manyu ng/iStock through Getty Pictures

This can be a follow-up to final yr’s long-term purchase sign in gold, “Investor Exercise In GLD Suggests A Value Breakout.”

Identical to silver, gold has primarily gone nowhere for 3 years. On September 18th, 2020, SPDR® Gold Shares ETF (NYSEARCA:GLD) closed at $176.70. Three years later, it is at $180.48. That’s a acquire of simply 2%. Nevertheless, we imagine investor metrics counsel this stagnant interval for GLD is ending and a big worth advance lies forward.

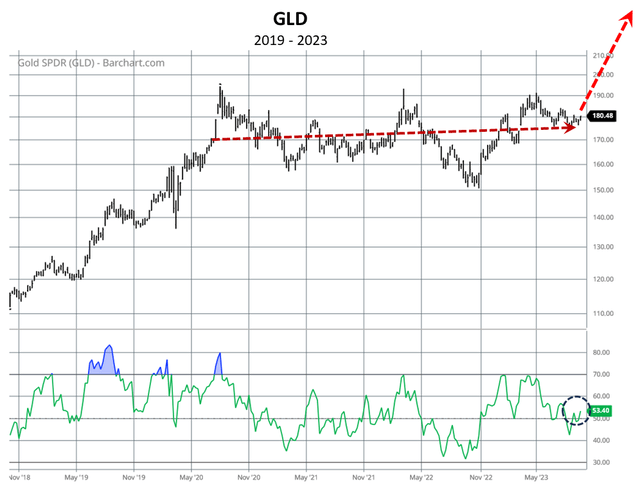

5 Yr Chart of GLD with Relative Power (The Sentiment King)

This can be a five-year chart of GLD. The horizontal, pink line highlights the three-year interval of little to no worth acquire. The upward slanted pink line to the correct graphically represents our forecast for GLD. We count on a rally of roughly 40%.

The inexperienced curve on the backside plots the relative power of GLD. It is at the moment mid-range, with a studying of 53.40 (black circle). We imagine the worth consolidation of the final three years presents a stable base for GLD to maneuver increased. The query is, “when?” The next indicators will display why we imagine the rally, which actually began final October, is able to resume.

Mixed Funding Exercise by Cash Managers and Producers Level Larger

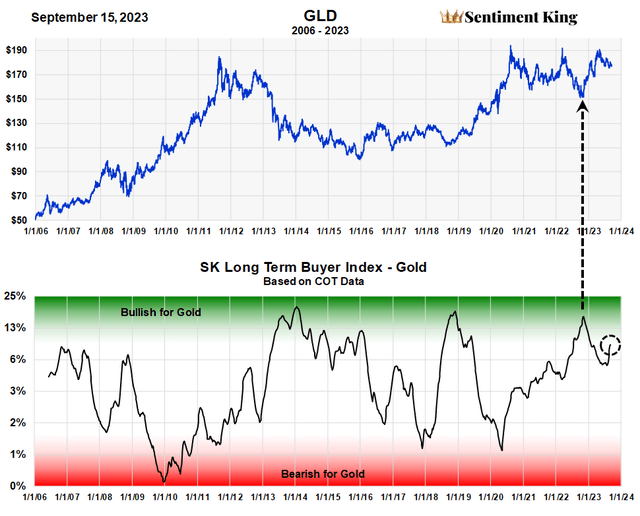

The chart beneath graphs the Sentiment King Lengthy Time period Shopping for Index for Gold. It is made by combining the COT funding positions of cash managers and gold producers. It’s typically constructive when cash managers are comparatively brief the market and gold producers lengthy, and this indicator displays when these two situations exist, and to what diploma.

The inexperienced zone represents when our calculations of their mixed funding positions are bullish for gold, whereas the pink zone is after they’re bearish. This indicator supplies long run purchase and promote indicators; it isn’t a brief time period indicator.

Lengthy Time period Chart of GLD and the SK Gold Shopping for Index (The Sentiment King)

The arrow on the correct factors to final yr’s October purchase sign. We have additionally circled the place the ratio is now. Whereas the ratio is not at an excessive, it has been rising over the previous few months and continues to be comparatively excessive after the eight-month rally.

To us, this implies final October’s long run purchase sign continues to be very a lot in impact and better costs lie forward. We imagine the next two indicators additionally help the view that GLD is able to transfer increased.

Put Possibility Purchases in GLD are Growing

The “places to calls” ratio was invented by Martin Zweig in 1971, and it has been utilized by market analysts as a opposite opinion indicator for over 50 years. It compares what number of put choices are being bought in comparison with name choices. Since put choices are bets that costs will decline, a excessive ratio is definitely constructive for costs. We have written in regards to the “places to calls” ratio for the inventory market in quite a few articles during the last twelve months.

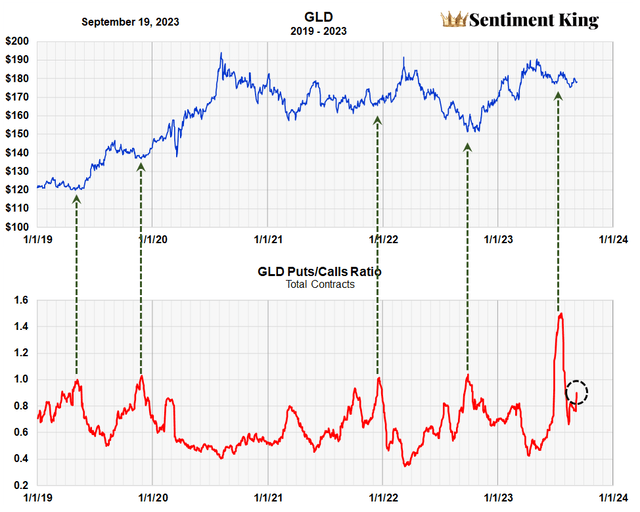

The traditional “places to calls” ratio divides put contracts bought by name contracts. The CBOE compiles these quantities each day for over 3,000 shares and ETFs. We then kind a twenty-day shifting common of the outcomes to achieve a long run perspective. That is what is graphed within the chart beneath.

Places to Calls Ratio of GLD (The Sentiment King)

It is easy to see that relative peaks within the ratio, which symbolize elevated put shopping for in comparison with name shopping for, often happen earlier than the worth of GLD will increase. We have indicated these previous peaks with black arrows. The second arrow on the correct factors to final October, which confirmed the robust purchase sign given by the earlier indicator.

The ratio hit 1.5 a month and a half in the past, which is the best ratio within the final 4 years. The present ratio is circled in black, and it is nonetheless at a really excessive quantity in comparison with previous peaks. To us, that is very bullish.

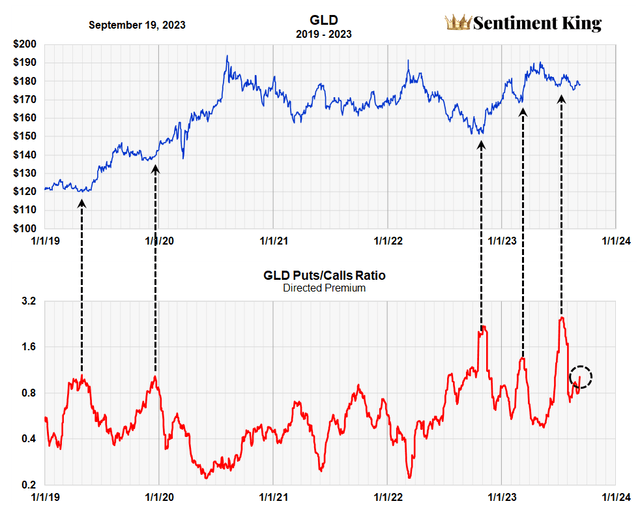

In addition to forming a ratio of the variety of put and name choice contracts bought, we have additionally discovered it useful to kind a ratio of the sum of money going into places in comparison with calls. Particularly, the sum of money going into directed calls versus direct places. This takes out of the equation put and name purchases which might be based mostly on hedging or earnings and never on the route of the market. This ratio of directed cash is proven within the subsequent chart.

The sum of money going into directed places in comparison with directed calls continues to be at a really excessive degree. These two indicators verify to us there’s nonetheless an excessive amount of bearish sentiment, which is all the time constructive for increased costs.

Places to Calls Ratio of Directed Premiums (The Sentiment King)

Abstract

The worth of gold has been stagnant for 3 years. Two metrics of investor expectations – the Dedication of Merchants to information for gold futures and excessive quantities of put shopping for in GLD – strongly counsel this buying and selling vary is ending, and that gold is able to get away in a serious transfer increased. In actual fact, we expect historical past will present that the beginning of the breakout was truly final October.

This might align gold with the robust purchase sign we simply gave on silver. We imagine a worth goal of $250 over the subsequent twelve months is well achievable, which might be a acquire of roughly 40%.