lechatnoir/E+ through Getty Pictures

Pricey readers/followers,

Vonovia (OTCPK:VONOY) is a German condo landlord which operates very equally to a REIT. The corporate owns and leases over half one million residences and represents one among my highest conviction shares out there in the present day.

I’ve lined the inventory extensively right here on Looking for Alpha, most just lately in an article the place I shared components of my money move mannequin for the corporate, highlighting the truth that latest disposals have improved the outlook considerably, particularly close to close to time period debt maturities.

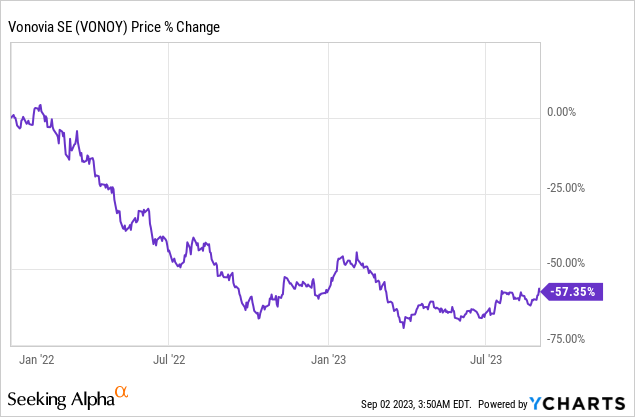

The inventory has bounced properly from the March low of round EUR 15.50 per share for the native share (ticker VNA) and now trades some 40% increased at practically EUR 22 per share. Nonetheless, shares commerce 57% under the place they have been only a yr and a half in the past and considerably under what I take into account honest worth, which makes the corporate attention-grabbing even in the present day.

Operational Efficiency

As soon as once more outcomes have been stable, particularly because it pertains to Vonovia’s rental section which represents round 90% of the corporate’s adjusted EBITDA.

Vonovia’s rental enterprise continues to be very secure with close to full occupancy of 98%, close to good collections of 99.9% and really predictable lease will increase of 3-3.5%.

Predictable will increase are a consequence of lease regulation, which (merely put) units a ceiling for rents as the typical of market lease during the last 6 years. Because of this, Vonovia’s rents lag market rents, however the will increase are extremely seen and quite a lot of volatility in market rents will get smoothed out. In flip, lease progress is often slower in good instances, however increased in dangerous instances.

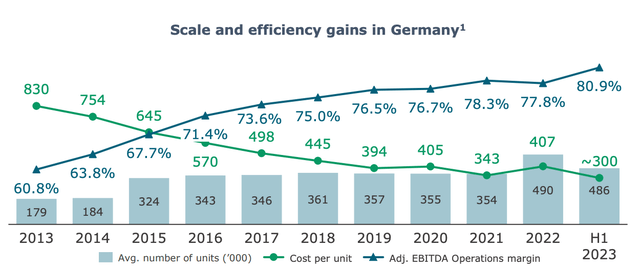

Through the second quarter, rental revenues elevated by 2.3% (3.5% natural lease progress, but additionally some disposals). The corporate additionally continued to (1) save on upkeep and (2) notice synergies from the incorporation of Deutsche Wohnen and, in consequence, posted the best adj. EBITDA margin ever of practically 81%.

Vonovia Presentation

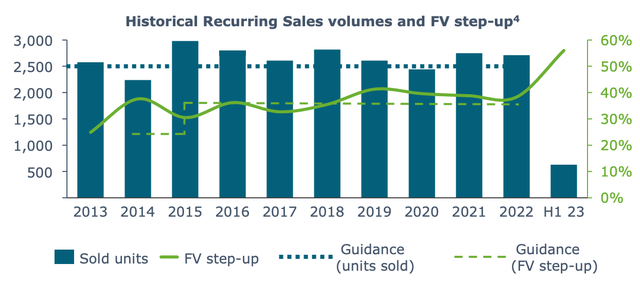

The remainder of Vonovia’s segments continued to function at an analogous degree seen through the first quarter. Greater price of fabric and power has continued to trigger drag on the value-add section, whereas low total funding quantity out there has saved recurring gross sales low. Regardless of a slight quarter-over-quarter enhance, the variety of models offered stays low compared to historical past.

The FV step-up for recurring gross sales has reached an all-time excessive of 45%, which signifies that though the amount is low, a minimum of the corporate is promoting these models at very excessive costs. Going ahead, I count on recurring gross sales to pick-up regularly because the funding market appears to be coming alive slowly, with funding volumes rising and several other giant transactions going down over the primary half of this yr. In the meanwhile, nevertheless, administration has suspended their steering for recurring gross sales resulting from low visibility.

Vonovia Presentation

General, whole adjusted EBITDA for the primary half of the yr got here in at EUR 1.34 Billion (about 1.2% increased than assumed within the mannequin offered final time).

Steering for the total yr stays robust as natural lease progress has been revised upwards to three.6-3.9% and the anticipated Group FFO per share has been confirmed at EUR 2.15 – 2.39.

Notably, the steering at present requires the dividend to return to 70% of Group FFO, which is the place it has been traditionally previous to the 50% minimize this yr.

Frankly, I do not assume it should occur except rates of interest lower quick and count on the dividend for this yr to stay on the present degree of 35% of Group FFO in order that the corporate can protect liquidity for debt compensation. This could be according to administration’s acknowledged deal with money technology and disposals to delever.

Financing

In case you’ve been following Vonovia you already know that operational efficiency shouldn’t be the rationale the inventory has offered off a lot. The unload has largely been associated to a excessive degree of debt on the corporate’s stability sheet and the concern that the corporate could not be capable to meet its near-term debt maturities or {that a} portfolio revaluation could trigger them to breech their debt covenants.

It’s true that the corporate has quite a lot of debt, largely as a consequence of the acquisition of Deutsche Wohnen which, in hindsight, was poorly timed.

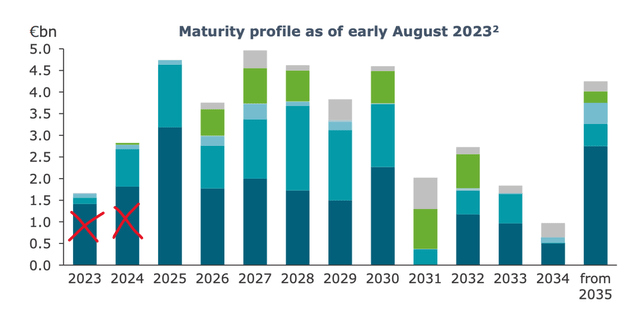

Nonetheless, following earlier main disposals to Apollo and CBRE, all of 2023 and 2024 debt maturities at the moment are lined and administration can execute their plan to (1) repay all maturing bonds and (2) refinance all financial institution loans.

Vonovia Presentation, darkish blue = bonds, the remainder = financial institution loans

Whereas there have been no additional disposals introduced since April, the corporate has recognized a possible JV in Northern Germany supposedly much like the Sudewo deal. If profitable, the disposal would permit the corporate to repay a major a part of bonds maturing in 2025 and would act as a significant bullish catalyst for the inventory value.

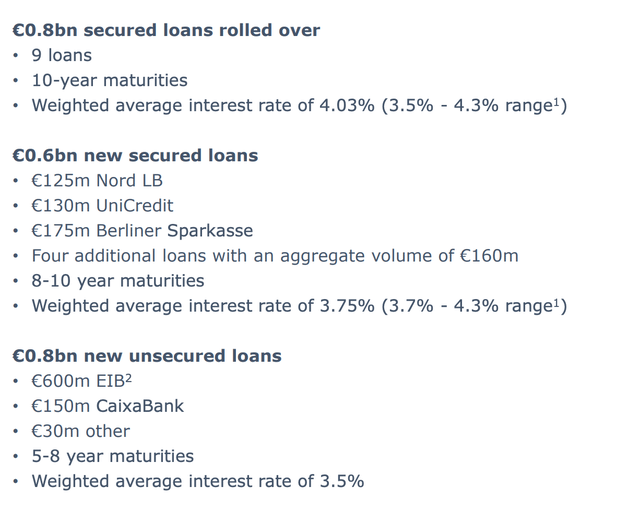

On the refinancing entrance, Vonovia has accomplished very nicely over the primary half of the yr, refinancing EUR 0.8 Billion of loans and securing EUR 1.4 Billion in new loans at affordable charges of three.5-4%. That is encouraging, as a result of it is a clear signal that banks wish to proceed to work with Vonovia.

Vonovia Presentation

Valuation

Vonovia is an organization that’s doing precisely what it is purported to do on an operational degree and regardless of being considerably over-levered, it has managed to cowl all of its financing wants till the top of 2024 and is now actively engaged on addressing 2025 maturities.

Within the meantime, the valuation has been completely hammered.

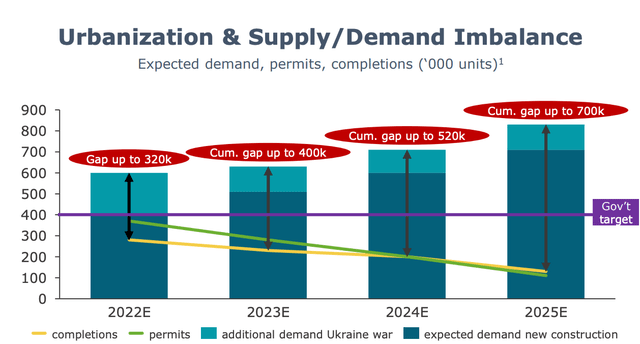

To know why I am so assured that the true honest worth is way increased than the present inventory value, it is essential to appreciate simply how a lot housing scarcity there’s in Germany.

New completions, in addition to the variety of issued constructing permits (which is a really correct proxy for completions 2-3 years later), has been falling for years.

Over the subsequent three years, it’s estimated that there will probably be solely about 250 ths. models delivered to the market. That is method under the federal government’s goal of 400 ths. and even farther from estimated demand of 600 ths.

Vonovia Presentation

And the factor is that latest occasions have solely made the matter worse. The Ukraine disaster has elevated demand and excessive materials and power costs mixed with a better price of capital have considerably decreased the pipeline of future initiatives.

The housing scarcity is actual in Germany and it’ll worsen earlier than it (possibly) will get higher. In flip Vonovia will profit by sustaining excessive occupancy, elevating rents and most significantly by proudly owning properties that will probably be valued extra, merely due to their scarcity.

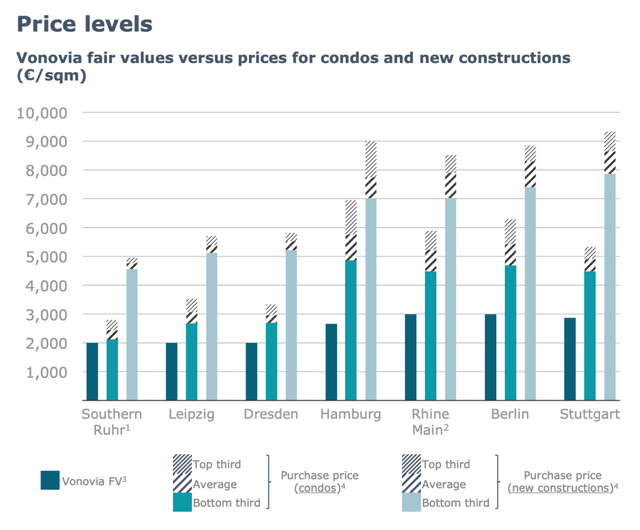

At the moment, Vonovia retains their properties on their books at EUR 2,350 / sqm which is equal to NAV per share of about EUR 50. That is method under alternative prices as argued right here, and method under market costs for comparable properties.

Vonovia Presentation

And though I do count on the NAV to return down over the subsequent couple of quarters as the corporate tries to generate liquidity by promoting properties (maybe considerably under BV), I nonetheless see true honest worth round EUR 40 per share.

With the inventory buying and selling at EUR 22 per share in the present day, that leaves upside of 80%+. I proceed to charge the inventory a BUY right here and do not plan on decreasing my place earlier than a minimum of EUR 30 per share.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.