ipopba

The Industrial Choose Sector (XLI) rose +0.56% for the week ending July 28, being among the many 7 out of the 11 S&P 500 sectors, which closed the week in inexperienced.

The SPDR S&P 500 Belief ETF (SPY) climbed +1.05% in the week, which noticed the earnings season rushing up, and the Federal Reserve pushing rates of interest to a 22-year excessive, with one other 25 foundation factors transfer. Nevertheless, the Fed workers is not forecasting a recession. In the meantime, European Central Financial institution and the Financial institution of Japan additionally carried out coverage price choices.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +11% every this week. YTD, 4 out of those 5 shares are within the inexperienced.

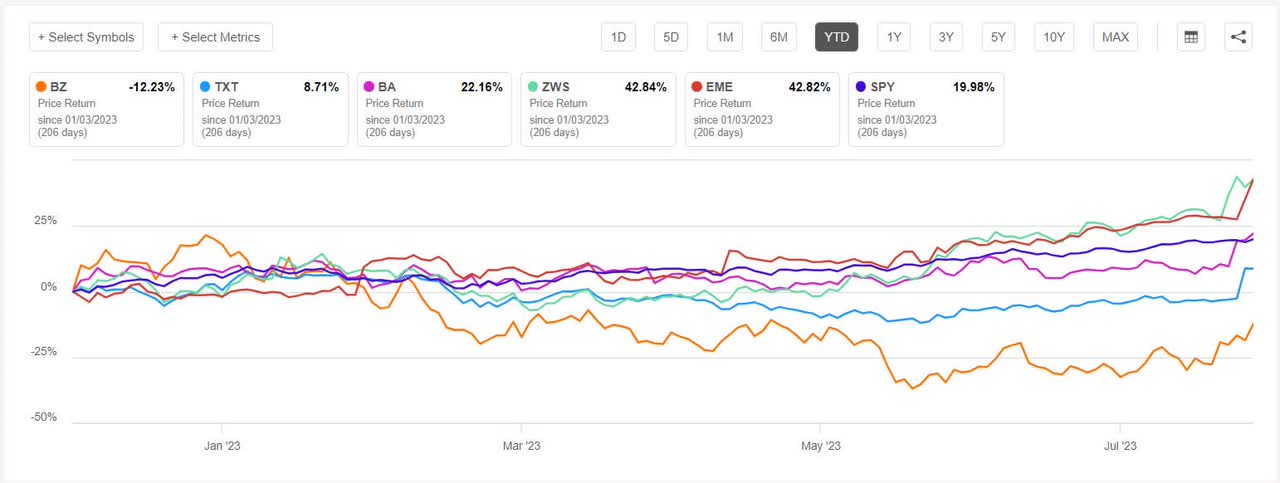

Kanzhun (NASDAQ:BZ) +21.45%. Shares of the Beijing-based on-line recruitment platform rose probably the most on Monday +11.69%. The inventory additionally obtained a lift on Friday (+7.67%) helped by a surge in Chinese language shares. BZ was the highest decliner about two months however since then it has recovered a few of its losses; Might 26 YTD the inventory was down -29.95%, in comparison with YTD July 28, -7.71%.

Nevertheless, Kanzhun is the one inventory amongst this week’s high gainers which is within the pink YTD. The corporate’s shares had additionally seen volatility in 2022.

BZ has a SA Quant Score — which takes into consideration components corresponding to Momentum, Profitability, and Valuation amongst others — of Maintain. The inventory has an element grade of B- for Profitability and A- for Development. The typical Wall Avenue Analysts’ Score differs fully with a Sturdy Purchase score, whereby 12 out of 17 analysts tag the inventory as such.

Textron (TXT) +12.94%. The enterprise jet maker’s inventory surged +11.87% on Thursday after Q2 non-GAAP EPS beat analysts estimates and the corporate raised its full yr outlook.

The SA Quant Score on TXT is Maintain with rating of B- for Momentum and D for Valuation. The score is in distinction to the typical Wall Avenue Analysts’ Score of Purchase, whereby 6 out of 15 analysts tag the inventory as Sturdy Purchase. YTD, +7.88%.

The chart under exhibits YTD price-return efficiency of the highest 5 gainers and SPY:

Boeing (BA) +12.70%. The inventory surged +8.72% on Wednesday, to a 52-week excessive, after Q2 outcomes supassed expectations. In the meantime, rival Airbus confronted new potential supply-chain hurdles linked to Pratt & Whitney engine woes.

BA has a SA Quant Score of Maintain with issue grade of A+ for Profitability however F for Valuation. The typical Wall Avenue Analysts’ score is Purchase, whereby 15 out of the 25 analysts see the inventory as Sturdy Purchase such. YTD, +25.30%.

Zurn Elkay Water Options (ZWS) +11.38%. Milwaukee, Wis.-based firm noticed its inventory climb +7.53% on Tuesday following second quarter outcomes publish market on Monday. YTD, the shares have surged +43.92%, probably the most amongst thiis week’s high 5 gainers. The SA Quant Score on ZWS is Maintain, which is in distinction to the typical Wall Avenue Analysts’ Score of Sturdy Purchase.

Emcor (EME) +11.28%. Second quarter outcomes of the development providers supplier exceeded analysts expectations which despatched the inventory surging +6% on Thursday. The SA Quant Score on EME is Sturdy Purchase, whereas the typical Wall Avenue Analysts’ Score is Purchase. YTD, +43.09%.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -9% every. YTD, solely all these 5 shares are within the inexperienced.

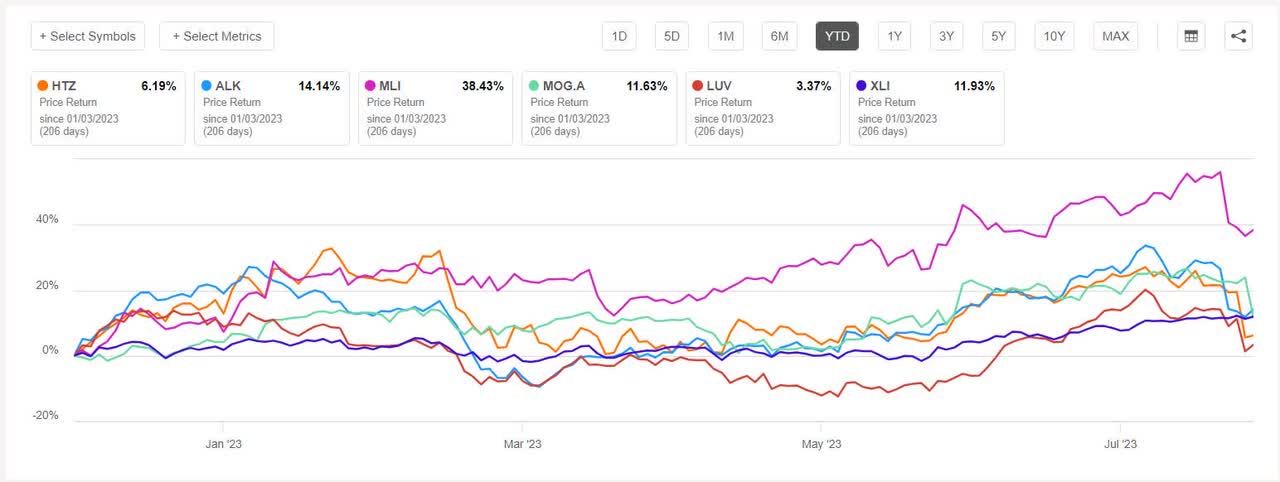

Hertz International (NASDAQ:HTZ) -12.65%. The inventory fell -11.65% on Thursday after the automobile rental firm narrowly missed its Q2 income and adjusted EBITDA estimates.

The SA Quant Score on HTZ is Maintain with an element grade of B- for Valuation and D for Profitability. The typical Wall Avenue Analysts’ Score diagrees with a Purchase score, whereby 3 out of 8 analysts see the inventory as Sturdy Purchase. YTD, +3.64%.

Alaska Air (ALK) -11.14%. Shares tumbled -9.66% on Tuesday after forecasts for full yr 2023 income got here in underneath expectations, regardless of Q2 outcomes beaing estimates. The SA Quant Score on the airline is Purchase with rating of A for Development however C- for Momentum. The typical Wall Avenue Analysts’ Score has a extra constructive view with a Sturdy Purchase score, whereby 9 out of 14 analysts tag the inventory as such. YTD, +12.06%.

The chart under exhibits YTD price-return efficiency of the worst 5 decliners and XLI:

Mueller Industries (MLI) -10.34%. The Collierville, Tenn.-based steel merchandise maker’s inventory fell -9.89% on Tuesday after Q2 income and EPS declined Y/Y. The SA Quant Score on MLI is Sturdy Purchase with issue grade of A for Profitability and B- for Development. One Wall Avenue Analysts score is Sturdy Purchase. YTD, the inventory has soared +37.92%.

Moog (MOG.A) -9.61%. The aero-defence firm’s shares crashed -9.91% on Friday following blended Q3 outcomes. The SA Quant Score on MOG.A is Maintain, whereas the typical Wall Avenue Analysts’ Score is Purchase. YTD, +13.72%.

Southwest Airways (LUV) -9.53%. The inventory fell -8.94% on Thursday after the airline warned that the current development of decrease unit income and better prices may proceed. The corporate’s Q2 income beat estimates however the non-GAAP EPS quantity narrowly fell in need of analysts’ expectations. The SA Quant Score on LUV is Maintain, whereas the typical Wall Avenue Analysts’ score is Purchase. YTD, +0.09%.