atakan

I have been round for almost 60 years. I bear in mind the 1973 Center East Struggle, the 1987 Crash, the Iraq-Kuwait-US battle, and the turmoil of recessions. I recall vividly the busting of the Dot-Com Bubble in 2000, the International Monetary Disaster in 2008, 9/11 and all of the opposite manic occasions of the previous a number of many years. I’ve endured hurricanes and one earthquake. And I used to be truly within the World Commerce Middle in 1993, when the constructing was bombed within the basement however they missed. 97 flooring of strolling later, we had been secure.

What is the level? I’ve been reminded time and again in regards to the idea of insurance coverage, significantly on the subject of the chance to property and belongings. The insurance coverage idea is a central a part of my “keep away from massive loss” mentality in managing portfolios. And so naturally, it would not take a lot to draw me to the funding potential of the most important shares within the property and casualty insurance coverage {industry}.

Invesco KBW Property & Casualty Insurance coverage ETF (NASDAQ:KBWP) owns firms on this {industry}, whose merchandise are more and more a necessity in an period of local weather change and geopolitical battle, in addition to weakened infrastructure. That has led to greater premium charges and stingier protection, following a interval of elevated claims brought on by hostile occasions. Versus different kinds of monetary firms which have dangers from depositors, capital markets exercise or shopper credit score, P&C insurance coverage is a comparatively secure sub-segment of the monetary sector.

I consider that is probably the most harmful market local weather of our lifetime. So with that in thoughts, let’s take a more in-depth have a look at why this P&C Insurance coverage {industry} ETF is one I’m contemplating as I collect a brief checklist of fairness market segments that I can have able to go as soon as I consider that reward lastly outweighs threat, one thing I’ve not felt since 2021.

KBWP: an ETF stuffed with stable options

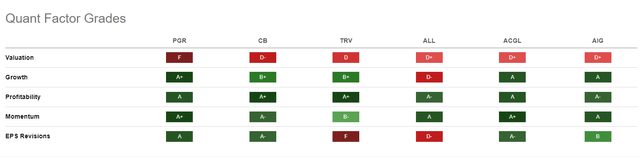

KBWP tracks the KBW Nasdaq Property & Casualty Index, which at the moment holds 26 shares. The highest 10 account for 62% of the ETF’s belongings, so I do know what I personal. In reality, one of many issues I like finest about centered, area of interest ETFs like this one is how I can use Looking for Alpha’s quant grades to see what’s driving the over efficiency. As is the case with many industry-specific ETFs, the highest weighted holdings carry the load.

Looking for Alpha

The 6 shares above comprise 45% of KBWP and the quant grades paint an image of an {industry} that’s solidly worthwhile, has a historical past of earnings and income progress, and relative to the broader inventory market, has some worth momentum. The sticking level, as is the case with almost each market section I observe (about 150 fairness ETFs) is valuation. But versus different industries, this one has the potential to be seen as a secure haven in a rocky market.

KBWP holds $164 million in belongings, and it has been listed since 2010. Invesco, the issuer, is likely one of the high tier companies within the ETF enterprise.

Property & Casualty Insurance coverage is at the moment in a ‘candy spot’ for the opportunity of rising returns. That is as a result of previous few years being a “exhausting marketplace for insurance coverage with worth will increase, reductions in phrases and situations (that’s, much less protection per greenback of premium written), and capital leaving the {industry}.” -Royceinvest.com. After the financial institution failures and uncertainties in March prompted a drop throughout the monetary sector, P&C Insurance coverage, which additionally suffered with the remainder of the monetary sector, has been slowly and steadily recovering.

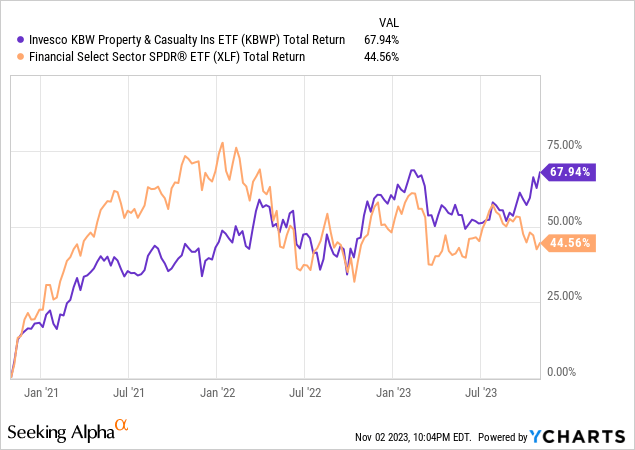

This chart tells a novel story

You do not see a chart just like the one above fairly often. It reveals the resilience of the shares on this {industry} over the previous 3 years, a most difficult interval for fairness traders. I charted it in opposition to the ETF that traders have a tendency to consider once they hear “monetary shares.” However as I famous earlier, P&C insurance coverage firms are in a unique kind of enterprise altogether. I feel that accounts for the smoother trip the previous few years.

In reality, I can not consider too many fairness ETFs I observe which have prevented main drops in addition to this one has. And my present chart evaluation hints at breakout potential. It isn’t fairly there but, however like I mentioned, KBWP is on my brief checklist for “recent cash buys” going ahead.