Prykhodov

Funding Rundown

The share value for DT Midstream Inc (NYSE:DTM) has been fairly unstable in the previous few months as it’s down by over 6% within the final yr after operating up fairly shortly in 2022 following the advance of pure fuel costs. Nevertheless, I feel that DTM nonetheless showcases a way of being overvalued because the p/e is at over 14 on a FWD foundation, which means a premium of round 40% to the remainder of the sector. That type of premium is barely relevant in my view if the corporate is rising at a excessive double-digit charge, YoY. For DTM, I don’t assume that’s the case.

What ought to be stated although is that DTM has a really strong dividend yield at over 5% proper now. I feel that is value participating in and will probably be score the corporate a maintain on account of it. The payout ratio is excessive, however not unreasonably excessive, I feel. The long-term secular demand for pure fuel is sufficient to push up each the highest and backside strains of DTM, I feel, all through the following decade not less than.

Firm Segments

DTM is a outstanding supplier of complete pure fuel providers inside america. The corporate’s operations are divided into two key segments: Pipeline and Gathering. Inside these segments, DTM excels within the improvement, possession, and operation of an in depth portfolio of significant infrastructure. This infrastructure contains interstate and intrastate pipelines, storage methods, lateral pipelines, gathering methods, related remedy services, in addition to compression and floor services. DTM performs an important position in facilitating the environment friendly transportation and administration of pure fuel sources throughout the nation’s vitality panorama.

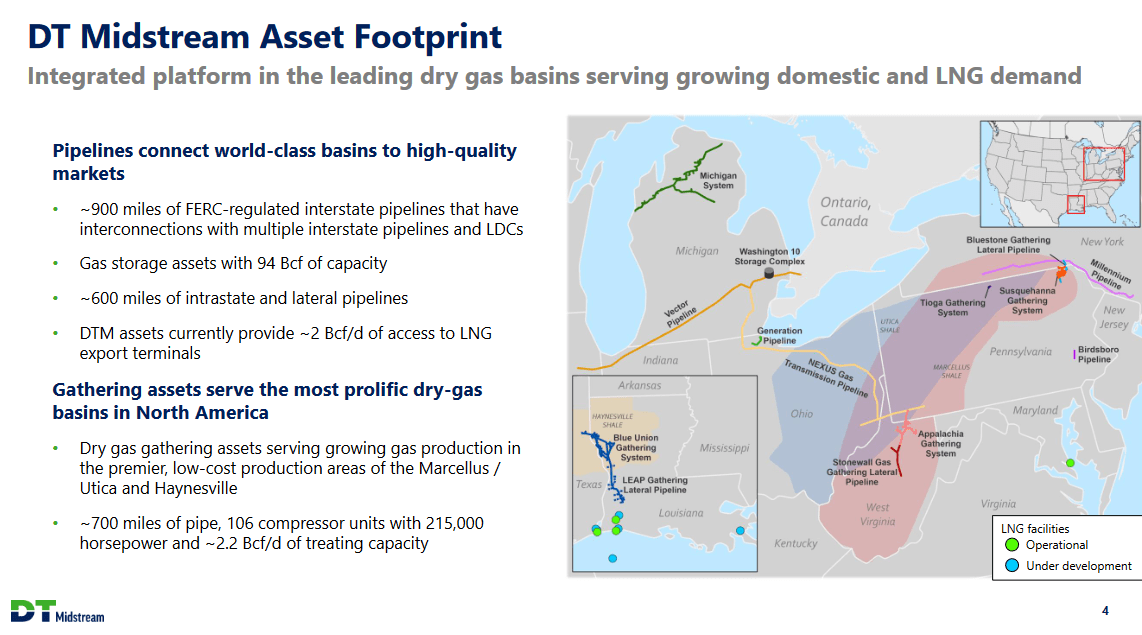

Asset Base (Investor Presentation)

The asset base for DTM spans a large space and has been a number one issue within the development of the enterprise. The pipelines maintain a top quality and interact in interesting markets. The corporate additionally has a powerful capability for fuel storage at 94 Bcf and 600 miles of intrastate and lateral pipelines proper now.

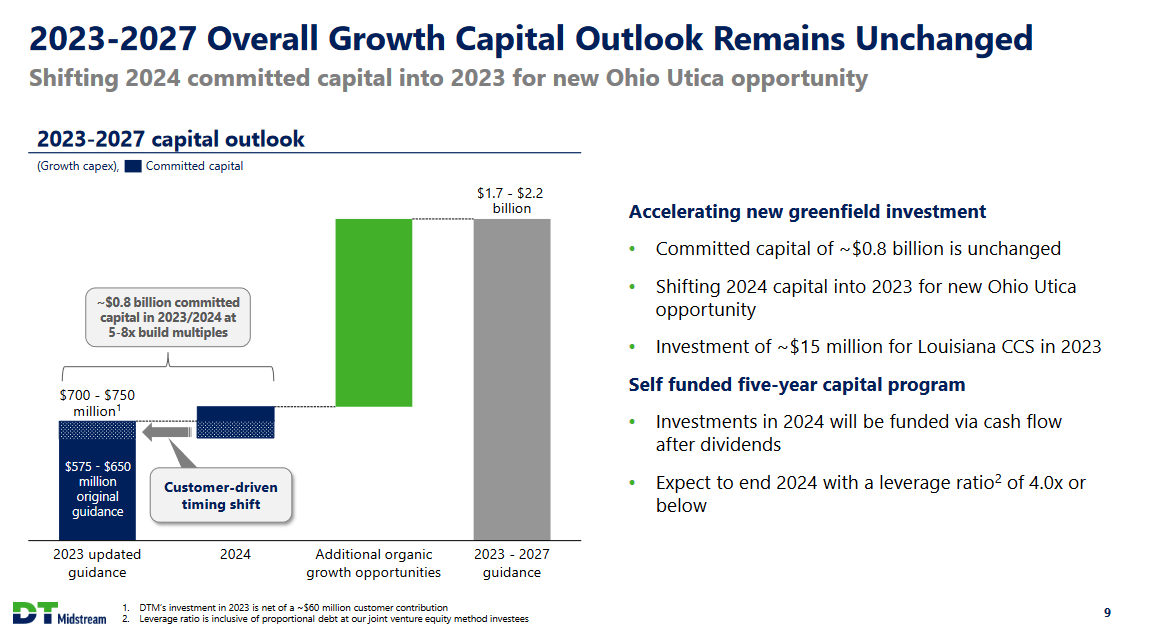

Progress Capital (Investor Presentation)

The corporate stays on monitor to ship a powerful quantity of development for traders as they reiterate their development capital outlook for the years 2023 – 2027. The brand new greenfield investments have dedicated capital ranges of $800 million and an extra $15 million is being invested in Louisiana CCS for 2023. The investments are being funded by free money flows which might be left after dividends have been paid out.

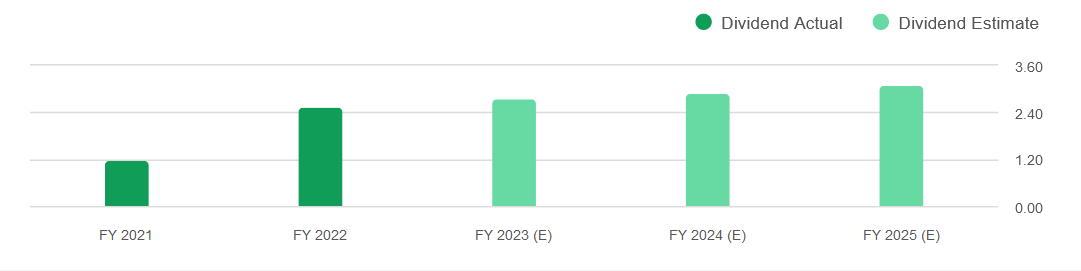

Dividend Estimates (In search of Alpha)

Estimates recommend that the dividends will proceed to enhance within the subsequent few years, and I feel the rise of pure fuel costs within the long-term goes to be a foremost driver behind this. DTM has made it clear they intend to drive a excessive shareholder return while additionally increasing shortly. I feel that the asset base that DTM has is an extra argument for this development. The Marcellus and Utica Basins are sometimes neglected in mainstream monetary discussions, it is value noting that these areas characterize two of probably the most considerable hydrocarbon basins in america, notably by way of pure fuel sources. What units DTM aside is its distinctive position as one of many choose midstream firms catering to producers working in these areas. This strategic positioning locations the corporate in an advantageous place to capitalize on any potential surges in demand for pure fuel. DTM’s skill to facilitate the transportation and distribution of pure fuel from these wealthy basins underscores its very important position in supporting the nation’s vitality panorama and its potential for development within the ever-evolving vitality sector.

Dangers

DTM’s operational efficiency and profitability are susceptible to shifts in regulatory legal guidelines and rules associated to the vitality sector. Adhering to security, environmental, and varied compliance necessities can current substantial challenges for the corporate. These regulatory adjustments might necessitate expensive changes to DTM operations and will affect its backside line. Moreover, evolving rules might have an effect on the corporate’s skill to pursue sure tasks or broaden into new markets, doubtlessly influencing its development prospects and profitability.

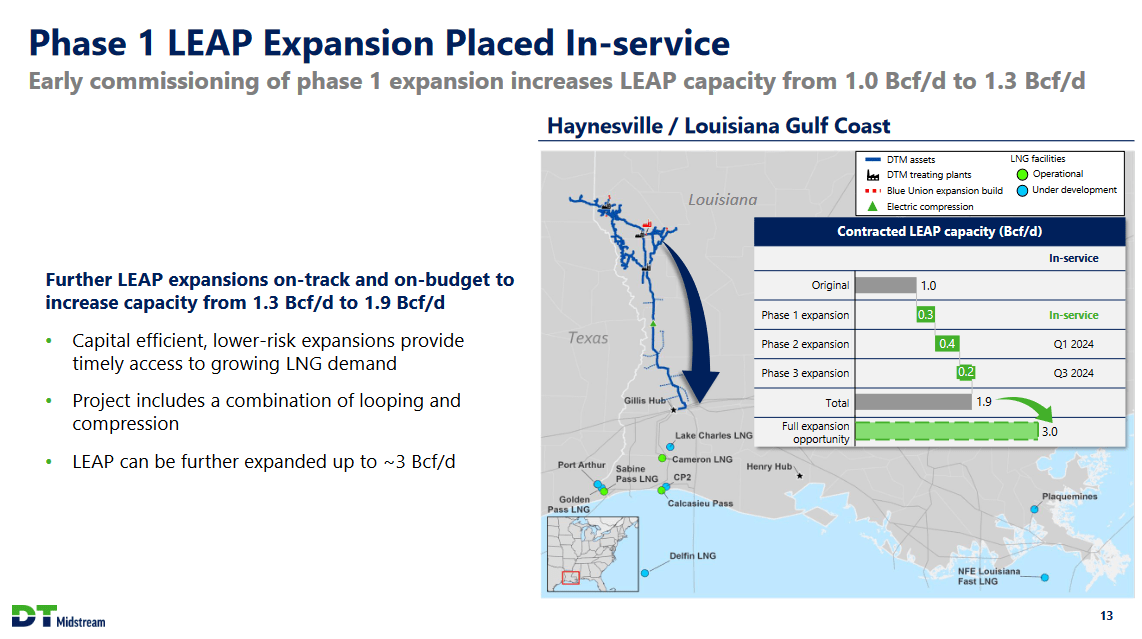

Expansions (Investor Presentation)

Operational dangers pose a big risk to DTM, together with potential manufacturing delays, reputational injury, and monetary losses. These dangers might manifest in varied varieties, together with tools breakdowns, provide shortages, or unexpected accidents. Any of those occasions might disrupt the corporate’s operations, resulting in expensive setbacks and negatively impacting its standing within the trade. Moreover that, nonetheless, the plain dangers of commodity costs fluctuating are actually outstanding and that may skew the earnings outcomes of the corporate considerably between quarters.

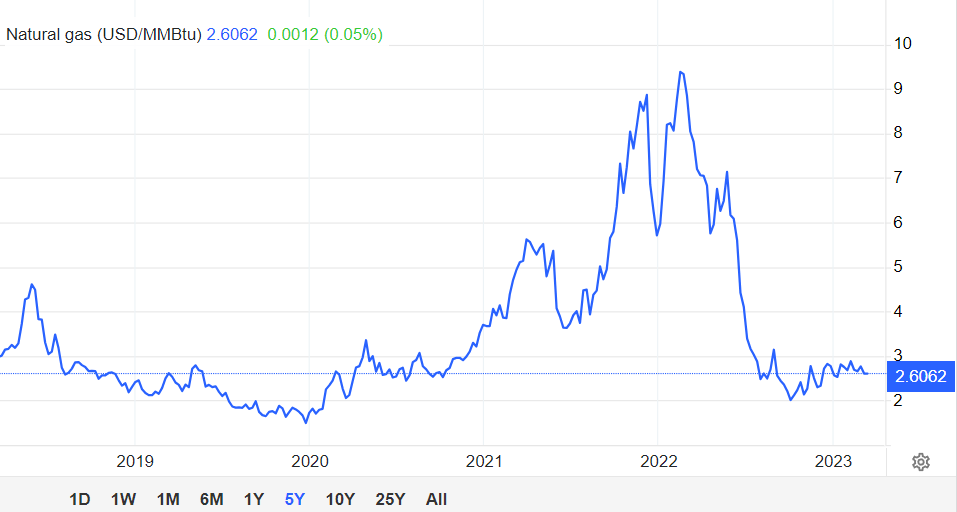

Pure Fuel (tradingeconomics)

Pure fuel costs have seen a decline since final yr and in contrast to oil, it does not seem to be it has been fairly capable of recuperate but, which is barely worrying in my view. If the costs stay suppressed, so will probably the earnings for DTM as effectively, sadly. However I feel that the long-term prospects and realization that we’d like pure fuel and a superb infrastructure for it to energy our societies is a megatrend benefiting the corporate very a lot proper now.

Financials

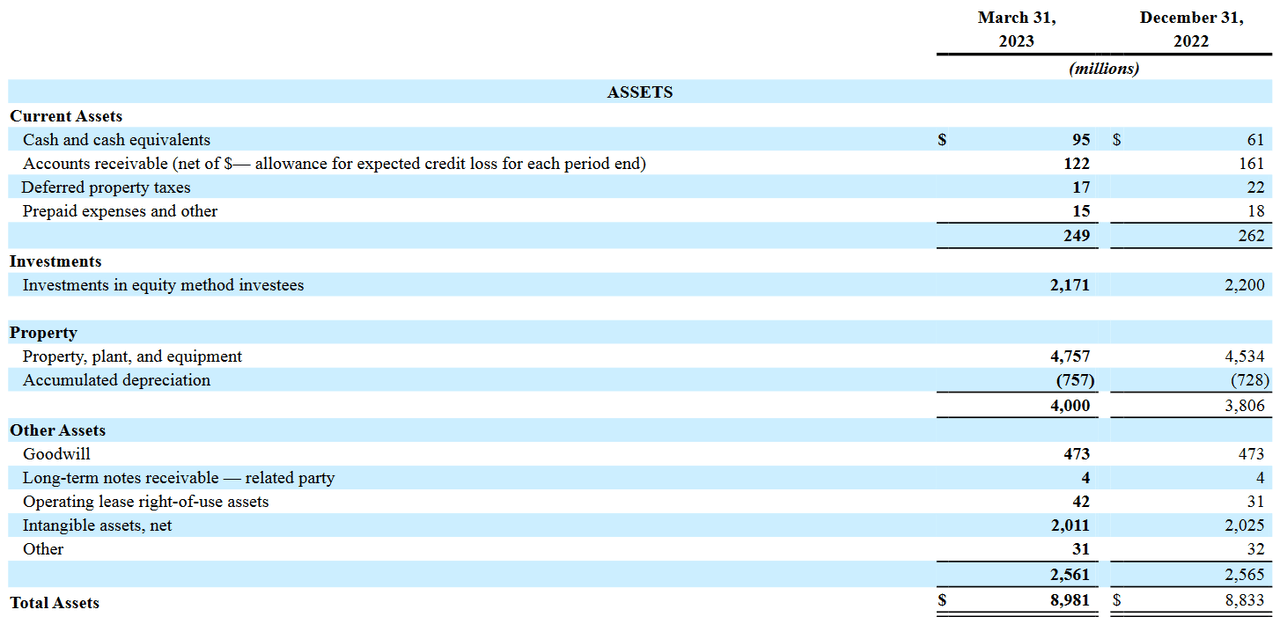

Property (Earnings Report)

On the asset aspect of issues for DTM the money equals $95 million proper now and compared to the over $3 billion of long-term debt that DTM holds it is a tough scenario to be in I feel. The curiosity bills for the enterprise have been climbing steadily because the debt place has grown, and the rates of interest are the identical. The TTM bills are $146 million, which I feel is barely worrying and does open up the opportunity of a lackluster dividend development charge to fulfill debt obligations as an alternative. However as we see on the steadiness sheet, DTM continues to be very constructive in direction of the market repeatedly because the funding into property has grown by over $200 million since December 31, 2022.

Last Phrases

DTM has a really strong dividend yield proper now at over 5% and with the hopeful rise in pure fuel spot costs the probability of elevating the dividend will increase. Based mostly on the earnings a number of, I feel that DTM continues to commerce at too excessive of a premium. I might be extra concerned about a p/e of round 9 – 10 as an alternative. Nevertheless, I understand the dividend is helpful to seize and will probably be score DTM a maintain because of this.