[ad_1]

Thousands and thousands of People have scholar mortgage funds beginning to come due this week, after a three-year pause throughout the pandemic and the Biden administration’s try and forgive the vast majority of scholar debt. In response—and in an effort to draw and retain staff—extra employers are offering scholar mortgage reimbursement assist, a brand new research exhibits.

A few third of employers (34%) at the moment provide some type of scholar mortgage reimbursement assist, in keeping with the research launched this week by the Worker Profit Analysis Institute (EBRI). That’s up from 1 / 4 of employers final yr and 17% in 2021. EBRI surveyed 252 U.S. corporations with 500 or extra staff.

Skilled Craig Copeland of EBRI believes extra employers needs to be providing this profit to staff in an effort to preserve their workforce secure amid rising inflation, the specter of a recession and continued labor challenges. Actually, earlier this yr, he forecast that nearer to 40% of employers would offer some assist over the following couple of years after the Supreme Courtroom nixed Biden’s aid program. However rising recession issues have held down the quantity, he says.

How employers assist faculty debt holders

These organizations which can be providing scholar mortgage help, which ranges from debt counseling and consolidation to direct money subsidies, achieve a recruiting and retention benefit, specialists say, significantly because the tight labor market persists. Seasonally adjusted weekly unemployment figures dropped to a brand new eight-month low final month, for instance, maintaining the strain on employers to carry onto their staff.

Quite a lot of choices can be found to assist the monetary crunch their staff face with the restart of scholar mortgage funds, says Copeland, director of wealth advantages analysis for EBRI.

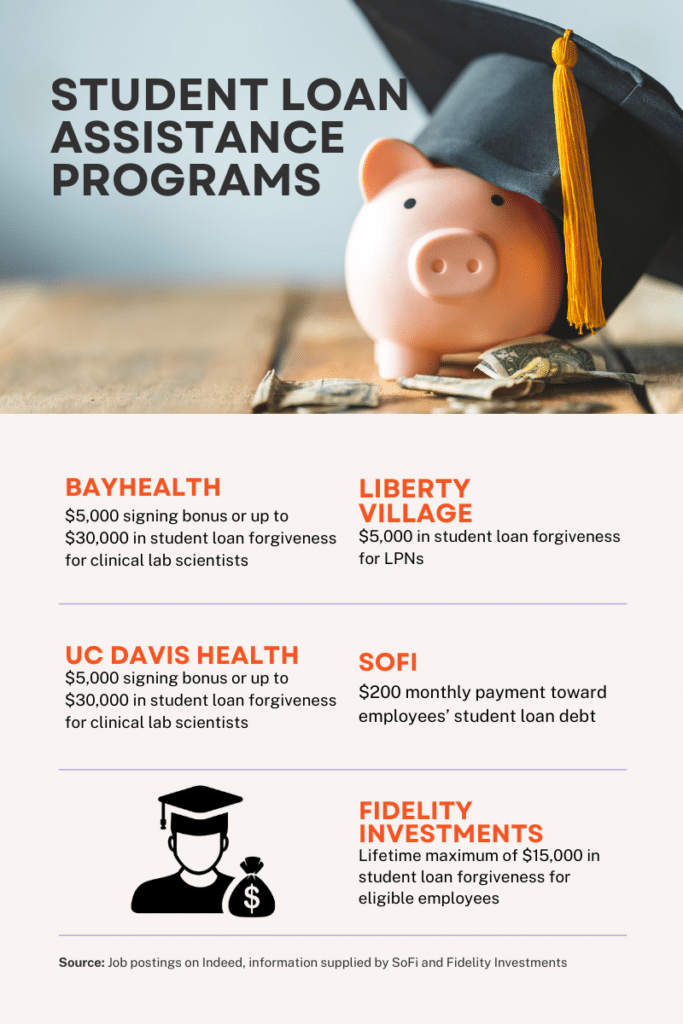

These embrace working with lenders to refinance scholar loans at a decrease rate of interest by bringing a bunch of worker debtors to the lender and, like UC Davis Well being in California, providing debt counseling or utility help for federal scholar mortgage forgiveness packages obtainable to some authorities and nonprofit staff.

“Nonprofits, most definitely, aren’t capable of give massive direct funds due to their restricted assets, so that is a technique they will actually assist their staff and garner extra loyalty,” Copeland says.

And a few employers are providing direct assist for funds. Bayhealth in Delaware, for instance, gives new hires the selection of a signing bonus or a a lot bigger scholar mortgage reimbursement. In response to a latest job posting, scientific lab scientists can select between a $5,000 signing bonus or as much as $30,000 in scholar mortgage forgiveness.

Such direct scholar mortgage funds, which often have a lifetime cap on the quantity, are additionally unusual, with simply 10% of staff providing them in 2023, in keeping with the EBRI research.

Given their excessive price and threat of stoking resentment amongst staff with out important scholar debt, such funds could be more difficult for employers, Copeland says.

“I’m more and more listening to that direct subsidies are somewhat costly and are very political,” he says. “Any recession or pullback within the financial system is prone to preserve this quantity decrease.”

Resentment dangers, nevertheless, usually could be managed with various choices, he says. These may embrace funds for youngsters’s faculty funds or different voluntary advantages supplied by the employer.

An unsure future for scholar mortgage advantages

Though employers are transferring slower than anticipated in offering scholar mortgage reimbursement aid, that might change rapidly.

Subsequent yr, below the Safe Act 2.0, which goals to entice folks to save lots of for retirement and make it less expensive for organizations to arrange retirement plans, employers can incentivize their workforce to repay their scholar loans by matching worker funds with a contribution to their 401(ok) plan.

Many employers have already embraced this method regardless of some administrative challenges, which Safe 2.0 is designed to unravel. At the moment, 42% of employers provide a 401(ok) scholar mortgage match, with one other 23% anticipated to supply it within the subsequent yr or two, in keeping with the EBRI report.

“It will likely be fascinating to see if it actually drives folks to take part in this system or has an antagonistic impact the place they’re simply making the minimal scholar mortgage cost and never contributing to their 401(ok),” Copeland says.

The unsure financial system and continued speak of a looming recession, nevertheless, may restrict participation and maintain again their scholar mortgage reimbursement assist from ever reaching his forecast of 40% of employers offering help.

“If we hit a recession and the unemployment price goes up, employers might imagine a scholar mortgage reimbursement program could be straightforward to chop,” Copeland says. “They might say, ‘I’m sorry, it was a technique that I can ensure that everybody can nonetheless work and never need to take a pay lower.’ ”

The submit How employers are displaying assist as scholar mortgage funds resume appeared first on HR Govt.

[ad_2]

Source link