jetcityimage

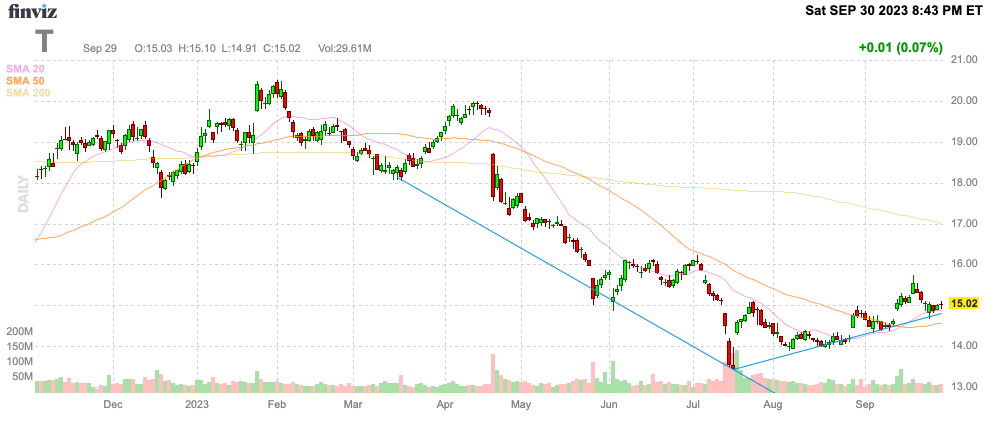

As highlighted just a few months again, AT&T (NYSE:T) was overwhelmed right down to the purpose the place the inventory was extra interesting. AT&T has now rallied off the late July lows as indicators counsel the rally will proceed. My funding thesis stays Bullish on the telecom inventory for a short-term rally into year-end, however traders should not flip this again right into a long-term funding due solely to the big dividend.

Supply: Finviz

Sensible Dividend Strikes

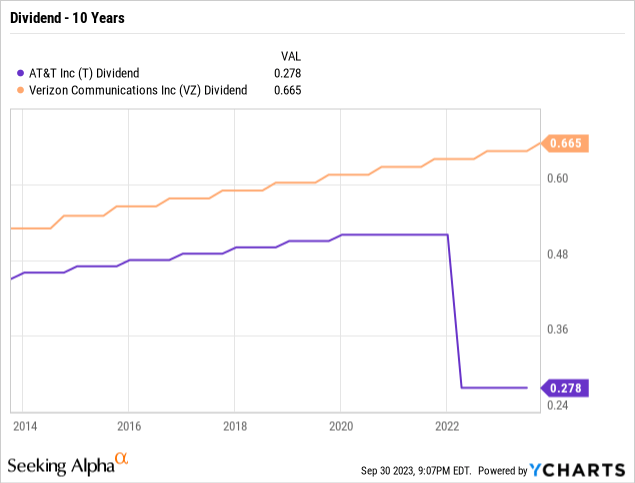

On Friday, September twenty ninth, AT&T introduced the following quarterly dividend of $0.2775 for a dividend yield of seven.4%. Shareholders of document on October 10 receives a commission the big dividend on November 1.

In fact, the dividend is simply over 7% because of the inventory value collapsing within the final decade. The excellent news is that AT&T is not blindly mountain climbing the dividend anymore, in contrast to wi-fi peer Verizon Communications (VZ).

AT&T has now introduced 7 straight quarterly dividend funds of $0.2775 per quarter following the dividend reduce in early 2022. The telecom large used to hike dividends initially of a brand new 12 months, however the firm seems to have lastly realized that mountain climbing the dividend payout makes completely no sense when the telecom large has an enormous debt load.

Verizon has taken the alternative strategy and the inventory hasn’t turned the nook. Our latest analysis highlighted how the BoD was making a mistake of accelerating quarterly dividend payouts boosting the annual payout by $200 million annually. The inventory trades at a decade low regardless of the fixed hikes yearly.

AT&T solely faces annual dividend payouts of $9.3 billion now whereas the free money movement targets for the 12 months are up at $16+ billion. The telecom large has far more money to repay debt after the dividends.

Beneath these monetary targets, AT&T has ~$6.7 billion to repay debt after paying annual dividends. A 2% annual dividend hike would’ve elevated the payouts ~$186 million for 2023 resulting in $372 million in extra dividend payouts for 2024. Instantly, the out there money movement after dividend payouts would shrink to unsustainable ranges.

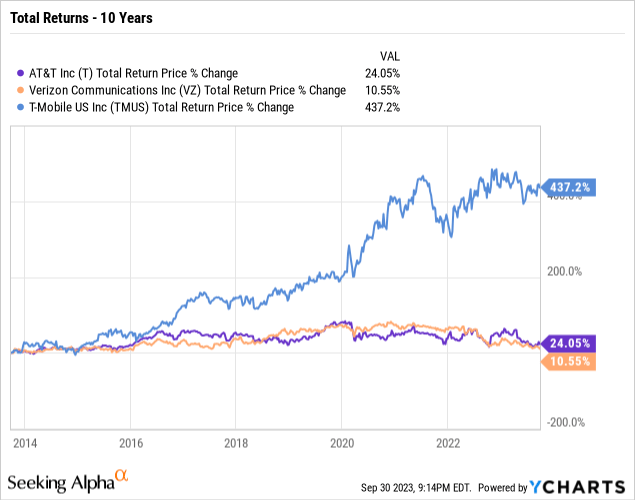

Prime Instance

As we have tried to tell dividend traders on this house over the past a number of years, dividends alone aren’t a motive to put money into a inventory. T-Cellular (TMUS) hasn’t supplied traders a dividend, but the inventory has a complete return of 437% within the final decade whereas each AT&T and Verizon have solely produced minimal 20% returns regardless of giant dividend payouts.

AT&T has well pulled away from specializing in dividend hikes for the sake of the corporate remaining a dividend aristocrat. On the Q2’23 earnings name, CEO John Stankey had this to say in regards to the dividend:

As Pascal will talk about, we have addressed quite a lot of one time and discrete gadgets and now count on to make use of an rising quantity of our free money flows after dividends to speed up our debt discount efforts.

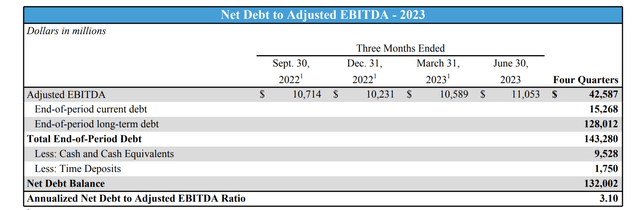

The telecom large ended June with a web debt of $132 billion. The corporate has made a number of non-recurring funds this 12 months and nonetheless has to pay one other $2 billion for spectrum earlier than debt repayments will begin. After that, AT&T will begin repaying debt and goal reaching a leverage ratio aim of two.5x EBITDA.

Supply: AT&T Q2’23 earnings launch

At present EBITDA ranges of $42.6 billion, AT&T would minimize the debt to $106.5 billion to hit the two.5x leverage ratio. Primarily based on the present debt ranges, the telecom firm hitting this ratio by 2025 would seem very aggressive.

Traders ought to notice {that a} aim of hitting a 2.5x web leverage ratio in over 2 years from now nonetheless leaves AT&T with over $105 billion in web debt. Traders ought to actually query why the corporate would wish to proceed carrying debt understanding the top-performing tech shares generate extreme returns partly to not turning into closely indebted.

AT&T is about to report Q3’23 outcomes on October 19. The consensus analyst estimates are for income to be principally flat at $30 billion with the EPS falling practically 9% to $0.62.

The most important concern is that monetary outcomes will not hit targets. One other situation, AT&T may find yourself dealing with main lawsuits and potential liabilities of the poisonous lead cable situation.

Takeaway

The important thing investor takeaway is that AT&T has turned the nook with the corporate now targeted on repaying debt versus mountain climbing the dividend. The telecom large nonetheless has to unravel points with the struggling enterprise, however the inventory presents much less threat when repaying debt to raised place the corporate for a wet day. In addition to, present traders nonetheless get a big dividend yield of seven.4%.

AT&T is not a inventory to personal for the long run until the enterprise magically returns to progress mode, however traders ought to acquire a pleasant rally to $20 whereas amassing the big dividend over the following 12 months. Traders simply should not change into married to the inventory or the dividend.