Scott Olson

Whereas shares of Toll Brothers (NYSE:TOL) have risen by greater than 60% over the previous yr after I rated TOL a purchase, they’re now down over 15% from their highs. With mortgage charges nearing 8%, concern about the sturdiness of the housing market has elevated. Right this moment, I reiterate the purchase advice as I view shares as low cost, TOL comparatively nicely positioned for present market circumstances, and because it has over the previous yr, as a result of I anticipate housing dynamics to outperform pessimistic expectations.

Looking for Alpha

Within the firm’s fiscal third quarter ending July 31, Toll reported genuinely improbable outcomes, laying to relaxation fears that slowing within the housing market thus far was weighing on profitability. Actually, EPS of $3.73 was up 59% from the $2.35 final yr. This was due to dwelling gross sales income rising 19%. There have been two parts of this improve as Toll delivered 2,534 properties, up nearly 5%. Moreover, the typical promoting costs elevated to $1.06 million from $934k.

Alongside sturdy topline outcomes, TOL benefited from bettering provide chains and normalizing commodity prices, which imply that adjusted gross margin expanded 140bp to 29.3%. Additional, its expense rationalization efforts confirmed success with SG&A spending as a share of income down 170bp to eight.6%. Greater promoting costs, extra deliveries, and doing so at wider margins is a recipe for substantial revenue progress, and that’s precisely what Toll delivered for buyers. One can take a look at these outcomes and marvel “what decelerate?”

I feel it is very important observe that the housing market did sluggish, in later 2022 and early 2023, as shoppers have been confronted with the shock of upper charges. As a consequence, Toll, like just about each builder noticed orders fall final yr. Due to that, its backlog has fallen from 10,725 to 7,295 whereas its worth of $7.9 billion is down $3.2 billion. Basically, as orders fell, TOL maintained an analogous tempo of deliveries, consuming into that backlog. Certainly, this backlog exists so as to assist present some insulation to operations from non permanent shifts in demand.

Administration mentioned that demand has improved “markedly” since earlier this yr as a result of many potential consumers final yr delay shopping for a house, however seeing that charges weren’t set to reverse course and dealing with life occasions (typically you may solely wait so lengthy earlier than shifting), they’ve come again into the market. This commentary is supported by the truth that signed contracts within the quarter have been 2,245, up from 1,266 final yr, a 77% improve, although the greenback worth rose a extra 30% as there was a mixture shift towards the lower-priced Mountain area the place orders greater than doubled to 632. Nonetheless, the typical backlog value gross sales value of $1.080 million is larger than the $1.05 million final yr.

Notably, on the earnings name, Toll mentioned site visitors in August was “good,” declining lower than half of the traditional seasonal decline from July whilst charges continued to rise. With orders recovering, backlog attrition ought to meaningfully sluggish, permitting Toll to keep up an analogous tempo of deliveries subsequent yr.

Toll has weathered the weak spot nicely, utilizing its backlog properly, and considerably rising earnings. Administration is guiding to $11.50-$12 in EPS this yr, with a $150 million buyback deliberate in This autumn. This means $3.20-$3.70 in This autumn earnings, just like Q3’s ranges, and indicating it continues to resist headwinds.

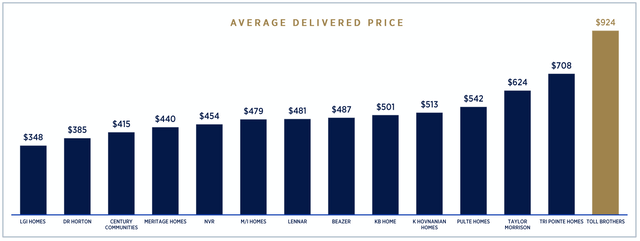

A significant motive for that is that it operates in a novel area of interest amongst giant, publicly traded homebuilders: the luxurious market. As famous above, its common gross sales value is over $1 million. As you may see beneath when in comparison with different builders on their 2022 delivered value, Toll is almost double friends. Not like a first-time homebuyer who could also be stretching to that final greenback to get right into a home, luxurious consumers are likely to have extra monetary flexibility. That is evidenced by that reality 25% of its consumers are money—if you find yourself a money purchaser, mortgage charges don’t matter a lot to your resolution. Of those that take a mortgage, the mortgage to worth is simply 68%, nicely beneath the usual 80% (i.e. placing 20% down).

Toll Brothers

Those that borrow, borrow much less to purchase a home from Toll, and a big share of consumers don’t borrow in any respect, as luxurious consumers are likely to have a wider pool of belongings from which to make a house buy. By working on the higher echelon of the housing market, Toll has insulated itself relative to friends from actions in rates of interest. I’m not saying Toll has no publicity—most of its consumers do take a mortgage, however it’s much less uncovered to charges than builders who serve lower cost factors. 10% mortgage charges can be good for no builders, however they’d be much less dangerous for Toll than an organization like KB House (KBH), which serves first-time consumers primarily.

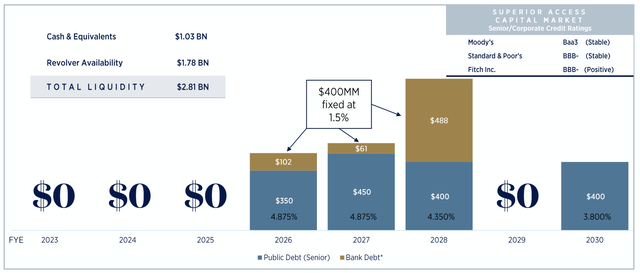

Past its area of interest, Toll has taken different actions to create a resilient enterprise. Right this moment, simply half of its tons are owned, down from 70% a decade in the past, lowering capital depth and offering extra flexibility. If the market turns down sharply, it could possibly select to to not train choices on the 50% of land it doesn’t personal, slightly than being saddled with costly land on the steadiness sheet. It is also carrying $1 billion of money, offering flexibility for buybacks or to make bolt-on purchases. It has steadily diminished debt, bringing debt to capital beneath 25%, and Toll doesn’t have a single maturity till 2026. It won’t must refinance any debt at immediately’s larger curiosity for a while, and it has ample money to pay down debt at maturity ought to it select slightly than roll it over.

Toll Brothers

Because of this sturdy monetary place, Toll has executed on $240 million in share repurchase this yr, together with $147 million final quarter and with one other ~$150 million anticipated in This autumn. Since 2016, TOL has purchased again 78 million shares at a mean value beneath $42. That has diminished its share depend by 37%. Ongoing share depend discount will assist to insulate EPS declines, even when internet earnings have been to fall.

Over the subsequent 12 months, I anticipate Toll to generate at the least $11.50 in earnings—it could possibly achieve this, by having deliveries down low-single digits over the subsequent 12 months from H2 2023 ranges, margins compress about 50bp, and have a mean gross sales value in-line with the present backlog of $1.08 million. With share depend more likely to decline by 5%, assuming an analogous gross sales tempo of repurchases, earnings might find yourself nearer to $12.

That leaves shares round 6-6.3x earnings, a really low cost a number of, suggesting markets worry that whilst its backlog helps earnings over the subsequent 12 months, earnings must fall meaningfully in some unspecified time in the future. With charges rising as a lot as they’ve, I perceive the impulse to suppose housing might want to fall considerably. Many felt this may occur when mortgage charges went from 3% to six% final yr, nevertheless it didn’t. Now in fact, there may be some degree that of charges that may “break” the housing market, and we might not understand it till we hit it. Nonetheless, the rationale I imagine housing can maintain round present ranges is that we’ve too little provide, and provide shortages preserve costs resilient.

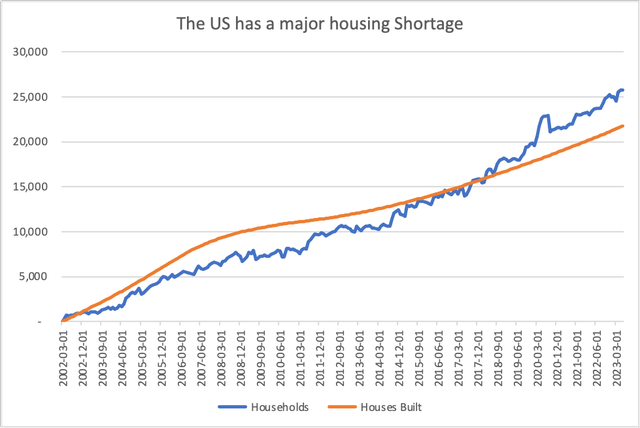

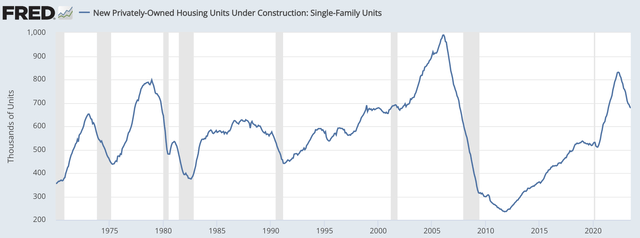

The US constructed so little housing after the monetary disaster that previously twenty years, we’ve created 4 million extra households than new housing models. This shortage of recent provide has minimized how far housing costs can fall, and why it usually appears each gross sales has a number of consumers. Even when larger charges scale back demand from some consumers, the pure demand degree is considerably above provide that the market holds in comparatively nicely.

Census Bureau, my very own calculations

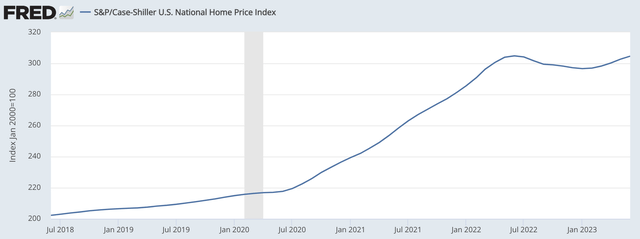

Certainly, we’ve seen that as dwelling costs have resumed their improve in latest months after falling modestly final yr when charges first shot up. They continue to be close to all-time excessive ranges.

St. Louis Federal Reserve

Perversely, the Fed’s price mountain climbing quest to scale back demand has additionally served to scale back provide, negating among the demand loss to maintain costs sturdy. This has occurred by means of two channels. First, builders have stepped again. Scarred from 2008 and afraid of over-building, the assemble surge of 2021-2022 has reversed as builders needed to make sure final’s yr’s softening of demand was not everlasting. There’ll now be meaningfully fewer new properties hitting the market than final yr. You may also see beneath simply how a lot building fell within the 2010s, driving the under-supplied market circumstances we’ve immediately.

St. Louis Federal Reserve

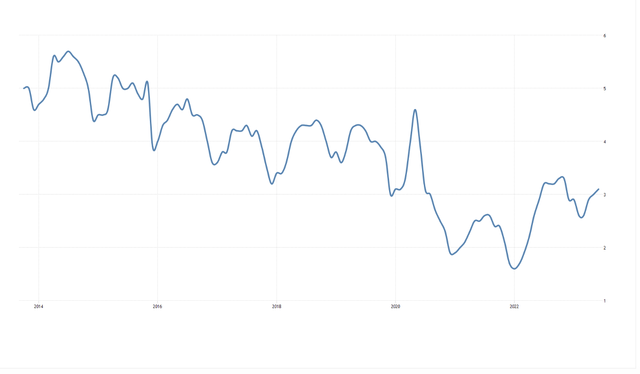

On high of this, the rise in charges has made it very costly for somebody presently in a home with a 3-4% mortgage to maneuver, because the rise in rates of interest over the previous two years has brought about the month-to-month cost on a $300k mortgage to rise about $800. Until you completely have to maneuver, you’re doubtless staying put with that low mortgage price appearing like a golden handcuff to your present property. As such, the availability of present properties stays very low by historic requirements even after its latest rise.

Buying and selling Economics

So whilst demand has fallen, provide has too, negating a few of this. The web drop in demand has not been sufficient to cease the housing market from functioning, given the structural scarcity. And with much less building occurring, that structural scarcity is more likely to persist even longer. These should not gratifying circumstances for homebuyers, however they’re favorable for homebuilders. It’s all the time good to promote into an under-supplied market. Layer on high of that the truth that Toll’s higher-end consumers are much less price delicate, and it’s comprehensible why the enterprise has held up so nicely.

Now, if we go right into a recession or charges go up one other 100bp, we may even see demand considerably weaken to trigger challenges, however at 6x ahead earnings, buyers are being nicely compensated for this threat, notably contemplating Toll’s stellar steadiness sheet and regular share repurchases. I think housing fears will persist, however as Toll continues to generate sturdy outcomes, the a number of can modestly increase to about 8.5-9x or $100 per share. That leaves about 40% upside from right here, which is why the inventory remains to be a purchase. Use the latest weak spot as a possibility to construct positions.