Bet_Noire

The disparity between publicity to shares by lively establishments and that of particular person traders stays sharp.

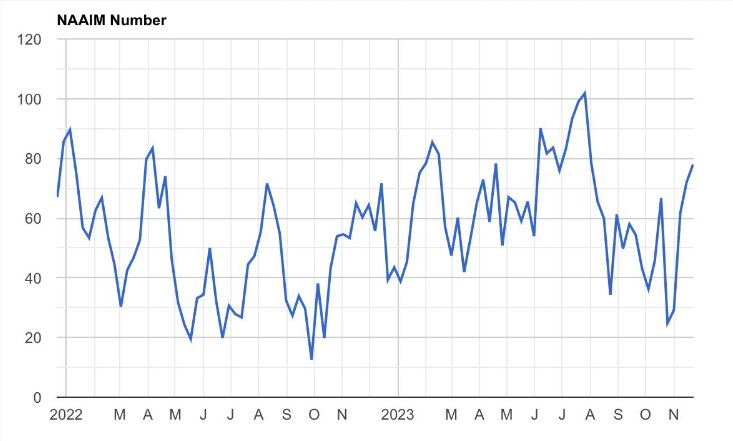

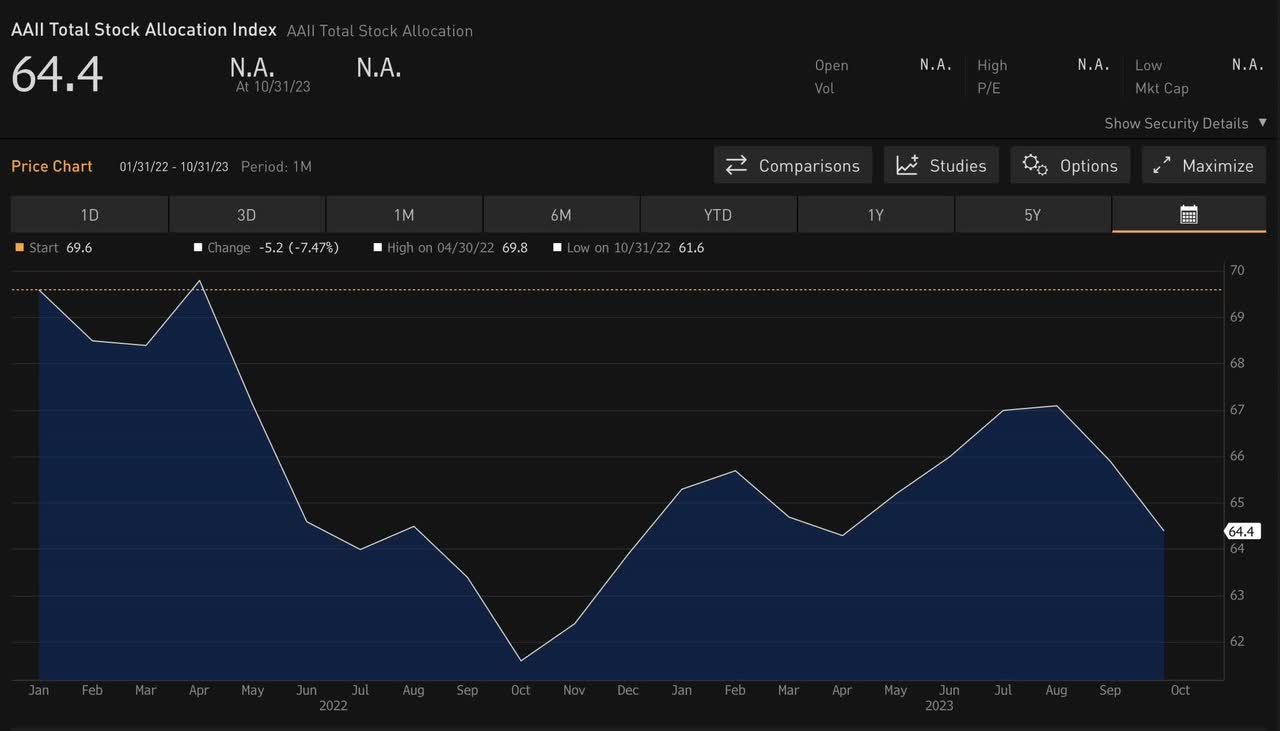

The Nationwide Affiliation of Lively Funding Managers’ Fairness Publicity Index and the American Affiliation of Particular person Buyers’ Whole Inventory Allocation Index are exhibiting two totally different instructions.

Liz Ann Sonders, chief funding strategist at Charles Schwab & Co, posted on X.com two charts exhibiting the NAAIM’s fairness publicity for lively cash managers, in comparison with the AAII’s.

The NAAIM Publicity Index represents the typical publicity to U.S. fairness markets reported by Charles Schwab, she mentioned. It “supplies perception into the precise changes lively danger managers have made to consumer accounts over the previous two weeks.”

Supply: Liz Ann Sonders through X.com

The AAII Whole Inventory Allocation Index, from Jan. 31, 2022, to Oct. 31, 2023, reveals present value.

Supply: Liz Ann Sonders through X.com