olegganko/iStock Editorial by way of Getty Pictures

Introduction

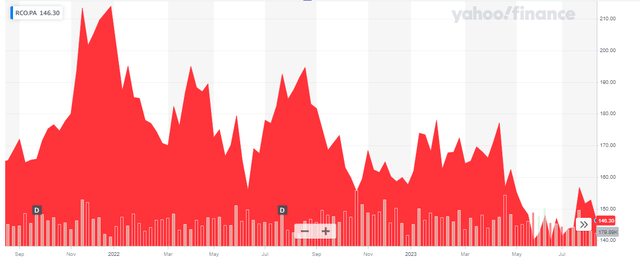

Remy Cointreau (OTCPK:REMYF) (OTCPK:REMYY) is without doubt one of the world’s best-known producers of cognac and liqueurs on the planet and plenty of liquor cupboards could have a bottle of Cointreau current. Whereas the corporate’s share value suffered through the COVID pandemic because the demand for its merchandise decreased, it has bounced again properly and the high-margin money stream machine is properly buzzing alongside. This doesn’t suggest Cointreau is affordable, although, and on this article I might wish to check out the inventory as its share value is now buying and selling about 10% decrease than the 164 EUR degree it was buying and selling at when my earlier article was printed.

Yahoo Finance

Remy Cointreau has its major itemizing in France the place it’s buying and selling with RCO as ticker image. The typical day by day quantity at the moment exceeds 70,000 shares per day for a complete worth of 10M EUR. I’ll use the Euro as base foreign money all through this text.

FY 2023 confirmed appreciable enchancment

The corporate’s monetary 12 months ends in March, which implies the latest detailed monetary statements are the annual outcomes for FY 2023, which resulted in March. This implies we are actually properly underway in FY 2024, which is able to finish in March subsequent 12 months.

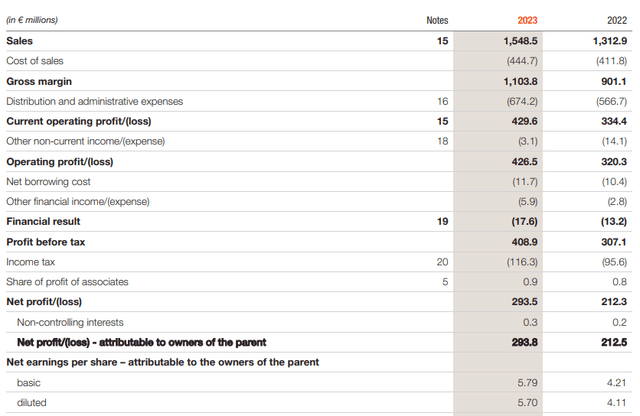

Throughout FY 2023, Cointreau reported an 18% income improve to 1.55B EUR. Because the Price of Gross sales barely elevated (by simply round 8%), the gross margin expanded by about 22% whereas the working revenue elevated by nearly 29% to 427M EUR (of which 16% was on an natural foundation). For sure it is easy to know why Cointreau’s press launch was touting ‘a file 12 months’. The margins stay vastly superior and the gross margin in FY 2023 got here in at 71.3%, which is about 4% factors larger than in FY 2020, the pre-COVID 12 months.

Remy Cointreau Investor Relations

The online revenue jumped to only over 293M EUR and this represented an EPS of 5.79 EUR. On the present share value of roughly 146 EUR, the inventory is buying and selling at about 25 instances earnings. That positively is not low-cost nevertheless it’s extra affordable than the a number of of in extra of fifty instances earnings the corporate was buying and selling at throughout its COVID years.

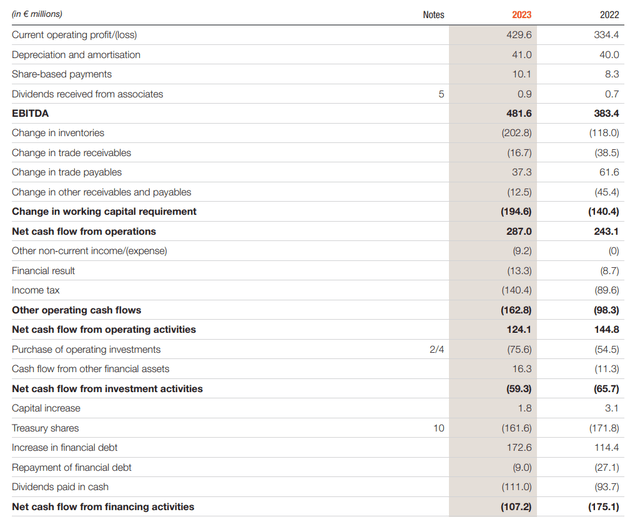

The robust margins are clearly very intriguing, and as Cointreau’s sustaining capex is often fairly low, the money stream end result tends to be very robust as properly.

As you’ll be able to see beneath, the working money stream was 124M EUR however this features a 195M EUR funding within the working capital place whereas the corporate additionally paid 140M EUR in taxes though the revenue assertion signifies solely 116M EUR was due. This implies the underlying working money stream adjusted for this stuff was 343M EUR.

Remy Cointreau Investor Relations

Curiously the capex was comparatively excessive at 76M EUR. This resulted in an underlying free money stream results of 267M EUR or 5.27 EUR share. That is decrease than the reported web revenue as the overall capex was nearly twice as excessive because the depreciation and amortization bills recorded throughout FY 2023. The capex will seemingly stay elevated within the subsequent few years as Cointreau is investing in further progress because it continues to develop its operations. The administration confirmed on the FY 2023 convention name the corporate has been investing in further manufacturing and storage capability.

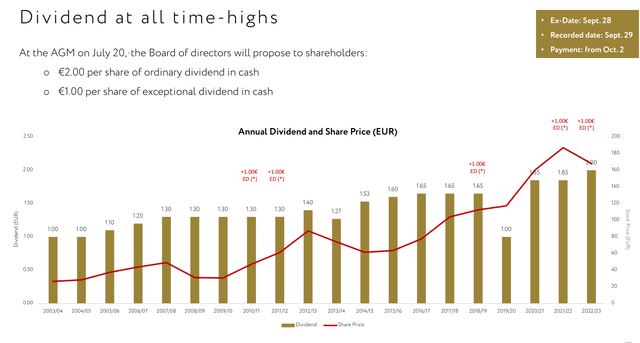

The corporate can pay a complete money dividend of three EUR per share. The yield clearly is not excessive, however Cointreau should not be seen as a dividend inventory anyway.

Remy Cointreau Investor Relations

FY 2024 might be a combined bag – do not anticipate an excessive amount of

Whereas FY 2023 was a wonderful 12 months, Cointreau is certainly much less upbeat in regards to the present monetary 12 months. It anticipated its income to point out a ‘robust decline’ within the first half of the 12 months as the primary semester of final 12 months was significantly robust in the US. Nevertheless, Cointreau expects the scenario to revert within the second half of the 12 months whereby it expects to watch a robust restoration.

Based mostly on that steerage, we in all probability should not anticipate an excessive amount of from Cointreau this 12 months and conserving the earnings flat would seemingly already be a great achievement. This additionally means the 35% natural income decline skilled within the first quarter of this 12 months was extensively anticipated. And when it launched the Q1 buying and selling replace, the corporate confirmed the full-year steerage.

Funding thesis

Remy Cointreau affords an fascinating dilemma. I am often very reluctant to pay 25-28 instances earnings for a inventory, even when it’s a firm that has confirmed the resilience of its enterprise mannequin previously. That being stated, the analyst consensus estimates are pointing in the direction of a resumption of the earnings progress from FY 2025 on with an anticipated EPS of 6.04 EUR in FY 2025 and 6.79 EUR in FY 2026. In fact these are simply estimates however these assumptions seem like fairly honest given the corporate’s ambitions.

And the sort of excessive margin shares hardly ever will get low-cost. Paying about 20 instances ahead earnings shouldn’t be unreasonable and a possible technique could possibly be to put in writing out of the cash put choices. The choice premium for a P120 expiring in March 2024 is roughly 3.5 EUR and that gives a pleasant trade-off: both one is ready to purchase the inventory at 17 instances the ahead earnings for FY 2026 or the three.5 EUR possibility premium may simply be pocketed.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.