AlexSecret

Thesis abstract

Mega-caps shares have been liable for many of the market appreciation, however that does not truly imply they’re costly. If we have a look at PEG particularly, they’re fairly low cost.

Given what’s to return, there is a legitimate cause why mega-caps ought to commerce at a premium.

Out of the Magnificent seven, Alphabet (NASDAQ:GOOGL) stands out, in my view, as providing one of the best worth and probably the most promising outlook.

Mega-caps are comparatively low cost

This 12 months, we’ve got witnessed the beginning of the Magnificent 7, an extension of the unique FAANG membership.

The magnificent 7 embrace Alphabet, Microsoft (MSFT), NVIDIA Company (NVDA), Apple, Inc (AAPL), Amazon.com (AMZN), Tesla (TSLA), and Meta Platforms (META)

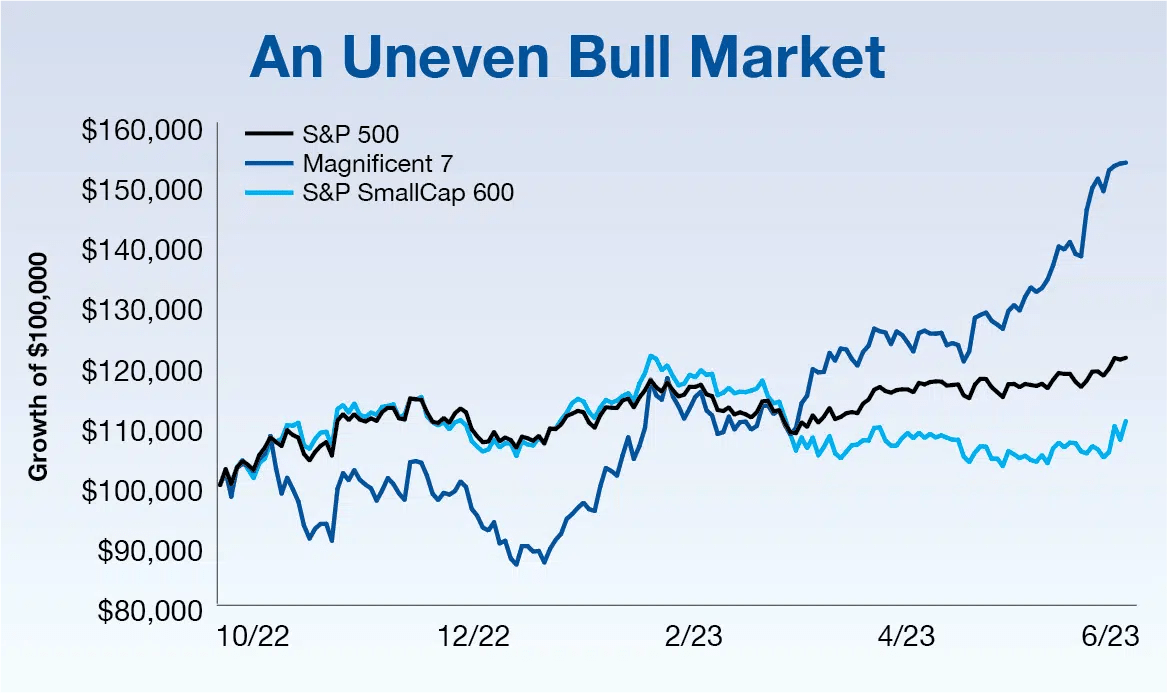

Mega-caps vs S&P (Adviser investments)

It is simple to see on this chart that the mega-cap shares have significantly outperformed the broader market. In truth, small-cap shares within the Russell 2000 (IWM) are actually just about flat during the last 12 months, whereas META is up over 100% in the identical time interval.

However simply because the shares have rallied doesn’t suggest they’re overvalued. In truth, they is perhaps traditionally undervalued after the final sell-off.

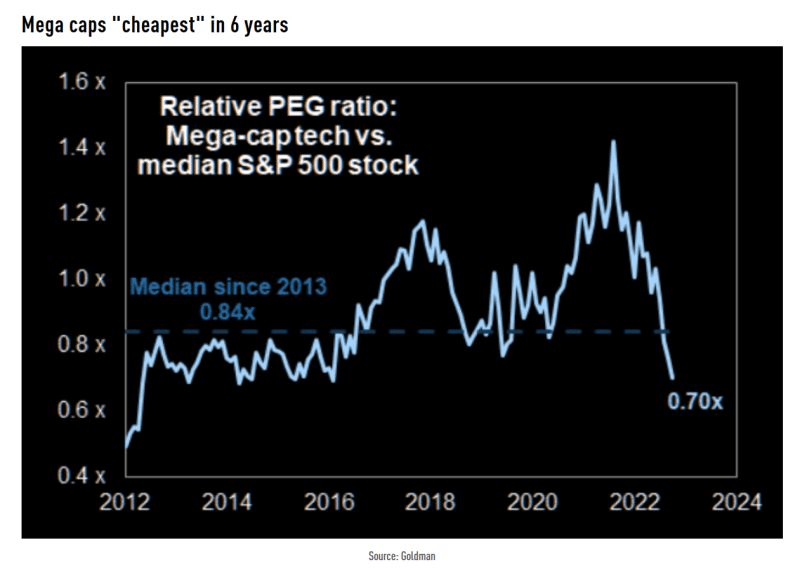

PEG mega-caps vs S&P (Goldman)

Measuring the PEG of the Mega Cap tech shares vs the S&P 500. The magnificent 7 even have a mean PEG of 1.3, in comparison with a mean PEG for the broader market of 1.9. That is the steepest “low cost” since 2013 and is presently under the median during the last ten years.

Magnificent 7; royal rumble

From what I can see, the PEG ratio utilized by Goldman Sachs (GS) is the Non-GAAP FW PEG.

Now, if we settle for that the magnificent 7 are value shopping for, which is one of the best within the pack?

|

GOOGL |

META |

TSLA |

AMZN |

AAPL |

NVDA |

MSFT |

|

|

PEG Non-GAAP (FWD) |

1,39 |

1,03 |

3,24 |

1,54 |

2,74 |

1,23 |

2,28 |

|

EV/EBITDA (FWD) |

13,42 |

11,24 |

46,67 |

14,31 |

21,19 |

38,70 |

19,96 |

|

Worth/Money Stream (TTM) |

17,23 |

14,17 |

59,40 |

21,19 |

24,01 |

91,42 |

27,06 |

|

Income 5 12 months (CAGR) |

18,50% |

19,97% |

47,03% |

20,92% |

8,51% |

22,44% |

13,94% |

|

EPS Diluted 3 12 months (CAGR) |

27,57% |

1,45% |

200,38% |

-0,96% |

21,81% |

44,84% |

18,89% |

Supply: Searching for Alpha

The desk above compares all the magnificent 7 on numerous metrics.

Primarily based on the PEG, META stands out as probably the most enticing, adopted intently by NVDA and GOOGL.

META as soon as once more wins on EV/EBITDA, with GOOGL coming in at an in depth second. These two corporations as soon as once more excel when it comes to Worth/money stream, and we will see fairly a marked distinction. Whereas META and GOOGL commerce at 14x and 17x money stream the subsequent finest inventory is AMZN at 21.

By way of income, TSLA and NVDA are in a league of their very own. The fast development during the last 5 years has additionally translated into very excessive EPS development. Tesla grew EPS by 200%, NVDA by 44.8%, and in third place, GOOGL.

Every investor has his personal set of preferences, however in case you ask me, GOOGL is the mega-cap tech inventory that gives one of the best stability of development, valuation and might be one of the best set-up for what comes subsequent.

GOOGL is properly arrange for what comes subsequent

Greater charges have been driving down the market. It looks like greater for longer might truly be quite a bit longer, so how ought to traders put together for this new atmosphere?

If credit score goes to be tight, and this may increasingly presumably result in a recession, then a powerful stability sheet is a should.

Look no additional than GOOGL.

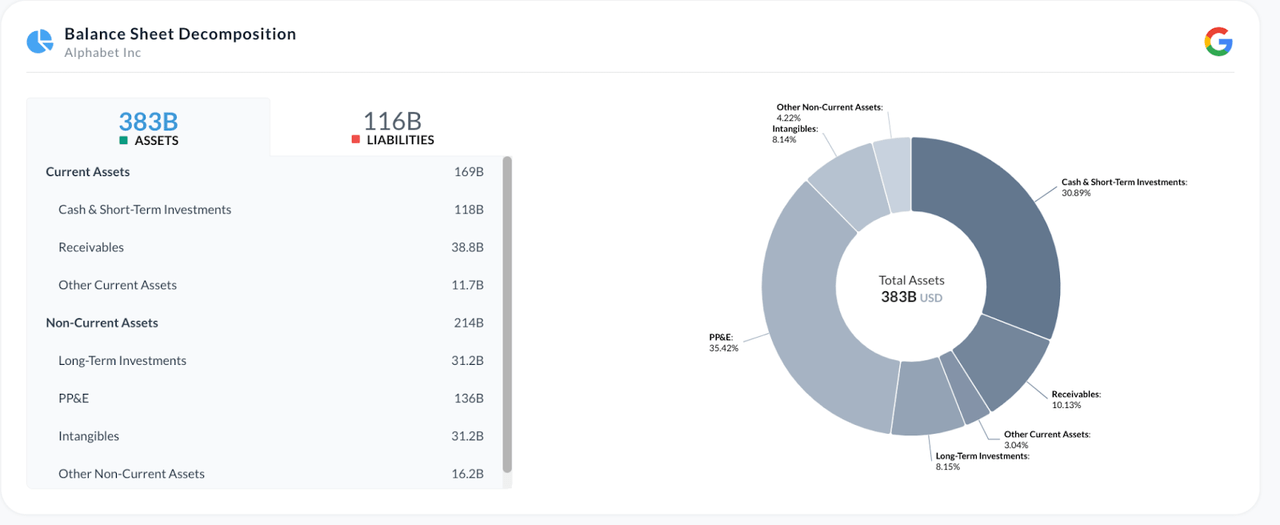

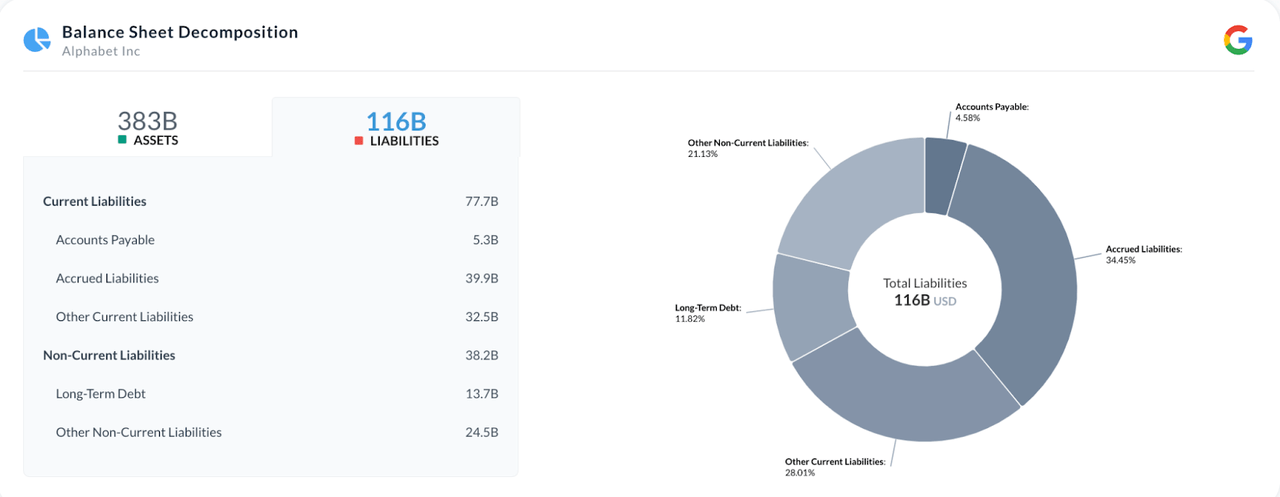

Google property (Alpha unfold) Google liabilities (Alpha unfold)

With $383 billion in property and solely $116 in liabilities, GOOGL has a fortress stability sheet. The corporate additionally boasts $118 billion in money and short-term investments.

These will are available in very helpful within the coming years. 1 month T-bills are paying 5.56% proper now. This implies GOOGL may very well be including over $6.5 billion yearly simply from holding T-bills.

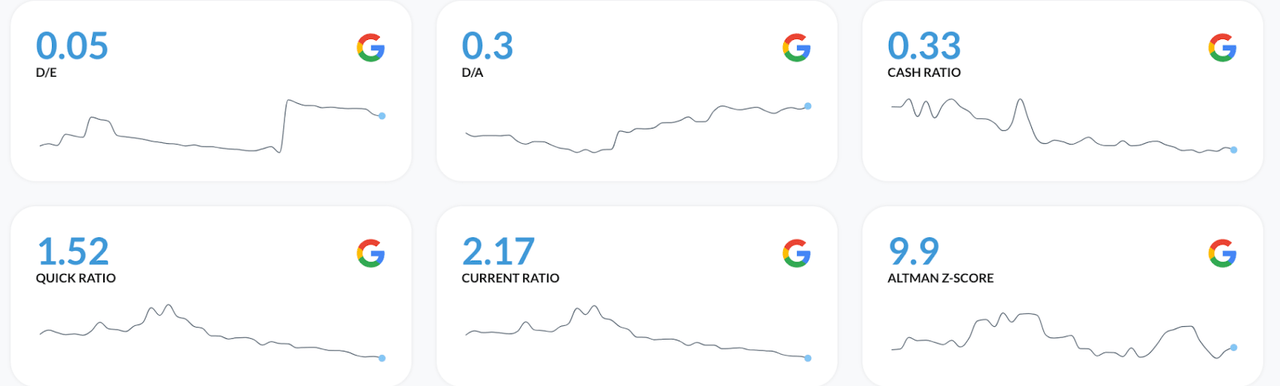

Solvency ratios (Alpha unfold)

GOOGL is extremely robust in all solvency measures, and in reality, it’s the strongest of the magnificent 7.

|

GOOGL |

META |

TSLA |

AMZN |

AAPL |

NVDA |

MSFT |

|

|

Debt/Free Money Stream |

1,70 |

3,59 |

12,68 |

14,62 |

3,03 |

2,22 |

4,35 |

|

Lengthy Time period Debt/Whole Capital |

8,92% |

20,70% |

6,56% |

42,44% |

57,84% |

24,70% |

24,71% |

|

Present Ratio |

2,17 |

2,32 |

1,59 |

0,95 |

0,98 |

2,79 |

1,77 |

|

Fast Ratio |

2,02 |

2,20 |

0,97 |

0,67 |

0,81 |

2,23 |

1,54 |

Supply: Searching for Alpha

GOOGL has one of the best debt/FCF and LT debt to Capital. It’s overwhelmed by META and NVDA on present and fast ratio, however this isn’t as necessary.

The opposite wonderful thing about GOOGL is its income diversification.

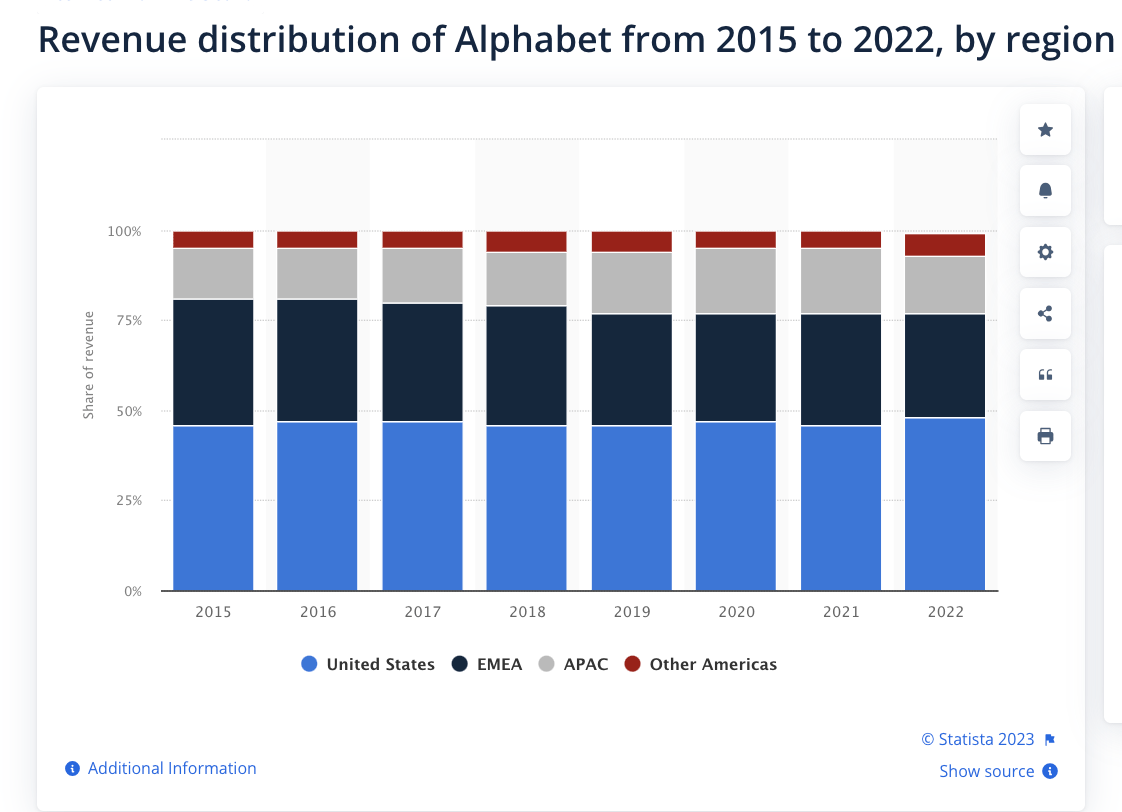

Alphabet income distribution (Statista)

Although half the revenues nonetheless come from the US, it has a powerful presence in Europe, The Center East and Africa, and in addition in ASIA.

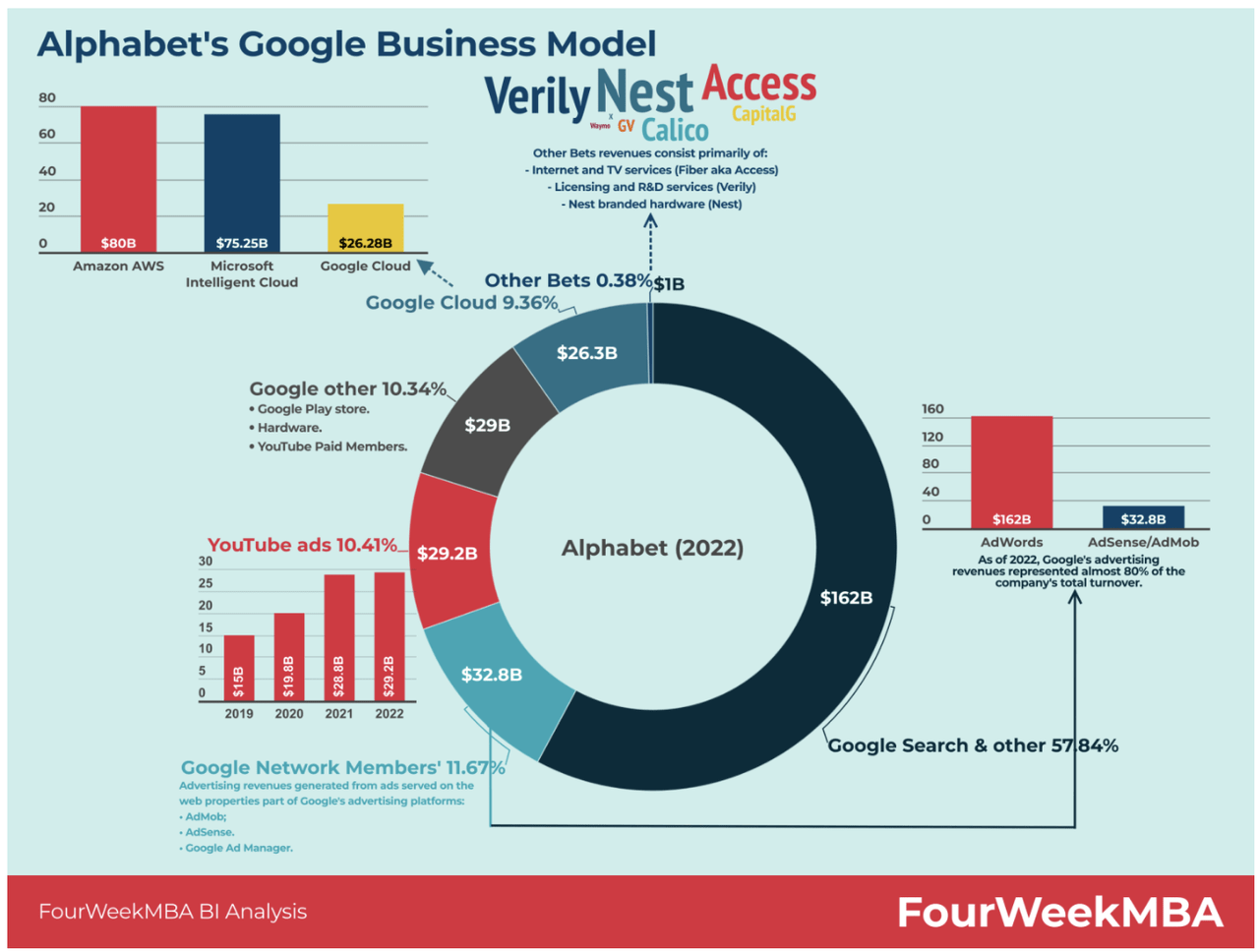

The income diversification does not solely apply to geographies but in addition to its segments:

Alphabet income by section (FourweekMBA)

Whereas a little bit over half of revenues nonetheless comes from advertisements, there are loads of different sources of income, together with Google Cloud, YouTube, and Google Different.

Google is much more than simply an advert firm. It has a world footprint and basically a monopoly on the web. 93% of all net site visitors passes by way of Google. This firm just isn’t going wherever.

Dangers

The one actual danger with Google does not come from the market however from regulators. Google is simply too massive for a lot of international locations’ liking, making it a goal in numerous lawsuits. Simply final month, UK shoppers launched a multi-billion pound lawsuit towards the corporate.

However the truth that GOOGL can simply shrug these off is a testomony to simply how highly effective this firm is.

Remaining Ideas

I feel there is a good cause why the magnificent 7 have rallied whereas different shares haven’t. For higher and for worse, the massive are getting larger, and there’s no larger than GOOGL. This can be a must-own inventory, in my view, and it makes for an excellent recession play due to its robust stability sheet and income resilience. GOOGL is maybe the best conviction inventory in my Finish Of The World Portfolio.