Bjoern Wylezich/iStock Editorial by way of Getty Photos

Introduction

I reaffirm my Purchase ranking on Koninklijke Ahold Delhaize N.V. shares (OTCQX:ADRNY) following the corporate’s Q3 outcomes, which beat expectations regardless of the corporate going through vital headwinds. Nevertheless, regardless of some margin weak point and a slowdown in top-line development, my bullish thesis stays unchanged. I proceed to view Ahold as a wonderful defensive alternative, providing resilience in a possible downturn and constant gross sales and EPS development.

For these unfamiliar with the corporate, the next info may be helpful:

Koninklijke Ahold Delhaize N.V. is a worldwide company that operates varied grocery store chains, on-line grocery platforms, liquor shops, and the well-known European e-commerce firm Bol.com, providing an alternative choice to Amazon.com. With a various portfolio of 21 manufacturers, the corporate has established its presence in over 11 nations throughout Europe and america. By way of income, roughly 60% is generated from the U.S., whereas the remaining 40% originates from Europe, primarily from The Netherlands and Belgium.

Ahold Delhaize meals manufacturers (Ahold Delhaize)

It has been some time since I final lined Ahold. My final protection of the shares on Searching for Alpha was again in Might, proper after the Q1 end result, after I rated the shares a Purchase. This was what I concluded again then:

Total, there weren’t many surprises within the earnings report, which for a defensive holding like Ahold is precisely the way you need these reviews to be. Consequently, my funding thesis from earlier than and, as defined within the introduction of this text has not modified, and I stay bullish on the shares. The corporate is in an ideal place to ship constant development over the subsequent a number of years. This, mixed with share buybacks and regular dividends, ought to guarantee first rate shareholder returns.

Nevertheless, whereas I remained bullish on the shares from a long-term development perspective, these have considerably underperformed international indices since, as earlier tailwinds changed into headwinds, and the corporate is fighting the persistently excessive inflation and rising charges impacting shopper spending well being.

These struggles had been clearly mirrored within the Q3 outcomes offered by the corporate earlier this week, and shares declined 6.5% within the following buying and selling session in response, which means these at the moment are down 16% since Might, which, contemplating this can be a very defensive holding, is critical. Moreover, shares declined closely following the Q3 outcomes regardless of Ahold truly beating analysts’ expectations with income in line, greater margins, and an upgraded FY23 FCF outlook. The corporate additionally elevated the dividend by 6.5%, which nonetheless couldn’t fulfill buyers.

Ahold is going through FX headwinds and weakening shopper spending energy however nonetheless performs comparatively nicely

Ahold reported Q3 web gross sales of €21.9 billion, down 2.1% YoY. It is a vital slowdown from the 9.4% development reported in Q1 and a couple of.9% development in Q2. Nevertheless, that is basically the results of the forex tailwind that has boosted Ahold’s outcomes over the past yr, with the corporate deriving nearly all of its revenues from the US, turning right into a headwind with the Euro strengthening in comparison with a yr in the past. Excluding this forex affect, income was up 2.9% YoY.

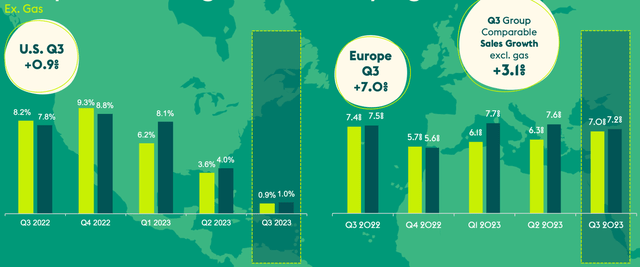

This was pushed by Q3 comparable retailer gross sales development of three.1%, pushed by 0.9% development within the US and seven% in Europe. The US comparable retailer gross sales development, the primary driver of development over the past two years, has slowed down considerably over latest quarters. In the meantime, comparable retailer gross sales development in Europe stays way more resilient, even amid fairly some strain on shopper spending energy.

U.S. and Europe development charges YoY (Ahold Delhaize)

US web gross sales got here in at €13.6 billion, which means it nonetheless accounts for 62% of group income. Whilst development within the US slows, the potential for Ahold on this market stays significant, and the corporate’s underlying operational efficiency is stable. Efforts in constructing out its omnichannel mannequin within the nation are paying off, highlighted by 19% YoY development in on-line site visitors in Q3 and the variety of omnichannel clients, that are probably the most worthwhile ones, rising 8% YoY. Consequently, Meals Lion has now grown gross sales for 44 consecutive quarters, and Ahold has gained market share in 28 of the final 30 quarters with its whole US operations.

European web gross sales had been €8.3 billion. The sturdy relative YoY efficiency of the European phase was supported by a powerful efficiency within the firm’s Benelux different to Amazon (AMZN) – Bol – which reported GMV of €1.4 billion, up 10.5% YoY, pushed by 48% development in promoting income. This introduced the group’s complete on-line gross sales to €2.8 billion, up 6.4% YoY in fixed forex.

Ahold additionally, final month, introduced the acquisition of native Romanian grocery store chain Profi for €1.8 billion or 7x EBITDA. This could not affect the capital allocation technique and can most certainly improve the debt place to 2.2x EBITDA from 2x.

In the meantime, this acquisition will greater than double the dimensions of Ahold’s present Romanian enterprise, which operates underneath the Mega Picture model and has 969 shops. The Profi acquisition provides one other 1654 shops to this complete and provides the corporate higher publicity all through the nation. The acquisition provides €2.5 billion in web gross sales going by the final twelve months.

I have to say I’m fairly proud of this acquisition. I do not consider the worth Ahold is paying is that top. In the meantime, it provides considerably to the corporate’s footprint in Romania, a extremely attention-grabbing market because of the rising wealth within the nation. The acquisition is predicted to be gross sales development and EBIT margin accretive publish synergies and EPS accretive to Ahold Delhaize as a gaggle within the first yr after closing.

Total, I consider rising publicity in Romania is an efficient transfer and will increase income development within the medium time period. Moreover, the enterprise at present reviews an EBIT margin above that of Ahold’s European enterprise, making it an ideal addition when it comes to profitability.

Ahold is going through weakening margins within the US, impacting the underside line efficiency

Transferring to the underside line, we will see that that is the place Ahold is struggling extra at present, partly because of the forex headwind affect on the top-line outcomes but additionally because of one-off impacts and better working prices.

Nonetheless, the corporate reported an working margin of 4.1%, which beat analysts’ expectations by 20 foundation factors. The underlying working margin was 3.8%, down 60 foundation factors YoY, pushed by one-off insurance-related changes and better working prices within the US on account of wage inflation.

The US underlying working margin was down 80 foundation factors YoY however nonetheless was fairly sturdy at 4.2%. Moreover, the modest margin strain we’re seeing for this area is predicted to be transitory and may move in a couple of quarters’ time. Subsequently, the long-term outlook right here stays unchanged, and aside from being a top-line development driver for Ahold, the US operations must also proceed to spice up the bottom-line efficiency.

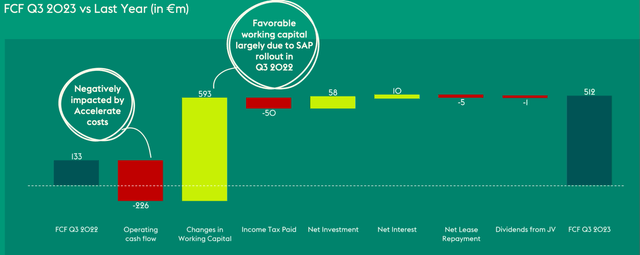

Europe’s underlying working margin was 3.5% and flat YoY. Sturdy value management offset the affect of the Belgian transformation and vitality and wage inflation in a lot of its markets. Nonetheless, the slight margin weak point on account of greater prices and FX headwinds drove EPS down 17.1% YoY to €0.58. Q3 free money stream was €512 million, up from €133 million one yr in the past.

FCF YoY adjustments (Ahold Delhaize)

With present headwinds anticipated to be transitory and US margins anticipated to rebound in a couple of quarters’ time, administration stays dedicated to its objective of persistently attaining an underlying working margin of not less than 4%. Pushed by the idea that margins ought to get better rapidly and the very sturdy FCF reported in Q3, administration additionally introduced a brand new share buyback program amounting to €1 billion to begin at the start of 2024.

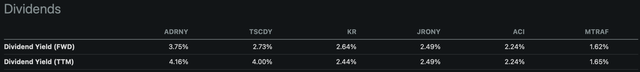

Moreover, following the 16% share value drop, the dividend yield has elevated again towards the 4% mark, making it one of many best-yielding shares amongst friends. Administration continues to focus on a 40-50% payout vary and at present sits comfortably inside that vary at round 40%, making the dividend very protected and sustainable. This provides to the attractiveness of the shares.

Dividend comparability (Searching for Alpha)

Outlook & valuation – Is Ahold a purchase, promote, or maintain?

Following the Q3 outcomes, administration largely maintained its FY23 outlook. Nevertheless, it did improve its FCF expectations and now expects to report free money stream in a variety of €2.2 billion to €2.4 billion (from a variety from €2.0 billion to €2.2 billion) however expects underlying EPS to come back in barely worse at under 2022 ranges, whereas this was beforehand anticipated to be in line. The working margin continues to be anticipated to be above 4%.

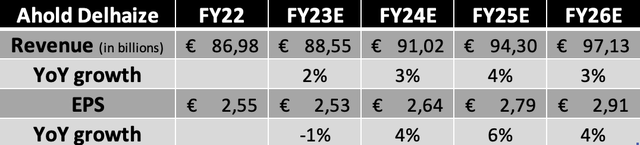

Following the Q2 and Q3 outcomes, enterprise developments, and revised FY23 steering, I barely lowered my FY23 and FY24 expectations based mostly on persisting forex headwinds in This fall and the primary half of FY24. Moreover, US margins will most certainly stay suppressed via the primary half of FY24. Nonetheless, I stay bullish on the corporate’s long-term prospects and consider it ought to have the ability to drive stable gross sales development via the top of the last decade. I now count on the next monetary outcomes via FY26.

Monetary projections (By creator)

Based mostly on these estimates, shares now commerce at a ahead P/E of 10.6x, which is a 13.6% low cost to the 5-year common however nonetheless a slight premium to the peer common. Nevertheless, contemplating the corporate’s sturdy market positions in each the US and Europe, its sturdy monetary profile, and superior dividend yield, I consider the premium is greater than justified.

I’d argue {that a} 12x a number of, which continues to be a reduction to historic averages, can be truthful for this enterprise, even when factoring within the threat of a recession and continued weak point. Based mostly on a 12x P/E a number of and my FY24 EPS projection, I calculate a value goal of €32 per share, leaving buyers with 19% upside potential over the subsequent 14 months or near 23% when factoring within the dividend.

Subsequently, I consider that Ahold shares at present, following two quarters of stable monetary outcomes and a 16% drop within the share value, supply a wonderful alternative to buyers. I consider Ahold stays a wonderful defensive alternative, providing resilience in a possible downturn and constant gross sales and EPS development. Based mostly on my FY26 EPS projection, I consider buyers can count on annual returns exceeding 8% or double-digit returns when together with dividends.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.