lcswart/iStock by way of Getty Photographs

Packaging and paper multinational Mondi (OTCPK:MONDF) had a troublesome first half, largely because of downward pricing stress within the world paper market (although that underlines that to a big extent it’s working in a commodity market). On the similar time, the underlying potential of the enterprise stays robust if not compelling.

I final coated Mondi in 2020 (Mondi: Positioned For Lengthy-Time period Development) with a “purchase” ranking, since when the full return has been -13%. I keep my “purchase” ranking. I keep my “purchase” ranking albeit I believe this can be a inventory to purchase and largely neglect about for coming years reasonably than a racy progress quantity.

Enterprise Surroundings is Difficult

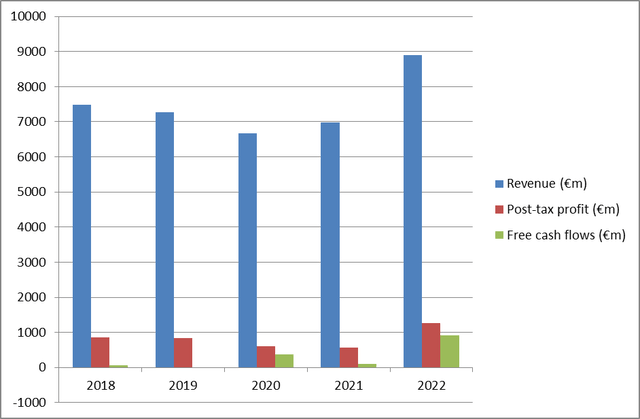

I’d say that Mondi turns in a decent although not excellent enterprise efficiency in a mature business. In recent times it has been persistently worthwhile, although free money flows have been variable and weaker than earnings.

Chart calculated and compiled by creator utilizing knowledge from firm annual studies

What I like about Mondi is that it’s well-positioned in an business that I anticipate to see excessive and rising demand, with comparatively excessive limitations to entry on the world degree. That should preserve revenues buoyant, in addition to offering some degree of safety to profitability.

I don’t see it as an thrilling share or one from which I’d anticipate dramatic returns. Relatively, I see it as doubtless being a reasonably stable performer over the lengthy haul.

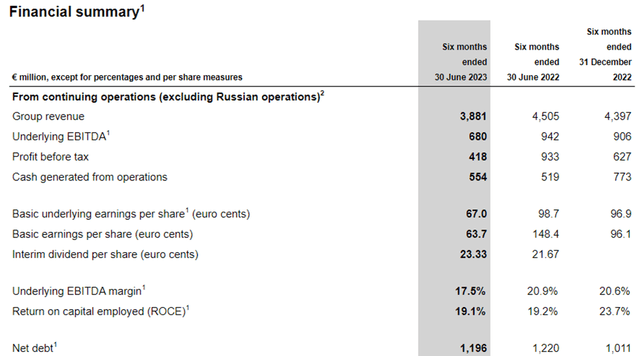

The corporate launched its interim outcomes final month. These had been underwhelming. Income fell, pre-tax revenue greater than halved, whereas primary earnings per share did a bit of worse but. A 7.6% improve within the interim dividend supplied some solace to shareholders.

Firm half-year report

Considerably disingenuously, the outcomes had been entitled “”Delivering in difficult markets. Investing for future progress.” The report emphasised what was seen as robust firm efficiency (as seen within the above chart, working money era grew by 7% year-on-year) in what was characterised as a difficult set of market situations. I observe, nevertheless, that pre-tax revenue at rival Smurfit Kappa (OTCPK:SMFTF) declined by solely 14% within the equal interval).

The primary half noticed the business experiencing a downtrend each in demand and pricing, exterior containerboard. Enter prices fell, however clearly that was inadequate to save lots of profitability ranges at Mondi.

The corporate had little to say about its full-year outlook. The paper market continues to face a troublesome surroundings and weak pricing. I anticipate that to point out via in Mondi’s second half outcomes and due to this fact throughout the 12 months as a complete. The downbeat observe struck by Mondi in its interim outcomes led to a 6% fall in its share worth on the day of their launch. They’ve since recovered from that (and extra) and are 4% down up to now this 12 months.

Within the quick time period I see the paper market pricing as unsettling. Nevertheless, it’s basically a cyclical market and I anticipate demand and provide to rebalance over time, bringing pricing up once more. In the meantime, even within the present depressed market, Mondi powered via and generated substantial money in its first half. Whereas the swings are massive (as is widespread in cyclical markets), in itself the primary half money era efficiency helps to underline the long-term funding case in my opinion.

Dividends have Room to Rise Additional

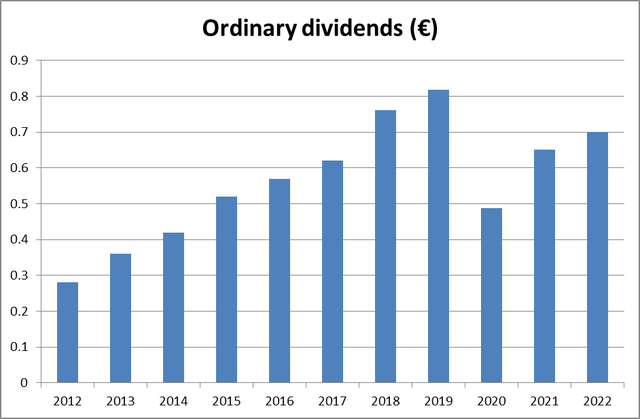

With a yield of 4.6%, Mondi is pretty engaging from a dividend perspective.

The dividend final 12 months was coated 2.8 instances by earnings.

The corporate generated €892m of free money flows even after paying €321m of dividends, which I regard as comfortably ample protection. Certainly that gives adequate flexibility for the corporate to proceed elevating its dividend even when monetary efficiency slips, as we noticed on the interim stage.

That stated, the previous few years have seen an inconsistent dividend degree (pushed partly by the corporate’s response to the pandemic). So, even after the 7% rise, the most recent interim dividend is simply 9% above the extent seen 5 years beforehand. That’s advantageous however not precisely the stuff of investor goals.

Chart compiled by creator utilizing knowledge from firm annual studies

Dangers

As the primary half demonstrated, pricing strikes within the wider market pose a major threat to income and notably to profitability at Mondi. The demand surge and fallback through the pandemic years proceed to work their manner via the system and I see this as an ongoing threat for some years to come back.

“Danger” is talked about 631 instances in the newest annual report (!) In actuality, although, I see this as a mature, secure and conservative enterprise with a threat profile to match.

Valuation

For the time being, Mondi has a market cap of £6.1bn. Its web debt at yearend stood at €1.0bn (sharply decrease than the prior 12 months’s €1.7bn). That means an enterprise worth of roughly £7bn.

It at present trades on a price-to-earnings ratio of simply 8, which makes it sound like a possible cut price. Because the above chart confirmed, although, earnings can transfer round a good bit and final 12 months’s efficiency was the most effective for years albeit this 12 months has begun (and appears set to finish) far much less lucratively. Nonetheless, even utilizing the far smaller 2021 quantity, the P/E ratio solely is available in at round 11, which appears affordable to me.

Rivals are even cheaper: Smurfit trades on a P/E ratio of seven, for instance. However I see that for instance of deep worth on this cyclical sector reasonably than of Mondi providing poor worth. I due to this fact keep my “purchase” ranking.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.