deepblue4you

Invesco QQQ Belief ETF (NASDAQ:QQQ) skilled a decline in Q3 2023 however nonetheless outpaced the S&P 500’s return. QQQ has additionally impressively outperformed the S&P 500 by a notable margin from 12 months to this point. The Federal Reserve’s actions and insurance policies closely influenced the monetary panorama throughout this era. Market contributors had been keenly attentive to the Federal Open Market Committee’s (FOMC) selections concerning fee changes. The ETF’s standout efficiency is attributed primarily to its investments within the Client Discretionary, Telecommunications, and Know-how sectors. This text offers an in-depth evaluation of the QQQ ETF, constructing on the insights from the earlier piece. The aim is to find out the longer term trajectory of QQQ and establish potential funding avenues for long-term traders. Whereas the inventory value is present process a downward correction after assembly its value goals, such corrections are thought-about potential shopping for alternatives for traders.

Unraveling the Future Path of QQQ ETF and Alternatives for Lengthy-Time period Traders

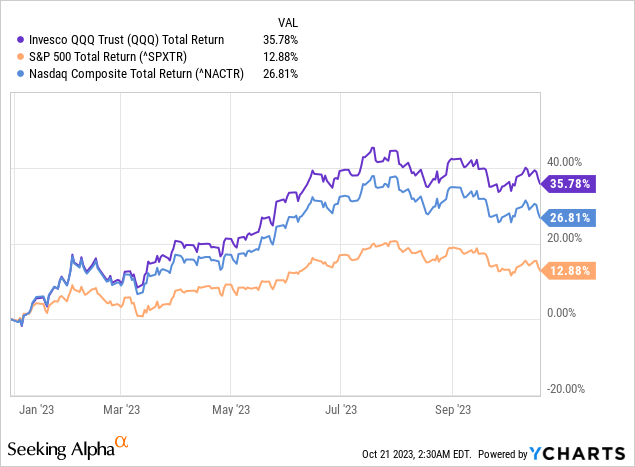

QQQ ETF skilled a decline of two.91% in Q3 2023, however it nonetheless managed to outpace the S&P 500 and Nasdaq Composite whole return. QQQ has remarkably outperformed with a complete return of 35.78% in comparison with the S&P 500’s 12.88%, a lead of greater than 22 share factors, as proven within the chart under. The Federal Reserve’s actions and insurance policies considerably influenced the monetary panorama throughout this era. The FOMC had the monetary world in suspense, with traders repeatedly speculating in regards to the timing and amount of potential fee hikes. Moreover, particular value metrics confirmed a notable year-over-year acceleration through the summer season months, resulting in discussions in regards to the length the Fed may keep the rates of interest.

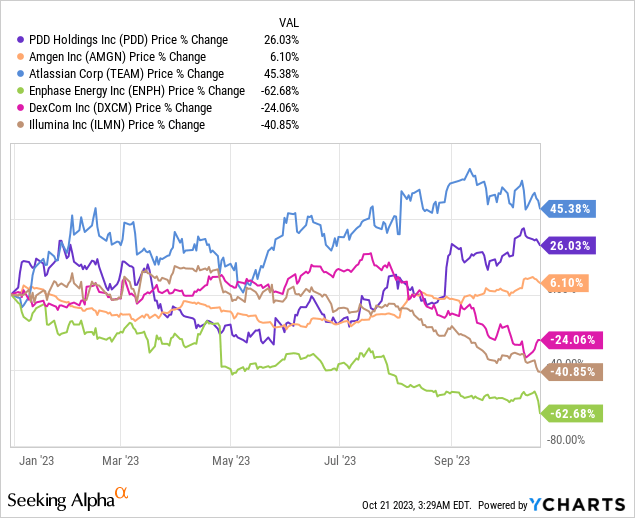

Furthermore, QQQ’s efficiency has been bolstered by its robust positioning within the Client Discretionary, Telecommunications, and Know-how sectors, per the Trade Classification Benchmark (ICB). Notably, the Know-how and Client Discretionary sectors have been pivotal for QQQ’s relative efficiency all year long, with common weights of 58.42% and 19.02%, respectively, and spectacular whole returns of 49.36% and 40.68% (till 30 September 2023). Delving deeper into stock-specific performances, NVIDIA Company (NVDA) and Meta Platforms, Inc. (META) emerged as the highest performers in QQQ year-to-date. NVIDIA witnessed a staggering development of 197.76% for the 12 months, spurred by sturdy Q2 earnings, the place the corporate reported a income of $13.51 billion, a considerable year-over-year development of 102%. Then again, Meta Platforms loved development of 149.47% year-to-date, with its Q2 earnings report highlighting a income of roughly $32 billion, marking an 11% year-over-year development—the primary time the corporate achieved a development fee surpassing 10% since This autumn 2021. The very best-performing shares in QQQ from the 12 months to this point are PDD Holdings Inc. (PDD) (+26.03%), Amgen Inc. (AMGN) (+6.10%), and Atlassian Corp. (TEAM) (+45.38%). The worst performers for the quarter had been Enphase Power, Inc. (ENPH) (-62.68%), DexCom, Inc. (DXCM) (-24.06%), and Illumina, Inc. (ILMN) (-40.85%), as proven within the chart under.

Furthermore, Q3 2023 efficiency appeared to pivot away from AI optimism to uncertainty on future Fed motion to fight value pressures. Alerts within the financial system stay blended with an enchancment in costs, albeit slowly, whereas nonetheless above the Fed’s long-term goal of two%.

Throughout Q3 2023, FOMC met in July and September 2023. The July assembly witnessed a big determination because the committee raised its benchmark fee by 25 foundation factors, positioning it at 5.25 – 5.50%, the very best over twenty years. This determination contrasted the earlier “Fed pause” in June, which maintained the speed, marking the primary time since March 2022. Jerome Powell, the Chairman, expressed optimism, indicating no forecasts of a recession for the latter half of the 12 months. This led to market hypothesis on the potential of a comfortable financial touchdown and potential future fee selections. By September, the Fed maintained the speed at its present degree. The month additionally revealed the Fed’s dot plot, hinting at one other fee hike by 12 months’s finish. By way of inflation, there have been blended indicators. June’s CPI mirrored a 3.0% YoY development, moderating from Could’s 4.0%. This development modified with July’s 3.2% and August’s fast 3.7% YoY development. Month-to-month knowledge mirrored this, with August seeing a notable 0.7% enhance. A major issue was the rise in vitality costs, with oil costs surging by over 28.5% through the quarter attributable to tight provide and manufacturing lower selections by main oil producers. Excluding risky parts like meals and vitality, the Core CPI displayed a gradual development, with August recording a 4.3% YoY enhance, at the same time as vitality costs influenced sectors like air journey.

Technical Worth Examination for QQQ

Recap

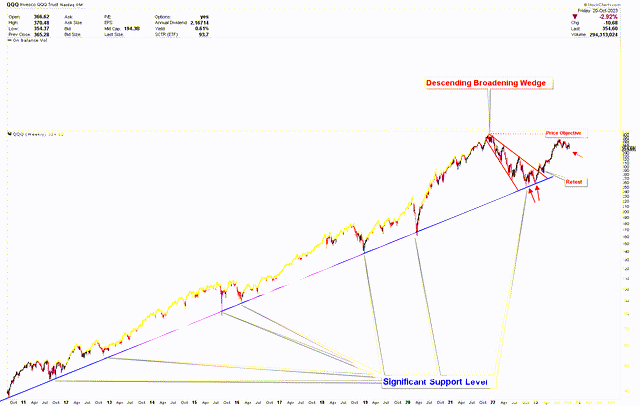

The technical outlook was explored in a earlier article, highlighting a pronounced bullish development in value motion. This was underscored by a rebound off the long-term trendline and a descending broadening wedge sample. Primarily based on these components, it was urged that traders may see QQQ ETF as a compelling purchase, given the potential for a strong breakout from this wedge. There was a breakout as anticipated, and the value surged to greater ranges to attain value goals. Subsequently, one other potent purchase sign emerged within the QQQ ETF, signaling one other sturdy rally. This was confirmed when the value retraced to the help line of the descending broadening wedge after which surged once more. The following forecast anticipated additional value appreciation, concentrating on the $400 mark related to the wedge sample. Presently, the value is at $387.42, present process consolidation on this bracket.

Present Worth Growth

The up to date weekly chart from the earlier dialogue exhibits that the inventory value has met its goal from the descending broadening wedge formation and is now consolidating at elevated ranges. This section of value stabilization suggests an upcoming value surge. This consolidation stems from the inventory value hitting the targets set by the breakout from the descending broadening wedge sample. The broader value trajectory continues to be firmly bullish. The double backside formation noticed in This autumn 2023 is a big historic sample that might pave the way in which for the subsequent shift in QQQ ETF.

QQQ Weekly Chart (StockCharts.com)

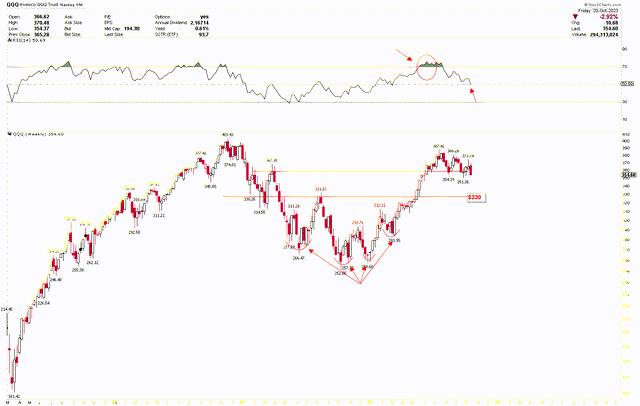

Moreover, the weekly chart exhibits an inverted head and shoulders sample, with the top at $252.55 and the shoulders at $266.47 and $283.95. This sample’s head is bolstered by a double backside at $252.55 and $258.60. The neckline, located at $330, has been breached, main the value to satisfy its targets. The secondary resistance close to $360 has additionally been damaged, consolidating the value at greater ranges. The current value changes available in the market present the enduring power of bullish momentum, priming the marketplace for a future rally. The weekly chart reveals a strong help zone round $330, which might be optimum for growing lengthy positions.

QQQ Weekly Chart (StockCharts.com)

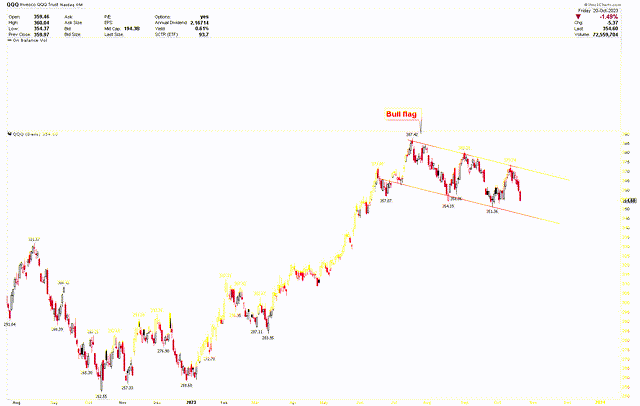

For a extra granular take a look at this bullish development and its current consolidation, the short-term day by day chart showcases a bull flag rising from the height of $387.42. This flag signifies optimistic value motion and underscores the constructive nature of present value motion. A dip to $340-$330 additional emphasizes the strong help at this vary, which might be a super entry level for long-term traders. Nonetheless, if there is a substantial decline, the market has a pivotal strong help of round $250.

QQQ Each day Chart (StockCharts.com)

Market Threat

The Federal Reserve’s selections on rates of interest stay essential, with sudden hikes probably inflicting market volatility affecting QQQ’s efficiency. The continued issues about inflation and the Fed’s response may adversely affect client buying energy and company profitability. Concurrently, whereas QQQ has benefited from its emphasis on the Know-how and Client Discretionary sectors, a downturn in these areas may considerably impression the ETF. The escalating vitality costs, pushed by restricted provide and important oil producers’ selections, can have an effect on a number of sectors, together with air journey, and world provide chain disruptions additional introduce uncertainties.

From a technical perspective, QQQ’s total bullish development requires traders to observe important help and resistance factors. The $330 degree is robust help, however any substantial dip may push the market towards the $250 threshold. A breach under $250 may problem the prevailing optimistic outlook.

Backside Line

QQQ ETF witnessed a slight decline however outperformed the S&P 500. This efficiency is attributed to its important investments within the Client Discretionary, Telecommunications, and Know-how sectors, with companies like NVIDIA and Meta Platforms enjoying a vital function on this development. Shares like PDD Holdings Inc., Amgen Inc., and Atlassian Corp stood out, whereas Enphase Power Inc., Dexcom Inc., and Illumina Inc. underperformed. The monetary panorama throughout this era was significantly influenced by the Federal Reserve’s selections, significantly regarding rate of interest changes. The technical outlook for QQQ stays bullish, with the value stabilizing at greater ranges after assembly targets set by earlier patterns. Nonetheless, potential market dangers embody sudden rate of interest hikes by the Federal Reserve, inflation issues, and disruptions within the world provide chain. From a technical standpoint, whereas the $330 mark acts as a strong help, a breach under $250 may problem the present bullish outlook for QQQ. Traders ought to stay vigilant, contemplating each the alternatives and challenges within the present market surroundings.