bloodua/iStock through Getty Photographs

Carriage Providers (NYSE:CSV) is an organization that engages in two companies, specifically funeral companies and cemetery administration in lots of states throughout the US. The corporate owns and operates a complete of 173 funeral houses and 32 cemeteries, using 2,500 folks nationwide.

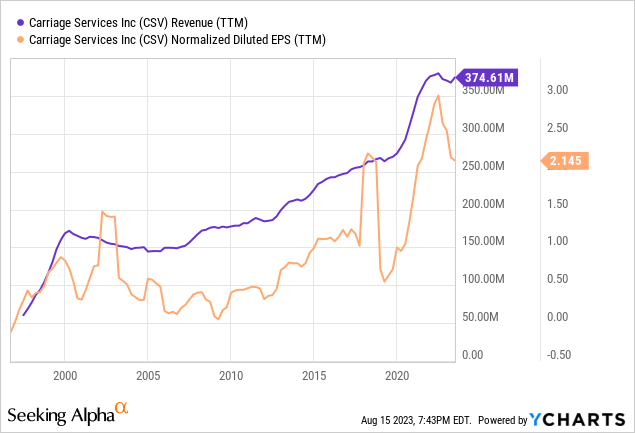

Over time, the corporate has been in a position to publish strong development in its revenues and income and its companies acquired an additional enhance in 2021 quickly after the COVID pandemic because of larger fee of dying within the nation. Final yr the outcomes dropped a bit from 2021’s highs however they nonetheless stay above 2019’s ranges and near all time excessive.

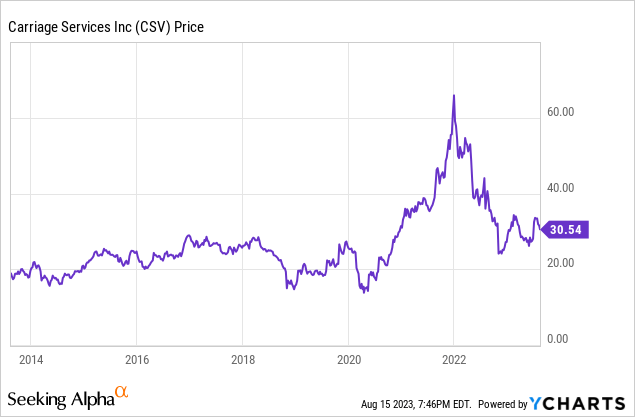

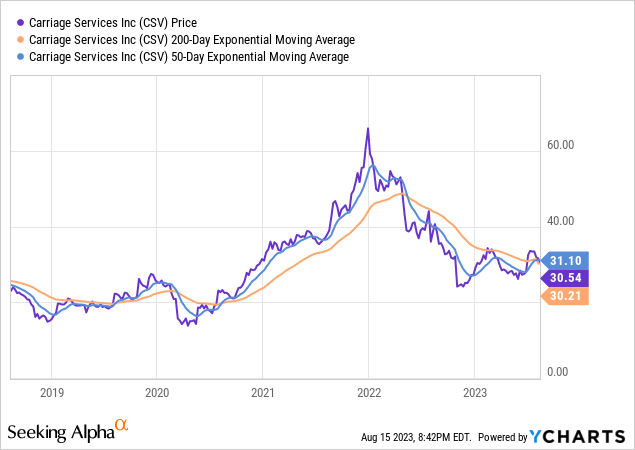

When the corporate’s enterprise noticed a lift from the pandemic, traders reacted by shopping for up shares in a rush the place CSV’s share value greater than tripled from $20 to $65 however it got here all the way down to $30 since then since traders came upon that the COVID enhance was solely going to be short-term despite the fact that the corporate’s enterprise did not drop that a lot since then.

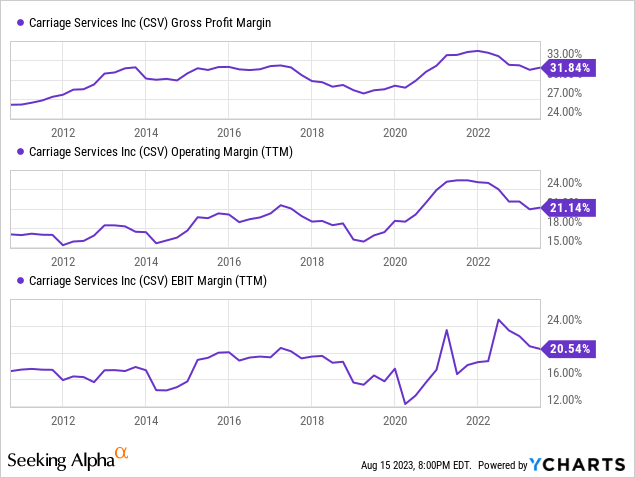

Over time, the corporate’s enterprise mannequin supplied wholesome ranges of money circulation and powerful margins. The funeral service facet of the corporate comes with a number of avenues of income era akin to merchandise gross sales, financing and sure upgrades. Financing is a giant one as a result of funeral companies have gotten more and more pricey and lots of households need to benefit from financing choices if the deceased individual did not have an insurance coverage protection for funeral prices. That is particularly widespread in circumstances the place dying occurs at an sudden age. On account of these extra income channels, the corporate’s margins have been fairly sturdy and considerably steady through the years. Presently we’re CSV producing near 32% in gross margins which is on the upper finish of its decade lengthy vary of 24% to 33%, working margin of 21% which can also be on the upper finish of the corporate’s 10-year vary between 15% and 24%. The corporate’s present EBIT margin of 20.54% is above its long run common of 17%.

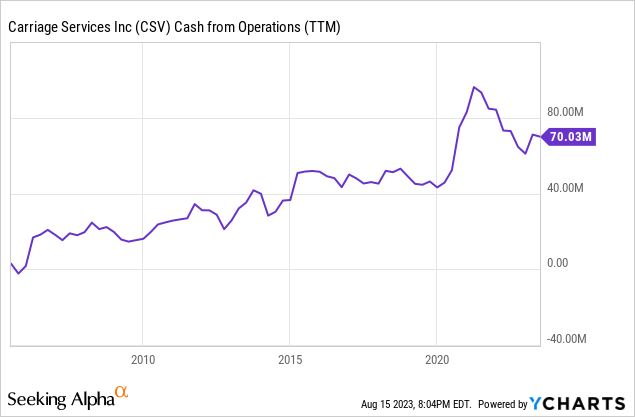

On account of these sturdy and bettering margins, the corporate’s working money circulation improved virtually persistently from yr over for the final twenty years. Present money circulation variety of $70 million is considerably under the corporate’s COVID pandemic highs however it’s nonetheless on the upper finish of the 20-year vary which ranged from $0 to $85 million.

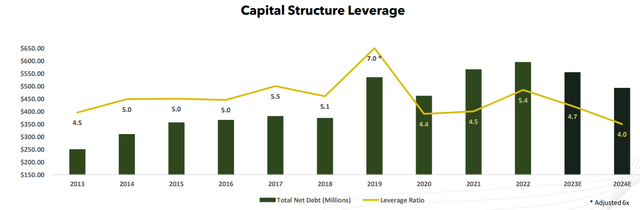

Not all the firm’s development got here organically although. Over time, the corporate has made plenty of acquisitions which resulted in larger debt and leverage ranges for the corporate. From 2013 to 2019, the corporate elevated its debt degree from $250 million to $550 million whereas rising its leverage ratio from 4.5 to 7.0. Since then the corporate has been engaged on lowering its debt and leverage ratios and it targets a internet debt degree of $450 million and leverage ratio of 4.0 by the tip of 2024. With a purpose to obtain this, the corporate must decelerate on acquisitions and save up some money.

Debt and leverage ranges (Carriage Providers)

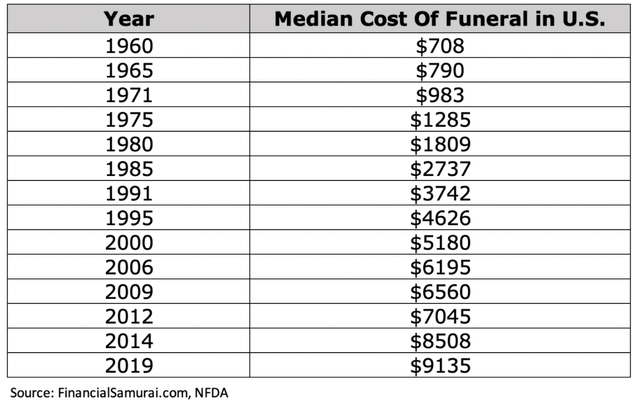

Funeral enterprise is a novel enterprise as a result of there are facets of it one would contemplate commoditized after which there are different facets of it which might be removed from commoditized. On one facet, the quantity of people that die yearly would not fluctuate a lot from yr to yr except there’s a main occasion happening akin to a world pandemic. The inhabitants is rising at a gentle however gradual fee and there’s solely a lot development funeral firms can see. Alternatively, funeral companies are extremely specialised and dear companies and this business has proven plenty of pricing energy through the years. Presently the median value of a funeral within the US is north of $9k and it has been rising at an exponential fee through the years.

Common value of funeral over time (Monetary Samurai)

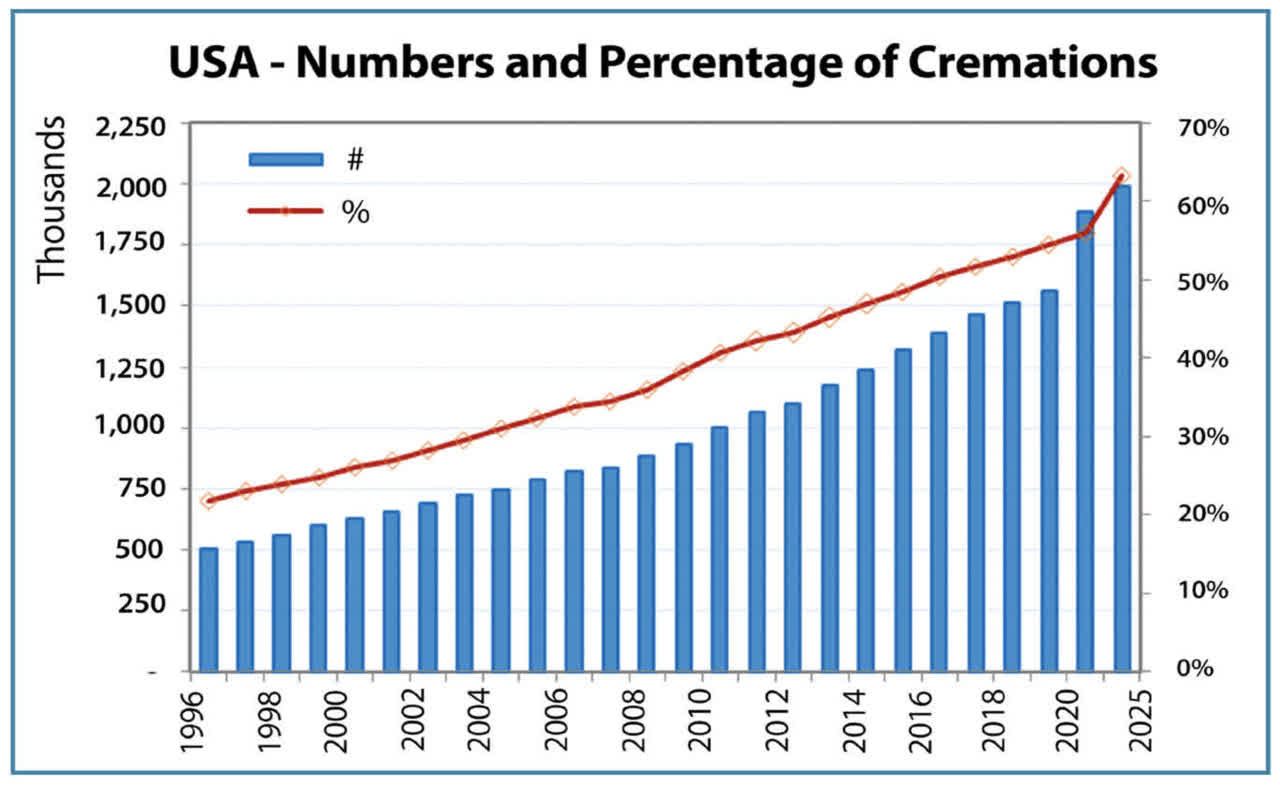

There may be additionally one other rising development the place a bigger and bigger share of persons are selecting cremation over a conventional funeral which comes with a decrease value. This could possibly be the selection of people that haven’t got a sort of life insurance coverage that covers funeral prices.

Share of cremations within the US (funeralleader.com)

Which means that funeral houses must take a look at additional rising their costs to make up for the decrease quantity of funerals however this may additionally end in extra folks choosing cremations if funerals develop into too costly. Corporations like Carriage Providers must discover a stability the place they will generate wholesome ranges of margins with out pushing away too many individuals from its companies.

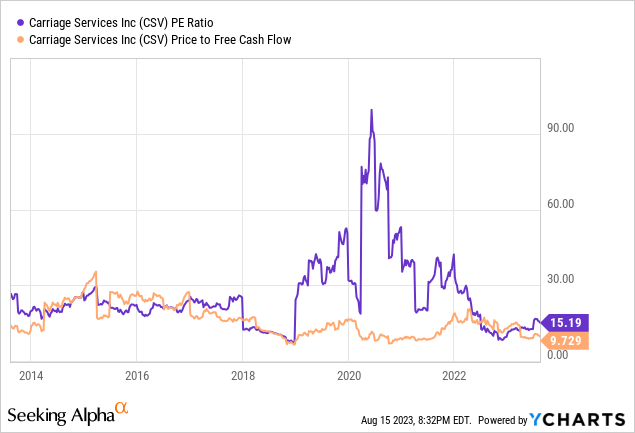

As a lot as valuation goes, the corporate at present trades for a value to earnings ratio of 15 and value to free-cash-flow ratio of 10. On one facet, this can be a truthful valuation for a corporation rising in mid-single digits and producing wholesome ranges of margins however I would not name it dust low-cost both. Alternatively, remember the fact that the most important competitor of CSV is Service Company (SCI) which trades at a better P/E of 20. Compared to SCI, CSV truly appears cheaper from a valuation standpoint.

From a technical evaluation perspective, the inventory is at present sitting at a crossroad of 50-day transferring common and 200-day transferring common. Traditionally these averages proved to be sturdy help ranges for this inventory which implies it won’t have far more draw back left barring a market-wide correction occasion. If your complete market experiences a deep correction or pullback, it’s more likely to take this inventory down with it but when the market is rising or not less than steady, these help ranges ought to be sustainable for the foreseeable future.

The corporate is at present engaged on a succession plan after its CEO Mel Payne had a stroke and there’s now a brand new CEO Carlos Quezada who has been handpicked and developed by the earlier CEO. Buyers had been ready since final yr for this succession plan to be accomplished and new CEO to settle and now it appears to be accomplished and the corporate can transfer on. Mel Payne will proceed to serve the corporate because the chairman of the board of administrators and proceed to supply mentorship to the present management group.

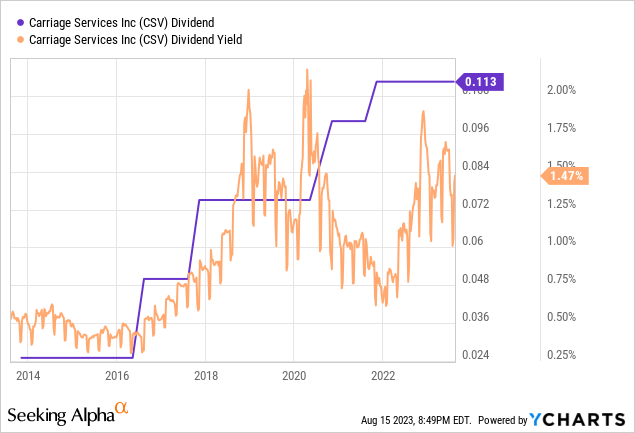

CSV additionally has a dividend historical past. The corporate has been mountain climbing its dividends on a constant foundation since 2016 and it plans to proceed rising its dividends over time however remember the fact that the present yield is about 1.5% which is not a lot for earnings oriented traders. You probably have a long run horizon and in search of dividend development performs, this may be an fascinating play although.

All in all Carriage Providers is an fascinating firm located in a novel business. The corporate enjoys some development, sturdy margins, first rate money flows and truthful valuation. This could possibly be a worthy decide for sure sorts of traders which might be in search of a steady and predictable enterprise mannequin with low valuations.