zhengzaishuru

A visitor submit by Ovi

Beneath are quite a few Crude plus Condensate (C + C) manufacturing charts, often shortened to “oil”, for Non-OPEC nations. The charts are created from information offered by the EIA’s Worldwide Vitality Statistics and are up to date to April 2023. That is the most recent and most detailed world oil manufacturing data obtainable. Info from different sources comparable to OPEC, the STEO and country-specific websites comparable to Russia, Brazil, Norway and China is used to supply a short-term outlook for future output and course for a number of of those nations and the world. The US report has an expanded view past manufacturing by including rig and frac unfold charts.

The place STEO information was used, the ratio of C + C to All Liquids was calculated. The common for the final six months was used to undertaking the Might and June manufacturing numbers in a number of instances.

World oil manufacturing and projection charts are offered on the finish of this submit.

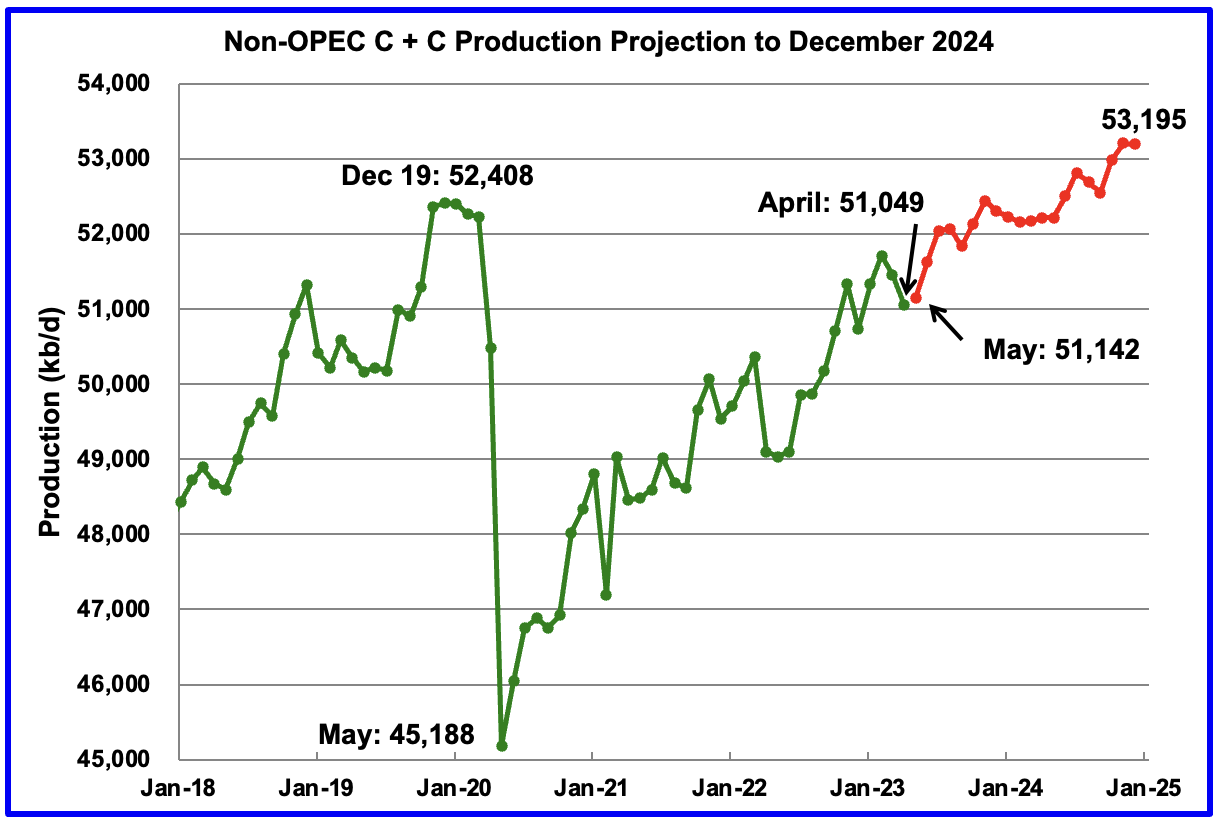

April Non-OPEC oil manufacturing dropped by 407 kb/d to 51,049 kb/d. The biggest decreases got here from Canada, US and Russia.

Utilizing information from the August 2023 STEO, a projection for Non-OPEC oil output was made for the interval Might 2023 to December 2024. (Crimson graph). Output is anticipated to succeed in 53,195 kb/d in December 2024, which is 787 kb/d larger than the December 2019 peak of 52,408 kb/d.

From Might 2023 to December 2024, oil manufacturing in Non-OPEC nations is anticipated to extend by 2,053 kb/d, a seemingly unrealistic forecast. In line with the STEO, the key contributors to the rise are anticipated to be the US, near 600 kb/d and Canada near 700 kb/d, each estimates thought of to be on the excessive aspect.

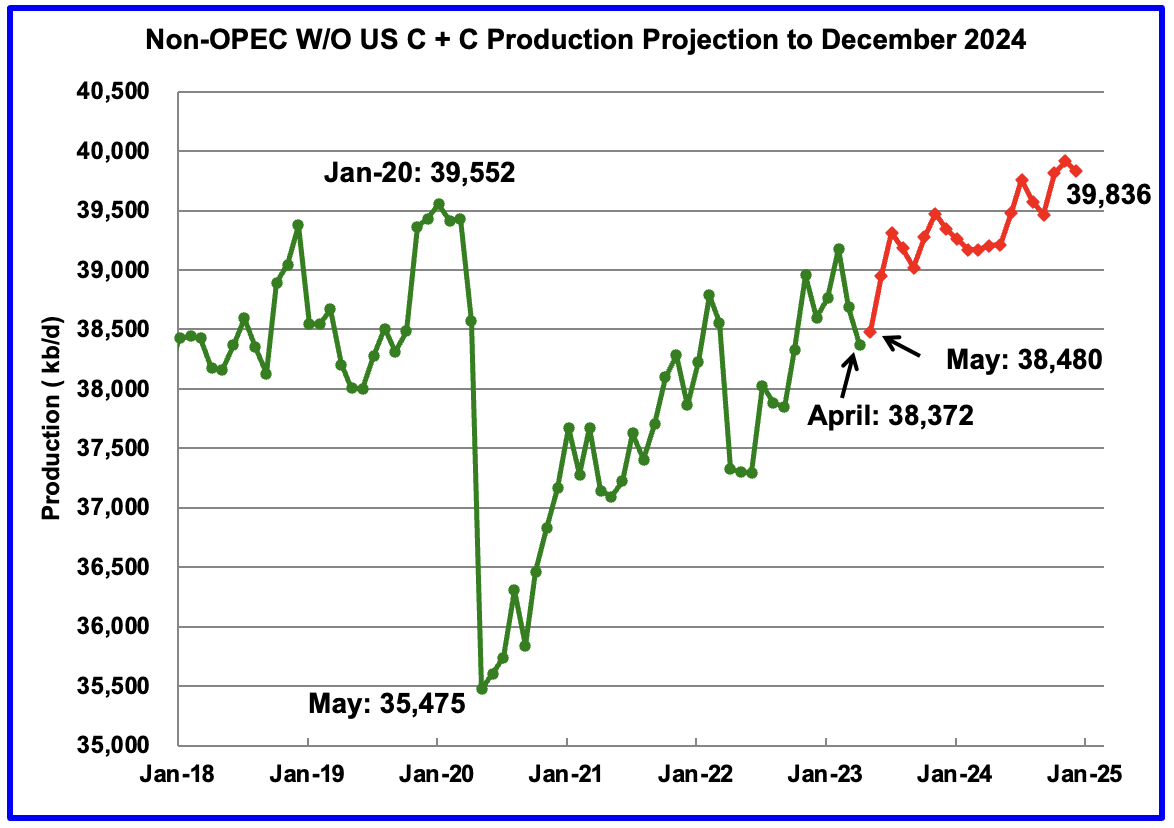

April Non-OPEC W/O US manufacturing dropped by 314 kb/d to 38,372 kb/d. Might manufacturing is projected to extend by 108 kb/d.

From Might 2023 to December 2024, manufacturing in Non-OPEC nations W/O the US is anticipated to extend by 1,356 kb/d.

Be aware that December 2024 output exceeds the pre-covid excessive of 39,552 kb/d in January 2020 by 284 kb/d.

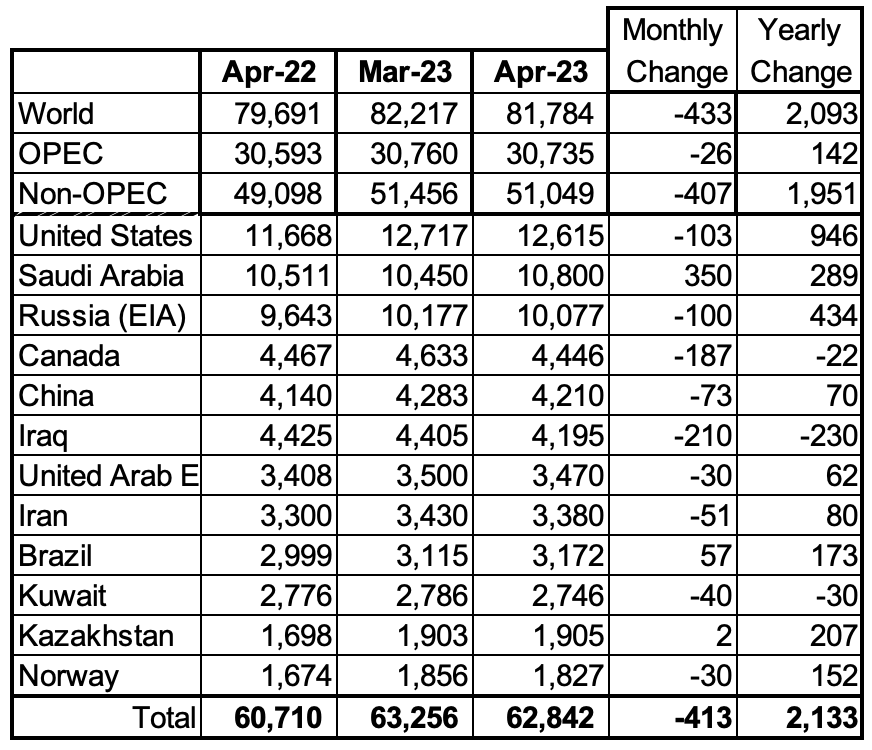

Non-OPEC Oil Manufacturing Ranked by Nation

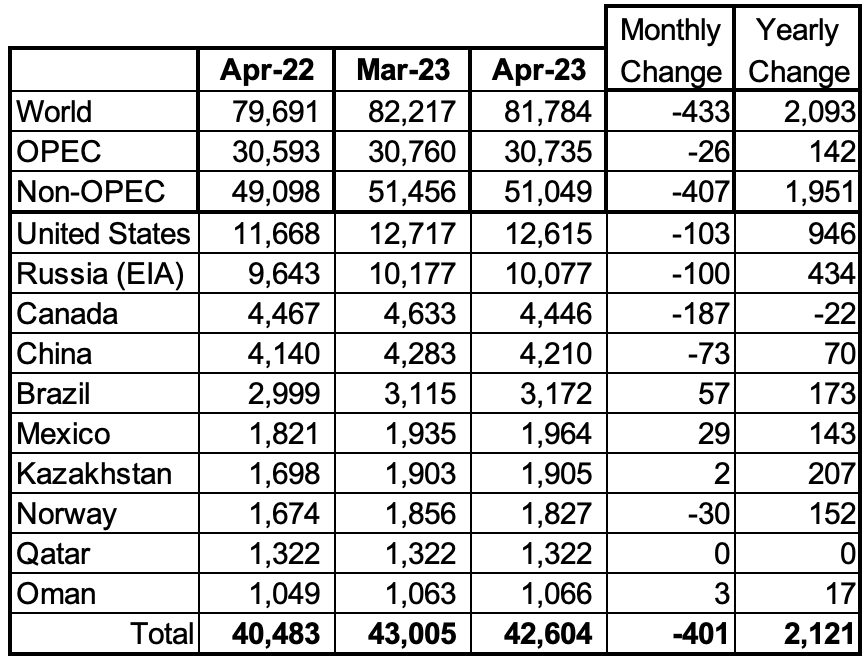

Listed above are the World’s 10 largest Non-OPEC producers. The standards for inclusion within the desk is that all the nations produce greater than 1,000 kb/d.

April’s manufacturing drop for these ten Non-OPEC nations was 401 kb/d whereas as an entire the Non-OPEC nations noticed a manufacturing lower of 407 kb/d. The highest 4 producers had a mixed output drop of 463 kb/d.

In April 2023, these 10 nations produced 83.5% of Non-OPEC oil manufacturing.

OPEC’s C + C manufacturing decreased by 26 kb/d in April whereas YoY it elevated by 142 kb/d. World MoM manufacturing decreased by 433 kb/d whereas YoY output elevated by 2,093 kb/d.

Non-OPEC Oil Manufacturing Charts

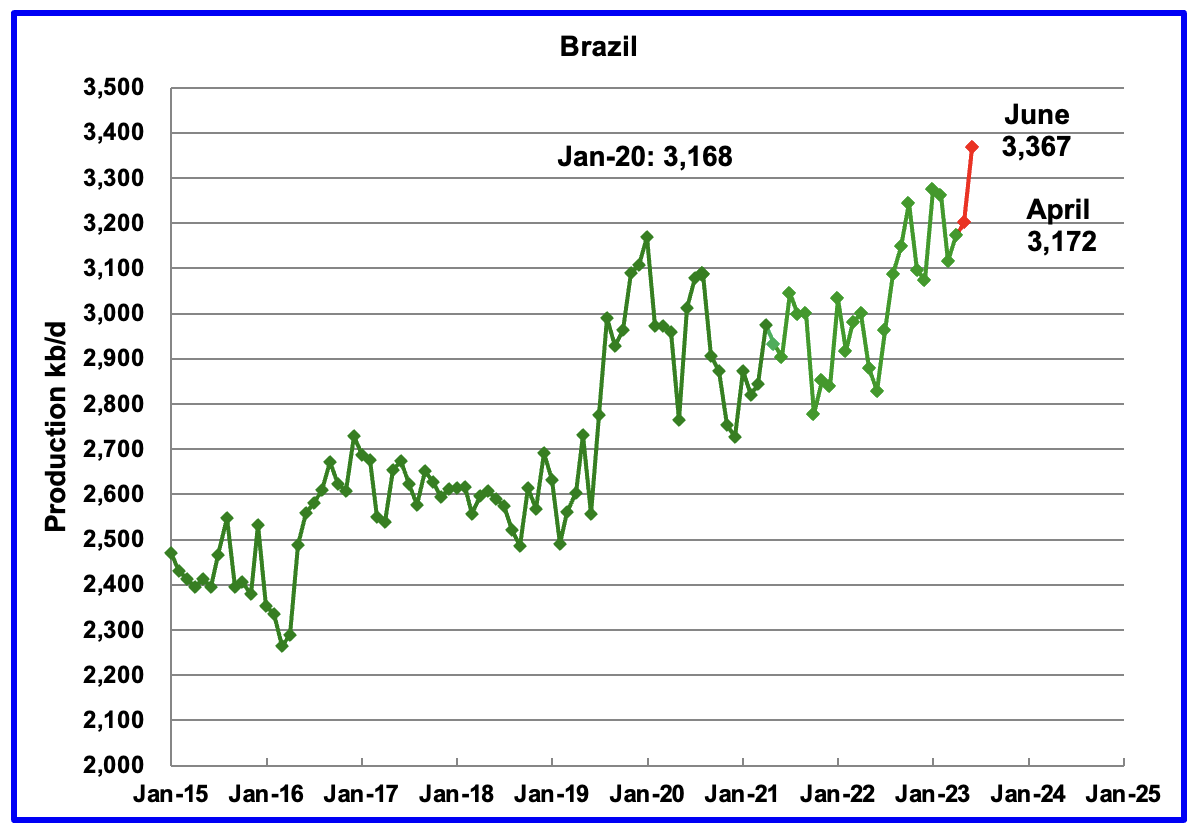

The EIA reported that Brazil’s manufacturing elevated by 57 kb/d in April to three,172 kb/d.

Brazil’s Nationwide Petroleum Affiliation (BNPA) reported that output in Might and June elevated and that June elevated by 166 kb/d to three,367 kb/d primarily resulting from new undertaking start-ups, a brand new file excessive, crimson markers.

A lot of Brazil’s upcoming 2023 manufacturing development of near 100 kb/d will come from the extremely productive pre-salt fields. From April 2022 to April 2023, manufacturing from the pre-salt fields elevated by 173 kb/d.

In line with the April 2023 IEA Oil Market Report: “We forecast provide to succeed in a brand new file excessive of three.42 mb/d this 12 months, up 300 kb/d y-o-y, as platform upkeep returns to regular scheduling and 5 further FPSOs come on-line.“

In line with the August OPEC MOMR: “Two new FPSOs began manufacturing throughout Might, with Petrobras pumping the primary oil from the FPSO Anna Nery put in on the Marlim complicated within the offshore Campos Basin. In line with Petrobras, the Buzios subsalt fields additionally acquired its fifth manufacturing unit, with the FPSO Almirante Barroso. Petrobras’ oil output fell by round 0.6% within the 2Q23 y-o-y resulting from losses from upkeep, along with the pure decline of mature oil fields and a few asset gross sales. Nonetheless, the crude oil output is anticipated to be supported by offshore start-ups introduced in the beginning of the 12 months.”

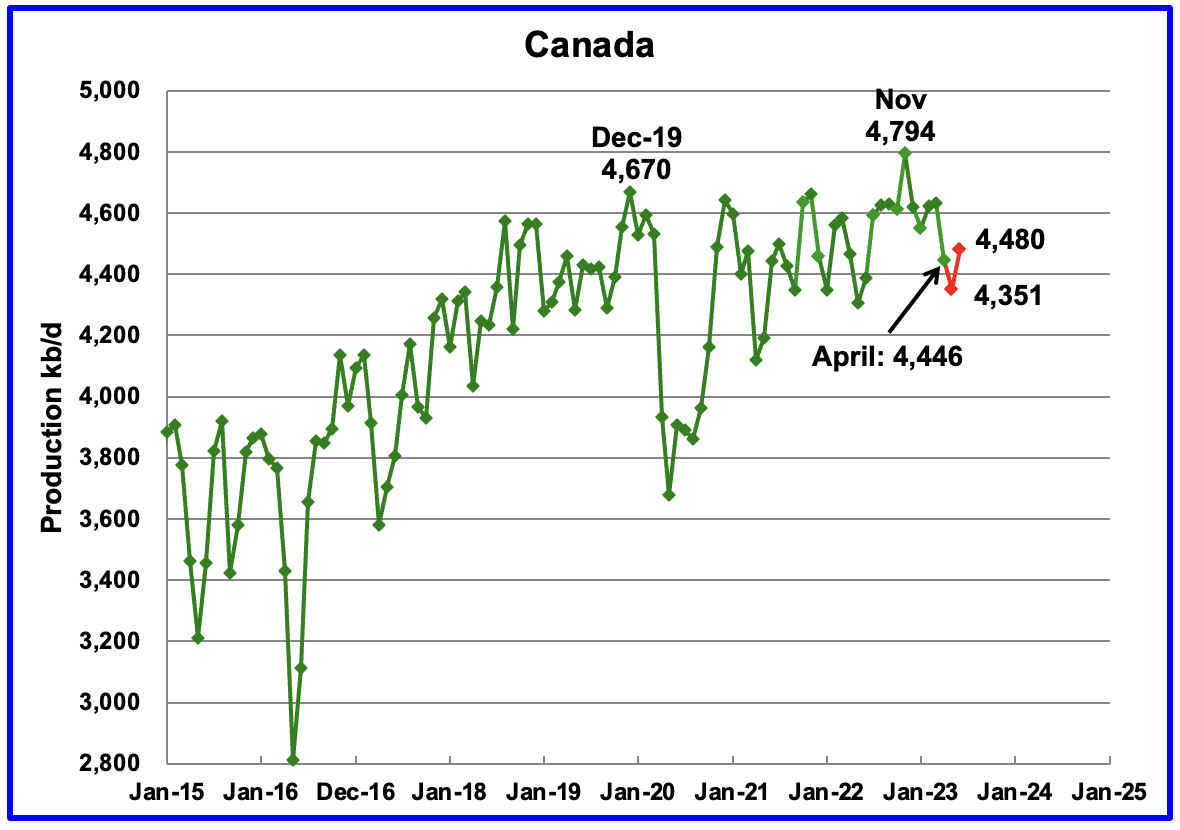

In line with the EIA, Canada’s manufacturing declined by 187 kb/d in April to 4,446 kb/d. The Might drop to 4,351 kb/d, together with April’s was resulting from vital upkeep on the oil sands mines and upgraders. The STEO is forecasting a manufacturing rebound in June to 4,480 kb/d.

In line with the OPEC July MOMR : “Scheduled upkeep programmes throughout 2Q23 and 3Q23 are anticipated to melt output. It’s the oil sands which are projected to be the principle driver of Canada’s manufacturing by way of to the top of the 12 months, pushed by Kearl debottlenecking and CNRL (Canadian Pure Assets) Horizon optimization. Moreover, the Terra Nova Floating Manufacturing Storage and Offloading unit (FPSO) is anticipated to restart manufacturing in mid-2023.

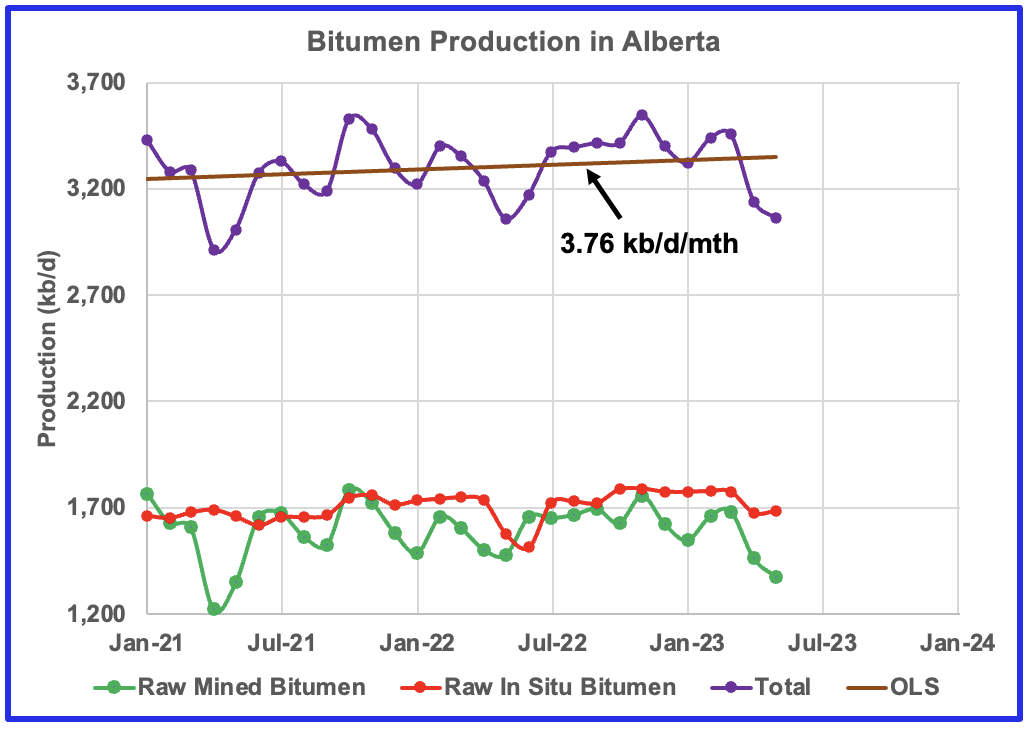

This chart reveals the post-pandemic pattern in bitumen manufacturing in Alberta and the info is offered by the Canada Vitality Regulator. Manufacturing in April and Might 2023 was affected by extreme climate and plant upkeep. On common, whole manufacturing has been rising at a price of three.76 kb/d/mth, brown OLS. Trying on the two totally different extraction strategies, it seems that In Situ is slowly rising whereas mined bitumen is holding regular.

In line with the OPEC August MOMR report: Crude bitumen manufacturing output fell m-o-m by 259 tb/d, and artificial crude declined m-o-m by 125 tb/d. Taken collectively, crude bitumen and artificial crude manufacturing dropped by 384 tb/d to 2.5 mb/d.

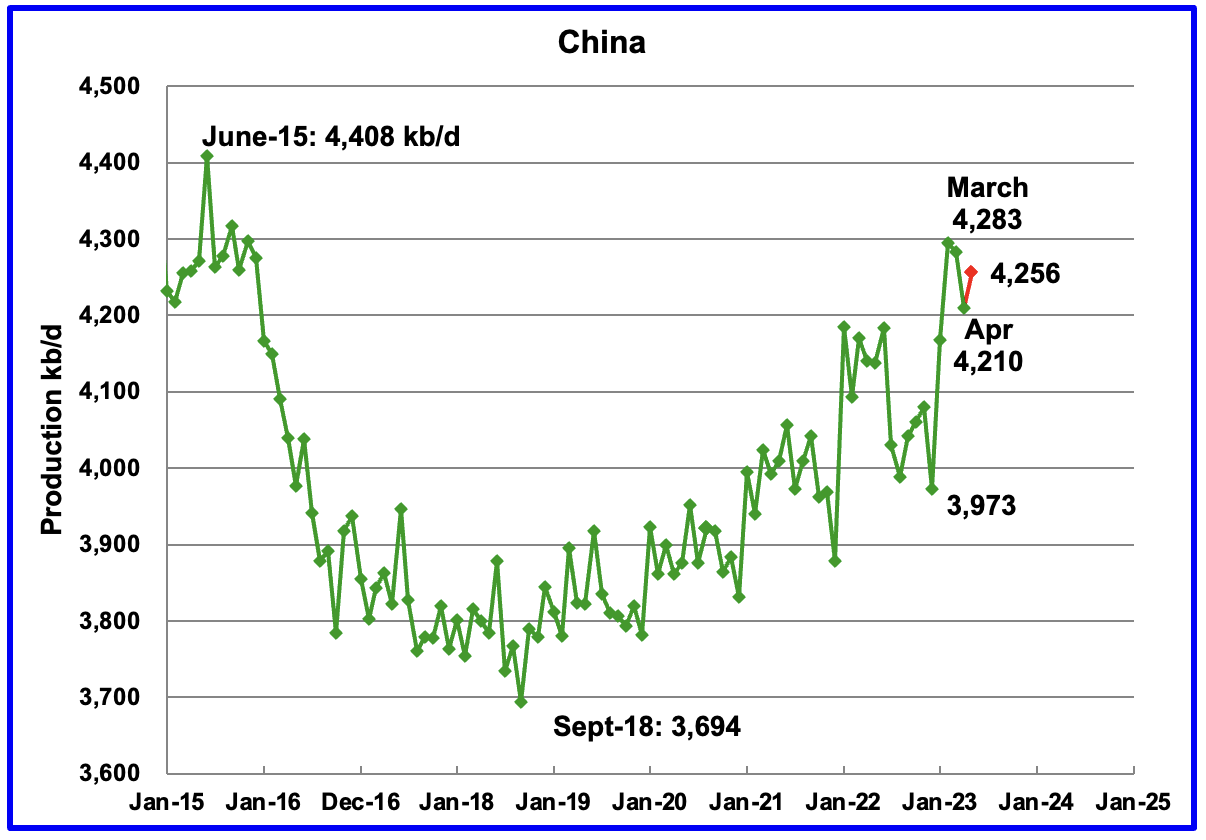

The EIA reported China oil output in April dropped by 73 kb/d to 4,210 kb/d.

The China Nationwide Bureau of Statistics reported that manufacturing throughout Might elevated to 4,256 kb/d.

Whereas China’s manufacturing development has risen steadily since 2018, it could be approaching its post-pandemic excessive.

In line with the OPEC July MOMR: “Pure decline charges are anticipated to be offset by further development by way of extra infill wells and EOR initiatives amid efforts by state-owned oil corporations to safeguard vitality provides.

For 2024, Chinese language liquid manufacturing is anticipated to stay regular y-o-y and is forecast to common 4.6 m/d. For subsequent 12 months, Liuhua 11-1, Shayan and Liuhua 4-1 (redevelopment) are deliberate to come back on stream below CNOOC and PetroChina. On the similar time, the principle ramp-ups are anticipated from the Changqing, Kenli 10-2, Wushi 17-2 and Kenli 6-4.”

In line with this supply: From the low level in 2018 to the height in 2023, China has added greater than 600,000 barrels a day of additional manufacturing – extra crude than some OPEC+ nations generate day by day. Pumping about 4.3 million barrels a day now, China is once more the world’s fifth-largest oil producer, solely behind the US, Saudi Arabia, Russia and Canada, and forward of Iraq.

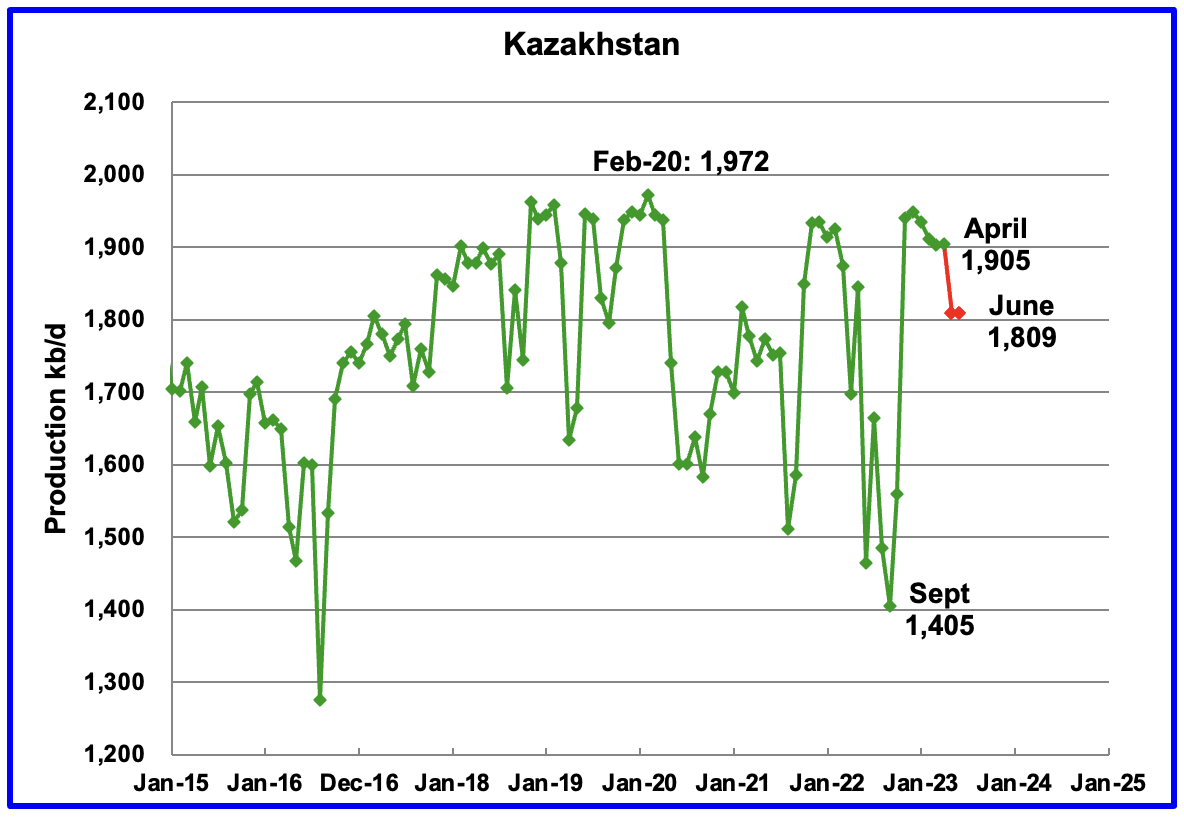

In line with the EIA, Kazakhstan’s output elevated by 2 kb/d in April to 1,905 kb/d. The STEO is forecasting a manufacturing drop to 1,809 kb/d in Might and holding regular in June at 1,809 kb/d.

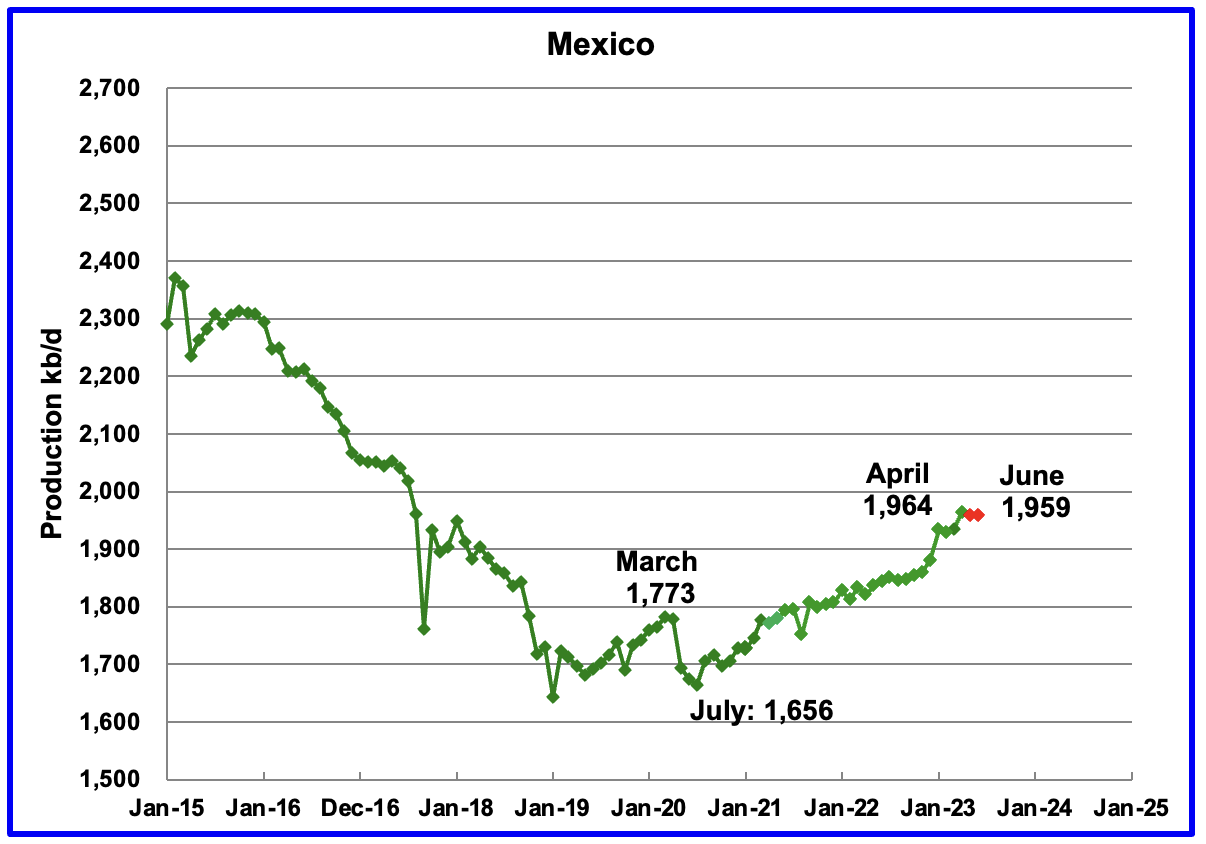

Mexico’s manufacturing in April was 1,964 kb/d a rise of 29 kb/d over March. Output dropped to 1,959 kb/d in Might and June, based on Pemex.

Mexico has just lately revised its definition of condensate. This has resulted within the EIA including an additional 60 kb/d, on common, to the Pemex report. The crimson markers embrace the extra 60 kb/d.

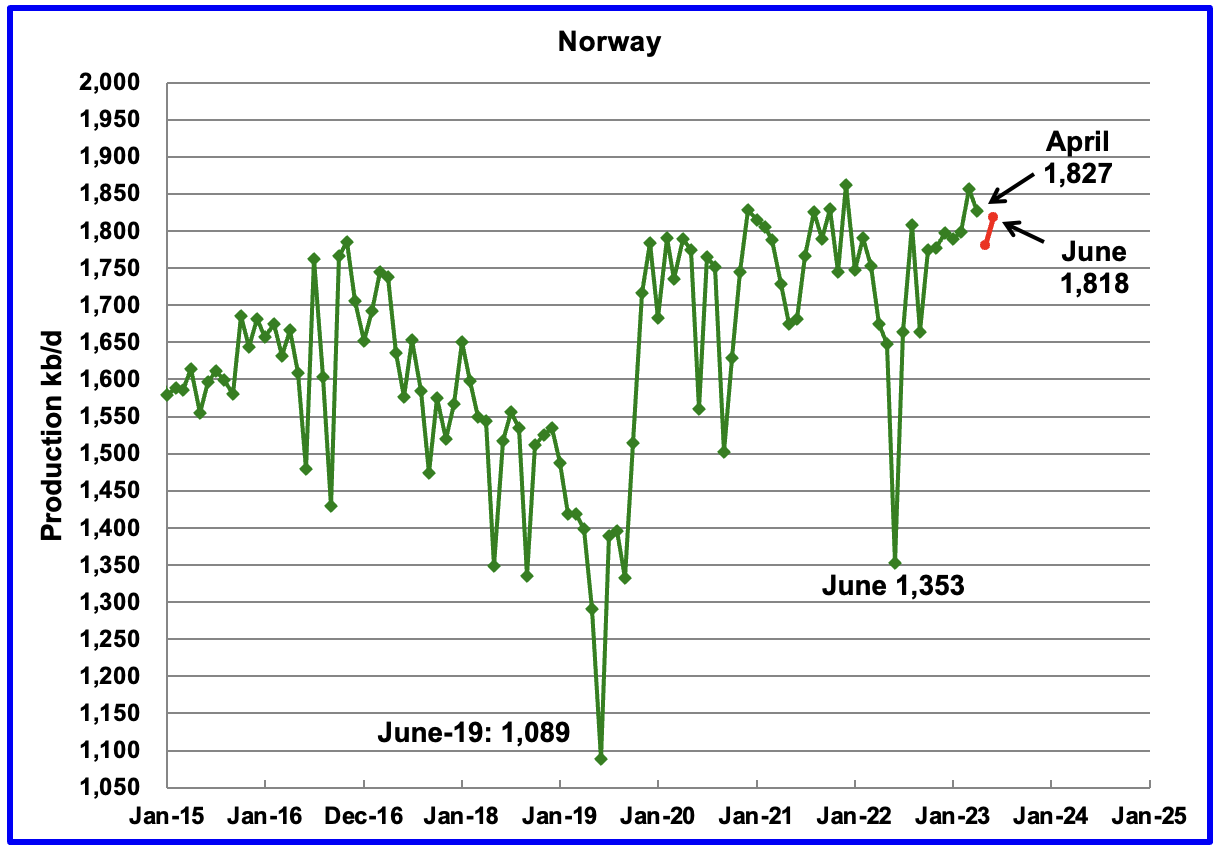

The EIA reported Norway’s April’s manufacturing to be 1,827 kb/d. The Norway Petroleum Directorate (NPD) reported that Might’s manufacturing dropped to 1,781 kb/d after which rebounded to 1,818 kb/d in June. (Crimson markers).

In line with the NPD : “Oil manufacturing in June was 0.6 % greater than the NPD’s forecast and 0.5 % decrease than the forecast to date this 12 months.”

In line with this supply: “The North Sea’s largest oil subject Johan Sverdrup now has the capability to supply as a lot as 755,000 b/d of crude.”

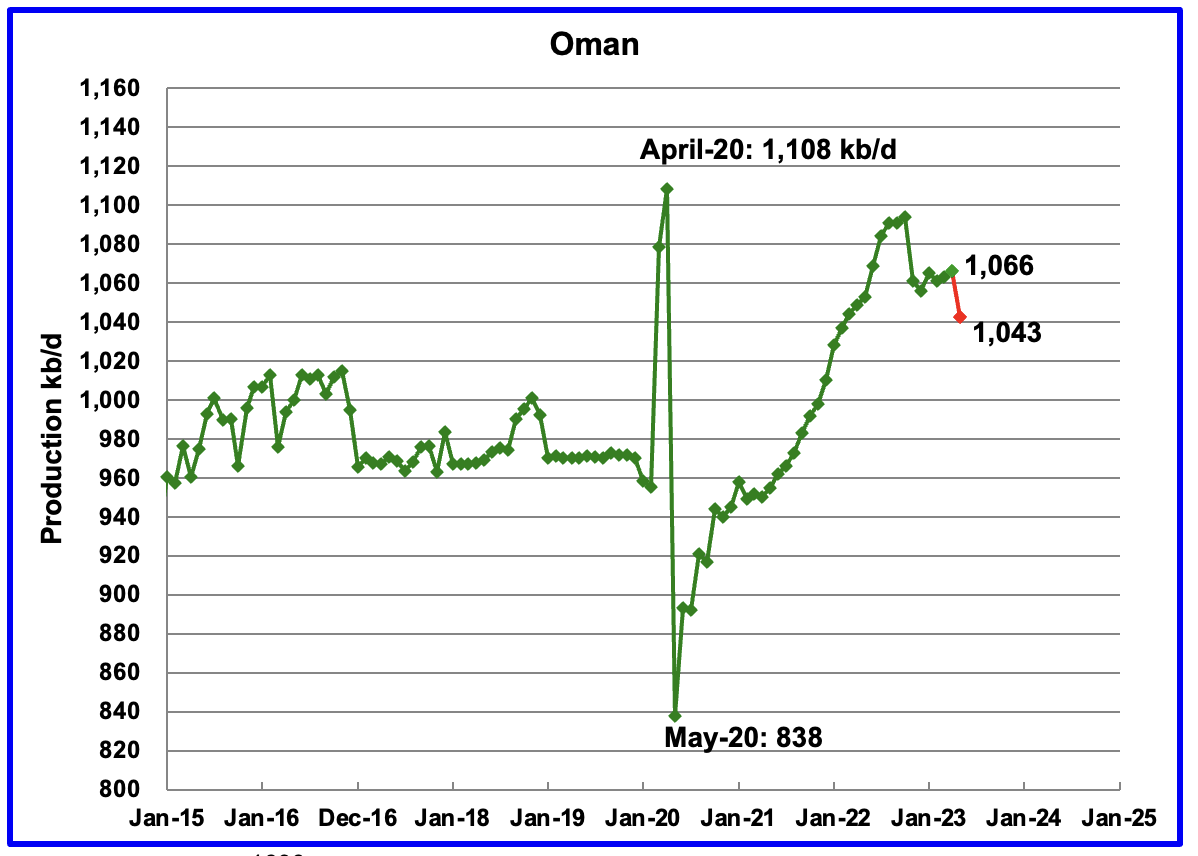

Oman’s manufacturing has risen very constantly because the low of Might 2020. Oman’s April output was primarily flat however dropped to 1,043 kb/d in Might.

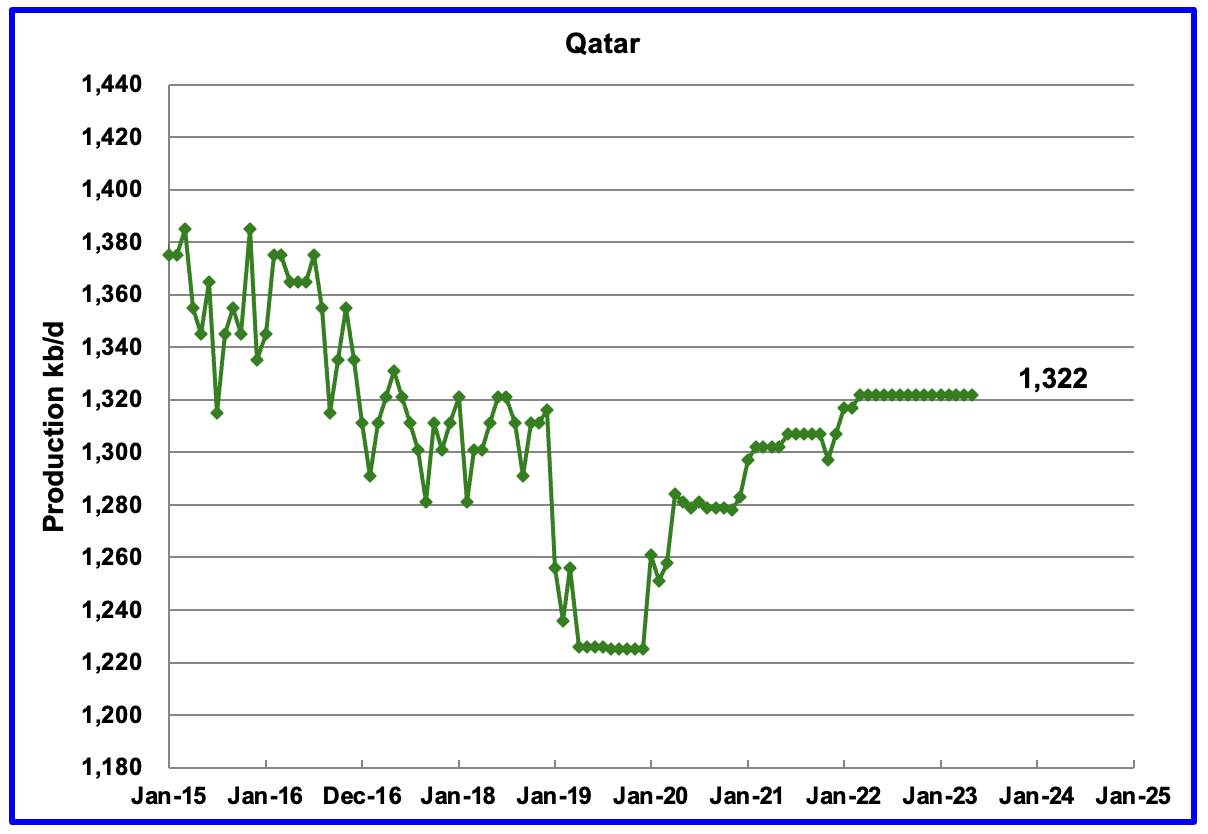

Qatar’s April output was unchanged at 1,322 kb/d, presumably resulting from lack of up to date data.

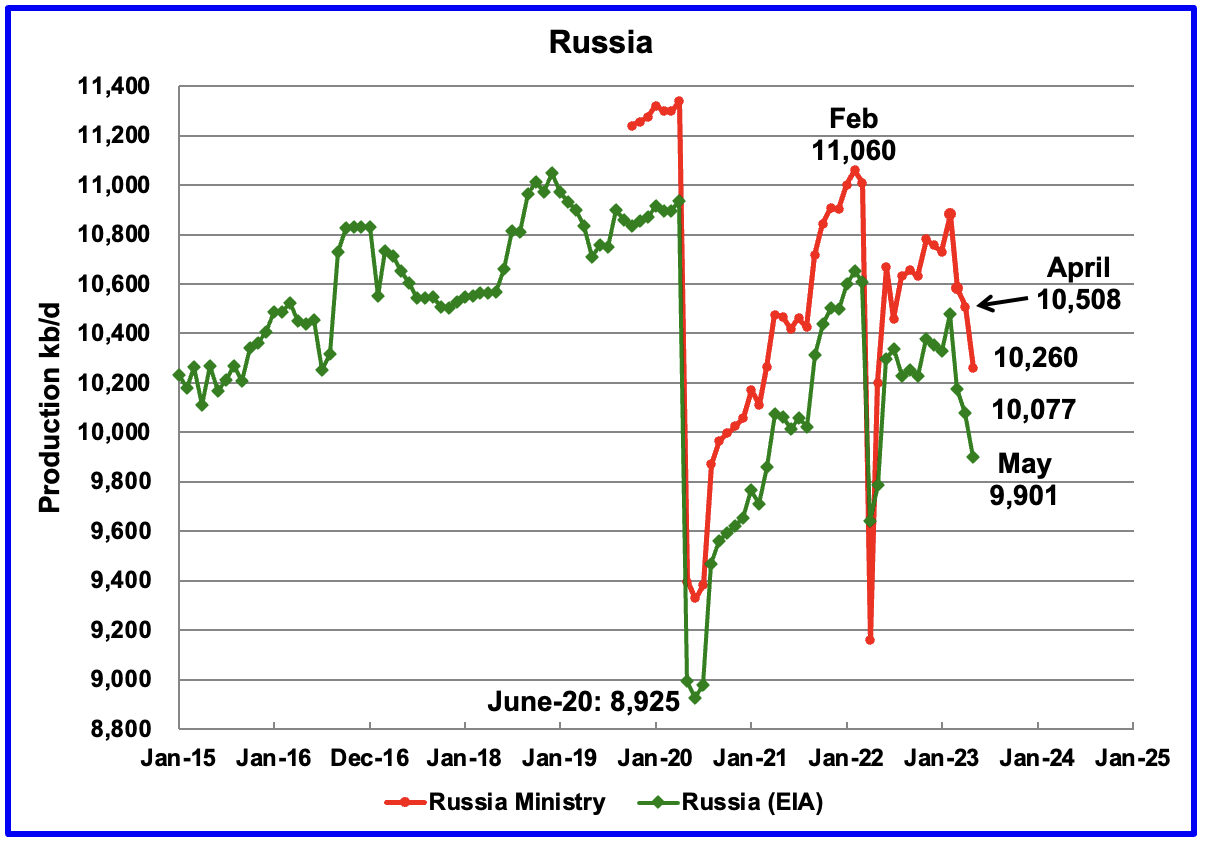

The EIA reported Russia’s April manufacturing was 10,077 kb/d. Utilizing information from the August STEO report, Russian output is anticipated to drop to 9,901 kb/d in Might 2023.

Utilizing information from Argus Media, Russian manufacturing, as beforehand reported by the Vitality Ministry, was estimated for April and Might. For April and Might, Argus reported that Russian manufacturing of crude was 9,730 kb/d and 9,500 kb/d, respectively. Might manufacturing is accessible right here. Utilizing data from this S & P World article, Russian condensate manufacturing is shut to eight% of crude manufacturing. Including the 8% to the crude manufacturing for April and Might leads to C + C manufacturing of 10,508 kb/d and 10,260 kb/d, respectively.

“Vienna — Russia’s condensate manufacturing averaged 833,000 b/d in November, vitality minister Alexander Novak stated Friday.

Stripping the November determine from Russia’s beforehand reported oil output information reveals that crude manufacturing was 10.41 million b/d within the month.

Russia is searching for to exclude its condensate volumes from its manufacturing quota below a provide minimize settlement with OPEC and 9 different allies, which the coalition will try and finalize Friday in Vienna.”

Previously when data was instantly obtainable from the Russian Ministry of Vitality, the distinction between the Russian Ministry and EIA was 404 kb/d larger. Evaluating the 2 impartial estimates above, Russian April output is 431 kb/d larger whereas Might is 359 kb/d larger. Use of the Argus information offers manufacturing charges moderately in line with the EIA estimates.

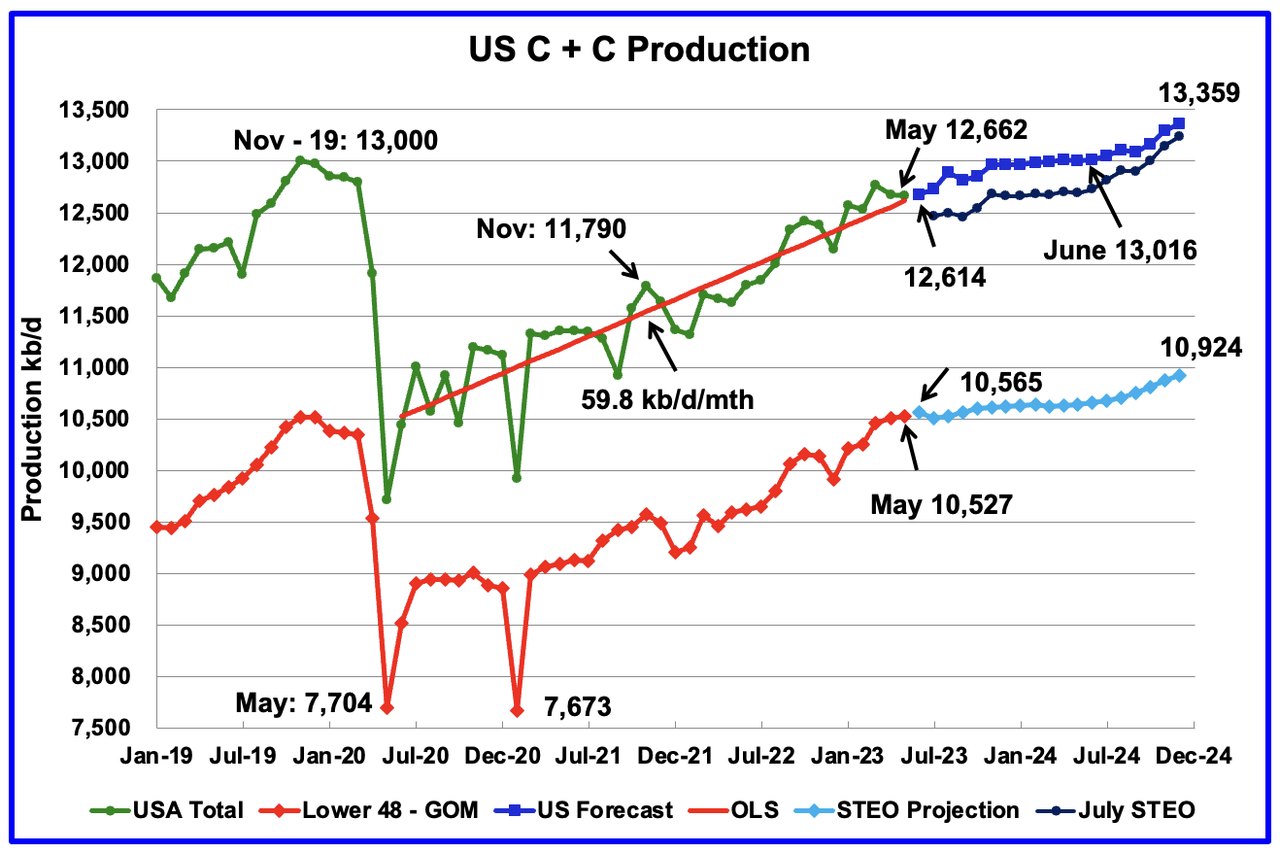

U.S. Might oil manufacturing decreased by 15 kb/d to 12,662 kb/d, a small change, primarily as a result of upward revision of April output from 12,615 kb/d to 12,677 kb/d.

The darkish blue graph, taken from the August 2023 STEO, is the forecast for U.S. oil manufacturing from June 2023 to December 2024. Output for December 2024 is anticipated to be 13,359 kb/d which is 359 kb/d larger than the November 2019 peak of 13,000 kb/d. Be aware the distinction between the August and July STEO forecasts for US oil manufacturing. The August forecast is between 125 kb/d and 350 kb/d larger than reported within the July STEO forecast.

Whereas general US oil manufacturing decreased by 15 kb/d in Might, the Onshore L48 had a manufacturing improve of 19 kb/d to 10,527 kb/d. The sunshine blue graph is the STEO projection for output to December 2024 for the Onshore L48.

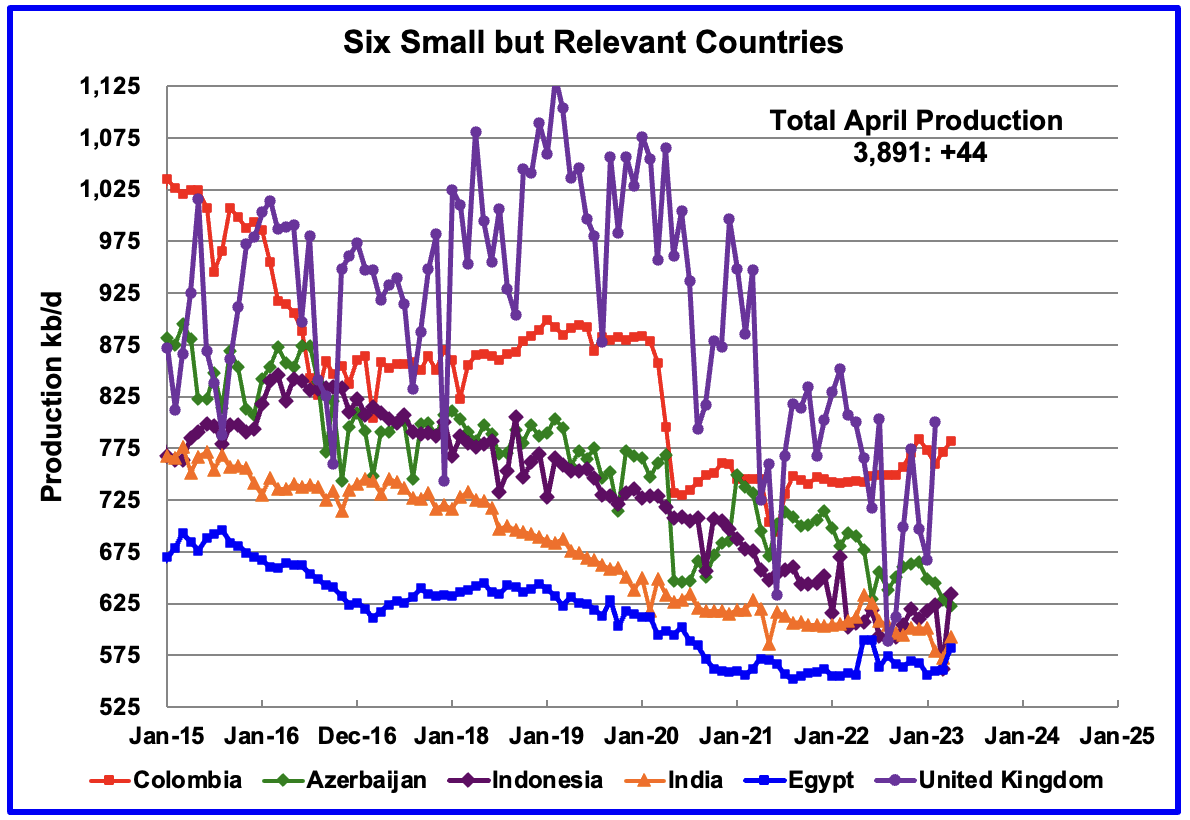

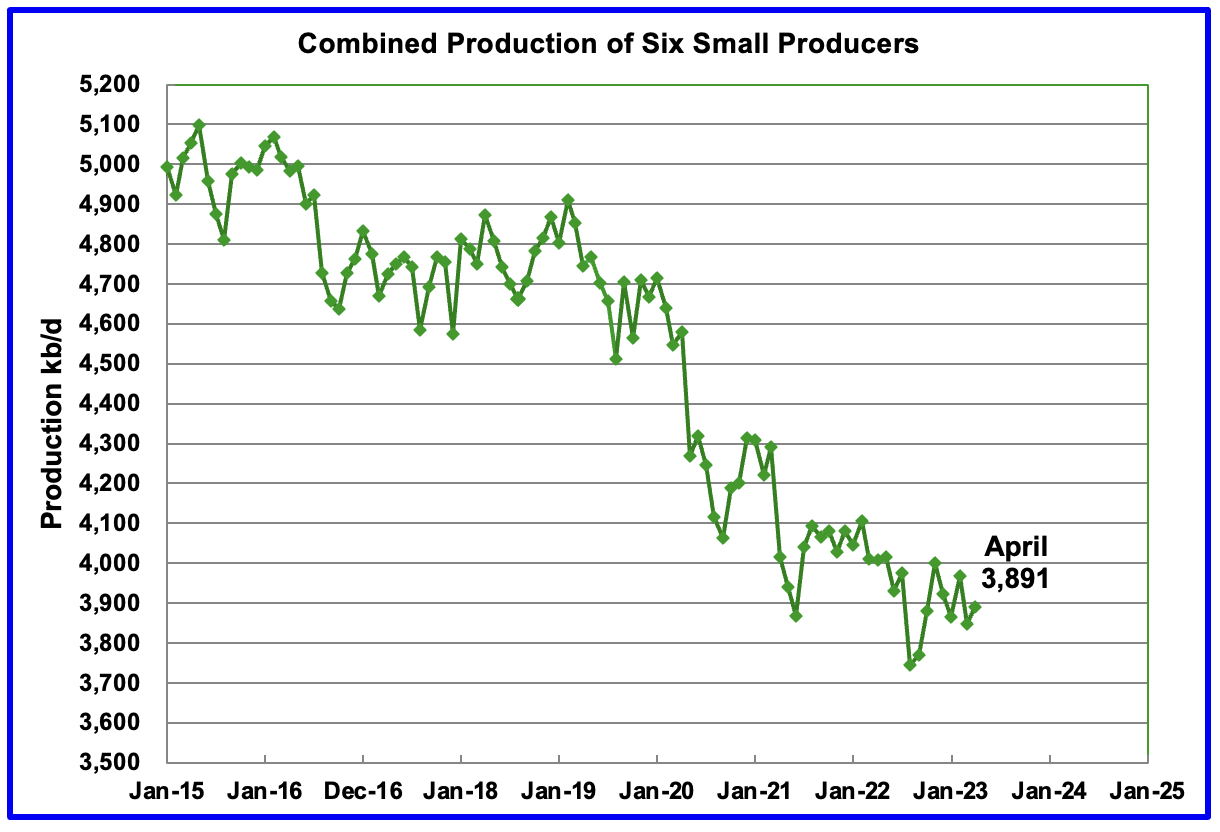

These six nations full the record of Non-OPEC nations with annual manufacturing between 500 kb/d and 1,000 kb/d. Be aware that the UK has been added to this record since its manufacturing has been beneath 1,000 kb/d since 2020.

Their mixed April manufacturing was 3,891 kb/d, up 44 kb/d from March.

The general output from the above six nations has been in a sluggish regular decline since 2014 and seems to have accelerated after 2019.

World Oil Manufacturing Ranked by Nation

Above are listed the World’s twelfth largest oil producers. In January 2022, these 12 nations produced 76.8% of the world’s oil. On a MoM foundation, manufacturing decreased by 413 kb/d whereas on a YoY foundation, manufacturing elevated by 2,133 kb/d.

World oil manufacturing decreased by 433 kb/d in April. The biggest decreases got here from Iraq, 210 kb/d and Canada, 187 kb/d whereas Saudi Arabia added 350 kb/d.

World Oil Manufacturing Projection

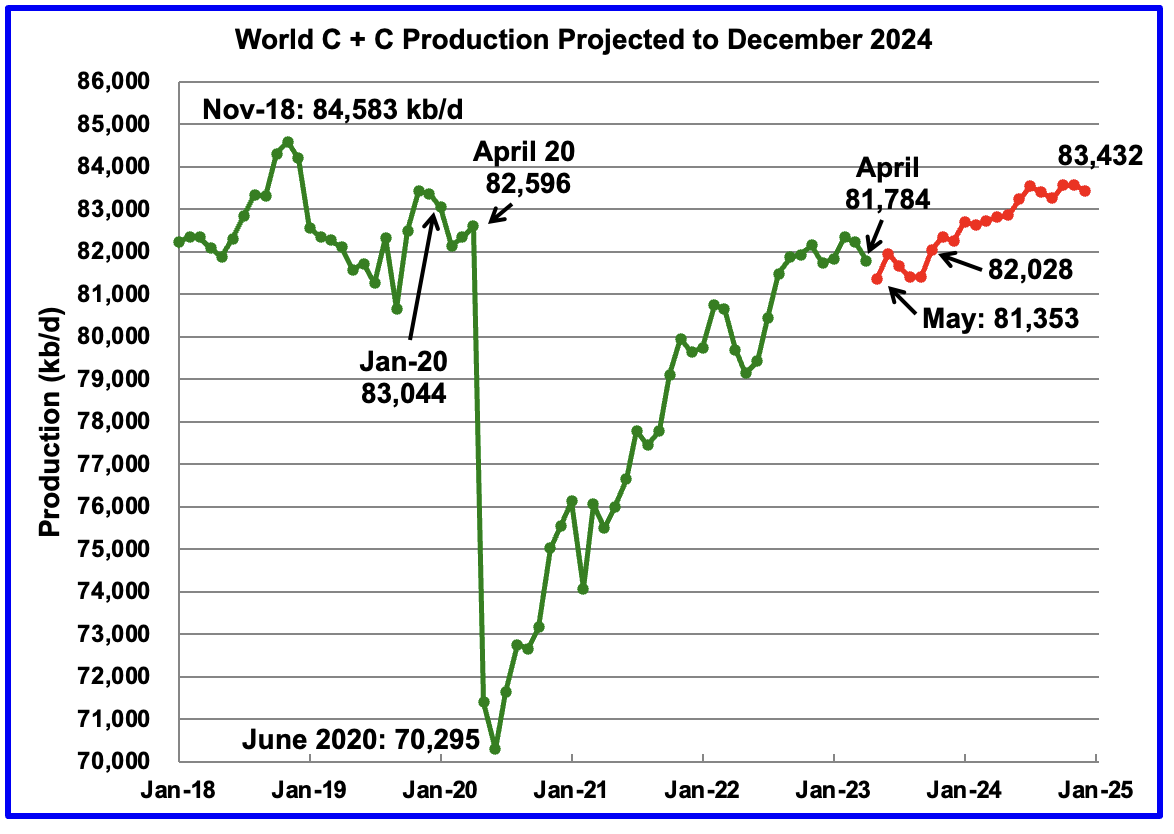

World oil manufacturing in April decreased by 433 kb/d to 81,784 kb/d.(Inexperienced graph).

This chart additionally initiatives World C + C manufacturing out to December 2024. It makes use of the August 2023 STEO report together with the Worldwide Vitality Statistics to make the projection. (Crimson markers).

The crimson graph forecasts that World crude manufacturing in December 2024 will likely be 83,432 kb/d and is 1,151 kb/d decrease than the November 2018 peak. Be aware the big improve to 82,028 kb/d in October 2023. This could possibly be resulting from Saudi Arabia reversing a part of its September 2023 1,000 kb/d minimize.

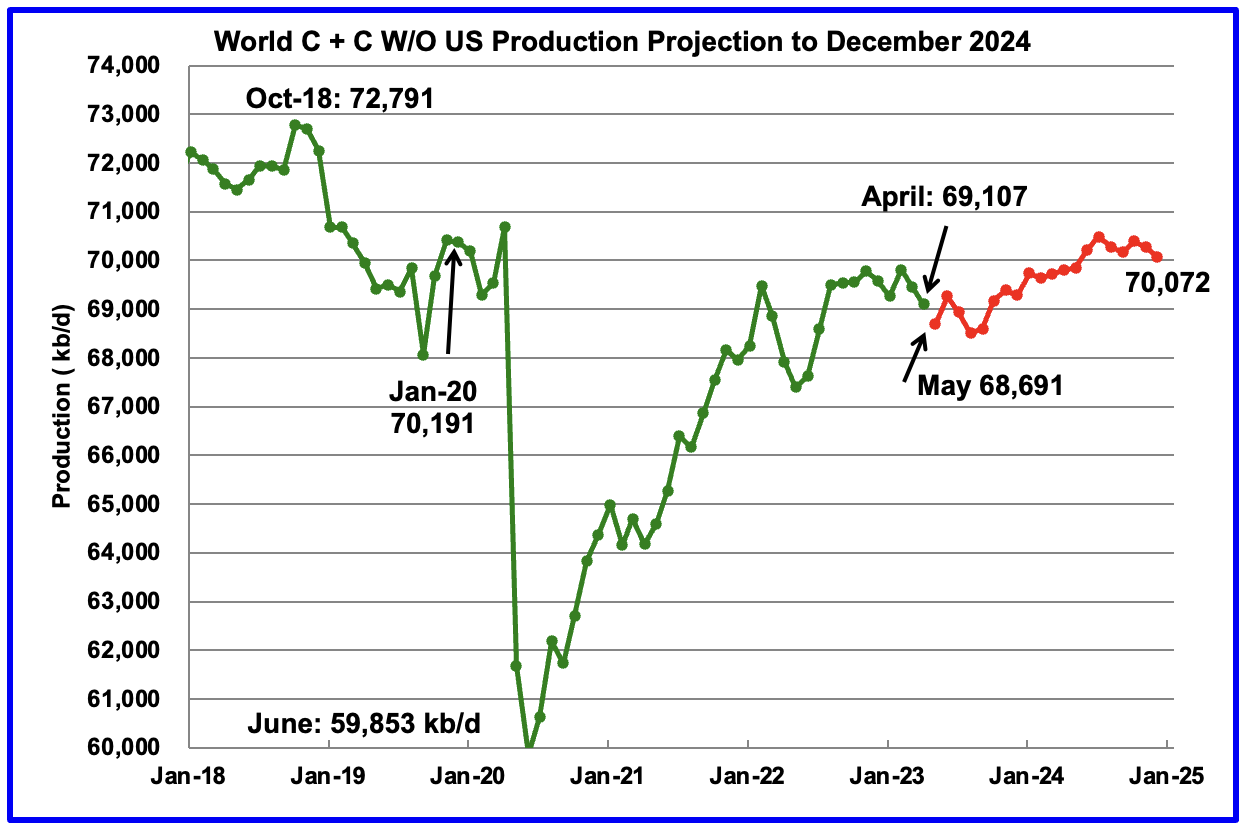

World with out the US oil output in April decreased by 340 kb/d to 69,107 kb/d. Might’s output is anticipated to lower by shut to a different 416 kb/d to 68,691 kb/d. December 2024 output of 70,072 kb/d is 2,719 kb/d decrease than October 2018 output of 72,791 kb/d.

World oil manufacturing W/O the U.S. from April 2022 to December 2024 is forecast to extend by a complete of 965 kb/d.

Unique Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.