Chip Somodevilla/Getty Photographs Information

Our final protection of The Walt Disney Firm (NYSE:DIS) was virtually 9 months again. Whereas we rated the inventory a maintain/impartial (in contrast to our 2021 items, see right here and right here), we felt that the magic quantity was probably to be $80.

However Disney’s 2X gross sales a number of pre-COVID-19 was a much more worthwhile firm with no sinkholes like Disney+. So we predict we go decrease primarily based on that. Technically talking the $80 mark has been an necessary bastion of help and marked the COVID-19 lows in addition to the 2014 lows.

Within the latest drop we got here shut however didn’t fairly breach by. At a minimal we predict that $80 quantity shall be examined and certain we are going to undergo that. We see no points with the inventory buying and selling at even 12-14 instances earnings, particularly with danger free rates of interest so excessive and the magic of Disney+ now within the rearview mirror. Look decrease and look to purchase beneath $80.

Supply: 3 Years Forward Of Schedule

The inventory complied in each single manner. It went decrease and lagged the S&P 500 (SPY) by 24.37%

In search of Alpha

It additionally went proper by that $80 mark, on three events, however it has bounced again.

We have a look at the This autumn-2023 outcomes, the long term technique and replace our name in gentle of the present valuation.

This autumn-2023

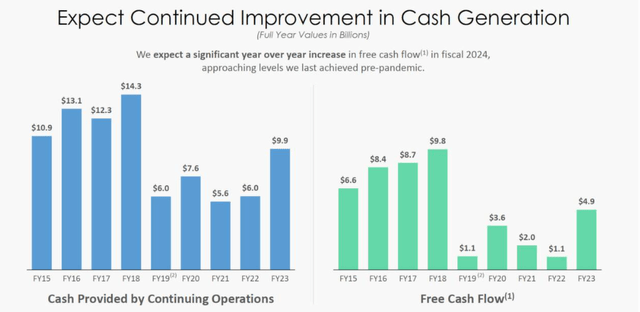

Disney’s fiscal 12 months ends in September and the lately launched outcomes have been for the fourth quarter. The media big missed the income estimates by a smidge however walloped the non-GAAP EPS estimate and that despatched the inventory flying out of the gate. What was probably a much bigger sign for the bulls, was the free money movement era which exploded to $3.4 billion. As you possibly can see under, this quantity is much forward of fiscal quarter of This autumn-2022. Actually, in all the fiscal 12 months 2022, Disney generated lower than a 3rd of this.

Disney This autumn-2023 Press Launch

Disney’s slide deck continued to stress this level, with expectations of a much bigger enhance subsequent 12 months. Pre-COVID-19 we noticed $12 billion annual run-rates and Bob Iger spoke about reaching that.

Disney This autumn-2023 Presentation

To make certain, this was not some progress story revival. The numbers have been going to return from Iger’s technique of spending with restraint (in different phrases, not just like the US Authorities). The anticipated drop for licensed content material shall be about $2 billion in 2024.

Disney This autumn-2023 Presentation

If you happen to use a 3%-4% deflator on that, inflation adjusted spend will drop not less than 11% in 2024. Different bonuses will come from the SG&A expense financial savings.

Disney This autumn-2023 Presentation

These have been the highlights from the Iger powerwalk. There have been some low factors as effectively. The a lot marketed progress within the Disney+ section was primarily a characteristic of worldwide (learn that as very low paying) subscribers. Home progress was extraordinarily muted with numbers barely forward of This autumn-2022.

Disney This autumn-2023 Presentation

The saving grace right here was that common income per consumer (ARPU) was up properly as pricing and promoting revenues helped saved the day. Disney continues to be getting losses handed to it on its Direct To Shopper section, however these losses look extra manageable right this moment versus a 12 months again.

Disney This autumn-2023 Presentation

Outlook

Disney’s focus has rightly shifted to income and free money movement versus that mindless progress mantra it adopted in 2021. Bob Iger’s technique shift has had lower than a 12 months to play out and the outcomes already look very spectacular. Streaming is anticipated to be worthwhile for This autumn-2024.

Our new construction additionally enabled us to significantly improve our effectiveness, notably in streaming, the place we have created a extra unified, cohesive and extremely coordinated method to advertising and marketing, pricing and programing. This has helped us to enhance working outcomes of our mixed streaming companies by roughly $1.4 billion from fiscal 2022 to fiscal 2023. And we stay assured that we are going to obtain profitability in This autumn of fiscal 2024.

Supply: Disney This autumn-2023 Convention Name Transcript

We should add right here that we have been a bit skeptical that the corporate can flip profitability levers so shortly, however it has certainly succeeded on this brief timeline. So what then ails the inventory? There are two points, which may be interconnected.

The primary was that Disney traded at some extremely ridiculous valuations and that wanted to be labored off. In March 2021, Disney traded at almost 6X gross sales. You’re simply not going to generate income on longer timeframes from that a number of. Folks attributed to “reopening” and “streaming progress”, however revenues are usually not income and paying 6X revenues is mostly catastrophe exterior the software program sector.

The second was that Disney analysts have been an extremely optimistic bunch. Now, most analysts lean optimistic however Disney’s expectations have been off the chart. One method to visualize that is to see how earnings estimates have advanced within the face of Bob Iger delivering an incredible and moderately fast, turnaround. Earnings estimates for fiscal 2024 are nonetheless falling!

In search of Alpha

Actually, they’ve fallen throughout all latest timeframes and throughout all fiscal durations forward. So expectations have been so excessive, that even this turnaround has led to a downgrade of estimates. Take into consideration that. Extra importantly, the bar nonetheless stays excessive for Disney to leap over. Expectations are that earnings will develop at a 20% compounded fee for the subsequent 4 years. All on the again of very modest gross sales progress (proven under).

Disney This autumn-2023 Presentation

So everybody has priced in some nice numbers and even the latest downgrades have not likely mounted that. The challenges stays that Disney will disappoint regardless of Bob Iger specializing in income and free money movement.

Verdict

Disney is reasonable right this moment relative to its historical past and at a worth to gross sales a number of of beneath 2.0X, your odds of creating a bang to your buck are excessive. Sure, Disney+ is nowhere close to as worthwhile as Netflix, Inc. (NFLX), however that exhibits the potential for progress and not less than some valuation growth.

The issue stays what we name the hurdle fee in finance. With risk-free charges approaching 5% (reference to 10 12 months Treasuries right here), you would see extra valuation compression. There’s actually nothing improper with a 12X-14X a number of in such an setting. We stay optimistic of the long term power within the franchise and imagine you would handle 6-7% annual returns from right here. However do you need to? You may get the identical in funding grade bonds yielding 7.0%-7.5% to maturity with a fraction of the danger. So whereas we will swear that buyers may have a cheerful 10 12 months end result from right here, comparatively, we’re arduous pressed to slap a purchase at virtually 20X 2024 earnings. We reiterate a maintain and would wait some extra time for Bob Iger to work his magic.

Please observe that this isn’t monetary recommendation. It might appear to be it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their goals and constraints.