sq. because of greater variable bills akin to P2P processing, danger loss, and card issuance prices.

Money App Margin Stays Sturdy

Investor Relations – Historic Monetary Info

Primarily based on the screenshot from the corporate’s Excel mannequin, we noticed that the expansion of subscription and services-based income stays robust in each Sq. and Money App ecosystem. The Money App progress historical past has been exceptional, with a 61% YoY progress in FY2022. The gross revenue of Money App has been largely contributed by Immediate Deposit and Money App Card, which achieved a powerful 43% YoY progress within the final fiscal yr. Furthermore, the introduction of financial savings accounts and the Money App Card has additionally performed an vital position in increasing monetization over the long run.

As talked about earlier, the Money App ecosystem presently maintains a decrease margin of 28% in comparison with the Sq. ecosystem’s margin of 45%. Nevertheless, there was a notable enchancment in margins, with a powerful enlargement from 17% in FY2021.

As well as, we should always remember the fact that the gross revenue from the Money App ecosystem was affected by a major slowdown in Bitcoin transactions throughout FY2022. Nevertheless, contemplating the current robust restoration in cryptocurrencies, this might probably generate constructive sentiment amongst traders.

Margin Enchancment in FY2023

The corporate mannequin

Certainly, FY2022 was a difficult yr for SQ. Nevertheless, there are lots of constructive indicators to contemplate. The adjusted EBITDA margin has rebounded from its current low, indicating a constructive development. Moreover, in 1Q FY2023, the corporate not solely exceeded expectations when it comes to income and adjusted EPS but additionally raised its FY2023 outlook for adjusted EBITDA. In the course of the earnings name, the administration is predicted to see an enlargement in Money App margin, which might contribute to general margin enlargement for the corporate. This implies that traders can anticipate a restoration in profitability within the present fiscal yr. If SQ can maintain constant earnings progress and proceed increasing its margins, it ought to enhance extra confidence in traders, even within the face of a slowdown in general top-line and GMV progress.

Valuation

1Q23 Shareholder Letter

When contemplating SQ’s adjusted EBITDA outlook for FY2023, the inventory is presently buying and selling at the next a number of in comparison with PayPal (PYPL). SQ’s EV/adjusted EBITDA FY2023E stands at 32.7x, whereas PYPL is at 10.5x. Equally, SQ’s P/E Fwd of 42x is greater than PYPL’s 14.3x, regardless of SQ’s robust rebound in adjusted EPS. Subsequently, I do not think about SQ as a worth inventory proper now. Nevertheless, I imagine that SQ can demand the next a number of because of its larger progress potential and robust outlook for margin enlargement in comparison with friends.

Moreover, the June CPI report signifies a major lower in inflation, with YoY inflation standing at 3% and core CPI dropping to 4.8%. This discount in inflation might function a constructive catalyst for prime valuation progress shares like SQ. If the US economic system achieves a soft-landing state of affairs, SQ’s valuation may very well be supported by decrease inflation expectations and a positive outlook on long-term rates of interest.

Conclusion

In conclusion, regardless of a 72% drop in inventory value from the pandemic excessive, SQ reveals many constructive indicators with an anticipated rebound in margin and profitability in FY2023. Furthermore, Money App’s progress stays robust, pushed by Immediate Deposit and Money App Card. Whereas SQ’s valuation might not presently be thought-about a discount, because the fintech market chief, its potential for top-line progress and margin enchancment following a cyclical downturn justifies the next a number of in comparison with its friends. Most significantly, decrease inflation expectations indicated by the June CPI report may benefit excessive valuation progress shares like SQ. Subsequently, contemplating the current muted value motion, I keep a constructive on the inventory and examine this as a possible shopping for alternative for long-term traders.