valtron84

Industrial actual property seems to have reached an inflection level and is poised to bounce up subsequent yr because the sector normalizes within the wake of the pandemic, based on a analysis observe from Financial institution of America Securities.

The sector boomed when customers, caught at dwelling throughout the pandemic, launched into on-line buying sprees, partly fueled by stimulus checks. That led to elevated demand for warehouses and success facilities to maintain up with the surge in enterprise. Then, as journey restrictions lifted, the demand for items slowed.

That softening in demand could also be bottoming out after BofA’s proprietary one-year industrial actual property main indicator declined on a month-over-month foundation for nearly two years, BofA analyst Camille Bonnel mentioned in a observe to purchasers. Whereas the analyst described the turning level, the observe did not disclose numerical values of the gauge.

“We view the latest enhancements as a constructive for Industrial demand beginning in late Spring ’24,” she mentioned.

The indicator has a robust historic correlation with GAAP same-store web working revenue progress for EastGroup Properties (NYSE:EGP), Prologis (NYSE:PLD), and Stag Industrial (NYSE:STAG), BofA’s Purchase-related industrial REITs.

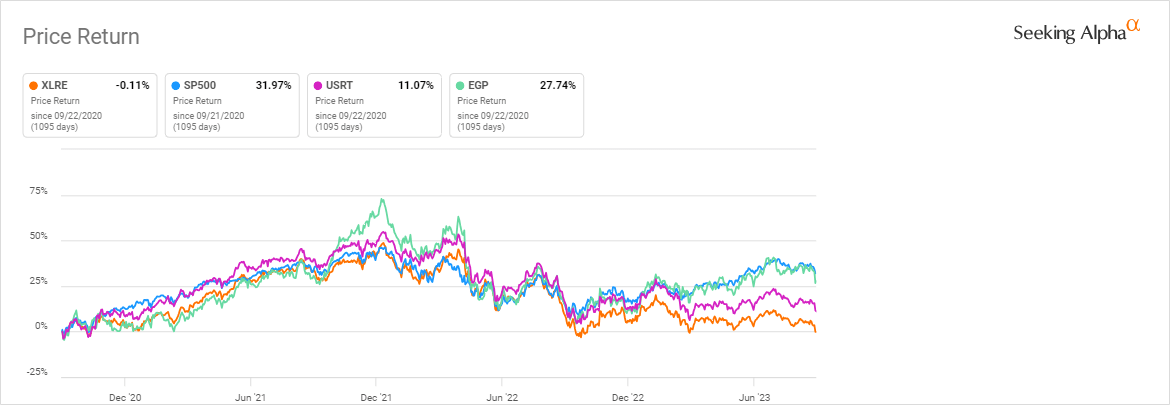

Observe that previously three years, the Actual Property Choose Sector SPDR ETF (XLRE) and iShares Clore U.S. REIT ETF (USRT) have didn’t sustain with the S&P 500. EastGroup (EGP) got here shut, rising 28% in contrast with the S&P’s 32% enhance.

The BofA IndRel indicator identifies 10 variables that present a 12-month main relationship with the demand cycles of business actual property. Inputs are throughout 4 major classes: consumption, commerce/provide chains, development, and jobs, with every key class weighted at 25% of the gauge.

The BofA analysts anticipated 2023 to “average from file ranges of unsustainable progress in 2021/2022.” YTD, market knowledge is monitoring forward of the indicator however is directionally according to their expectations of “moderating wholesome developments.”

Whereas BofA expects industrial actual property demand to choose up steam, market circumstances remained wholesome total. Prologis (PLD) forecasted that emptiness charges will keep under 5% and development deliveries (i.e., provide of latest industrial buildings) will decline by 35% in ’24, “each positives for landlord pricing,” Bonnel mentioned.

She additionally expects an acceleration in 2024 leasing spreads, as BofA’s Purchase-rated REITs have decrease in-place rents on expirations vs. H2 2023. In the meantime, Moody’s REIS actual property knowledge analytics service forecasts +6% market hire progress in 2024, for extra upside.

See the SA Quant system’s inventory picks for the actual property sector.