Kirk Wester

Funding Overview

Simply over 6 weeks in the past, in a publish for Looking for Alpha, I mentioned how Eli Lilly and Firm (NYSE:LLY) had assumed the mantle of being the world’s Most worthy pharmaceutical firm, regardless of being nowhere close to the largest income driver, and much from probably the most worthwhile.

Pfizer (PFE), for instance, earned practically >3.5x extra income than Lilly in 2022 – $100bn, to Lilly’s $28.5bn – but its market cap valuation is $205bn, which is lower than half Lilly’s valuation of $440bn.

Johnson & Johnson (JNJ), the corporate Lilly briefly changed on the high of the valuation desk, earned internet earnings of $17.9bn final yr – practically 3x greater than Lilly. Lilly’s dividend yield of <1% is the bottom within the Huge Pharma sector – the common payout yielding ~3%.

As I mentioned in my final observe nevertheless, Huge Pharma valuations are not often primarily based on precise efficiency at present, however perceived efficiency tomorrow. Indianapolis-headquartered Lilly is assumed to have developed – within the type of its Glucagon-like Peptide-1 (“GLP-1”) receptor agonist pipeline – a diabetes and weight reduction franchise with the potential to ship the {industry}’s all-time greatest promoting drug.

Tirzepatide is already authorised by the FDA to deal with Kind 2 diabetes, beneath the model title Mounjaro. It’s anticipated to be authorised to deal with weight reduction/weight problems earlier than the top of the yr in each the U.S. and Europe, after outcomes from the drug’s Section 3 SURMOUNT-2 research revealed the drug achieved a mean 15% weight reduction in adults, versus 3.2% achieved by sufferers taking a placebo.

I defined in my final observe that, as massive a market as Kind 2 diabetes is – ~37m individuals within the U.S. alone are identified with the situation within the US, and Lilly’s checklist value for Tirzepatide is estimated to be ~$13k, making a theoretical market alternative of ~$450bn – the burden loss market is way bigger. In response to the World Well being Organisation (“WHO”), 650m individuals globally are overweight, and 1.6bn individuals are obese.

Briefly, the potential of Tirzepatide – a drug that works by binding to each the GLP-1 and GIP receptors, answerable for controlling your urge for food, and actually making sufferers really feel extra full – is mind-boggling. And it isn’t simply Tirzepatide that Lilly is engaged on – there are 2 different medication within the firm’s pipeline that could possibly be as efficient, or maybe much more efficient.

Retatrutide, nicknamed “Triple G” as a result of it combines glucagon receptor agonism with GIP and GLP-1 receptor agonism, lately achieved 17.5% imply weight discount in a Section 2 research of >330 sufferers, assembly all main and secondary endpoints, while orforglipron, a once-daily oral nonpeptide GLP-1 receptor agonist (tirzepatide and retatrutide are self-injectable therapies), has achieved 14.7% weight discount at 36 weeks in obese or overweight adults in its personal Section 2 research.

These are momentous knowledge readouts – higher than something that has come earlier than, with the attainable exception of Novo Nordisk’s semaglutide – already authorised in Kind 2 Diabetes (“T2D”) as Ozempic, and in weight reduction as Wegovy. Ozempic drove ~$8.6bn of revenues in 2022, and the demand for Wegovy has been so nice, there may be at the moment a world scarcity of the upper dose formulation.

Each Lilly and Novo Nordisk inventory has bucked the pattern of underperformance by massive Pharma corporations in 2023 – Lilly’s share value is up by 44% to date this yr, and by >420% throughout the previous 5 years. Novo Nordisk inventory is up by 21% to date this yr, and by >230% over 5 years.

Conservative estimates round tirzepatide gross sales counsel the drug may obtain peak gross sales of ~$25bn each year in T2D alone – Lilly itself hasn’t volunteered a determine, however administration has identified that obesity-related issues and comorbidities price the US authorities upwards of $1 trillion each year. My very own private perception is that the franchise may drive revenues each year >$80bn.

As such, it isn’t laborious to grasp why Lilly’s share value has been hovering. Equally, it isn’t stunning to see individuals questioning whether or not a $440bn market cap valuation – which means a value to earnings ratio primarily based on 2022 earnings ratio of >70x – at the least twice as excessive as the subsequent Pharma – and value to gross sales ratio of 14x – at the least 3 occasions as excessive as the subsequent pharma – goes too far.

Is Lilly’s Hovering Valuation Justified? Let’s Begin With Donanemab

Tirzepatide is undoubtedly one of many most-hyped medication in current reminiscence. Its potential is so vital, it has even solid a shadow over one other breakthrough drug that Lilly has simply launched pivotal trial knowledge for.

That drug is donanemab, Lilly’s Alzheimer’s Illness (“AD”) remedy. Final week, Lilly revealed the outcomes from its Section 3 TRAILBLAZER-ALZ 2 research, which confirmed, in keeping with a press launch:

Donanemab considerably slowed cognitive and practical decline for amyloid-positive early symptomatic Alzheimer’s illness sufferers, decreasing their danger of illness development.

Further subpopulation analyses offered stay confirmed that these research individuals at earliest stage of illness had even higher profit, with 60% slowing of decline in comparison with placebo.

Donanemab assaults the clumps of amyloid beta protein that construct up within the brains of Alzheimer’s sufferers, and efficiently removes them. When approving Biogen (BIIB) and associate Eisai’s (OTCPK:ESALF) drug lecanemab (beneath the model title Leqembi) which has an analogous mechanism of motion (“MoA”), the FDA made it clear that it considers removing of amyloid plaque to be a surrogate endpoint for AD medication.

With donanemab additionally exhibiting a medical profit in its pivotal research, the drug appears extremely prone to be authorised, even with a considerably troubling security profile. Circumstances of Amyloid-related imaging abnormalities (“ARIA”), a facet impact of the drug that may trigger nausea and dizziness, and in additional critical instances, swelling of the mind (“oedema”), had been skilled by 37% of sufferers within the donanemab arm of the research, versus 15% within the placebo arm. General loss of life within the donanemab arm was 1.9%, versus 1.1% within the placebo arm.

The slowing of cognitive decline skilled by sufferers utilizing donanemab – and lecanemab – has been hailed as a serious breakthrough, though neither drug remotely resembles a remedy for the illness, and it’s even unclear if these caring for sufferers will have the ability to see any noticeable impact or enchancment in sufferers.

Donanemab is a vital drug and an essential step ahead within the battle towards Alzheimer’s, and it’ll doubtless be a serious income driver for Lilly, maybe even producing gross sales within the double-digit billions yearly. However make no mistake, tirzepatide is the drug driving Lilly’s share value larger and better.

Speaking Of Alzheimer’s – May Tirzepatide Flop On Security Issues, Like Biogen’s Over-Hyped Aduhelm?

When Biogen’s first AD drug Aduhelm was authorised – controversially – by the FDA in June 2021, the corporate’s share value leaped from ~$265, to ~$395 in a single day – a acquire of ~50%, which represented a rise of >$20bn in Biogen’s market cap.

Among the forecasts for that drug had been virtually as excessive as these quoted for tirzepatide – however Aduhelm was related to antagonistic security occasions, overpriced by its builders, at >$45k each year, and did not safe reimbursement from the Facilities for Medicare and Medicaid Providers (“CMS”) exterior of medical trials, earlier than being shelved altogether. Right now. Biogen’s share value trades at an analogous value to the pre Aduhelm approval spike, even with the profitable approval of lecanemab.

Is there any prospect of tirzepatide struggling an analogous destiny to Aduhelm?

Though the long-term results of utilizing tirzepatide haven’t been fully established, it does include side-effects – gastrointestinal, cardiovascular, renal, dermatologic, hepatobiliary, ocular, endocrine and pancreatitis issues have all been reported in medical trials – the out there knowledge suggests most side-effects are gentle in nature.

The “miracle” T2D / weight reduction drug seems to be secure for many sufferers to make use of, though Mounjaro does include a boxed warning – because it has been discovered to trigger dose-dependent and treatment-duration-dependent thyroid C-cell tumors in rats.

Arguably, the largest security subject to have come to mild to date in relation to GLP-1 agonists includes prospects who can’t acquire entry to Novo Nordisk’s semaglutide turning to compounding pharmacies to purchase ready-made compounds, which might be dangerous. A cynic may additionally counsel it is extremely a lot in Lilly and Novo Nordisk’s pursuits to stop sufferers accessing their medication by way of every other provider.

One different concern could possibly be associated to psychological well being. The European Medicines Company lately introduced it’s:

reviewing knowledge on the chance of suicidal ideas and ideas of self-harm with medicines generally known as GLP-1 receptor agonists, together with Ozempic (semaglutide), Saxenda (liraglutide) and Wegovy (semaglutide).

The overview was triggered by the Icelandic medicines company following reviews of suicidal ideas and self-injury in individuals utilizing liraglutide and semaglutide medicines. Thus far authorities have retrieved and are analysing about 150 reviews of attainable instances of self-injury and suicidal ideas.

This is a vital dimension of security that’s tough to guage as there has by no means earlier than been a weight reduction drug as efficient as GLP-1 agonists seem like. Generally known as the “Hollywood Drug,” some high-profile figures have instructed that Novo Nordisk’s Wegovy has not labored for them, while others have purchased into the hype, with the likes of Elon Musk praising Wegovy use as integral to his personal weight reduction.

This has helped create large international demand for semaglutide and triggered a world scarcity of the drug – and an ethical headache. Celebrities singing the praises of those medication may result in a world sense of “FOMO” (concern of lacking out) and harm the conceit of individuals whose psychological well being is linked to their weight.

Moreover, the usage of semaglutide and tirzepatide off label to drop some weight may lead to there being not sufficient provide to deal with diabetics, whose want is extra pressing.

Can Lilly Create Sufficient Tirzepatide Product To Meet Demand?

In Q123, Novo Nordisk introduced that gross sales of Ozempic had been ~$2.9bn- up 46% year-on-year – and gross sales of Wegovy had been $679m – up 225% year-on-year. Wegovy gross sales would doubtless have been a lot larger had it not been for provide shortages skilled by the corporate.

For Lilly’s half, the corporate reported Mounjaro gross sales of $569m in Q123 – up from $279m in Q422 – a determine which set analysts pulses racing, given the drug was solely authorised in Could 2022.

Talking at a Goldman Sachs healthcare convention in June, Lilly’s Chief Monetary Officer (“CFO”) Anat Ashkenazi revealed that the corporate had accomplished its regulatory submission for tirzepatide in weight reduction, and because of a Precedence Evaluation Voucher (“PRV”), anticipated to obtain an approval on this indication earlier than the top of 2023.

Apparently, Mounjaro is already being prescribed off-label for weight reduction, and as I mentioned in additional element in my final observe, tirzepatide, because of its twin motion, which has earned it the nickname “twincretin” (incretins are hormones that increase the secretion of insulin), is tentatively anticipated to emerge because the superior various to semaglutide. Lilly itself is assured, and its SURMOUNT-5 research will instantly examine the two medication.

Analysts have forecast that Mounjaro alone will generate >$26bn in annual revenues by 2030, and with weight reduction, as mentioned, representing a far bigger market, the place demand has already outstripped provide, it’s laborious to place a quantity on the sorts of annual revenues tirzepatide may drum up in its second indication.

For good measure, the drug can be prone to be authorised in non-alcoholic steatohepatitis, one other “holy grail” indication through which no different medication are authorised, and revenues within the double-digit billions, if authorised, are nearly assured.

With all that stated, Lilly can solely promote no matter portions it will possibly produce, and administration is determined to not expertise the shortages suffered by Novo Nordisk. Lilly is spending $1.7bn on a facility in North Carolina, Ashkenazi informed the GS convention, however rapidly realised that it might want extra:

That facility is progressing effectively, and we needs to be launching out of that facility — or not launching, promoting out of that facility this yr. So it is on observe to what we stated beforehand. However we knew that this was most likely not going to be enough. It is a very massive website with a number of strains. So we broke floor final yr, mid final yr.

On a second website in North Carolina in Harmony, a few hours drive from the primary website, equally massive website as effectively, one other over $1 billion funding, however we knew that is not going to be enough.

So we now have three extra websites we’re beginning. One is an API website in Eire, which we simply broke floor on. And I feel you already know, we now have massive presence in Eire. After which two new websites in Indianapolis, not all of them for the incretin portfolio, however we appeared on the broader portfolio that we now have. And we felt that we wanted that capability to be out there. So virtually $4 billion of funding in simply North of Indianapolis for extra manufacturing capability.

By my rely that’s 5 new websites devoted to producing tirzepatide, which makes use of the identical auto-injector pens as the remainder of Lilly’s diabetes franchise, e.g. Trulicity, Emgality. The full funding of ~$6bn into new manufacturing vegetation is peanuts in comparison with anticipated gross sales of tirzepatide, and permits Lilly to manage manufacturing versus utilizing contract manufacturing organisations, the technique that has not labored out so effectively for Novo.

For additional consolation, Ashkenazi informed the convention attendees that “each time we see us launch in a market, you must really feel assured we’re going to have the ability to help that market”, and likewise made the purpose that the corporate wouldn’t be utilizing PRV – which might shorten the FDA’s overview interval from e.g. 18 months, to only 6 – if it didn’t really feel it may meet demand for tirzepatide in weight reduction.

Reimbursement Points

Though the above-mentioned Aduhelm and tirzepatide are 2 very completely different medication, there may be one other aspect of the previous’s business failure that might additionally have an effect on the latter.

Within the U.S. at present, the CMS doesn’t present reimbursement – i.e., the method by which low and center earnings sufferers can entry costlier medication, with CMS funding the vast majority of the associated fee – for any weight reduction medication. Mounjaro has a listing value of ~$1k monthly, doubtless that means the vast majority of sufferers will want some type of reimbursement if Lilly costs the identical for the weight problems model of the drug.

One research has instructed that if 10% of individuals within the U.S. with weight problems lined by Medicare had been prescribed with “a model title semaglutide,” the associated fee can be within the area of $26.8bn. The writer of the research informed Beckerspayer.com:

After we have a look at outcomes relative to prices, within the brief and long run, the value of semaglutide merely doesn’t align in the mean time with the additional advantage over earlier technology anti-obesity drugs

Presumably, the identical would even be true for tirzepatide, and tirzepatide will doubtless be a life-long therapy, making it probably prohibitively costly for not simply the CMS, however non-public insurers additionally, who usually look to the CMS when making their very own reimbursement choices.

Celebrities and higher-earners could not bat an eyelid at paying ~$12k each year for a drug with confirmed weight reduction capabilities, and if, for argument’s sake, 5m individuals had been to take action annually – ~1.5% of the U.S. inhabitants – the drug may nonetheless earn $60bn each year for Lilly.

That determine could or will not be reasonable, nevertheless, so probably Lilly will contemplate it vitally essential to safe reimbursement. Huge Pharma corporations, it’s well-known, have very highly effective lobbies, and final week a gaggle of U.S. senators reintroduced a invoice that can permit Medicare recipients to obtain reimbursement for weight reduction medication – apparently, it’s the seventh time the invoice has been launched since 2012.

Pharmas have a behavior of ultimately getting their approach in such issues, though the federal government secured a notable victory final yr with the introduction of the Inflation Discount Act (“IRA”) that gave it a say in drug pricing for the primary time, and prevented Pharmas from elevating drug costs quicker than the speed of inflation. Unsurprisingly, a number of outstanding pharmas have opted to sue the federal government because of this – though Lilly just isn’t but certainly one of them.

In the end, the CMS determination on whether or not to reimburse for weight reduction medication could possibly be price as a lot as $25bn each year to Lilly, if no more.

A Fairweather Discounted Money Movement Valuation of Lilly’s Enterprise

As instructed when protecting donanemab, above, Lilly has extra to supply than its diabetes/weight reduction franchise. Its oncology division drove $5.7bn of revenues final yr, and three potential “blockbuster” medication – i.e., able to driving >$1bn revenues each year – have lately been, or will likely be, added to the portfolio.

These three are Retevmo, authorised final yr for metastatic stable tumors with a rearranged throughout transfection (RET) gene fusion, Pirtobrutinib, authorised in January for relapsed or refractory mantle cell lymphoma (MCL), and Imlunestrant, a breast most cancers remedy nonetheless in late stage medical research.

Neuroscience division revenues – $3.5bn in 2022, will doubtless develop considerably because of donanemab, and a second AD drug in improvement, remternetug, whereas the immunology division – 3.3bn of revenues in 2022 – will develop because of 2 new medication, lebrikizumab, and mirikizumab, that might drive mixed revenues >$6bn in time.

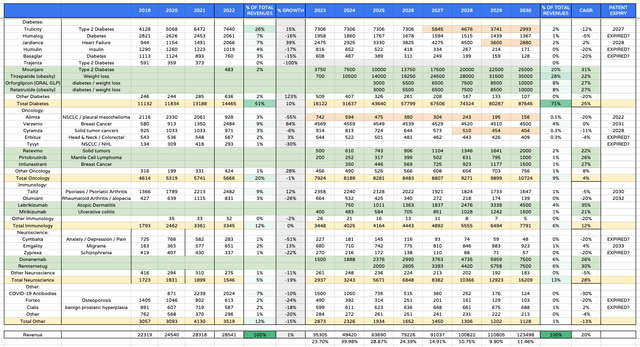

Lilly ahead product revenues (my desk and assumptions)

As a way to attempt to assess if Lilly inventory is genuinely price $465 per share – its present traded value – or extra, or much less, I created a desk of product-by-product revenues forecasts as above.

That is an optimistic desk through which peak GLP-1 franchise revenues in 2030 are $80bn, with the subsequent technology medication retatrutide and orforglipron authorised and producing double-digit billion revenues.

By 2020 I even have the oncology division delivering revenues within the double-digit billions, and the neuroscience division >$16bn each year. On this optimistic state of affairs Lilly’s revenues in 2030 exceed $120bn, which might be a file for a Pharma. The compound annual development fee for revenues is an virtually extraordinary (for such a big firm in such a aggressive {industry}) at 20%.

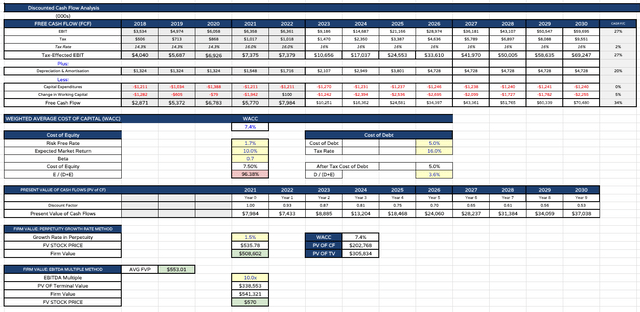

Lilly – forecast earnings assertion (my desk and assumptions)

I take these income figures and plug them right into a forecast earnings assertion, as above. Observe I additionally considerably cut back working bills as a proportion of revenues over time, to only over 50% by 2030, and likewise cut back curiosity expense – if these projections had been correct, Lilly could have generated >$200bn in money by 2030 – an astonishing determine! Within the above desk, EPS reaches >$50 by 2030 – a ahead value to earnings ratio of ~9x.

Lilly DCF value evaluation (my desk and assumptions)

Lastly, I current my discounted money movement (“DCF”) evaluation and value targets – $535 per share primarily based on the perpetuity development fee technique, and $570 primarily based on the EBITDA a number of technique.

Observe the weighted common price of capital is simply 7.4%. I often use a WACC of 10% when finishing DCF evaluation on massive Pharmas, however I’m decreasing Lilly’s beta, anticipating the corporate outperforming even whereas financial circumstances are harsh and offering industry-wide headwinds, and the anticipated market return, for a similar causes.

My last value goal – on this optimistic state of affairs – is the common of the two calculations – or $553 per share.

Concluding Ideas – Over-Hyped, or Underneath-Valued? The Jury Stays In Session – However The Bull Case Can Nonetheless Be Made

Lilly, and Novo Nordisk (NVO), exist in a parallel universe to the remainder of the Huge Pharma {industry} at the moment, their share costs climbing whereas the others fall, and make no mistake, that is solely right down to their diabetes/weight reduction franchises, and extra particularly, semaglutide and tirzepatide – 2 merchandise the market believes are nothing wanting revolutionary. However is the market proper?

On this observe I’ve highlighted some sensible points that should be overcome to ensure that Lilly to justify its present sky excessive valuation and standing because the world’s greatest Pharma by market cap.

Safe an approval for tirzepatide in weight reduction. Guarantee there may be enough provide to satisfy demand. Make sure the long-term security profile is confirmed and handle points round off-label use and psychological well being implications of utilizing the drug. Safe reimbursement for weight reduction from CMS.

A last essential level to think about is patent safety – how lengthy can Lilly moderately anticipate to have exclusivity in these markets? It could possibly be 10-15 years, and after that, the burden loss empire would crumble beneath the burden of generic competitors, with franchise revenues doubtless falling at >25% each year.

As talked about in my intro, with many hurdles to be overcome, it isn’t stunning there may be bearish sentiment on Lilly and disbelief that the corporate warrants its present valuation. Take away tirzepatide, and Lilly’s valuation doubtless falls by 50% or extra in a single day, simply as Biogen’s did with Aduhelm.

Bulls, alternatively, have each motive to imagine Lilly’s share value can climb even larger, primarily based on an goal evaluation of the market alternative. My value goal implies Lilly’s share value could also be as a lot as 15% undervalued.

The implications of a profitable, secure, weight reduction drug addressing a market of ~2bn individuals worldwide are mind-boggling, to the extent that Lilly changing into the primary ever $1 trillion greenback market cap pharmaceutical firm doesn’t even appear too outlandish.

There are many explanation why we are going to by no means see such a excessive valuation, as mentioned, however I personally imagine Lilly is able to getting over half approach there, and fairly doubtless past $600bn, though it could not keep there for lengthy, with so many “unknowns – recognized and unknown” – in play.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.