DNY59

As a probable financial slowdown approaches, the funding outlook for brief, high-quality client asset-backed securities seems enticing. Though additional prime credit score normalization is predicted given client headwinds, delinquencies and defaults stay under pre-pandemic ranges.

The mix of enticing pricing and stable beginning fundamentals might lead to engaging risk-adjusted yields whilst financial situations deteriorate within the second half of the 12 months.

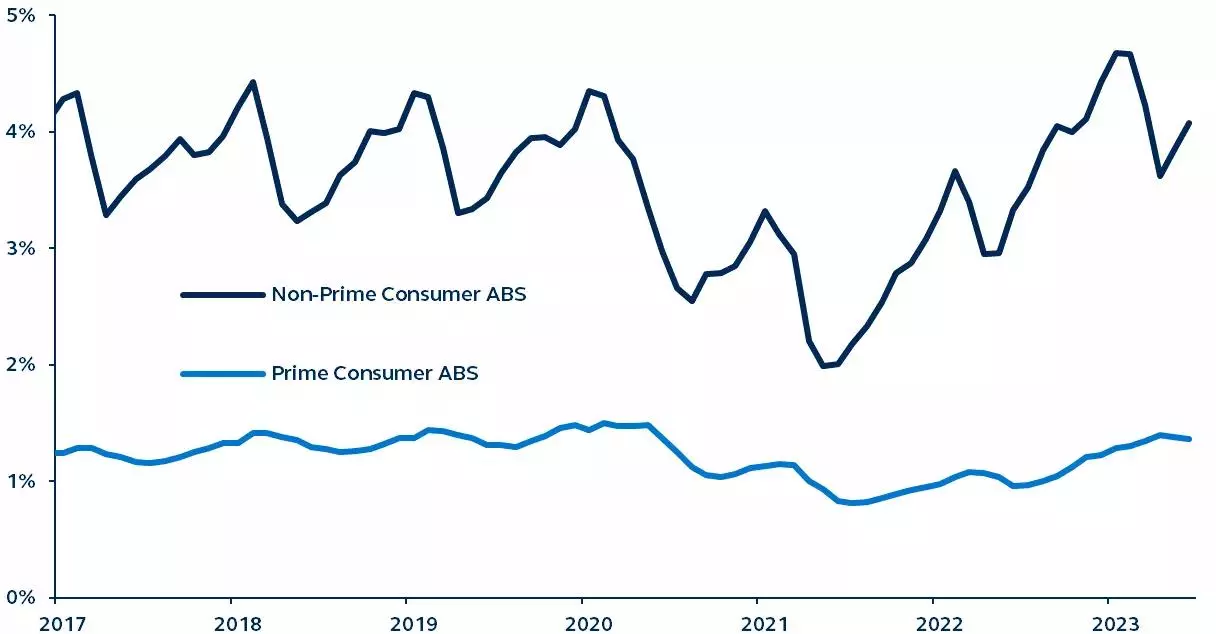

ABS delinquencies

January 2017–June 2023

Supply: Intex, Principal Asset Administration. Knowledge as of June 30, 2023.

The panorama for fastened revenue buyers is shifting as we enter the third quarter of 2023. Notably, a number of traditionally dependable financial indicators are signaling {that a} recession is on the horizon – setting the stage for segments of fastened revenue to carry out nicely because the financial system slows.

On this setting, brief, high-quality client ABS seems notably enticing. The inverted yield curve and market technical elements have led to excessive benchmark yields and vast spreads, whereas prime client credit score stays stable regardless of current normalization.

This mixture of enticing pricing and stable beginning fundamentals might lead to engaging risk-adjusted yields even when financial situations deteriorate within the second half of 2023.

Though additional prime credit score normalization is predicted given client headwinds, delinquencies and defaults stay under pre-pandemic ranges, and tight post-International Monetary Disaster credit score underwriting ought to hold efficiency in test.

Conversely, subprime credit score has weakened extra noticeably. Inflation has weighed on decrease revenue households, and delinquencies and defaults amongst riskier debtors at the moment are above pre-pandemic ranges.

Because the U.S. financial system faces headwinds, the funding outlook for brief, high-quality client ABS seems favorable – notably, prime credit score with well-structured offers and powerful sponsors.

Wider spreads have the potential to reinforce returns and the resilient construction of the asset class, with a historic observe file of performing nicely via financial cycles, presents a stage of draw back threat mitigation amidst heightened market volatility.

Authentic Submit

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.