Funtap

REITs declined within the week ended Sep. 22 as price hike issues fueled a sell-off, significantly impacting sure subsectors.

The Fed held charges regular, however a bulk of officers nonetheless see yet one more rate of interest hike in 2023. The speed hike issues fueled a sell-off within the trade, with the newly launched VanEck Workplace and Industrial REIT ETF (NYSEARCA:DESK) tumbling 4.8% on its debut day on Thursday, Reuters stated in a report.

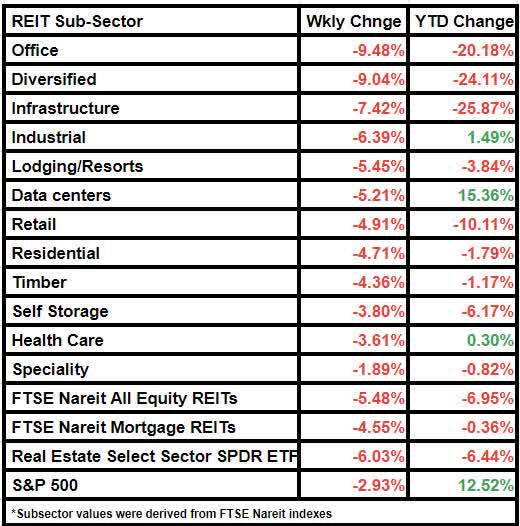

The workplace subsector noticed the largest decline, having decreased 9.48% from final week. Diversified REIT W.P. Carey (WPC) introduced that it plans to exit the workplace sector by promoting greater than half of its workplace properties and placing the others in a brand new firm to be spun off as a separate publicly traded REIT. The inventory declined by 9.65% in worth this week.

The diversified subsector was one other main laggard, having fallen by 9.04% on a weekly foundation. In the meantime, speciality and healthcare noticed the least decline amongst subsectors.

The federal government’s proposed minimal nursing house staffing requirements are anticipated to lift working prices and stress margins for nursing facilities. However they’re unlikely to decrease healthcare REITs’ scores, Fitch Rankings stated in a report.

Sabra Well being Care REIT (SBRA) was upgraded by Jefferies analyst Joe Dickstein on “vital upside embedded” within the firm’s senior housing working portfolio. Additionally, the analyst began protection of CareTrust (CTRE), which additionally invests in expert nursing and senior housing properties, with a Purchase ranking.

Notably, all of the subsectors dipped this week, dragging the FTSE Nareit All Fairness REITs index down by 5.48% and the Dow Jones Fairness All REIT Whole Return Index by 5.39%.

The FTSE NAREIT Mortgage REITs index was down by 4.55%, whereas the broader actual property index decreased by 6.03%.

Comparatively, the S&P 500 declined by 2.93% W/W.

Here’s a have a look at the subsector efficiency: