FreshSplash

This does not occur typically. An organization buying and selling under e book worth. Sorry, that was not proper. What’s uncommon is discovering high quality firms that commerce under e book worth. I imagine WestRock Firm (NYSE:WRK) is one such firm that has enticing traits however has been penalized by the marketplace for a number of causes. Two major causes that stand out to me are the business it operates in and the narrative-driven AI hype cycle we’re in (If you’re at a dinner with your pals does it sound hip whenever you say you’ve got purchased Palantir and Nvidia in your portfolio or whenever you say have invested in a paper packaging firm?) Different causes may very well be their debt ranges which could be fairly regarding at first look. The corporate additionally overpaid for its acquisitions, needed to write down a big chunk of its goodwill, and is in a turnaround of its operations. However what could be anticipated from this firm if we put all of those within the rearview mirror? If we are saying that the inventory value greater than displays the corporate’s present scenario, can this be an excellent funding within the present market circumstances?

Enjoying Protection

I imagine within the present market the perfect offense is an efficient protection. Meaning investing in industries which have secure demand, dependable money circulation, and exhibit much less sensitivity to financial cycles. This additionally means they’re normally not well-liked and are extra centered on worth.

WestRock Firm is a multinational packaging options supplier. They concentrate on creating revolutionary packaging options for varied industries, akin to shopper items, meals, and healthcare. With a deal with sustainability, WestRock provides an array of packaging supplies, corrugated containers, folding cartons, shows, and packaging equipment. They cowl the whole packaging provide chain, from design to manufacturing and distribution, making them a big participant within the packaging business. One in all their latest huge wins is partnering with Costco to interchange single-use plastic “canine bone” clips with a Paperboard resolution that’s obtainable in curbside recyclable codecs

Investor Presentation

So this isn’t an business that will function in any “scorching” investing listing. However this doesn’t imply it could not give you above-average market returns. This inventory has suffered just lately however there have been durations the place it has supplied even above benchmark returns. Whereas I perceive timing the entry is tough, I imagine we’re once more round one such entry level the place the enterprise is buying and selling for lower than what it is price, and it has presumably put the worst behind it.

The corporate’s fairness is at $10B and with a market cap of $8.23B, its e book a number of is 0.8x. Whereas a P/B ratio lesser than one is already an indicator of worth, since that is an unloved business now we have to verify if that is widespread throughout the business or if the corporate is definitely undervalued. Throughout the business, the median is 2x and the common is 3x.

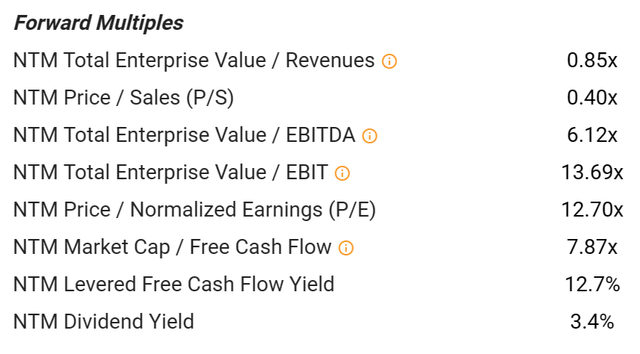

Moreover, their money circulation ratios are additionally very enticing. For LTM, their OCF got here in near $1.8B which places their P/CF at 4.6 which once more ranks fairly favorably throughout the business (and in addition inside their sector). LTM PE a number of doesn’t precisely replicate their enterprise primarily on account of one-time bills. However this begins normalizing whenever you take a look at their ahead multiples.

Tikr

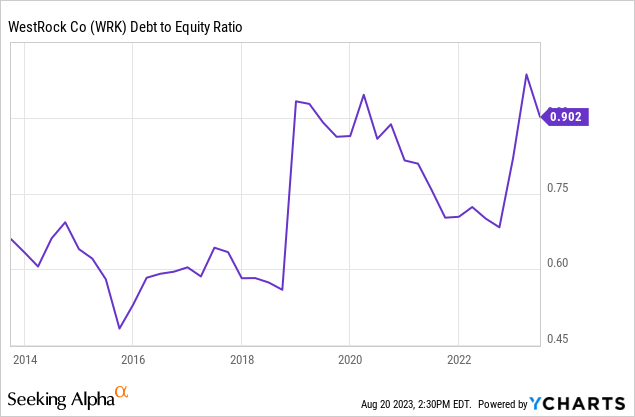

Debt Ranges

The opposite concern expressed about this firm is its debt degree. Debt to fairness is shut it its highest ranges within the final ten years.

However peeling again the layers we understand that it’s not as a lot of a priority.

1. Its debt is properly coated by its working money circulation. OCF as a share of its long-term debt is over 20%

2. Its EBIT for LTM is at $1.45B and it’s fairly enough to cowl its present funds on its debt. Its present ratio of 1.5 suggests there aren’t any liquidity issues confronted by the corporate.

Wanting ahead

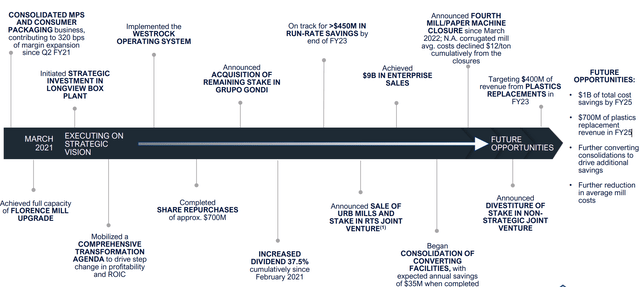

Previous, Current and Future (Investor Presentation)

The corporate has made vital efforts to place its worst behind it and look forward. QoQ they’ve proven a income decline of seven% for Q3 coming in at $5.1B. Whereas they don’t anticipate any bump in revenues, they’re concentrating on $400M of income from plastics replacements in FY23. On an extended timeframe, they anticipate $700M of plastics alternative income in FY25. They’re additionally making vital enhancements in bettering their operations and backside line.

They anticipate to exit FY23 with greater than $450M in run-rate financial savings by closing and consolidating their amenities. Additionally they anticipate their consolidated EBITDA to be within the vary of $675 to $725M and adjusted EPS to be within the vary of $0.66 to $0.83 per share. On an extended timeframe, they anticipate additional changing consolidations and extra reductions in common mill prices to drive further financial savings. In complete, by 2025 they anticipate their value financial savings to be round $1B.

In conclusion, the steps undertaken by the corporate bode properly and can result in a a lot brighter future forward for them.

Dangers to this thesis

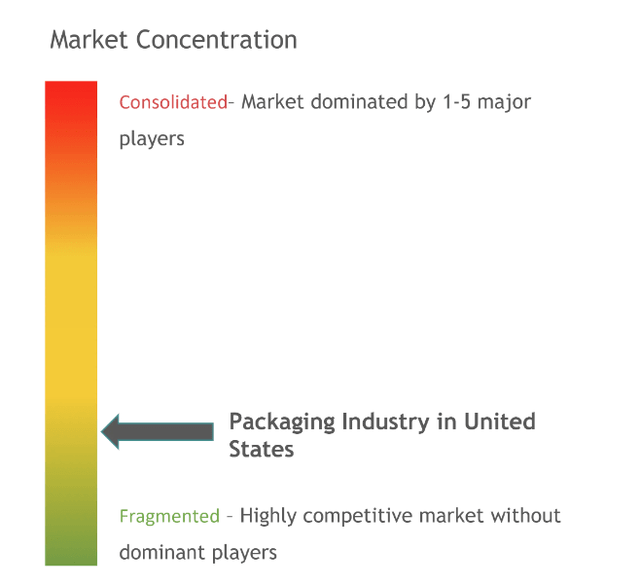

The most important dangers I see to this firm are from its rivals. The business has low limitations to entry with little to no differentiation between friends outdoors of value.

Mordor Intelligence

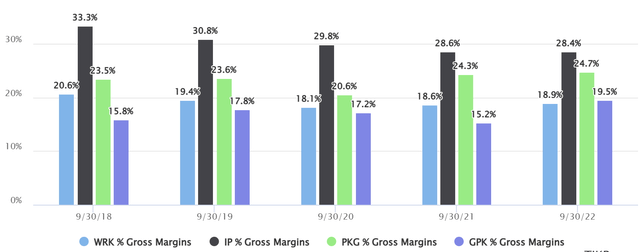

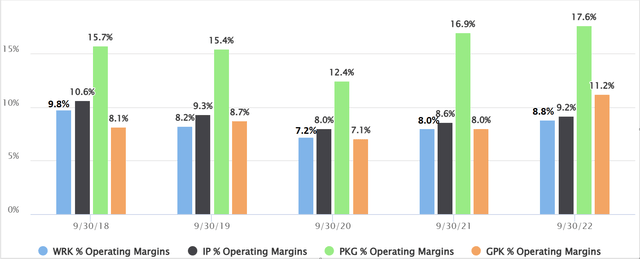

Now to verify if an organization might effectively compete on value, the very first thing to search for is margins. If we evaluate the margins of Westrock in opposition to a few of the key gamers within the business we see that it doesn’t fare properly.

Gross Margins Comparability (Tikr) Working Margins (Tikr)

The excellent news is that as we noticed, the corporate is working to enhance its effectivity and making value financial savings an enormous a part of its future plan. However this may positively take a while to pan out and might be essential metrics to be careful for.

Ultimate Name

Presently, I charge this firm as a purchase. I do acknowledge the corporate is popping out of a turnaround and in addition fares much less favorably than its rivals. However I do imagine that it has put the worst behind it and the market is giving a possibility for the traders to purchase into this enterprise at a reduction. Beforehand, in these conditions, the corporate has all the time been capable of broaden its multiples and get above the benchmark returns, and for my part, we’re at the same juncture this time round as properly. Over the rapid time period, we may even see extra ache whereas the turnaround is in its ultimate phases however over the medium time period, this may very well be a fantastic entry level. However I do not anticipate to carry this inventory previous its expiry date. Competitors is excessive and ultimately the corporate might discover itself again in one other unhealthy scenario. My technique for this firm is to get into this firm on the proper value (I imagine we’re close to one proper now), hold an in depth eye on their progress, and revisit my thesis each six months to see how now we have progressed. I’d not maintain this funding for the long run and would look to get out every time the worth is correct. I’ll intention to maintain the readers knowledgeable right here on In search of Alpha via my journey.