[ad_1]

What was the enterprise capital deal worth in Europe in 2023? PitchBook Q3 2023 European Enterprise Report exhibits it was €43.6B in the course of the first 9 months of this 12 months.

The report additional reveals that the deal worth in Q3 grew 5.9 per cent in comparison with Q2 despite the fact that the general deal worth declined over the identical interval final 12 months.

Whereas we speak about funding rounds of startups and VC companies funding these rounds, there are funding managers who usually need to mitigate numerous technical challenges to make these funding potential.

Anup Kumar Adlakha and Ankur Agarwal had an opportunity to intently perceive the challenges and ache factors confronted by funding managers whereas working with a European non-public fairness agency.

They realised that the choice funding administration {industry} has been underserved resulting from only a few IT options targeted on funding administration and investor relations administration.

“There was a necessity for a easy, cost-effective, and full industry-specific expertise answer with an intuitive UI,” says Adlakha.

![]()

The 2 Indian entrepreneurs then joined palms to start out PE Entrance Workplace, a SaaS startup providing a easy and seamless technological answer for the choice funding administration {industry} necessities.

PE Entrance Workplace

Whereas Adlakha and Agarwal began PE Entrance Workplace in 2013, the inception of the startup aimed to assist funding managers started greater than a decade earlier than that.

The 2 co-founders of PE Entrance Workplace first met at Actis and have now labored collectively for over 12 years. Adlakha says every step on this 12-year journey collectively has been a brand new problem for them.

Proper from their Actis days collectively, they needed to work on an answer that might cater to the entrance and center workplace groups, vis-a-vis, funding administration and investor relations administration.

“We needed to design, develop, and roll out an built-in answer that modified the best way information seize, reporting, and analytics was carried out,” says Adlakha about their early profession.

He says Agarwal together with his expertise as an IT architect and publicity to the non-public fairness area had a imaginative and prescient for the way IT enterprise expertise can be utilized within the various funding administration {industry}.

Agarwal additionally wrote a guide titled “Enterprise Know-how in Non-public Fairness” in 2013, which Adlakha calls the definitive guide on the topic even at present.

After engaged on fixing the dearth of compelling end-to-end software program for funding administration and investor relations administration groups, they started to create a brand new product providing within the type of PE Entrance Workplace and take it to clients worldwide. There may be a lot synergy of their imaginative and prescient that their paths have been meant to cross.

The higher echelon of PE Entrance Workplace is made up of Adlakha because the Chief Government Officer, Agarwal because the Chief Know-how Officer, and Raghav Gupta serving in a Senior Director function.

This administration staff combines IT experience, non-public fairness area information, and world operation expertise.

Various Funding Administration Trade

Adlakha says totally different asset courses within the various funding administration {industry}, particularly non-public debt, non-public fairness, and enterprise capital function in another way however they do share loads of widespread challenges together with prompt and easy accessibility to info, information safety, compliance, superior reporting, analytics, and so on.

He says PE Entrance Workplace differs from its opponents by providing an built-in answer that addresses these widespread challenges and necessities of all of the groups particularly, funding administration, investor relations, and finance/fund admin groups in an alternate funding administration agency.

Adlakha’s journey as an entrepreneur started as a part of the analysis and improvement staff at NIIT, the place he first launched an automatic testing instrument in 1995, the identical 12 months Microsoft launched Home windows 95 with Web Explorer 1.0.

Later, he developed a full-fledged studying administration answer (LMS) in 1997, a pioneering answer within the edtech area at the moment.

After working at NIIT, Adlakha held the function of supply head at Lionbridge Applied sciences, the place he led a CMM Stage 5 Product Improvement and Help Centre. He was additionally liable for the P&L for the event centre and offered pre-sales assist to the gross sales groups.

Later, as Chief Know-how Officer at Actis, Adlakha set group expertise requirements and ensured that the expertise technique underpins enterprise aims and meets person necessities.

Whereas at Actis, Adlakha and Agarwal seen how all of the end-to-end options accessible within the various funding administration area have been primarily meant for the finance and fund admin groups. In addition they noticed how funding administration and investor relations groups would both depend on Excel or find yourself utilizing a number of options and be depending on the CFO or COO for all information factors.

All these experiences, he says, performed a pivotal function in shaping the methods for progress at PE Entrance Workplace.

Whereas establishing the PE Entrance Workplace, they then designed a complete SaaS-based answer geared toward all of the stakeholders particularly catering to funding administration and investor relations groups.

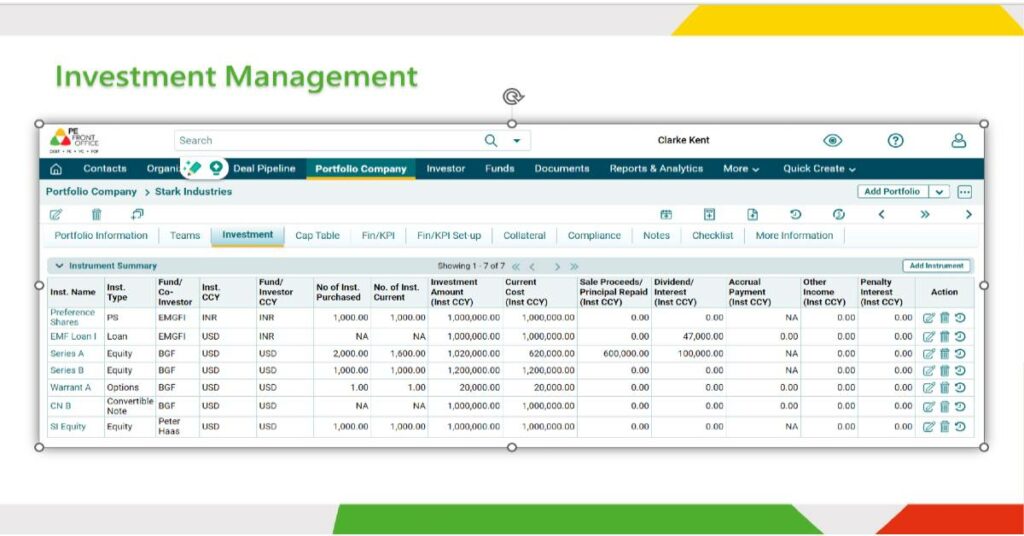

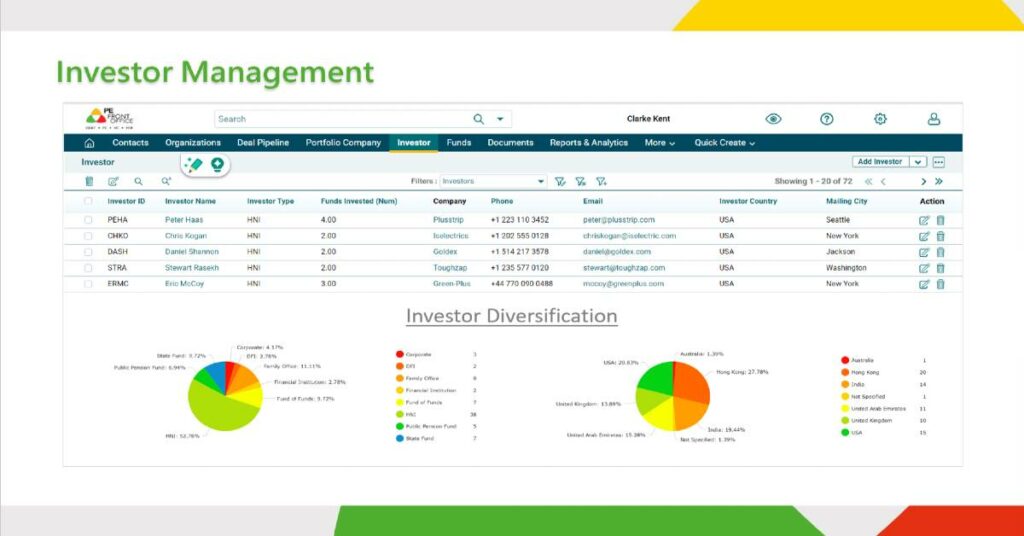

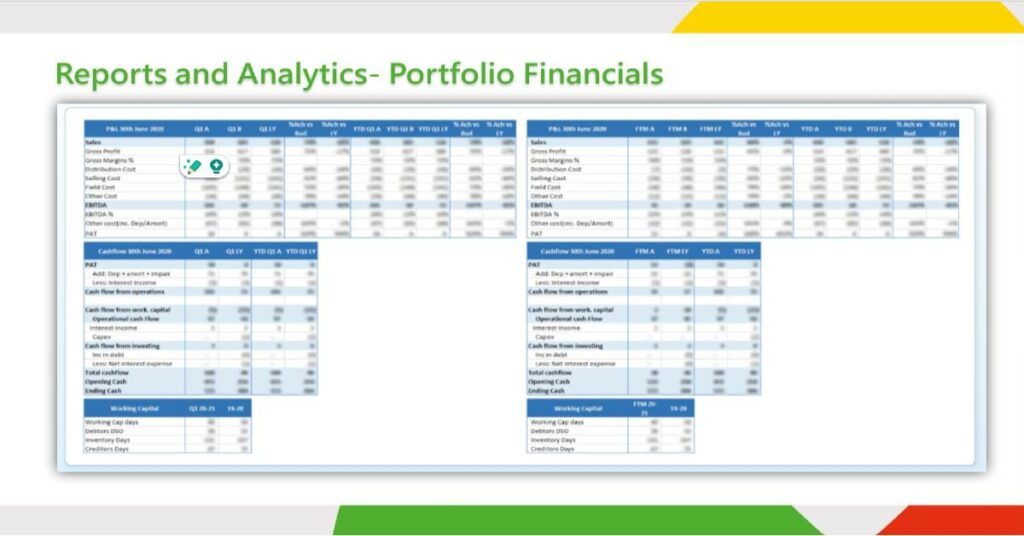

PE Entrance Workplace’s present answer contains Deal Stream, Funding Administration, Portfolio Monitoring, Fundraising, Investor Relations Administration and reporting, and Investor Portal.

“As the one built-in and complete SaaS-based answer, these groups can handle their full workflow and report by way of an intuitive person interface,” says Adlakha.

As a standard platform for all stakeholders, he says their answer serves as a single supply of fact for all information factors and reduces dependence on Excel and e-mail visitors between numerous groups and leads.

For PE Entrance Workplace, Adlakha says the preliminary problem was to create software program that was straightforward to make use of, fast to deploy, straightforward to configure and customise, and may very well be accessed by way of a number of platforms.

“This meant that the answer ought to characteristic an intuitive interface to get rid of the need for intensive coaching for the funding administration and investor relations groups,” he provides.

Digitisation

Like each different {industry}, Adlakha says even the choice funding administration {industry} is seeing an enormous shift due to digitization and tech infusion.

He explains that earlier the {industry} targeted solely on fundamental automation and effectivity, which concerned transitioning from paper-based techniques to digital options, together with CRM, and the storage of essential paperwork in digital codecs.

However now there was relentless progress with processes changing into extra environment friendly by the automation of duties and workflows, improved communication instruments, real-time collaboration, and doc sharing.

As a part of this digitisation drive, he says the {industry} has additionally witnessed a big shift in direction of leveraging massive information and superior analytics that permit funding professionals to make extra knowledgeable selections.

Nonetheless, he says the most important change has come within the type of important information being now not restricted to a couple executives and expertise permitting intuitive entry to information.

“Know-how permits intuitive entry to information by a number of gadgets and platforms, guaranteeing that groups keep linked and knowledgeable, whether or not they’re within the workplace, on the go, or working remotely,” explains Adlakha.

Moreover, clients at the moment are in search of a SaaS-based platform that is ready to talk within the buyer’s particular terminology and guarantees the shortest implementation cycle within the {industry}.

PE Entrance Workplace has constructed a software program answer for all of the stakeholders within the various funding administration {industry} that has a versatile framework to permit customizations as per the shopper’s particular performance, with an intuitive UI, and accessible throughout gadgets.

What’s the present state of digitisation? Adlakha says they’re witnessing a shift in direction of AI-driven algorithms able to analysing huge datasets, predicting market tendencies, and automating funding methods.

“This expertise provides the potential for extra correct decision-making and improved portfolio efficiency,” he provides.

Enlargement to Europe

PE Entrance Workplace operates in 15 international locations, together with the US, the UK, Europe, Africa, and APAC serving greater than 100 clients.

Whereas the platform was initially utilized by non-public fairness and enterprise capital market segments, it has now advanced to fulfill the wants of different segments equivalent to Non-public Debt, Fund of Funds, Restricted Companions, and Fund Admins.

Now, PE Entrance Workplace has determined to additional develop its attain within the European market because it stands as one of many world’s main monetary hubs.

Adlakha says the European market with its numerous economies, established monetary establishments, and plenty of funding alternatives has led to the expansion of the choice funding administration {industry}, which is a compelling prospect for his or her growth.

He provides that 80 per cent of personal debt, non-public fairness, and enterprise capital companies, significantly their funding administration and investor relations administration groups, depend on Microsoft Excel or some standalone software program.

“It’s inside this context that our alternative arises,” he says.

To develop in Europe, PE Entrance Workplace is taking a look at a multi-faceted method that goals to deal with numerous features of progress and improvement.

Adlakha says they’re taking a look at every part from outreach to potential clients and fostering connections, to elevating model visibility.

Whereas they plan to depend on advertising campaigns, leveraging digital platforms, and taking part in {industry} conferences, PE Entrance Workplace can even set up a bodily presence with devoted groups in key areas.

For PE Entrance Workplace, the audience is non-public debt, non-public fairness, enterprise capital, fund of funds, restricted companions, and fund directors.

Regulation and an eye fixed on the long run

Europe has come to be often called the usual for regulation and it has usually restricted companies from increasing to the market.

Adlakha says, “PE Entrance Workplace sees adherence to authorized and regulatory requirements as paramount to its operations and GDPR already holds significance inside its framework”.

He additional provides, “Our adherence to GDPR compliance ensures that the non-public information and knowledge of our purchasers and stakeholders are dealt with with the best ranges of care and safety.”

PE Entrance Workplace can be proactively following the requirements set forth by the Institutional Restricted Companions Affiliation (ILPA), that are well known as greatest practices within the {industry} and PE Entrance Workplace’s experiences are ILPA compliant.

As massive traders have shifted their focus in direction of profitability over progress, numerous small and medium-sized traders have stuffed the void.

For PE Entrance Workplace, these traders are potential clients in Europe and Adlakha sees their platform as a possibility for GPs, LPs, and household workplaces to lastly undertake software program for managing and monitoring their investments.

As a platform designed for a number of stakeholders inside the various funding administration {industry}, PE Entrance Workplace is uniquely positioned with its answer and value-added providers vis a vis information administration, customized reporting, and implementation led by a devoted account supervisor “to deal with the particular necessities of mid-sized and bigger GPs, LPs, and household workplaces.”

Adlakha says their main income is software program subscriptions whereas further income comes from customization and information migration providers.

He provides that PE Entrance Workplace is poised to generate a income of between €7.5 and €9.5M within the subsequent three years.

The corporate is at present increasing its groups throughout numerous features, together with expertise, advertising, gross sales, and account administration with plans to have staff members based mostly in Europe by subsequent 12 months.

Amidst software program companies attempting to develop in any respect prices, PE Entrance Workplace stands out with its method to make sure its software program fulfils at the least 80 per cent of buyer necessities out of the field and customising additional to ship on all fronts.

This capability to customize and tailor a singular product whereas additionally gathering additional insights units up PE Entrance Workplace to achieve a somewhat underserved market of other funding administration.

[ad_2]

Source link