marchmeena29

Funding Thesis

At this time, I’m initiating protection on the Avantis U.S. Massive Cap Worth ETF (NYSEARCA:AVLV), an actively-managed fund with a low 0.15% expense ratio and $1.27 billion in belongings underneath administration. As you are effectively conscious, large-cap worth ETFs have considerably underperformed large-cap progress ETFs in 2023 by 20-25%, and whereas AVLV has additionally struggled, it is a strong fund with an above-average, albeit restricted, observe document. On this article, I’ll examine AVLV’s historic efficiency in opposition to dozens of friends and consider the ETF basically in opposition to fashionable alternate options like SPYV and VTV. Whereas I do not assume AVLV stands out on this crowded class, I ask readers to place it on their watchlist to diversify their worth portfolio by type in a cheap means. I hope you benefit from the evaluation.

AVLV Overview

Technique Dialogue

In line with AVLV’s truth sheet, the first goal is long-term capital appreciation, not earnings. AVLV provides lots of the identical advantages related to indexing (diversification, low turnover, transparency) however is actively managed, permitting its fund managers to make the most of present alternatives with out ready for a scheduled rebalancing. For a 0.15% expense ratio, that is a great deal, assuming managers are expert.

The outcomes thus far point out they’re. Utilizing the iShares Russell 1000 Worth ETF (IWD) to mirror the efficiency of its said benchmark, AVLV delivered an annualized 6.28% achieve since its September 2021 launch, in comparison with 2.88% for IWD. Volatility was larger, however not in a nasty means. AVLV’s Sortino, which measures draw back risk-adjusted returns, was considerably higher at 0.43 vs. 0.16 for IWD. Moreover, its most 16.96% drawdown between April and September 2022 was about 1% much less.

Portfolio Visualizer

These outcomes kind the inspiration for a purchase suggestion. Nevertheless, IWD is only one large-cap worth ETF in the marketplace. I recognized 33 others in my ETF database, and since it is not prudent to personal all of them, let’s look nearer at how AVLV carried out in opposition to these subsequent.

Efficiency Evaluation

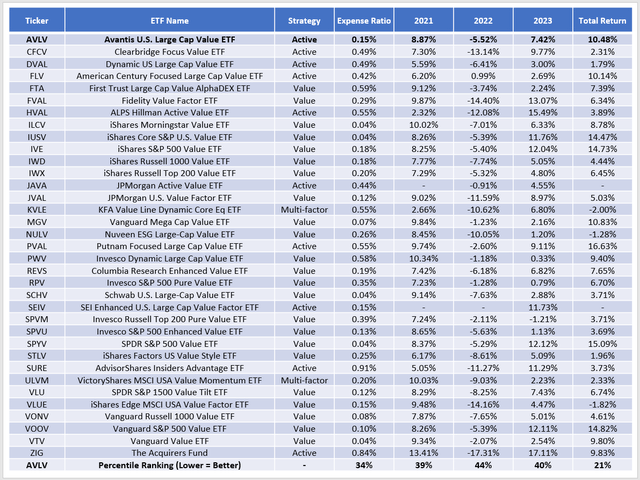

The next desk highlights annual returns for AVLV, IWD, and 33 different large-cap worth ETFs. Please be aware that efficiency was restricted to the final three months of 2021, whereas 2023’s returns are YTD by way of June.

The Sunday Investor

This desk reveals how AVLV’s 8.87%, -5.52%, and seven.42% returns between 2021-2023 have been within the second quartile, which led to a ten.48% whole return that beat out almost 80% of large-cap worth friends. I like constant performers, because it signifies managers did not simply get fortunate one yr, which might skew the outcomes. Nevertheless, this desk additionally reveals the competitors. On whole returns, the next 9 ETFs produced an analogous or higher end result:

- American Century Centered Massive Cap Worth ETF (FLV)

- iShares Core S&P U.S. Worth ETF (IUSV)

- iShares S&P 500 Worth ETF (IVE)

- Vanguard Mega Cap Worth ETF (MGV)

- Putnam Centered Massive Cap Worth ETF (PVAL)

- SPDR S&P 500 Worth ETF (SPYV)

- Vanguard S&P 500 Worth ETF (VOOV)

- Vanguard Worth ETF (VTV)

- ETF Sequence Options – The Acquirers Fund (ZIG)

Moreover, PVAL and SPYV are two different ETFs that by no means ranked within the third or fourth quartiles. PVAL is one other actively-managed fund, but it surely’s solely a semi-transparent fund with 48% portfolio turnover final yr, so it is a more difficult fund to research. Nonetheless, we now have a gaggle of 9 ETFs that is perhaps thought-about appropriate alternate options to AVLV, so let’s take a look at how AVLV compares to some of them in additional element subsequent.

AVLV Evaluation

Sector Exposures and Prime Ten Holdings

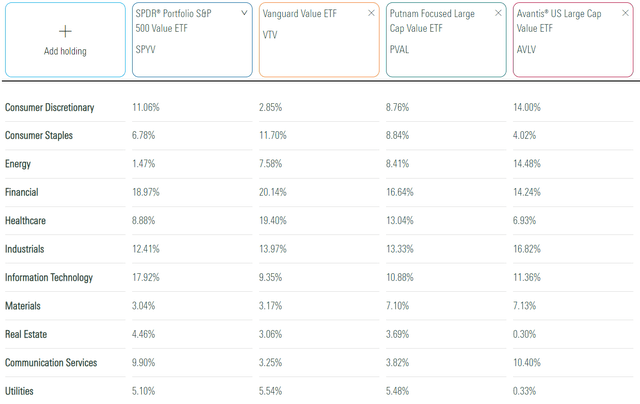

Sector exposures for SPYV, VTV, PVAL, and AVLV are beneath. Please be aware that PVAL’s figures are solely approximate because of its construction. The present monitoring basket has a 77.49% overlap with the precise portfolio.

Morningstar

In some ways, the 4 ETFs have related publicity areas. Nevertheless, AVLV overweights Shopper Discretionary (14.00%) and Communication Companies (10.40%) and is noticeably mild on Shopper Staples (4.02%) and Well being Care (6.93%). These variations seemingly result in a extra risky portfolio.

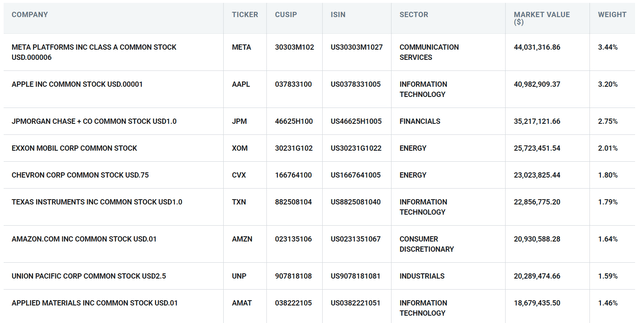

AVLV’s prime ten holdings are listed beneath, totaling 22% of the fund. Meta Platforms (META) is the highest holding, as the corporate has just lately modified focus in favor of operational effectivity moderately than progress. Apple (AAPL) is an uncommon alternative; it trades at 32.51x ahead earnings and yields simply 0.49%. Lastly, JPMorgan Chase (JPM) aligns extra with what worth buyers count on. The financial institution trades at 9.60x ahead earnings and has an honest 2.61% yield.

Avantis Buyers

AVLV Fundamentals

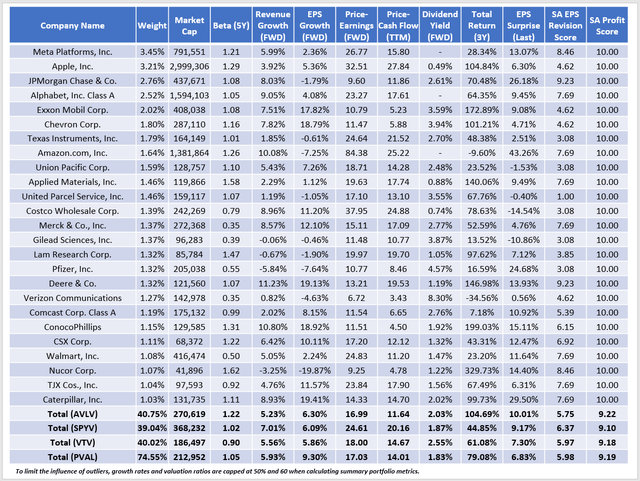

The next desk highlights chosen elementary metrics for AVLV’s prime 25 holdings. Within the remaining row, I’ve additionally included abstract metrics for SPYV, VTV, and PVAL. As a reminder, PVAL’s metrics are based mostly on the present monitoring basket and are solely partially correct.

The Sunday Investor

The primary standout metric is AVLV’s 1.22 five-year beta, considerably larger than the opposite three ETFs. Solely three others within the 35 ETF pattern from earlier (SURE, ZIG, RPV) have larger betas, so AVLV is undoubtedly completely different than what you are seemingly used to. Concerning overlap, AVLV has solely 37%, 33%, and 15% with SPYV, VTV, and PVAL, so it might complement passive ETFs effectively.

The second metric I need to spotlight is how AVLV’s present holdings had a 104.69% whole return over the past three years, considerably greater than its friends. On this sense, it is not a typical worth fund. I already talked about how Apple was an odd choice, however AVLV has 6.80% and 4.49% publicity to the Oil & Fuel E&P and Built-in Oil & Fuel industries. Constituents in these industries are up 265.08% and 158.68% within the final three years, however Power is a key chubby space for AVLV that has stunted returns thus far in 2023. Exxon Mobil (XOM), Chevron (CVX), and ConocoPhillips (COP) are all down YTD.

AVLV provides 6.30% estimated earnings progress and trades at 16.99x ahead earnings, which is healthier than SPYV and VTV, however worse than PVAL’s 9.30% and 17.03x figures. Nevertheless, the draw back is weak earnings momentum pushed by AVLV’s excessive allocation to Power shares. AVLV’s constituents had a formidable Q1 2023 earnings season, delivering a weighted common 10.01% earnings shock. Nevertheless, Wall Avenue is not as bullish this quarter, particularly after Exxon Mobil forecasted “sharply decrease” Q2 earnings from decrease pure fuel costs and tighter oil margins. It stays to be seen how a lot is baked into share costs, however we can’t have to attend too lengthy to seek out out. Each Exxon Mobil and Chevron are scheduled to launch earnings on July 28.

Funding Suggestion

AVLV is a strong large-cap worth ETF that provides the advantages of lively administration at a low price. Nevertheless, it operates in a crowded class, and 9 different ETFs have outperformed AVLV since its September 2021 launch. Whereas AVLV’s fundamentals look sturdy, notably its mixture of progress and valuation, I am involved with its 14.5% publicity to the Power sector and comparatively weak earnings momentum in comparison with passive alternate options like SPYV and VTV. Subsequently, I’ve set my ranking to a “maintain”, however I look ahead to discussing AVLV and different large-cap worth ETFs within the feedback part beneath. Thanks for studying.