[ad_1]

From a productiveness standpoint, constructing, sustaining, and updating growth environments is an arduous activity for software program groups. Containerization, the place parts of functions are pre-bundled right into a single picture, has helped alleviate a few of these challenges. Daytona is taking it one step additional with its administration platform for self-hosted, safe, and standardized growth environments. The platform simplifies the creation and ongoing upkeep of safe environments, introduces automation for brand new undertaking branches, and facilitates collaboration between completely different crew members in real-time. It’s been described as much like Github’s Codespaces however self-hosted. Daytona is presently in closed beta with a rising waitlist.

AlleyWatch caught up with Daytona CEO and Cofounder Ivan Burazin to be taught extra in regards to the enterprise, the corporate’s strategic plans, current spherical of funding, and far, rather more…

Who had been your buyers and the way a lot did you elevate?

$2M. It was a Pre-Seed spherical, we purposefully aimed for backing from seasoned founders and operators on the core of the developer instrument sector, whose names are related to the instruments you seemingly use every day.

- Abhinav Asthana (Founding father of Postman)

- Charity Majors (Cofounder of Honeycomb)

- Christian Bach (Cofounder of Netlify)

- Paul Copplestone (Cofounder of Supabase)

- Prashanth Chandrasekar (CEO of StackOverflow)

- Luke Kanies (Founding father of Puppet)

- Cassidy Williams (CTO of Contenda)

- Milin Desai (CEO of Sentry)

- Moataz Soliman (Cofounder of Instabug)

- Shawn Wang (Founding father of smol.ai)

- Zach Lloyd (Founding father of Warp)

Inform us in regards to the services or products that Daytona affords.

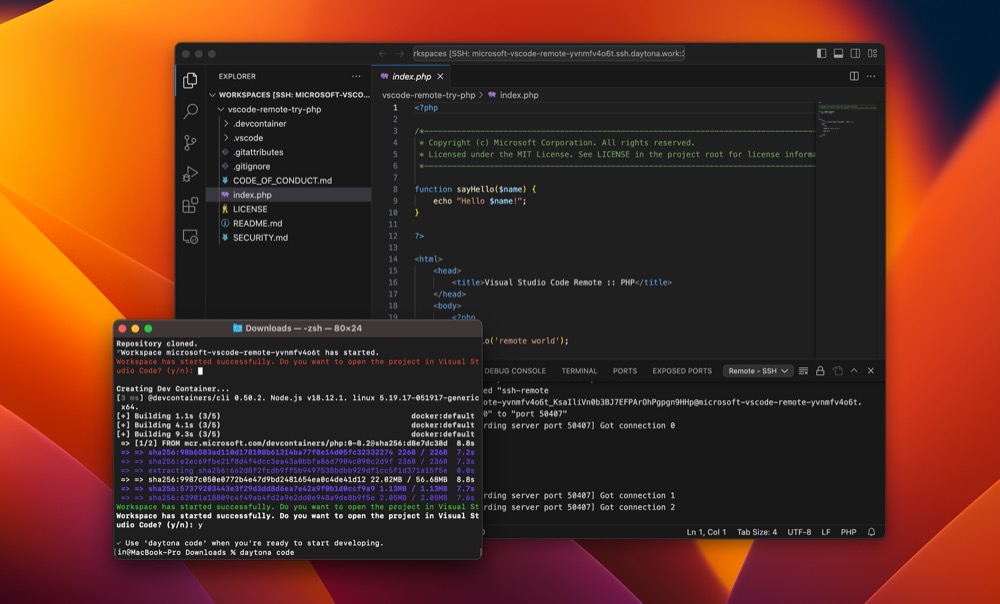

Daytona is a self-hosted “Improvement Setting Administration” platform that simplifies creating customary and safe growth environments, automates setup on new undertaking branches, and facilitates sharing amongst crew members. It’s designed to be suitable with any IDE & GIT supplier, following {industry} requirements like Dev Container.

What impressed the beginning of Daytona? Daytona was impressed by a 14-year historical past within the Cloud Improvement sector, beginning with a undertaking known as PHPanywhere, which advanced into Codeanywhere. The founders’ historical past on this sector and deep understanding of shopper wants and challenges on this sector led to the creation of Daytona.

Daytona was impressed by a 14-year historical past within the Cloud Improvement sector, beginning with a undertaking known as PHPanywhere, which advanced into Codeanywhere. The founders’ historical past on this sector and deep understanding of shopper wants and challenges on this sector led to the creation of Daytona.

How is Daytona completely different?

Daytona affords functionalities much like GitHub Codespaces however provides the good thing about being self-hosted on a corporation’s personal infrastructure.

What market does Daytona goal and the way huge is it?

Daytona targets the enterprise sector, specializing in corporations the place self-hosted environments are essential.

What’s your corporation mannequin?

Daytona’s enterprise mannequin is per seat per thirty days licensing.

How are you making ready for a possible financial slowdown?

In anticipation of an financial downturn, Daytona positions itself as an important instrument for sustaining and enhancing Developer Velocity, which is a important metric for operational effectivity in difficult financial climates. Moreover, Daytona introduces Excessive-Density Workspaces, a characteristic that considerably reduces cloud growth workspace prices for corporations by 2 to 10 instances in comparison with opponents, providing substantial financial savings.

What was the funding course of like?

The fundraising journey was very strategic, as talked about focusing totally on skilled founders and operators within the developer instruments sector. We began by crafting a wishlist of potential buyers—some I had earlier connections with, whereas others had been new contacts.

Leveraging my community, we rapidly secured the primary 30% of our goal. The following 50% was a lot tougher and took extra time and effort, however after reaching 80% of our aim, we began to get a number of inbound. The curiosity then was so sturdy that we blew previous our expectations and ultimately needed to cap our spherical at $2 million, even having to show buyers away.

What components about your corporation led your buyers to jot down the test?

I assume buyers had been seemingly influenced by Daytona’s historical past of the cloud growth sector by the crew and with that, the deep-rooted understanding of the client and market. Moreover, the potential for Daytona to turn into an industry-standard in Improvement Setting Administration.

What are the milestones you intend to realize within the subsequent six months?

Primarily, doubling our buyer base, together with product updates.

What recommendation are you able to supply corporations in New York that do not need a contemporary injection of capital within the financial institution?

Preserve your prospects blissful. In fact, watch prices, however I imagine that is key.

The place do you see the corporate going now over the close to time period?

Daytona is targeted on changing into an industry-standard in Improvement Setting Administration, beginning with the enterprise sector. There may be nothing else presently.

What’s your favourite fall vacation spot in and across the metropolis?

I really like going for a run in Central Park, particularly within the fall. The autumn colours create this good backdrop for a run, and whereas I normally train at residence, there’s one thing particular about being outside throughout this season.

The AI revolution has already begun to rewire Wall St, and its impression has been strongly felt in a single rising market particularly. As a result of, due to a Harvard information scientist and his crack crew, on a regular basis individuals can now profit from a beforehand “off-limits” funding.

The corporate that makes all of it potential known as Masterworks, whose distinctive funding platform permits savvy buyers to spend money on blue-chip artwork for a fraction of the associated fee. Their proprietary database of artwork market returns offers an unmatched quantitative edge in analyzing the artwork market.

With all 16 of its exits, Masterworks has achieved a revenue, with current exits delivering +17.8%, +21.5%, and +35.0% annualized web returns.

Intrigued? Alleywatch readers can skip the waitlist with this referral hyperlink.

Investing includes threat and previous efficiency is just not indicative of future returns. See necessary Reg A disclosures and combination advisory efficiency at masterworks.com/cd

[ad_2]

Source link