Blissful discuss from Washington, constantly low unemployment, and a slowing tempo of inflation have mixed to help a constructive market sentiment – however can it final? ‘Shark Tank’ star Kevin O’Leary believes it received’t, and he doesn’t hesitate to checklist the headwinds that might convey ‘actual chaos’ by the 12 months’s finish.

The important thing issue is increased rates of interest. The Federal Reserve has already pushed charges as much as their highest degree in over 20 years, and the repercussions are spreading. O’Leary takes particular care to level out the consequences on the industrial actual property market, the place the elevated charges suggest that industrial mortgage loans – of which $1.5 trillion is because of flip over within the subsequent few years – will refinance at practically double their present rate of interest.

With already greater than $64 billion in troubled industrial actual property property, O’Leary additionally notes that industrial mortgage delinquencies have been as much as 3% by the tip of 1Q23. Moreover, small companies, constituting round 60% of the US jobs market, are already strapped for money and credit score as banks and different monetary establishments tighten lending situations.

All of those components add as much as a state of affairs that calls for a defensive stance; buyers might want to discover safety for his or her portfolios. The logical transfer – and the basic defensive inventory play – is a shift towards dividend shares. These shares, with their mixture of passive earnings and decrease common volatility, supply a defend in opposition to potential downturns.

Wall Road’s analysts have tagged two dividend-paying shares as compelling ‘Sturdy Purchase’ candidates with promising outlooks. Let’s take a more in-depth look.

Brookfield Renewable Companions (BEP)

The primary dividend inventory we’ll have a look at is Brookfield Renewable Companions. Primarily based in Bermuda, the corporate claims a world footprint of numerous vitality property. Its portfolio consists of a variety of distributed vitality and sustainable operations. Moreover, it options extra typical inexperienced vitality tasks, comparable to wind, photo voltaic, and hydro-electric energy era methods.

The title ‘Brookfield’ needs to be acquainted. It is among the largest various funding companies in Canada, and Brookfield Asset Administration owns a 60% curiosity in Brookfield Renewable Companions. This offers a stable monetary underpinning for the vitality firm, permitting it to broaden its power-generating amenities and function at utility-grade scales.

Earlier this month, BEP launched its monetary outcomes for the second quarter of 2023. Notably, the corporate skilled a 6.1% year-over-year development in its funds from operations (FFO). Particularly, FFO surged from $294 million within the corresponding quarter of the prior 12 months to an $312 million in 2Q23. Per share, the FFO amounted to 48 cents, which was 2 cents increased than within the prior-year quarter. The FFO helps the dividend right here, which amounted to 33.75 cents per frequent share.

Turning to the dividend, we discover BEP’s annualized fee of $1.35 per share and a yield of 5.1%. The dividend has been maintained with out lacking 1 / 4 since 2018.

For Wells Fargo analyst Jonathan Reeder, the story on BEP is all about taking advantage of decarbonization. The analyst believes that BEP has positioned itself to outlive a downturn.

“We proceed to view BEP/BEPC as a compelling approach for buyers to play the worldwide decarbonization motion. Brookfield has the flexibility to deploy capital—at scale—into conventional renewable property in addition to extra strategic investments into companies which are levered to the developments (i.e., Westinghouse and Origin). We imagine BEP’s conservative technique (IG steadiness sheet, extremely contracted w/ inflation-linked revenues, and so on.) is constructed to face up to macro challenges,” Reeder opined.

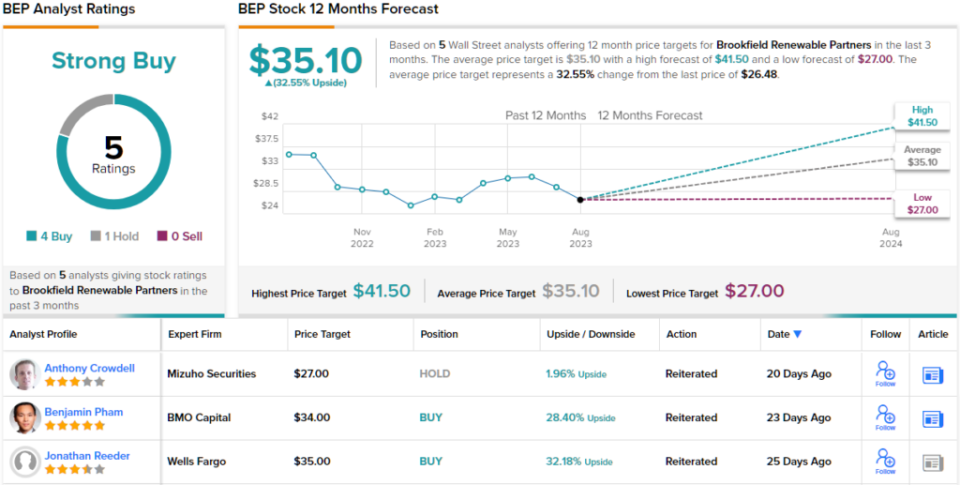

To this finish, Reeder charges BEP shares an Obese (i.e. Purchase), whereas his $35 worth goal factors towards a 32% upside heading out to the one-year horizon. (To observe Reeder’s observe document, click on right here)

A lot of the Wells Fargo analyst’s colleagues are on the identical web page. Primarily based on 4 Buys and 1 Maintain, BEP has a Sturdy Purchase consensus ranking. At $35.10, the common worth goal might present buyers with upside of ~23% within the coming months. (See BEP inventory forecast)

Diamondback Power (FANG)

Subsequent up is Diamondback Power, an impartial oil and pure gasoline exploration and manufacturing agency primarily based in Texas. Diamondback focuses on unconventional onshore performs in each oil and pure gasoline, participating in actions comparable to acquisition, growth, exploration, and exploitation of those vitality sources, primarily within the Permian Basin of West Texas. Diamondback employs a technique of horizontal exploitation to maximise the worth extracted from every effectively.

The Permian Basin, the place Diamondback concentrates its efforts, stands as the biggest oil-producing sedimentary basin within the US. Over the previous 20 years, its excessive manufacturing has propelled Texas again onto the world map of petroleum producers. Within the second quarter of this 12 months, Diamondback achieved a every day common manufacturing of 449,912 barrels of oil equal, marking a 5.8% improve from the earlier quarter and an 18% improve year-over-year.

Regardless of the expansion in Diamondback’s gross manufacturing numbers, the corporate skilled declines in each revenues and earnings on a year-over-year foundation. Whole income amounted to $1.92 billion, representing a lower of ~30% in comparison with the earlier 12 months. Equally, the adjusted EPS determine of $3.68 per share was down from over $7 within the corresponding interval of the earlier 12 months. Nevertheless, each the 2Q23 income and EPS figures surpassed analyst forecasts, outperforming expectations by $26.19 million and 21 cents per share, respectively.

Throughout Q2, Diamondback generated a free money movement of $547 million. This determine ought to pique the curiosity of dividend buyers because it straight helps the corporate’s capital return coverage, which encompasses dividend funds and share repurchases. In Q2, Diamondback allotted $473 million for these functions. The newest dividend fee for Q2 was disbursed on August 17, amounting to 84 cents per share. Yearly, this interprets to $3.36 per share and yields a 2.2% return. The corporate has a historical past of adjusting dividend quantities to make sure protection and has constantly distributed dividends since 2018 with out lacking a single quarter.

For RBC Capital’s 5-star analyst Scott Hanold, this firm’s reliability is the purpose that buyers ought to be aware of. He writes of Diamondback, “Give attention to secure operations is delivering constant outcomes which are barely forward of expectations. This underpins its robust FCF outlook that offered confidence to extend the fastened dividend. Incremental shareholder returns stay a choice primarily based on the intrinsic FANG worth that might transfer again to extra variable dividends. We see good upside worth in FANG shares within the present market, which usually warrants buybacks, however at mid-cycle oil costs, valuation is probably going close to the excessive finish of the band.”

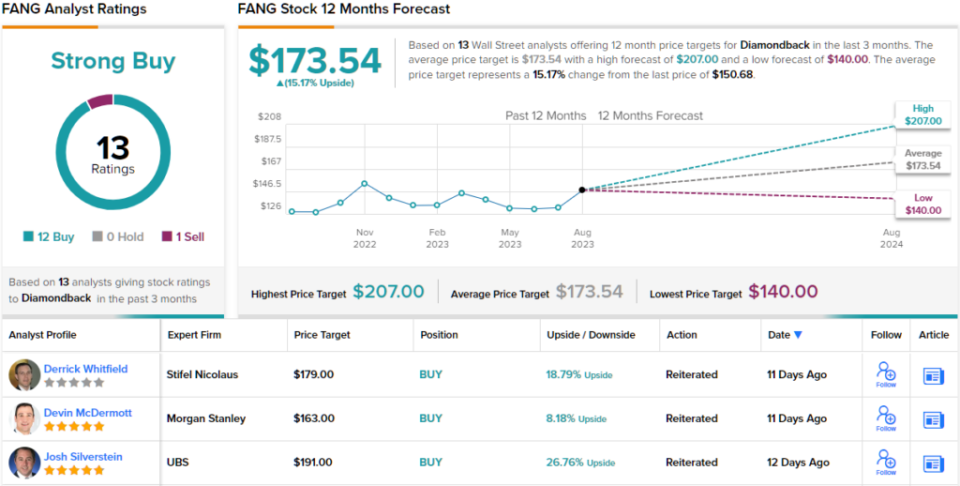

Hanold goes on to provide FANG shares an Outperform (i.e. Purchase) ranking, whereas his worth goal of $170 implies a share appreciation of ~13% within the 12 months forward. (To observe Hanold’s observe document, click on right here)

All in all, 11 different analysts be part of Hanold within the bull camp and the addition of 1 bear can’t detract from a Sturdy Purchase consensus ranking. The forecast requires 12-month returns of 15%, contemplating the common goal stands at $173.53. (See Diamondback inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.