Andres Victorero

Funding thesis: After greater than a decade of low rates of interest, a reversion again to regular, the place cash is now not basically free to borrow makes for an fascinating funding case for sovereign bond ETFs. I final coated the iShares 1-3 Yr Worldwide Bond ETF (NASDAQ:ISHG) in 2019. At that time, I highlighted its potential as an funding down the road, as soon as the bond bubble we have been in will burst. Its profile gives sure particular funding alternatives. As an example, a lot of the sovereign bonds within the fund are euro-denominated, with Japanese yen-denominated bonds being the second main class. It subsequently acts as a forex guess, not solely as a guess on bonds.

Alternatively, buyers can think about the iShares 1-3 Yr Treasury Bond ETF (NASDAQ:SHY), which gives publicity to US treasuries and takes out the forex fluctuations side of it. It thus strikes far much less by way of value. Additionally it is arguably much less dangerous, provided that as unhealthy because the debt and deficits state of affairs could appear, it arguably pales compared to being uncovered to Italian bonds.

As the worldwide financial system is beginning to present indicators of slowing much more than the already beforehand forecast sluggish charges of development, gaining some publicity to bonds which can be deemed to be principally safe is one thing value contemplating. At first, the regional and international macro developments should be thought of in mild of the necessity to time such an funding proper. The macro elements that should be thought of vary from financial development trajectories, to the danger of arguably tight international vitality provides triggering a second wave of inflationary pressures. Second, the query of whether or not one of many two choices I’m evaluating is healthier than the opposite. Third, the final total danger concerned in investing in bond ETFs, given rising international uncertainty, the place the unthinkable tends to occur must be accounted for. As I’ve been doing lately, I are inclined to attempt to time investments in addition to attainable, to reduce the general draw back danger.

The worldwide macroeconomic state of affairs is seemingly deteriorating, and it may very well be additional exacerbated by ongoing and arguably intensifying geopolitical tensions.

As I identified in an article I wrote earlier this summer time entitled “Tis The Summer time For Taking Income”, my expectations for the inventory marketplace for the second half of this yr should not significantly rosy. Regardless of a slowing financial system, there are robust odds that vitality costs will stay excessive, and probably head even greater on tight provides, which might additional dampen financial development.

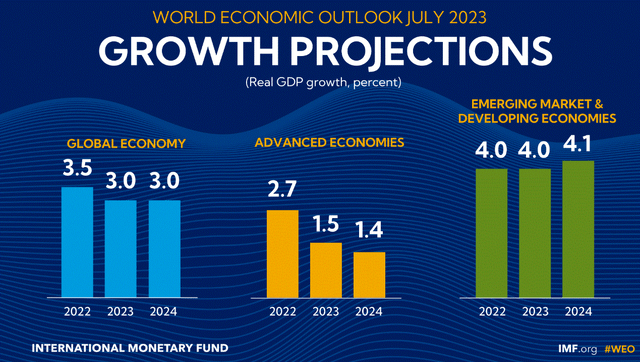

IMF

It ought to be famous that the IMF forecast for July doesn’t have in mind the seemingly dire state of affairs in China, the place issues acquired so unhealthy in the previous couple of weeks that the federal government determined to cease publishing youth unemployment stats. This alone in all probability brings the expansion forecast down for your complete world by a number of tenths of a proportion level.

Different potential unfavourable surprises that would affect the worldwide financial system or areas & nations inside it are numerous. They span by way of selection from potential disruptions within the international provide chains as a consequence of continued huge energy rivalries, to a colder-than-average winter within the Northern Hemisphere that has the potential to plunge the EU specifically right into a extreme vitality disaster.

Even when there isn’t any spectacular vitality disaster on the horizon, vitality costs stay stubbornly excessive, at the same time as the worldwide financial system is something however strong. This creates a probably awkward state of affairs for central banks, provided that they’re caught between having to combat inflationary pressures, even because the financial system wants financial & fiscal stimulus. What this would possibly imply for the outlook for bonds is that there’s elevated uncertainty. If central banks proceed to lift rates of interest to attempt to tame higher-than-desired inflation, then bonds at the moment held in each ETFs I selected for comparability will decline in worth, as a result of yields will proceed to rise. If nevertheless, the necessity to combat the financial downturn outweighs the necessity to maintain inflation in examine, yields on freshly issued bonds will decline, offering a lift to currently-held bond costs, which is optimistic for each ETFs.

ISHG & SHY ETFs are prone to stay principally positively correlated in relation to one another by way of share value motion, however a number of elements may have an effect on the magnitude of the share value transfer.

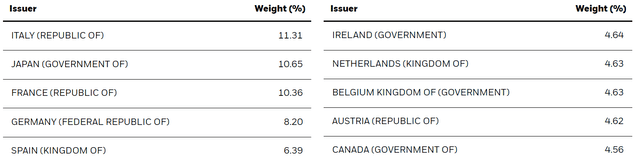

The ISHG ETF principally gives publicity to main EU economies, in addition to Japan & Canada.

iShares

One of many foremost differentiating elements that would decide whether or not this ETF outperforms or underperforms the SHY ETF is the euro/USD trade charge going ahead. The SHY ETF is prone to proceed to commerce inside a tighter vary as a consequence of an absence of forex fluctuation.

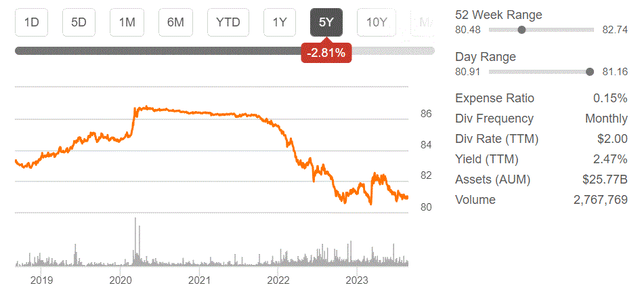

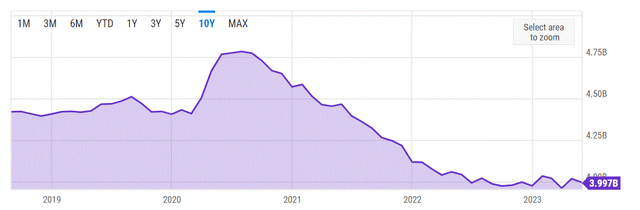

ISHG share value & monetary metrics (Looking for Alpha) SHY share value & monetary metrics (Looking for Alpha)

As we are able to see, there’s a roughly 3% hole between SHY’s 52-week high and low, whereas ISHG noticed a roughly 10% hole by way of the identical metric. The one issue that each of them have in widespread is the truth that each ETFs began shifting down by way of share value as rates of interest began shifting up.

Different metrics of word, embrace the common yield to maturity, with SHY at the moment at slightly below 5%, whereas the ISHG fund has a mean yield of three.2%. This is a vital issue as a result of, in my opinion, it alerts that forex trade fluctuations however, SHY could have extra upside potential if rates of interest begin to transfer down. We should always needless to say these funds will in all probability rise when rates of interest transfer down as a result of bond costs which have greater yields will acquire, versus freshly issued bonds that may have decrease yields. The expense ratio additionally favors SHY, with a price of .15% versus .35% for ISHG

Funding implications:

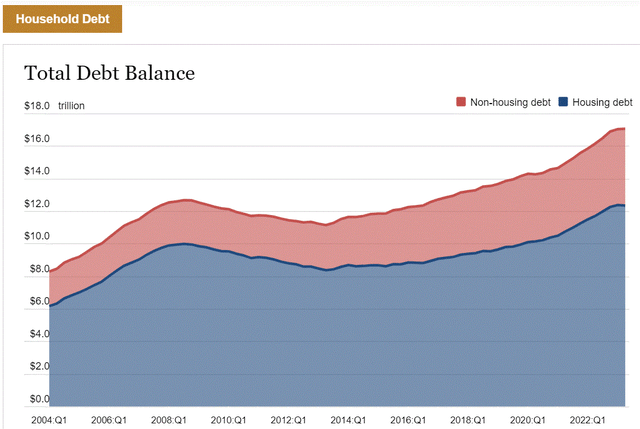

The general US, EU, and international macroeconomic state of affairs at the moment makes for one of the crucial unsure environments for bonds. On one hand, we have now a relentless influx of information factors that inform us the financial system is slowing. There are information factors comparable to shopper financial savings charges, in addition to rising indebtedness that inform us that shopper spending is prone to dive quickly.

Federal Reserve Financial institution of New York

We should always keep in mind that along with family debt ranges being excessive, the rise in rates of interest is including an additional burden by rising the price of carrying debt. Sooner or later, in all probability fairly quickly, we should always see a softening in shopper demand, which accounts for about 2/3 of the Developed World financial system. This alerts a future rate of interest coverage that’s prone to development in the direction of a downward development.

OECD oil shares billions of barrels (Ycharts)

As we are able to see, regardless of a less-than-robust international financial development trajectory, OECD oil inventories are at the moment roughly 10% under the historic ranges we noticed in regular occasions, in different phrases, earlier than the COVID-19 pandemic. For my part, there’s a roughly 1-3 mb/d international provide/demand hole at the moment primarily based on OPEC’s demand forecast, versus present manufacturing information we have now out there, till the top of the yr, that means that OECD oil storage shares are headed for a big decline from present already low ranges, which ought to in idea set off a market response within the type of an oil value spike within the subsequent few months. This can be a issue that would in idea maintain central banks from reducing rates of interest, regardless of the softening tempo of the worldwide financial system.

Summing up the online results of the 2 figuring out elements I recognized as being essential to the long run outlook of the trajectory of the bond markets, one would possibly argue that the 2 elements could have a web impact that’s near zero since they could largely cancel one another out. These two ETF funds ought to subsequently in idea see little or no motion for the foreseeable future till one thing modifications. I consider this to be the more than likely state of affairs for the following few months, after which we’ll see a better degree of concern for declining financial exercise, versus inflationary pressures, principally pushed greater by rising vitality prices.

As for which of the 2 ETFs is extra enticing, the principle differentiating issue is the outlook for the forex trade fluctuations going ahead, between the US greenback on one hand and the euro & Japanese yen on the opposite. Given the unsure occasions we reside in, there may be potential for a substantial amount of forex fluctuation within the months and years forward. In my private view, the euro and the yen each share a specific potential danger issue, particularly the necessity for each of their economies to import a big quantity of vitality, throughout the context of a seemingly less-than-ideal international provide state of affairs. In different phrases, their currencies may find yourself chasing spiking LNG and oil costs, with their push to purchase at any value resulting in their currencies shedding worth. Alternatively, the US is working what appears to be deficits approaching $2 trillion as an institutionalized actuality, in different phrases, that is the brand new regular even in one of the best of occasions. Taking these elements into consideration, the forex challenge is a possible danger but additionally a possible purpose to be extra bullish on ISHG. The way in which I see it at the moment, it may go both manner.

In the meanwhile, I’m watching the worth of oil, in addition to the evolving provide/demand state of affairs as a foremost indicator of when it is perhaps a superb time to purchase into both or each of those ETFs. It appears that evidently the worth of oil would possibly nonetheless have a protracted method to go on the upside, which suggests there may nonetheless be some upside surprises for inflation within the coming months, subsequently rates of interest may nonetheless rise, which tends to be negatively correlated with the motion of each ETFs. Sooner or later, presumably within the subsequent twelve months, international financial development will possible decelerate sufficiently for international oil & vitality demand development to return again into line with tight provides. At that time, it can possible be a superb entry level for each ETFs. Personally, if I handle to time this proper, I’ll more than likely put money into each ETFs, with the proportions but to be decided, primarily based on prevailing realities on the time.