bin kontan

Expensive subscribers,

To say that Braemar Accommodations (NYSE:BHR) has had a little bit of a nasty yr could be an understatement. The corporate is down over 40% in lower than 12 months, and at present, frequent shares of the corporate are buying and selling fingers at nearly $2/share, which involves an FFO a number of of lower than 2.6x. It is a dirt-level valuation not seen because the COVID-19 disaster – after which it solely lasted for a month or two.

My query with regards to a REIT like Braemar is, is that this justified? Clearly, this REIT has a major threat profile. The valuation is illustrative of that.

However are we speaking about chapter threat? The corporate managed to outlive a full yr of unfavourable outcomes, and has truly, 2021-2023E, improved its state of affairs materially.

Am I, as of this text, saying that it is best to make investments important quantities of capital into Braemar and make it one in every of your core holdings?

I’m not.

Am I saying that this can be a secure firm?

Once more, I’m not.

Am I saying this firm is sweet sufficient to spend money on, you probably have the precise threat profile and could also be on the lookout for a 5-9% yield with some important appreciation potential?

Sure, that is what I’m saying.

Let’s take a look at this firm.

Braemar – what the corporate could supply us

To name Braemar a battleground inventory could be fallacious additionally. The previous couple of articles on the corporate, particularly after the 22% drop over the past day, have been unfavourable. The unfavourable sentiment concerning the firm is actually comprehensible given the outcomes – and 3Q23 would not precisely add any feathers to the corporate’s imaginary cap, provided that we’re seeing a unfavourable EPS.

Nonetheless, I want to remind you at this level that one of many methods to develop into rich, and for my part one of many constant methods to truly get “wealthy”, is to go constantly in opposition to the grain and the herd. This isn’t the identical as doing so willy-nilly or with out logic. However should you apply conservative fundamentals and valuation logic to your investments, and also you accomplish that in a managed and diversified method, the quantity of RoR you may get goes into the quadruple digits.

My finest funding ever, a Swedish actual property firm within the workplace sector, that started off as a spin-off and not using a dividend ended up netting me over 500% RoR on a decent funding. That was yr, particularly provided that Sweden in my account kind doesn’t have any kind of capital good points tax.

Nonetheless, with the intention to spend money on these companies, you must have the abdomen of a billy goat (pardon my French). It is a set-and-forget kind of funding the place you may’t be bothered by any kind of downturn until it is primarily based on elementary deterioration implying chapter – as a result of then you must get out.

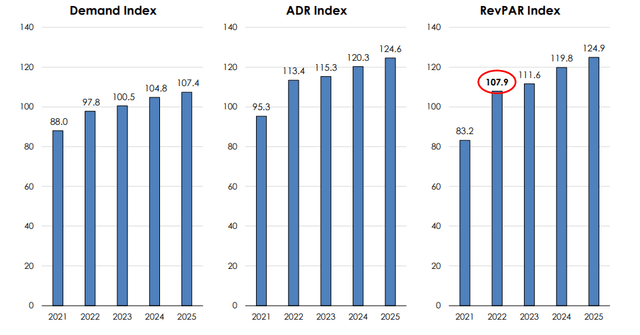

To say that Braemar would not have an attraction could be fallacious. It is a 100-200M vary market cap Lodge and Resort REIT with a administration crew with many years of hospitality expertise underneath the belt. Like different sectors after COVID-19, the corporate is seeing a return to the norm when it comes to related KPIs for its sector – this being ADR, Demand, and RevPAR. ADR, by the best way, is the common each day price within the resort/hospitality trade.

Braemar IR (Braemar IR)

Additionally, ADR is climbing far sooner than CPI – and at the same time as early as the start of this yr, RevPAR had already recovered to pre-pandemic ranges in each the Resort and the City sector, with City at 106% as of the February 2023 interval.

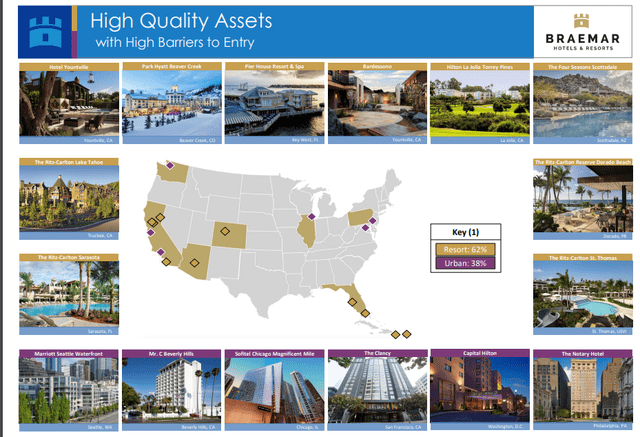

Braemar’s portfolio composition is just not with out threat – and that is placing it mildly. Whereas the corporate’s areas and geographies actually have excessive entry boundaries, they’re additionally present in areas the place customers and traders are asking themselves; “Will we need to be right here?”

Braemar IR (Braemar IR)

Simply as with different west-coast investments, the locale would not make the property uninvestable or dangerous, merely one thing that must be correctly discounted for the long run. The worry concerning the firm’s efficiency in a looming recession and an financial downturn could also be well-founded, with over 60% of the corporate’s portfolio being uncovered to the resort sector.

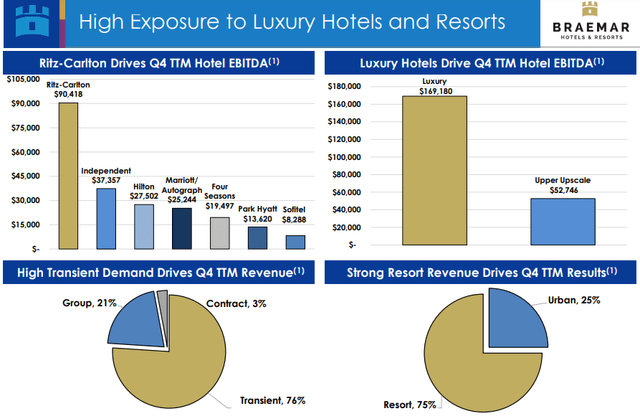

Nonetheless, the corporate’s EBITDA has truly been recovering for elements of the yr – and I argue that Braemar’s publicity to luxurious resorts and resorts, give it some safety.

Braemar IR (Braemar IR)

The share worth has been plummeting – so let’s undergo what the explanation and the background for this deterioration is. As a result of, whenever you truly look over the outcomes, it might at first look be arduous to see the issue. The city resort EBITDA is continuous its momentum, the corporate is definitely actively M&A’ing additional property, and these M&A’s are performing above authentic underwriting expectations. The corporate can also be working by way of its refinancing targets, lately closing a $200M company financing and upsizing/extending a mortgage for the Scottsdale 4 Seasons and an extension on a Lake Tahoe property.

A part of the justification is little doubt the 3Q23 quarter for the corporate, the place the resort noticed a decline of 13% YoY. Nonetheless, it is vital at this level to say that regardless of this decline, it is nonetheless a broader-scope enhance to 2019 and pre-COVID, to which the outcomes present a rise of 46% in ADR. The corporate, regardless of the share worth deterioration, is obvious that the property, each city and resorts, are performing above the 2019 ranges and the housekeeping work when it comes to debt goes in line with plan.

A second concern for the REIT was the margin. The margins are considerably down, and what we are able to discover there’s that because the city a part of the corporate’s portfolio grows in RevPAR, that is going to influence the margin. Additionally, provided that the corporate’s properties are situated (a lot of them) on the West Coast, and for the insurance coverage trade typically, the corporate’s insurance coverage prices are going up. That is particularly robust for Braemar’s portfolio, and this strain won’t be over but. That is about 100 bps of the corporate’s EBITDA erosion for the quarter.

One other concern is clearly labor prices – and BHR has completed some work to cut back its general contract labor publicity, bettering general productiveness. The corporate could be very aggressive when it comes to flexing labor, with a goal of each sustaining and considerably probably bettering ADR.

The corporate is anticipating enhancements going into 2024 as a result of the trade forecasts is a RevPAR enhance of 4-5% relying on the section. The corporate expects the present development decline to probably flip in both 1Q or 2Q, so these are kind of the quarters to regulate.

The REIT has confirmed that it’ll reduce the dividend and not using a second thought if wanted. It went to $0 throughout elements of 2021 however is now again to an annual dividend payout of $0.2 on the yr, which involves a 9.66% yield as of the present numbers. This dividend is at present coated by AFFO by a proportion payout of 26.6% – and that is to the 2023E degree of $0.75 of AFFO. The corporate may considerably underperform for the yr, and in the meanwhile, the dividend would nonetheless be at a cushty degree. Bear in mind, pre-COVID-19, this firm paid out $0.63/share which at in the present day’s share worth could be nearly 31% – although that is clearly not a related quantity to contemplate for the close to time period future presently.

Braemar is exhibiting robust traits, even to the 2023E interval. Occupancy is excessive, and the opposite numbers “work” as effectively. The entire related numbers, together with Nominal ADR and RevPAR are both at ATH’s or almost recovered on an actual foundation. Present trade forecasts think about development seemingly as effectively, particularly within the luxurious and upscale sector, the place Braemar is essentially the most energetic.

The corporate’s present maturity schedule is probably the most important concern. There are important maturities in each 2024 and 2025E effectively in extra of the corporate’s present whole money ranges, as of 3Q23 at round $225M.

The bearish views on BHR are targeted primarily, as I see it, on the extra near-term traits, with quite a lot of comprehensible give attention to the state of its stability sheet, with a debt of over $1B as of this time. The very fact is that even with the current injection of company financing, the corporate nonetheless is not able to fulfill its 2024-2025E debt obligations, which might be key right here – and this confidence when it comes to refinancing from the corporate hasn’t modified from 2Q to 3Q – administration remains to be assured in with the ability to just do this.

The core of the issue that traders appear to have with the corporate is that Braemar will be unable to fulfill its financing and debt obligations or have the ability to successfully refinance its debt. If that’s the case, asset gross sales are anticipated, and the query then in fact turns into what costs the corporate may anticipate on this market.

Let’s take a look at the valuation right here for a second.

Braemar – The valuation implies that the chance might be value it – and outperformance appears sure within the case of success

I might put it like this.

If Braemar is profitable in attractively and even considerably attractively refinancing its 2024-2025E upcoming maturities, then I anticipate the share worth to reverse with a vengeance, delivering outperformance to risk-tolerant traders.

The reason being easy. It is all about valuation. Buying and selling under 2.5x P/AFFO, even at a 3-3.6x AFFO reversal a number of, the corporate would generate over 20% annualized RoR. Within the case of even a conservative historic AFFO a number of, the corporate would annualized RoR within the triple digits, a whole bunch of % or 200-300% in 2-3 years.

Clearly, this can be a dangerous prospect, and qualifying or estimating the reasonable threat for failure right here is extremely tough given the present macro. We will solely have a look at the corporate’s historic efficiency and successes to get a sense for this.

I think about it unlikely that an operator with this luxury-oriented portfolio together with each resorts and concrete may fail to refinance these kinds of maturities. If I did not imagine that, I would not be writing this text. However apart from the corporate’s historical past, the administration crew’s expertise, and the standard of its portfolio, I haven’t got many different strong arguments for why that is the case. That is the explanation the corporate is so low-cost – no less than that is my stance.

Braemar must be in comparison with different yields of 7-9%, and the actual fact is that you would be able to get yields this measurement at a a lot safer threat profile – simply have a look at most of the pref shares out there in the present day in vitality, utility, and even REITs they usually’ll offer you security you do not have on this firm.

However that yield can also be all you will get (normally). You will not get a triple-digit RoR, which Braemar can present you.

As I mentioned initially – the recipe for important market-beating outperformance is strategic risk-taking. I’ve completed this for years, going in opposition to the grain, however doing so strategically. Whereas I’ve had losses, I’ve not had losses that’ve gone into chapter 11 or full capital loss – I do not anticipate Braemar to be the primary such firm both.

Different analysts agree with this evaluation. Apart from the iREIT on Alpha targets for BHR, S&P International targets go from a low of $3.5/share low to $12/share excessive, with a mean of $6.5/share. One among these analysts has the corporate at a “BUY” right here, with the rest at a “HOLD”. Clearly, risk-taking is not a part of many traders’ plan presently, which is comprehensible.

I allocate 1-2% of my portfolio to those kinds of investments. I lately after the crash added a small portion of BHR to my risk-oriented portfolio. Any place I add to this a part of my portfolio comes with a major, long-term plan – no totally different right here.

Until one thing elementary modifications or the corporate is wholly unable to refinance, I am holding this funding for years, and I anticipate large returns.

However it is going to be each dangerous and very long time.

Right here is my thesis for Braemar.

Thesis

- Braemar is just not a “secure” funding. It is a high-yielding, high-risk-appetite REIT funding with a large potential upside.

- The chance is that the corporate is unsuccessful in refinancing the loans and debt for its luxury-grade or above-average tier resorts and resorts, leading to asset gross sales. The corporate is dealing with maturities of over half a billion of its loans within the subsequent two years, till the top of 2025.

- I think about the probability of full capital destruction right here to be distant – the administration crew and the property within the portfolio are, as I see it, financiable and in a position to be leveraged at “workable” charges, which the corporate has seen traditionally with the power to refinance different loans.

- As a result of the probability of full capital destruction is distant, this dictates that the REIT is a “BUY” right here, albeit a “SPEC BUY”.

- I give the corporate an preliminary PT of $4/share conservatively.

Bear in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

This firm is general qualitative. This firm is basically secure/conservative & well-run. This firm pays a well-covered dividend. This firm is at present low-cost. This firm has reasonable upside primarily based on earnings development or a number of enlargement/reversion.

Because of this the corporate fulfills each single one in every of my standards, making it comparatively clear why I view it as a “BUY” right here.

Thanks for studying.