AlxeyPnferov

Japan’s non-public sector progress floor to a halt in November based on the newest flash PMI information, which relies on about 85%-90% of whole PMI survey responses every month.

This was primarily attributed to a sharper fall in manufacturing output as service exercise expanded at a barely quicker tempo within the penultimate month of the 12 months.

Amidst the softening of financial circumstances, worth pressures declined, signalling additional moderation of CPI within the months forward.

On the similar time, enterprise sentiment barely improved amongst non-public sector corporations, hinting at higher efficiency within the 12 months forward regardless of the newest stalling of personal sector financial progress.

Japan’s flash PMI sign softening progress circumstances

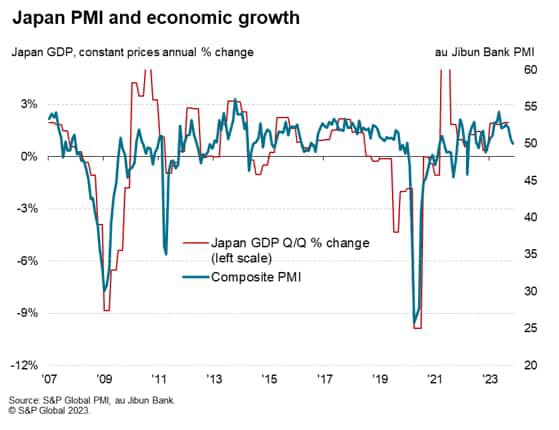

The au Jibun Financial institution Flash Japan Composite PMI, compiled by S&P International, fell to the impartial 50.0 mark in November, down from a ultimate studying of fifty.5 in October.

The flash studying, primarily based on roughly 85%-90% of whole PMI survey responses every month, subsequently prompt that Japan’s non-public sector circumstances stalled in November after ten straight months of progress.

The most recent composite output studying – protecting each manufacturing and companies – subsequently factors to GDP rising at an annual fee just under 1.0% halfway into the fourth quarter, which is barely decrease than the pre-pandemic 10-year common.

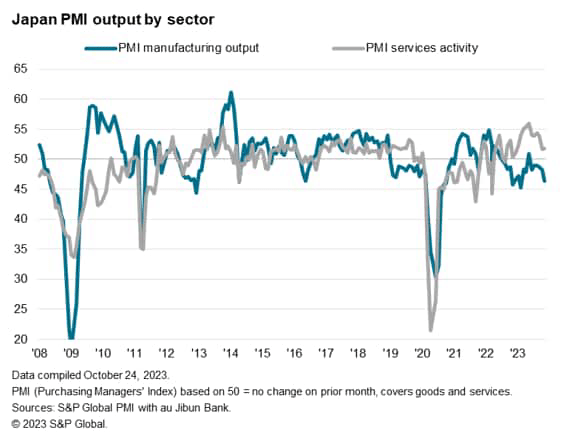

Manufacturing and companies circumstances diverge in November

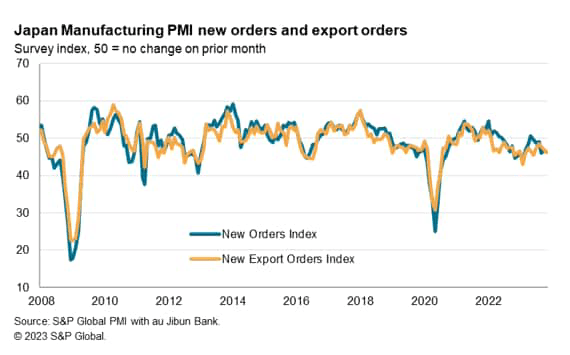

The most recent downturn in non-public sector circumstances was pushed solely by manufacturing sector weak point. Items manufacturing contracted on the quickest fee in 9 months, with new orders additional drying up into the tip of 12 months.

Anecdotal proof once more pointed to destocking efforts at shoppers, which alongside decreased budgets on the again of deteriorating international financial circumstances, negatively affected demand.

The tempo of export order contraction notably picked as much as match that of general items new order decline, with each being traditionally marked.

Survey panellists talked about deteriorating overseas demand at key export locations together with mainland China, the US and Europe.

Moreover, falling pursuits in electronics have been additionally flagged by respondents. Consequently, the extent of backlogged work within the goods-producing sector additional depleted into November, signalling the paring of manufacturing momentum within the close to time period.

In distinction, companies exercise prolonged the sequence of growth that commenced September 2022 with the speed of progress accelerating for the primary time in three months, albeit solely barely.

This was pushed by quicker new enterprise inflows amid stories of elevated tourism exercise into the year-end.

Moreover, forward-looking indications together with the backlogs of labor index additionally confirmed renewed progress, that are supportive of continued enterprise expansions within the months forward.

Additional cooling of worth pressures

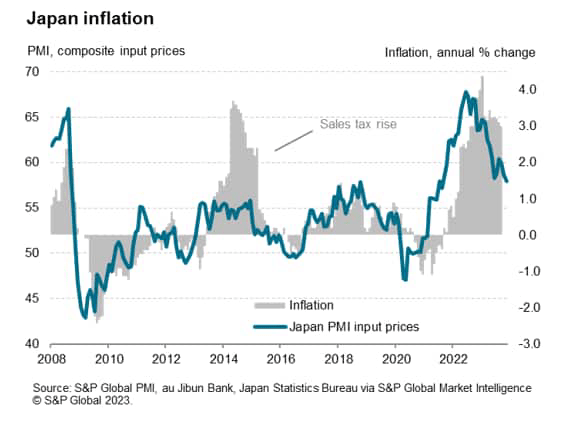

Amid the manufacturing-driven stalling of personal sector exercise in November, worth pressures eased once more.

Total promoting worth inflation, measured throughout each manufacturing and repair sectors, fell for a fourth month in a row to the bottom since February 2022.

That is in line with headline CPI sliding to across the 2.0% mark within the months to return.

Supporting the paring of general inflationary pressures had been softer promoting worth will increase in each the manufacturing and companies sectors, aided additionally by slower value inflation amongst service suppliers and little modified items enter inflation in November.

Whereas the general promoting worth inflation stays properly elevated above the long-run sequence common in November, will probably be price watching the trajectory from right here, particularly with demand circumstances remaining subdued within the newest survey.

Any additional easing of worth pressures might pose challenges to current expectations of the Financial institution of Japan (BoJ) departing from the ultra-accommodative financial coverage settings.

Optimism improves

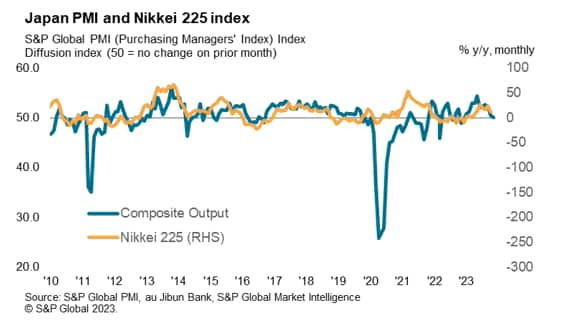

Inspecting the correlation of the PMI and the Japanese fairness market, we’re seeing the newest figures pointing to subdued worth motion within the close to time period.

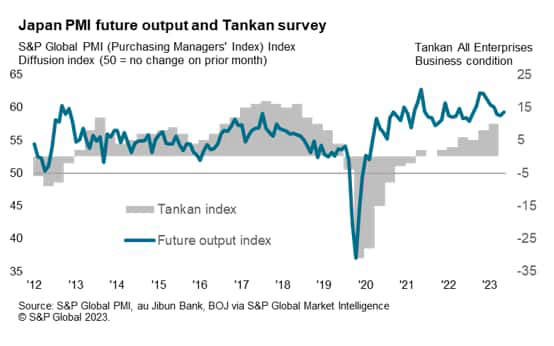

That stated, the Future Output Index, the one sentiment-based PMI sub-index, presents some hope for higher efficiency within the coming months. Optimism amongst Japanese non-public sector corporations improved to the best since August, with higher confidence unfold throughout each manufacturing and repair sectors.

It can, nevertheless, be essential to see the important thing manufacturing sector efficiency catch as much as their service sector counterpart to drive higher output efficiency.

Authentic Put up

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.