[ad_1]

Final week, I wrote concerning the ache of losses. Now we have mathematical proof exhibiting that painful emotions of losses cloud our selections.

If we overcome that worry of ache, we may obtain higher outcomes as merchants.

However shrinking from the ache of losses is only one method our feelings can negatively affect our portfolio.

Behavioral finance consultants have recognized dozens of how we will go flawed in deciding when to purchase and promote. Their information exhibits that all of us have biases that drive errors.

Let’s check out three main biases you may be carrying that would drag down your portfolio…

Are These 3 Biases Killing Your Earnings?

Let’s begin with salience. This is a crucial bias to grasp. It means we are inclined to concentrate on the flawed issues.

As buyers, we could chubby the most recent information. For instance, let’s say we see that inflation rose 0.1% final month. That’s an enormous decline from six months in the past. We anticipate inflation to remain low and begin shopping for shares aggressively.

The newest report is salient info. If solely we had been to dig deeper, we might see that residence costs are reported with a lag. Simply that one issue may drive inflation to 0.3% subsequent month.

This requires an in depth evaluation, however many buyers don’t dig deep. They take a single information level and run with that.

Analysis exhibits we’re comfy doing that. It’s simple to make selections with out detailed evaluation.

It’s additionally simple to do what everybody else is doing. If we discover that inflation is about to rise whereas everybody believes it can fall, we’re uncomfortable. That’s the herding intuition, our pure need to be a part of the in-crowd. For buyers, herding implies that as a substitute of going in opposition to the group, we ignore information and comply with our associates.

The tendency to disregard information is particularly widespread when the info contradicts what we need to imagine. This is called the anchoring bias.

Generally we anchor on earlier costs. It’s widespread to anchor on current highs. We anticipate costs to achieve these highs once more. Low costs imply we’re getting a discount.

We overlook the truth that decrease costs may imply gross sales are falling. Or revenue margins are shrinking. As a rule, low costs imply dangerous information fairly than an opportunity to purchase at a discount.

Anchoring means buyers ignore the most recent info. They concentrate on one thing that confirms what they need to imagine.

Whereas there are analysis papers on these biases (and plenty of others) the true world isn’t as exact as educational analysis. Biases usually work together and amplify one another, and GameStop (NYSE: GME) is an effective instance of that taking place in the true world…

The Excellent Storm for Biases Operating Amok

GameStop hit the information in January 2021. Merchants on a Reddit message board began shopping for. They wished to show Wall Avenue quick merchants a lesson or one thing.

Their shopping for pushed the worth up. The hedge fund they focused did endure losses. Finally, the supervisor shut the fund down. Poor man. He’s in all probability fascinated with the teachings he realized in his $44 million Miami residence.

As people piled into the GME commerce, they had been pushed by the salient info that Redditors had discovered a solution to make tens of millions. In actuality, few really made massive earnings within the commerce. There are rumors that a number of the largest hedge funds did revenue from the buying and selling frenzy. That’s in all probability true.

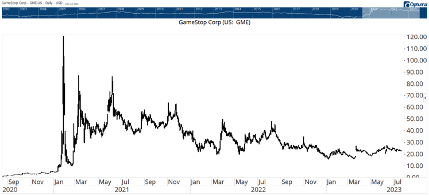

A lot of the shopping for resulted from misguided anchors. Many buyers anchor on info they prefer to imagine. They purchased GameStop at $60 a share in early 2021. They anchored on the current excessive of $120 a share. They had been getting a 50% low cost of their thoughts.

They believed the inventory would double — or extra. The argument was that it was $120 at one time, so it will absolutely attain that degree once more.

Shopping for additionally allowed buyers to be a part of the herd. Tens of millions of people had been shopping for. They had been on-line congratulating one another for purchasing. However sadly, many by no means profited.

The chart under exhibits that GME by no means reached its outdated excessive. Though the inventory has been risky, it’s usually been in a downtrend for greater than two years.

GME By no means Returns to Outdated Highs

Rational buyers averted GME. The corporate was (and nonetheless is) dropping cash. Administration described the corporate’s state of affairs within the 2022 annual report:

At first of 2021, GameStop had burdensome debt, dwindling money, outdated programs and know-how and no significant stockholders within the boardroom. The corporate was in misery and had an unsure future.

None of this was a secret on the time. Everybody may see that the corporate was in bother. The one purpose the inventory went up was as a result of merchants believed they may “stick it” to Wall Avenue by shopping for. And that’s what drove the shopping for.

If you happen to purchased GME in early 2021, you had been a part of the group (herding). You believed the worth may prime $100 a share as a result of it had achieved that earlier than (anchoring). And it was one thing you saved seeing within the information (salience).

In hindsight, it was a trifecta of errors that led many to losses throughout the GME frenzy.

Herding, anchoring and salience biases will virtually all the time result in errors.

Recognizing that you may make these errors is step one towards avoiding them. It’s a step that would show you how to keep away from hundreds of {dollars} in losses sooner or later.

Regards, Michael CarrEditor, Precision Earnings

Michael CarrEditor, Precision Earnings

Add Recency and Availability Biases to the Record

For many years, the prevailing knowledge on Wall Avenue was that the market was “environment friendly,” and that buyers rationally analyzed all out there information and priced shares appropriately.

In fact, that’s absurd. Examine after examine proved the environment friendly market speculation flawed. Our personal Adam O’Dell integrated a few of these “anomalies” into his market-beating Inventory Energy Rankings system.

Nevertheless it took two nonfinancial psychologists to clarify why the market isn’t environment friendly.

Daniel Kahneman and Amos Tversky successfully rewrote the finance and financial textbooks with their examine of behavioral finance. Truly, I can’t say that they “studied” behavioral finance. They invented it.

Mike talked about salience, herding and anchoring as cognitive biases that may lead us to make poor selections. To those, I might add two extra carefully associated biases: recency and availability.

What Is Recency Bias?

Recency bias is strictly what it seems like. It’s the tendency to place undue weight or significance on current info when making selections concerning the future.

In plain English, it’s the error of assuming the long run goes to appear to be the current previous.

You don’t need to be a market wizard to grasp why that will be harmful. The market rips larger … till it doesn’t. Or massive caps outperform small caps … till they don’t. Or a short-squeezed meme inventory is a “can’t lose” funding … proper till it loses.

You get the concept!

What Is Availability Bias?

Availability bias is comparable. It’s the tendency to make selections based mostly on examples that come to thoughts, actually because the examples are excessive or traumatic.

For instance: Since you remembered seeing a aircraft crash on TV, you may draw the conclusion that air journey is unsafe and select to journey by automotive … though you’re much more more likely to expertise an auto accident than a aircraft crash.

Combating Your Biases

Recency bias usually pushes buyers to make “greed-based” errors. They assume no matter development they’re following will final eternally.

In the meantime, the provision bias will usually push buyers to make “fear-based” errors, avoiding worthwhile alternatives due to horror tales they’ve heard prior to now.

And naturally, generally recency and availability work collectively to drive fear-based errors.

For instance, the horror of the 2008 meltdown led to each recency and availability biases. That monetary disaster pushed buyers out of the market at precisely the time it was poised to get pleasure from an epic rally.

So what’s the takeaway right here?

The theme for many of 2023 has been the resurgence of tech on the expense of nearly each different sector. Considerably, all the positive factors of the S&P 500 within the first half of the 12 months had been as a result of efficiency of the highest six largest tech shares.

However then a humorous factor occurred. The rally began to broaden. Non-tech shares lastly began to take the lead.

As merchants, we’d like to concentrate on our biases in order that we will higher conquer them.

Mike Carr is somebody who focuses on the info in relation to investing smarter and extra effectively. So if you wish to be taught extra about how he trades (and get his experience), take a look at his Commerce Room at the moment.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link