undefined/iStock through Getty Pictures

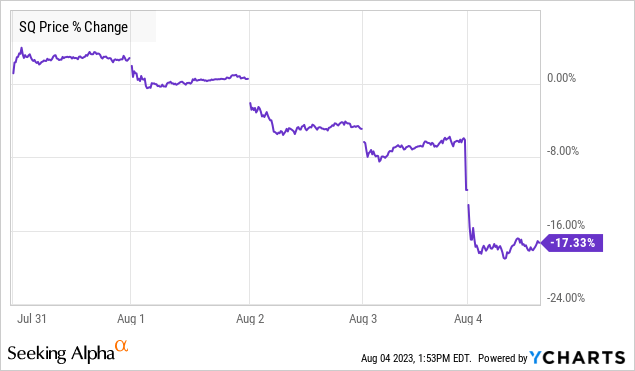

Final month, we shared a bull put unfold thought on PayPal (PYPL) (see PayPal: Choices Technique To Generate 17.1% Yield With -27.4% Draw back Safety). We’re maintaining with the theme on fintech shares battered by earnings, as Block, Inc. (NYSE:SQ) (previously Sq.) disillusioned the market with its miss on gross fee quantity (GPV), regardless of continued progress in all segments and a major enhance to its 2023 steering for adjusted EBIDTA. A more in-depth examination of Sq.’s robust second-quarter outcomes and improved outlook reveals a compelling alternative for potential traders.

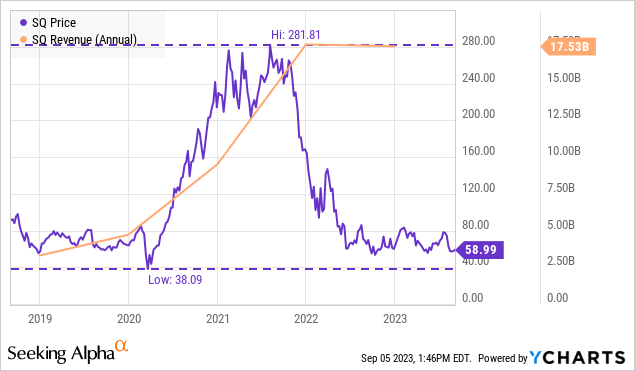

YCharts

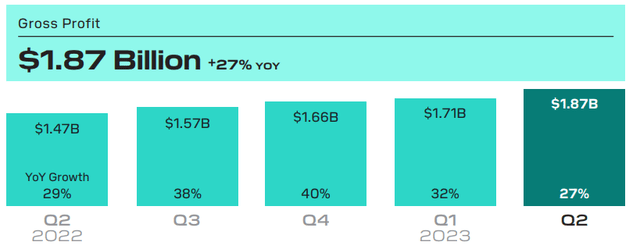

Whereas the market has been preoccupied with PayPal’s challenges, Sq. delivered an impressive Q2 report, showcasing spectacular progress throughout its enterprise segments. The corporate achieved a notable 27% year-over-year improve in complete gross revenue to $1.87 billion, demonstrating its skill to generate substantial income beneficial properties.

SQ 2023 Q2 Shareholder Letter

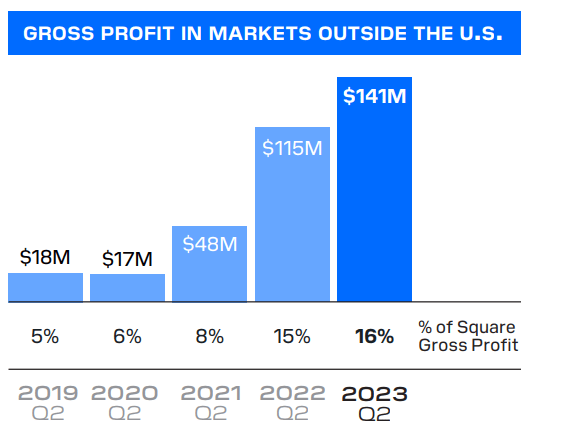

One of many key drivers of Sq.’s progress is its vertical penetration. By increasing its footprint in numerous industries, Sq. is ready to seize a bigger share of the market and drive vital income progress. For instance, food and drinks GPV and retail GPV had been up 17% and 9% year-over-year respectively. Furthermore, contributions from worldwide markets continues to rise, with gross revenue from markets outdoors the US up +23% year-on-year to $141 million, representing 16% of the corporate’s complete gross revenue. This diversification of income streams positions Sq. for sustained progress and decreased reliance on any single product or market.

SQ 2023 Q2 Shareholder Letter

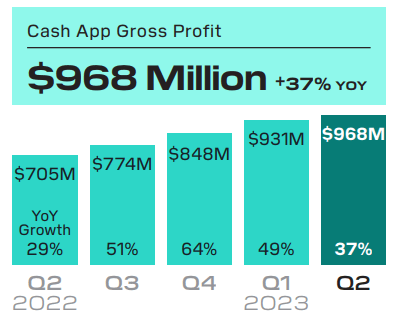

Sq.’s Money App, its common cellular fee service, additionally performed an important position in driving progress. Money App’s gross revenue surged by a formidable 37% year-over-year to achieve $968 million, indicating robust person adoption and engagement. The variety of month-to-month transacting actives (MTAs) in June was 54 million, which was up 15% year-over-year. This progress in Money App’s person base, coupled with the enlargement of its product choices, presents a major alternative for Sq. to drive additional income progress and monetize its massive person base.

SQ 2023 Q2 Shareholder Letter

Trying forward, Sq.’s administration demonstrated confidence within the firm’s restoration by upgrading its FY23 adjusted EBITDA outlook to $1.5 billion. This upward revision underscores Sq.’s anticipation of continued progress and profitability. Administration expects to realize profitability on an adjusted working revenue foundation for the 12 months, inclusive of share-based compensation bills, and year-over-year margin enlargement is anticipated on each an adjusted EBITDA and adjusted working revenue foundation.

Yahoo Finance

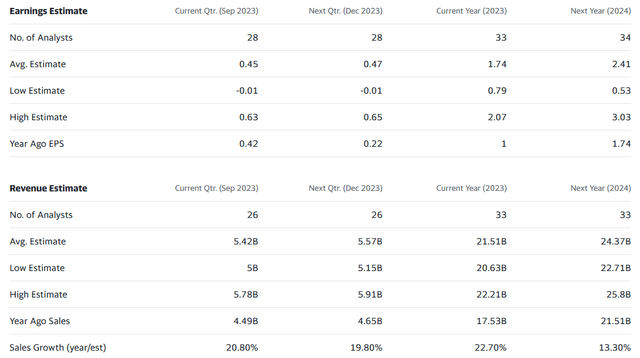

In response to In search of Alpha creator The Asian Investor, SQ’s greater valuation than its chief competitor PYPL is justified on account of SQ’s stronger progress prospects, significantly in its Money App ecosystem (see: Block: Purchase The Drop):

Nevertheless, Block just isn’t as costly because it appears to be like as a result of the FinTech is anticipated to develop rather more quickly than PayPal. Block is anticipated to generate 43% EPS progress in FY 2024 in comparison with PayPal’s 15%. Block’s long-term EPS progress estimates implies that the FinTech might develop nearly twice as quick as PayPal going ahead.

Nevertheless, one key threat is that SQ has but to show itself to be constantly worthwhile, and any indicators of headwinds on that entrance would probably be detrimental to SQ’s premium valuation.

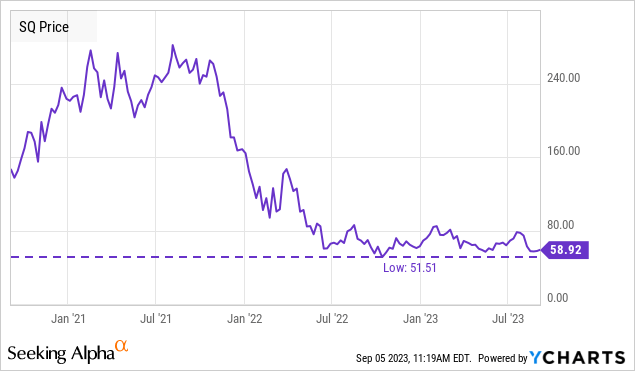

In abstract, the market’s failure to acknowledge Sq.’s robust efficiency and constructive steering creates a pretty alternative for consumers who missed out on the inventory’s earlier lows. The latest selloff has introduced its ahead valuation multiples again to extra engaging ranges. From a technical evaluation perspective, Sq.’s value chart signifies that the inventory might discover help on the $50-55 stage.

YCharts

SQ is a superb progress story, and traders with very excessive conviction within the firm could properly want to merely purchase the frequent inventory and take part absolutely in each the upside (and draw back) of the inventory from right here on out.

We focus on producing revenue via promoting choices or possibility spreads. This can be a nice possibility (no pun supposed) for these traders who could want to take part in restricted revenue motion within the underlying inventory, whereas defending their funding with a large margin of security.

Though SQ doesn’t pay a dividend, we are able to generate “yield” from this inventory utilizing choices. By promoting put choices on SQ, we’re taking a bullish stance as a result of we’re committing to purchasing SQ if it declines beneath the strike value.

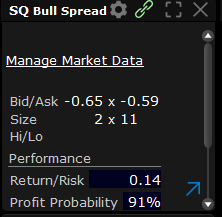

This specific bull put unfold thought generates $0.62 per contract in SQ from now till June twenty first, 2024, with -40.6% margin of security. In different phrases, SQ has to drop -40.6% from at this time’s costs earlier than any losses are taken.

The choices commerce

(information up to date as of September 5, 2023)

The Commerce: Block, Inc. (SQ) Bull Put Unfold 35/30 expiring June twenty first, 2024, inventory value at $58.95

- Bought SQ $35 Put for $1.48

- Purchased SQ $30 Put for $0.86

Ticker: SQ

Expiration: June twenty first, 2024

Sort: Bought Bull Put Unfold

Higher Strike Value: $35

Value Transfer Till Higher Strike: -40.6% lower

Premium Collected: $0.62 or $62 per contract

Days To Expiration: 289 days

Breakeven: $34.38 (Max loss $438 per contract achieved if the inventory goes beneath $30)

Choice Quantity: Respectable, with a $0.65/$0.59 bid-ask unfold on the time of writing.

Interactive Brokers

Due to SQ’s premium valuation, I am going with a wider margin of security to guard towards draw back triggers. The higher strike value is $35, which is -40.6% beneath the present inventory value of $58.95 and -31.8% beneath the 52-week low of $51.34. $35 can also be beneath the March 2020 bear market low of $38.09, when SQ’s income was a fraction of its present income at this time.

YCharts

The decrease strike value is $30, giving a most lack of $5 not counting the premium acquired.

The put unfold expires on June nineteenth, 2024 which is 289 days (about 9.5 months) from at this time. The put unfold will be offered for $0.62, with a capital prone to $4.38 (the distinction between the 2 strike costs, minus the premium acquired). When calculating the potential return of the choice unfold, bear in mind to additionally embody the rate of interest paid on money (e.g. 4.83% for Interactive Brokers) because the premium from promoting the choice is acquired upfront.

An investor scripting this put must be comfy with any of those three eventualities occurring on the expiry date of June twenty first, 2024:

- SQ closes above $35: Each choices will expire nugatory, and the investor pockets the $0.62 premium.

- SQ closes between $35 and $30: The investor can be pressured to take project of SQ shares at $35, whereas the decrease put will expire nugatory. (however you continue to get to maintain the $0.62 possibility premium, successfully decreasing your value foundation to $34.38).

- SQ closes beneath $30: Each lengthy and brief places can be assigned, and the investor will expertise the utmost lack of $4.38.

Keep in mind that every possibility contract represents 100 shares of the underlying and that anybody buying and selling choices must be absolutely conversant in the dangers as set forth right here.