[ad_1]

Quite a lot of traders depend on “intestine really feel” to make selections.

We’ve all made at the very least one funding like this. Possibly you got Apple inventory whenever you noticed the iPhone beginning to take over the U.S. cellular market. Otherwise you purchased Berkshire Hathaway merely for the truth that Warren Buffett is the person in cost.

Don’t get me mistaken, instincts like these can typically work out properly for you. However for each success story an investor can attribute to their instinct, there could also be dozens of errors they will blame on the identical supply.

That’s why I don’t use a complete lot of “intestine feeling” in my investing method.

As an alternative, I exploit my proprietary six-factor mannequin: the Inexperienced Zone Energy Scores system.

This technique considers 75 particular person metrics throughout six confirmed funding elements to provide a transparent indication a few inventory’s potential to beat the market.

Three of these elements are price-based, telling us whether or not an organization’s inventory is, in layman’s phrases, “behaving properly.” The opposite three elements are based mostly on the firm’s fundamentals and operational outcomes. They inform us if we’re shopping for an excellent enterprise. The very best investments are those the place each of these line up positively.

General, we get an entire image of the well being of the corporate and the conduct of its inventory. And we do that all with quantitative evaluation, permitting us to price hundreds of particular person shares, with updates on a day by day foundation. This is able to require a small military of analysts if we didn’t have such a strong system at our fingertips.

In consequence, my crew and I are capable of “slice and cube” the market each which solution to discover one of the best shares to swimsuit each want.

Let me present you…

1 Extremely Rated Slice of the Market

Paid-up subscribers of my Inexperienced Zone Fortunes advisory routinely obtain a curated Weekly Hotlist, the place we “slice and cube” the market utilizing my Inexperienced Zone Energy Scores system.

We spotlight the week’s 10 highest-rated shares throughout the whole inventory universe in my Weekly Hotlist. Shares rated at this superior, “Robust Bullish” degree have traditionally gone on to outperform the market 3-to-1.

Our Inexperienced Zone Fortunes group finds this Weekly Hotlist immensely beneficial. And it generates a variety of interplay amongst Inexperienced Zone subscribers who do their very own analysis and stock-picking … And we’re engaged on a broader number of prime 10’s based mostly on numerous sectors, themes or the rest we will consider!

Simply final week, one subscriber named Gordon shared an important thought of how we might construction a listing based mostly on dividend shares.

Gordon steered:

It could be superior when you would come with a “Dividend Shares” prime 10…

Could wish to guarantee that there’s a minimal SP Score of, say, 85 within the record of prime 10, to truncate the record, simply in case there are only a few dividend shares at any given second that rating excessive sufficient. Can also wish to filter the record based mostly on a minimal present dividend yield of, say, 4%.

Thanks in your electronic mail, Gordon! We predict this is a superb thought, particularly for the reason that latest improve in bond yields has made a number of the slimmer-dividend paying shares look much less engaging. What traders are actually in search of is a high-quality firm that pays a Treasury-beating yield.

Usually, I’d reserve this kind of evaluation for my Inexperienced Zone Fortunes subscribers. However I’m making an exception right this moment, as a result of I understand how a lot Banyan Edge readers respect dividend-paying shares!

When you’re a type of people and also you need extra of this kind of analysis, study extra a few Inexperienced Zone Fortunes membership right here.

Anyway, right here’s what we discovered once we dug in to satisfy Gordon’s request, for the highest 10 rated shares paying at the very least a 4% dividend:

Inexperienced Zone Energy Scores Dividend Hotlist

I hope this helps get you began in your quest to figuring out rock-solid firms that pay bond-beating yields.

I perceive why so many individuals are in search of most of these shares proper now. With inflation at elevated ranges, people want greater ranges of funding revenue simply to maintain tempo. And we don’t need you to need to go too far out on the danger curve to receives a commission a decent yield!

And that’s the place my Inexperienced Zone Energy Scores system is available in…

A Dividend Is Step Two

As I belief you already know, dividend yield is just one means you will get “paid” as an investor. Capital appreciation is simply as necessary. And never all dividend-paying shares are strong capital-appreciators.

Some people understand a dividend to be a sign of a secure funding. If the corporate gives a routine yield to shareholders, it should make sufficient cash to ship that payout at a constant price, proper?

Properly, that’s the case for a well-run firm, such as you’ll discover within the record above.

However not all dividend shares are created equal. Some shares challenge excessive dividends for the specific objective of “advertising and marketing” the inventory and getting income-hungry investor eyeballs onto it.

However when you purchase a inventory with a excessive dividend and it falls, capital losses can simply erase no matter profit the dividend introduced within the first place.

That’s why it’s so crucial to purchase well-rounded shares — ones which can be recognized by an goal, data-driven instrument like my Inexperienced Zone Energy Scores system, as being a positive mix of high quality enterprise and market-beating inventory.

Briefly, inventory choice needs to be your first consideration, then the inventory’s dividend yield ought to come after that. It’s the cherry on prime of an already glorious funding, not the preliminary draw.

The record above, with its near-perfect optimistic scores throughout the board, is a sign that you simply’re more likely to take pleasure in a robust dividend payout AND capital good points — a successful mixture.

And once more, when you’re in search of extra of this kind of analysis — both my data-driven Weekly Hotlist or in-depth mannequin portfolio inventory suggestions — you will discover all of it in Inexperienced Zone Fortunes.

To good earnings,

Adam O’Dell

Adam O’Dell

Chief Funding Strategist, Cash & Markets

Debt Downgrade: What Took Them So Lengthy!

Properly, it lastly occurred.

Credit score scores company Fitch downgraded the US to AA+ from AAA. America is not a risk-free borrower.

After all, we’ve been right here earlier than. The S&P downgraded the US again in 2011, specializing in the close to default, as a result of all too acquainted debt ceiling standoffs.

I solely have one query: What took Fitch so lengthy?

What number of years of trillion-dollar deficits do you’ll want to see to simply accept the plain … that Uncle Sam is about as removed from a risk-free credit score as you will get? However let’s take a deeper dive.

The U.S.’s $32 Trillion Debt

Our nation has managed to spend itself $32 trillion in debt. Sure, trillion, with a “t.”

We added $1.4 trillion {dollars} to that whole this previous 12 months, and will likely be including over a trillion {dollars} per 12 months to it, yearly for the foreseeable future … with no apparent finish in sight.

The U.S. authorities brings in $4.9 trillion a 12 months in revenues. You’ll assume we might run a authorities on that. Each different nation someway manages to get by on far much less. But we handle to spend $6.3 trillion a 12 months, forcing us to borrow $1.4 trillion to cowl the distinction.

And maybe the worst facet of all: $970 billion of the whole is curiosity due on the debt accrued in prior years. That’s 15% of the whole price range, which is used to pay the money owed for cash lengthy since wasted on “investments” with zero return.

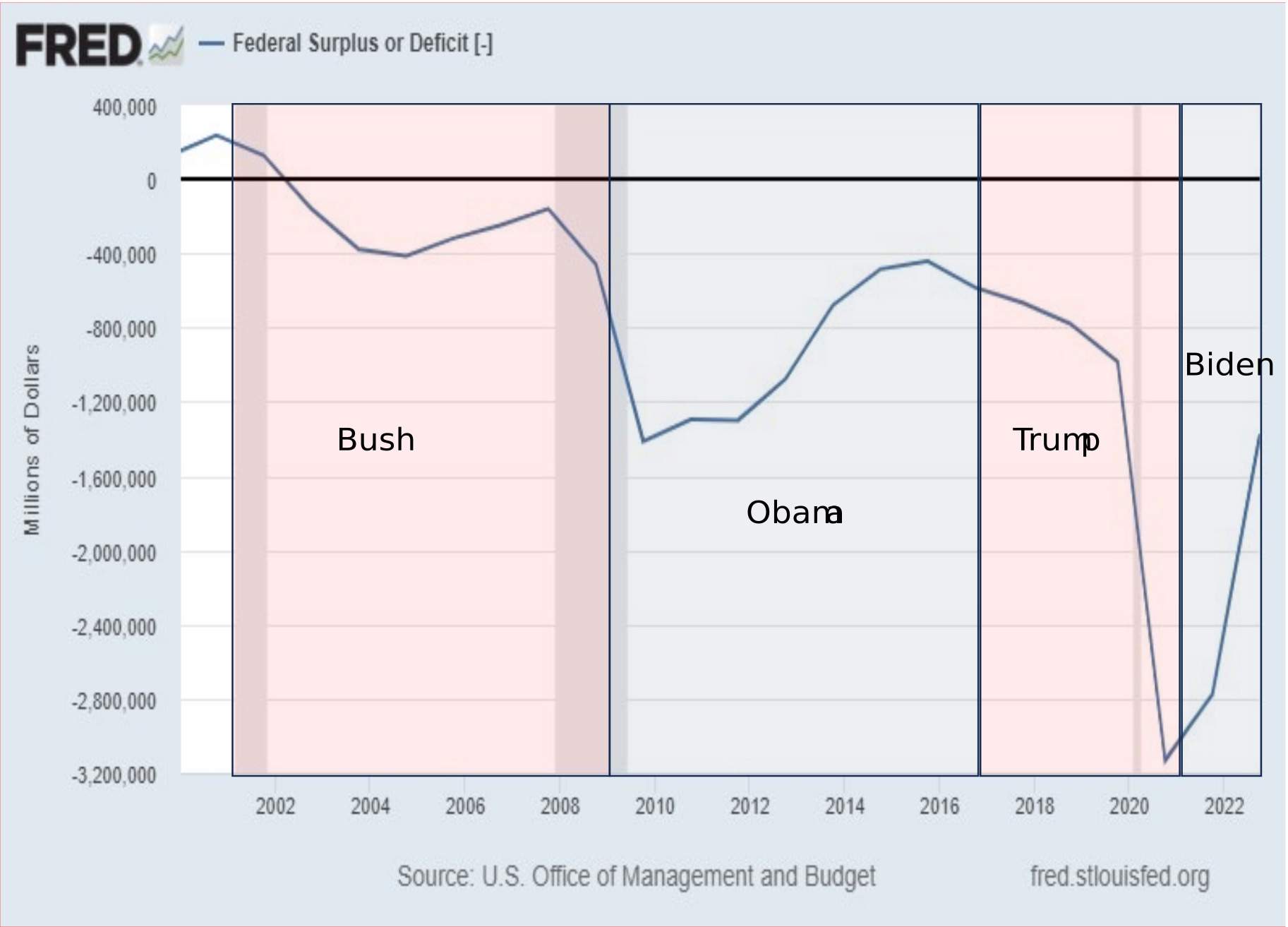

President Biden carries his share of the blame for this, after all, however he’s not alone. Debt exploded underneath Trump’s presidency, and we will’t blame it on the pandemic. The deficit was already snowballing years earlier than anybody had ever heard of COVID-19.

“Draining the swamp” clearly had no impact on deficit spending.

George W. Bush was additionally notably egregious in blowing out the deficit underneath his presidency, with Vice President Dick Cheney famously declaring that “deficits don’t matter.”

If something good got here out of the fixed infighting between President Obama and the congressional Republicans, it will be that the price range deficit shrunk. And to an nearly cheap quantity throughout his presidency from 2009 to 2017 — or at the very least, by the requirements of the previous 20 years,

However I’d hardly name $400 billion deficits a mannequin of accountability.

Once I have a look at the historical past of deficit spending, I alternate between blind rage and deep despair. I’m offended that it’s come to this, and depressed that there is no such thing as a apparent means out. Neither political occasion is critical about deficit discount, and neither one has a plan to cease this insanity.

However what can we truly do about it?

Ultimately this mess will turn into unsustainable, and the federal government will likely be pressured to steadiness its books. When does that occur? Your guess is nearly as good as mine. However within the meantime, it is smart to guard your self one of the best you’ll be able to.

Think about including hedges like gold or bitcoin to your portfolio. And be ready to take a extra lively method in your buying and selling.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]

Source link