[ad_1]

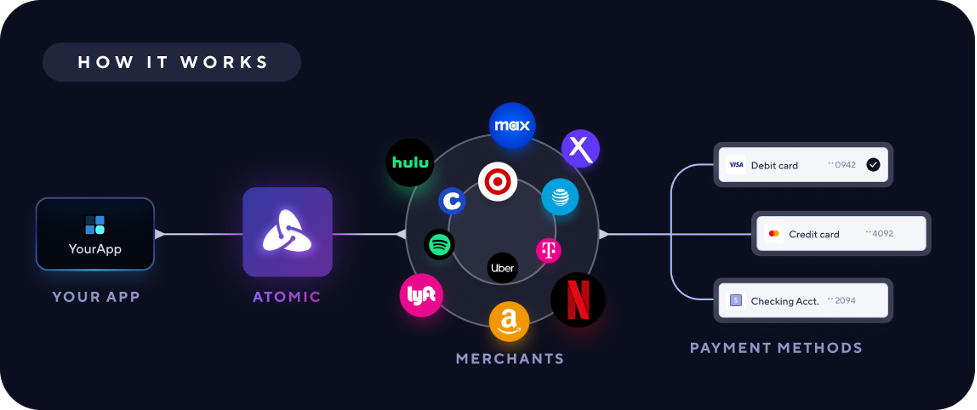

Atomic, a frontrunner in monetary connectivity options, right now introduced the launch of PayLink, a groundbreaking answer suite that streamlines cost switching, making it simpler for shoppers to change their main banking relationship. Along with offering a considerably improved shopper expertise, this answer brings Atomic nearer to offering a platform that may allow monetary establishments to align with the Client Monetary Safety Bureau’s (CFPB) renewed concentrate on fostering open banking in the US.

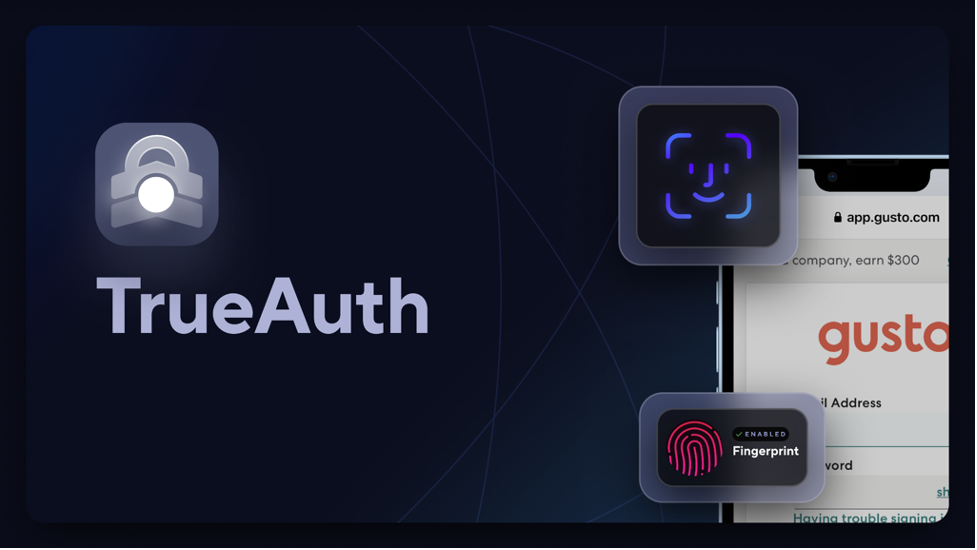

“Making it straightforward for individuals to maneuver their funds from one cost mechanism to a different is vital in bettering the broader shopper banking expertise,” mentioned Jordan Wright, Co-Founder & CEO of Atomic. “With the event and launch of PayLink, Atomic is including one other vital constructing block to the open banking ecosystem in the US, and with its new TrueAuth expertise – which doesn’t require Atomic to assemble shopper credentials – it’s revolutionizing the safety and authentication protocols for user-permissioned information entry.”

Aligning with CFPB’s Focus

In June, CFPB Director Rohit Chopra introduced the Bureau is “working to speed up the shift to open banking by a brand new private information rights rule meant to interrupt down these obstacles [consumers face], jumpstart competitors, and shield monetary privateness.” Atomic stands as a significant software in translating this imaginative and prescient right into a practical actuality by permitting shoppers to extra simply swap their banking relationship. When switching turns into simpler, competitors grows between monetary establishments resulting in extra advantageous options for the U.S. public.

Empowering Customers

Atomic believes that customers must be within the driver’s seat on the subject of their private information and advocates for a system the place shoppers determine when, how, and with whom their information is shared. This ethos is deeply embedded in its services, empowering shoppers to train their private information rights responsibly and securely.

PayLink shifts energy to shoppers by providing:

- Enhanced safety by way of TrueAuth: With TrueAuth, shoppers received’t have to fret about their credentials being shared with a 3rd social gathering, as a result of the patron authenticates with their service provider immediately.

- Seamless Switching: Customers can simply transition to new financial institution accounts in only one session, aligning with the CFPB’s imaginative and prescient for open banking.

- Multi-Cost Replace: A simplified mechanism to replace a number of subscriptions and recurring funds without delay, minimizing trouble.

- Cost Administration: PayLink helps shoppers confidently handle subscriptions and invoice funds from their new accounts.

Remodeling Monetary Establishments’ Operations

PayLink delivers a transformative affect on the monetary ecosystem with its array of options:

- Enhanced safety by way of TrueAuth: For many years now, monetary establishments have fought the programs that sought to accumulate and retain their prospects credentials. With TrueAuth that is now not a priority, since TrueAuth operates with out ever receiving buyer credentials.

- Unified Answer: Atomic can now function a one-stop answer for dealing with each direct deposits and cost switching, eliminating the necessity for a number of instruments.

- Accelerated Account Primacy: With streamlined account opening procedures, monetary establishments can extra shortly develop into the first alternative for shoppers’ banking wants.

- Income Era: Monetary establishments might expertise extra funds processed by debit and bank cards, leading to elevated interchange income.

- Person Retention: Leveraging superior expertise for an enhanced consumer expertise, PayLink serves as a catalyst for long-term buyer loyalty.

“PayLink arms individuals with the ability of alternative – whereas holding their private data safety a prime precedence,” mentioned Arjan Schütte, advocate for monetary inclusion and board member at Atomic. “Atomic is main the way in which in consumer-driven, open banking expertise that may enhance competitors and basically change the way in which we have interaction monetary establishments.”

The Energy of TrueAuth Know-how

Pushed by Atomic’s new, proprietary TrueAuth expertise, PayLink units a brand new commonplace in connectivity safety and user-centric options. With TrueAuth, customers can authenticate immediately on their gadget, that means they by no means must share their password with Atomic.

- Credential Safety: TrueAuth makes use of an OAuth-like authentication technique that retains consumer credentials confined to their gadget.

- Person-Centric Method: The expertise empowers customers by placing them accountable for their very own information, reinforcing belief and dedication to privateness.

- Seamless Expertise: TrueAuth’s native authentication assist for password managers helps guarantee a frictionless consumer expertise, driving conversion charges.

- Authentication Compatibility: TrueAuth helps numerous {hardware} authentication strategies like FaceID and TouchID, and can assist any on gadget authentication strategies – making it a future-proof answer.

Market Validation:

Atomic has validated the market demand for open banking options by intensive consultations with its prime purchasers, together with three of the highest 10 conventional monetary establishments within the U.S., in addition to 13 of the highest 20 fintech apps. This collaboration underscores the business’s urge for food for safe, streamlined options that drive market competitors and empower shopper alternative.

“PayLink is revolutionizing monetary establishments’ operations by providing a unified answer that accelerates account primacy by streamlining direct deposits and cost switching, making Atomic the best choice for shoppers’ banking wants,” mentioned Scott Weinert, Co-Founder and CTO. “On the identical time, we’re empowering shoppers with seamless switching, simplified cost updates, and safe transactions, aligning with the CFPB’s imaginative and prescient for open banking.”

[ad_2]

Source link