KanawatTH

I used to be very fortunate with the timing on my final article on Curaleaf (OTCPK:CURLF), once I prompt that readers ought to promote the inventory. This was in early July, and the inventory had closed at $4.00. The inventory fell sharply and is now at $2.90, down 27.5% in seven weeks. Not unhealthy!

Whereas some would possibly wish to declare a victory after an excellent name like that, I wish to present an replace that implies there could possibly be extra draw back. The inventory stays very costly relative to friends. On this piece, I replace my year-end goal, which was $3.09 in early July. The corporate, although, reported its Q2, and the estimates have come down, and my goal, which I share beneath, has too.

On this replace, I present a take a look at Q2 and the analyst estimates forward, I overview the chart, I talk about an enormous threat and in addition a potential progress driver, and I assess the valuation.

Q2

Income progress slowed in Q2 from Q1, growing simply 1%. This represented progress of 4% from a 12 months in the past to $339 million. Adjusted EBITDA fell far in need of expectations, which had been for $80 million, falling from $73.2 million in Q1 and $86.6 million a 12 months in the past to $70.0 million.

The stability sheet deteriorated and is stunningly dangerous. Money fell 48% within the first half, and web debt has expanded to now $529 million. The corporate has a present ratio of simply 0.9X, suggesting a possible liquidity occasion forward. The corporate’s filings point out that it might want to repay $53.5 million in debt in 2024 and $60 million in 2025. With simply $85 million in money, there could possibly be an issue with debt maturity. The corporate has generated working money circulate in 2023, but it surely has been exceeded by the capital spending. The tangible e-book worth moved from -$592 million on the finish of Q1 to -$722 million.

The Outlook

After an enormous miss on adjusted EBITDA, the ahead estimates for 2023 and 2024 fell sharply. Forward of the Q2 report, analysts had been searching for 2023 income of $1.368 billion, growing in 2024 to $1.471 billion. Now, the analysts anticipate income to extend 2% in 2023 to $1.36 billion and 6% in 2024 to $1.44 billion, a slight decline.

The outlook for adjusted EBITDA fell extra sharply. The pre-report forecast was $343 million in 2023 and $386 million in 2024. Now the analysts venture $301 million in 2023, a decline from 2022 of 1%, after which $358 million in 2024, up 19%. This is able to be a margin of practically 25%.

The Charts

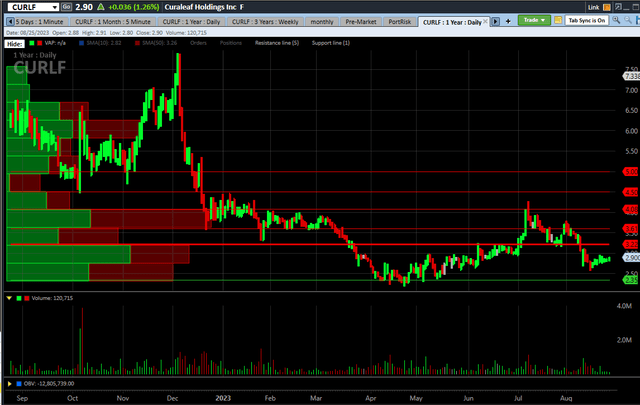

Curaleaf peaked in December close to $8 and set a brand new all-time low in April:

Charles Schwab StreetSmart edge

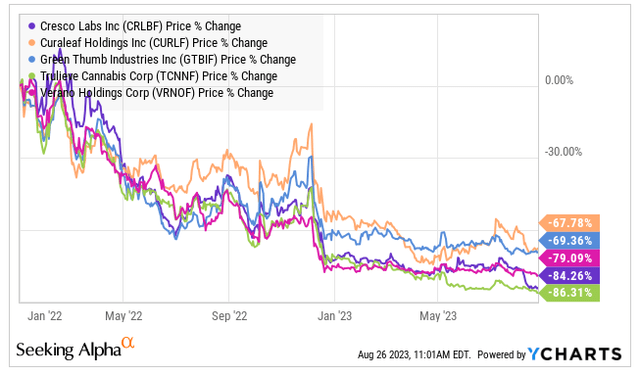

The inventory is down loads from the height in 2021, but it surely’s not down as a lot as its friends. Here’s a look since 12/31/21:

YCharts

CURLF is down the least, with Inexperienced Thumb Industries (OTCQX:GTBIF) shut behind. The others, although, are down much more, with Trulieve (OTCQX:TCNNF) down essentially the most, barely worse than Cresco Labs (OTCQX:CRLBF). Verano (OTCQX:VRNOF) too has misplaced nearly 80%.

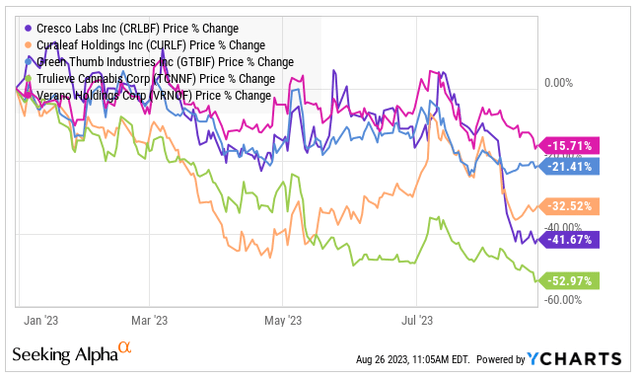

In 2023, CURLF is down, however two are down extra:

YCharts

A Massive Threat

AdvisorShares Pure US Hashish ETF (MSOS) owns 67.6 million shares, over 21% of the fund and its second-largest place. This weighting could be very excessive in comparison with the market cap relative to friends and to its market share.

In December, MSOS began seeing redemptions, and it really bought shares of Curaleaf and others. Regardless of the restoration within the variety of shares, which have elevated 3.2% now year-to-date, they’re nonetheless down greater than 5% from the height. The year-over-year progress has slowed dramatically and is simply 16.3%. That ETF is down 29.9% in 2023, and it’s dropping its attraction to traders. If it begins to redeem once more, it will possible promote some CURLF.

A Attainable Driver of Development

Whereas it isn’t a completed deal but, Germany could also be shifting in the direction of adult-use legalization. Curaleaf stands out amongst friends for its involvement in that market after shopping for what it now calls Curaleaf Worldwide. The corporate it purchased, EMMAC, value $50 million and 17.5 million shares in 2021, a deal that was introduced close to the highest of the market. The parents operating it had been the individuals who bought Nuuvera to Aphria in a really costly deal in 2018. It bought at closing 31.5% of Curaleaf Worldwide to a single strategic investor for $130 million.

Curaleaf Worldwide is insignificant at current. It is H1 income at $26.8 million was simply 4% of general income, and its contribution to gross earnings is decrease. Most of its gross sales are wholesale relatively than retail.

My very own view is that whereas it’s thrilling to see a significant nation liberalize its hashish legal guidelines, this system will not be that huge of a deal for Curaleaf in 2024. It is not but official, so the analysts will not be together with something. There’s a probability that as Germany adopts the potential program, Curaleaf estimates might enhance.

The Excessive Relative Valuation

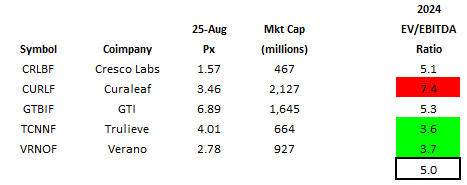

I’ve already pointed to the unhealthy stability sheet, and this will get factored into my valuation by means of using enterprise worth, which provides the web debt to the market cap. Right here is the ratio of enterprise worth to projected adjusted EBITDA for every of the biggest MSOs:

Alan Brochstein, utilizing Sentieo

Curaleaf instructions an enormous premium, and I do not imagine it’s justified. I’ve lowered my a number of of projected adjusted EBITDA from 7X to 6X, which remains to be greater than the present ratio for its 4 friends. Utilizing the present 2024 projected adjusted EBITDA of $358 million, this works out to be $2.20, close to the all-time low that was just lately set in April. $2.20 represents a 24% decline from the present worth. In fact, it might fall extra. I’m utilizing 5X for another MSOs, and this might characterize $1.72.

Conclusion

Whereas Curaleaf has fallen loads since I known as it out in early July and is down 32.5% year-to-date, it might fall extra to get its valuation in step with friends. My year-end goal is $2.20, an enormous decline from the present worth, and it will characterize a full 12 months decline of 48%. It might fall about 10% decrease to the spherical $2.00.

If MSOS sees share redemptions, this might outcome within the ETF promoting the shares of its second-largest holding, however there’s one other supply of shares: Curaleaf. I pointed to the weak stability sheet, and the corporate might have to promote inventory to cowl debt maturities. Both method, traders needs to be cautious.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.