-

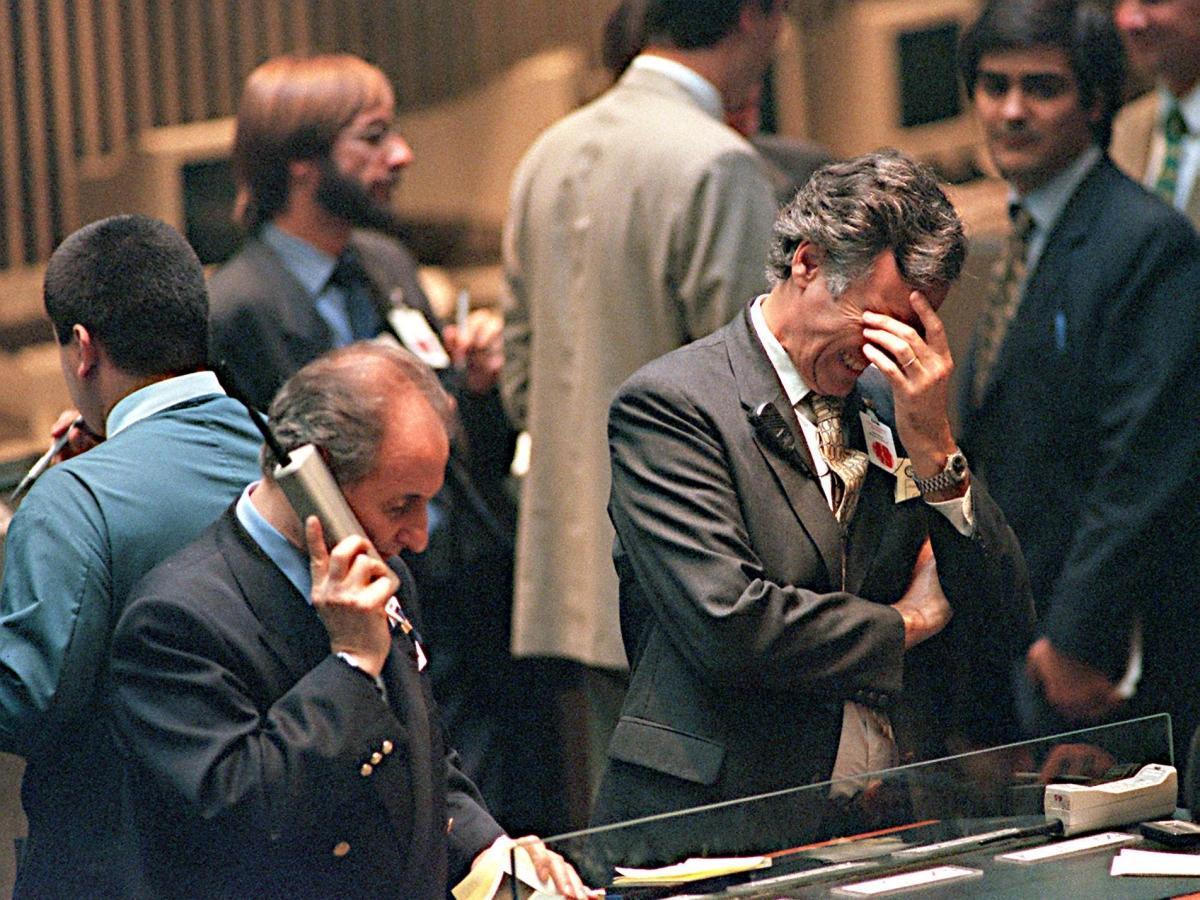

John Hussman, an asset-bubble skilled, forecasts the continuing rally in US shares will “finish in tears.”

-

The S&P 500 dangers a 64% collapse given excessive valuations and “unfavourable market internals,” he stated.

-

Listed here are the long-time market bear’s six most hanging quotes from a current word.

The US shares have loved a powerful rally in 2023, due to a mixture of cooling inflation, fading recession fears and hype over synthetic intelligence.

However do not wager on the cheer lasting lengthy, based on John Hussman.

The long-time fairness bear who referred to as the 2000 and 20008 crashes lately doubled down on his grim outlook for US shares, warning of an astonishing 64% plunge within the S&P 500 index that’ll burst what he referred to as an “excessive yield-seeking speculative bubble”

The president of Hussman Funding Belief has based mostly his views on stretched fairness valuations and unfavourable “internals” – deeming a steep plunge in shares obligatory to revive market situations again to regular.

The S&P 500 has rallied 19% to date this yr, taking its good points for the reason that finish of 2008 – the yr of the worldwide monetary disaster – to greater than 400%. The worth-earnings ratio of the index, one of many valuation metrics tracked by buyers, has climbed to about 26 from final yr’s lows close to 19, based on information from macrotrends.internet.

Listed here are Hussman’s six most hanging quotes from a current word.

1. “There’s a explicit ‘setup” that we have traditionally discovered to be related to abrupt ‘air pockets’ and ‘free falls’ within the S&P 500. It combines hostile situations in all three options most central to our funding disciple: wealthy valuations, unfavourable market internals, and excessive overextension.”

2. “The current mixture of traditionally wealthy valuations, unfavorable internals, and excessive overextension locations our market return/danger estimates – close to time period, intermediate, full-cycle, and even 10-12 yr, on the most destructive extremes we outline.”

3. The potential for a near-term ‘air pocket’ or ‘free fall’ is not a forecast a lot as a regularity that shouldn’t be dominated out. Likewise, with valuations once more larger than at any level in historical past previous to December 2020, aside from a number of weeks surrounding the 1929 peak, the potential for a a lot steeper follow-through ought to be taken severely.”

4.“At current, the valuation extremes we observe indicate {that a} -64% loss within the S&P 500 could be required to revive run-of-the-mill long run potential returns. I do know. That sounds preposterous. Then once more […] I’ve turn out to be used to creating seemingly preposterous danger estimates at bubble peaks.”

5. “Regardless of enthusiasm in regards to the market rebound since October, I stay satisfied that this preliminary market loss will show to be a small opening act within the collapse of essentially the most excessive yield-seeking speculative bubble in U.S. historical past.”

6. “Sure, it is a bubble for my part. Sure, I consider it’ll finish in tears.”

Learn the unique article on Enterprise Insider