shih-wei

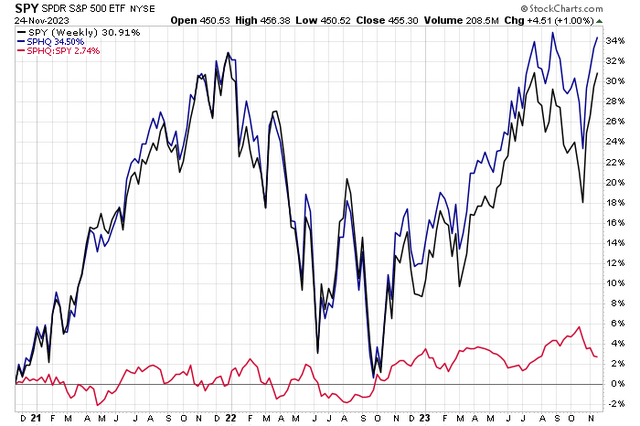

Excessive-quality S&P 500 shares have outperformed the broad US large-cap index over the previous three years. On a complete return foundation, the Invesco S&P 500 High quality ETF (NYSEARCA:SPHQ) is simply fractionally beneath its all-time weekly closing excessive, illustrated in the chart beneath. Whereas SPHQ has given again some relative positive aspects within the final month, contemplating the rebound led by riskier shares as rates of interest have turned decrease, SPHQ has a strong observe report.

I’ve a maintain ranking on the fund. Whereas it does not differ a lot from the SPX itself, a deal with a number of measures of high quality can supply some profit during times of market turmoil, however its portfolio is just not all that low-cost at present.

SPHQ: Small Alpha Produced Final 3 Years

Stockcharts.com

For background, SPHQ goals to trace an index of shares within the S&P 500 which have the highest high quality rating, which is calculated primarily based on three basic measures: return on fairness, accruals ratio, and monetary leverage ratio. The fund and the index are rebalanced and reconstituted semi-annually on the third Friday of June and December, in accordance with Invesco.

SPHQ is a big ETF with greater than $6.5 billion in property beneath administration, and its trailing 12-month dividend yield is about on par with the S&P 500’s at 1.55%. The ETF sports activities an “A” ETF Grade from Searching for Alpha for its sturdy share-price momentum traits, whereas a low 0.15% annual expense ratio earns SPHQ a strong A- ranking. The fund is just not overly dangerous given its large-cap and high quality building strategies and the ETF’s liquidity measures are strong contemplating the common each day quantity of barely multiple million shares and a 30-day median bid/ask unfold of simply two foundation factors as of November 24, 2023.

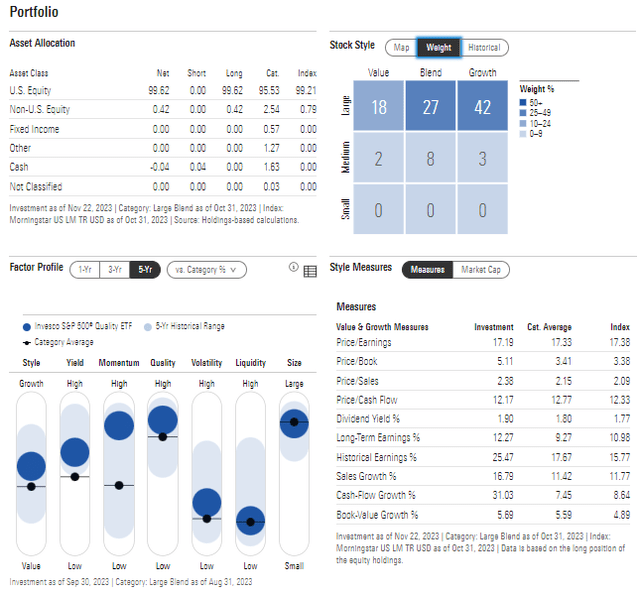

Digging into the portfolio, SPHQ is sort of totally a large-cap fund with simply 13% of property thought of mid-cap by Morningstar. The 5-star, Silver-rated fund by that analysis agency reveals a average 17.2 price-to-earnings ratio, although it’s costly on a price-to-book foundation. It additionally trades greater than 12 occasions money circulate, which can also be considerably dear. Lengthy-term earnings development is kind of sturdy, nevertheless.

SPHQ: Portfolio & Issue Profiles

Morningstar

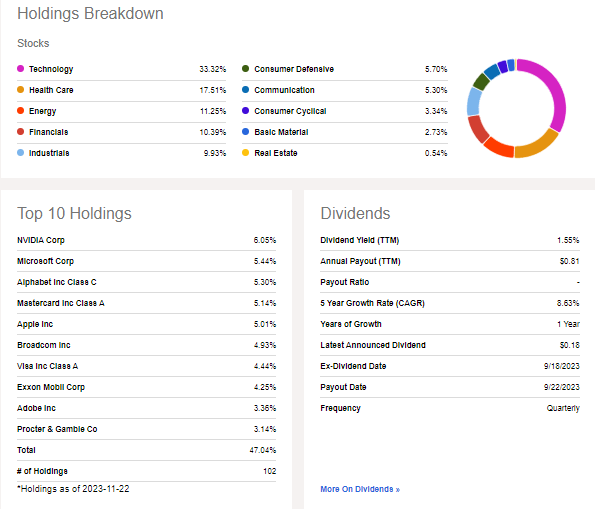

The portfolio breakdown reveals that the fund intently resembles the S&P 500, making me not overly excited to stray from the index by going obese this ETF. Tech is absolutely a 3rd of SPHQ however discover the highest holding – it is not Apple (AAPL) or Microsoft (MSFT), however fairly NVIDIA (NVDA). Normally, nevertheless, the allocation seems to be much like the SPX. There’s a little bit of an added threat in that just about half the fund is invested within the high 10 shares.

SPHQ: Holdings & Dividend Info

Searching for Alpha

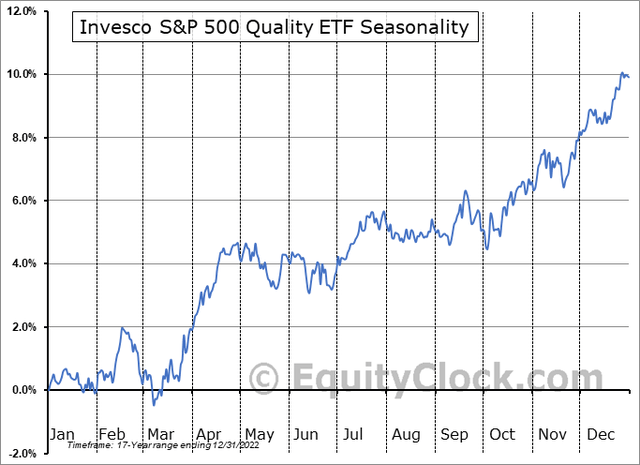

Seasonally, SPHQ tends to rally into year-end, however then sputter over the primary handful of weeks of the brand new yr, in accordance with information from Fairness Clock. Nonetheless, December has been optimistic 82% of the time over the previous 17 years, per the information’s historical past, and the everyday return within the remaining month of the yr is 1.4% with a 0.0% common achieve in January.

SPHQ Seasonality: Bullish Traits Into 12 months-Finish

Fairness Clock

The Technical Take

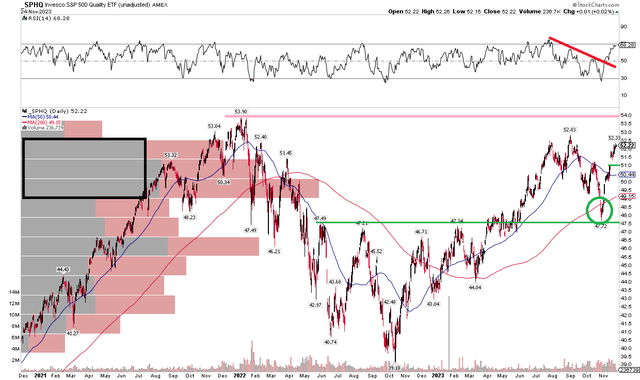

With an allocation and efficiency that each look near the S&P 500, the technical chart is likewise comparable. Discover within the chart beneath that shares are encroaching on all-time highs – a modest outperformance versus home giant caps. I believe new highs are in play over the approaching months now that the long-term 200-day transferring common is positively sloped.

Additionally, check out the RSI momentum oscillator on the high of the graph – it broke a downtrend line a number of weeks in the past, confirming the snapback in worth. A climb above the August peak of $52.83 would probably assist result in all-time highs earlier than the top of the yr amid optimistic seasonal tendencies proper now. On the draw back, be aware of a spot close to $51 – that would get crammed if we see troubling macro information quickly, however I see long-term help at $47.50 which held completely throughout the August to October correction.

Total, the technical state of affairs is usually strong, very like that of the S&P 500 at present.

SPHQ: RSI Breakout Confirms the Value Rebound, All-Time Highs In Play

Stockcharts.com

The Backside Line

I’ve a maintain ranking on SPHQ. Its very shut resemblance to the S&P 500 is considerably unappealing if you’re trying to sharply beat the market over time, however with modest alpha produced over the previous few years, it is also not a foul alternative if you wish to modestly tweak your US large-cap weighting fashion.