BackyardProduction/iStock by way of Getty Photos

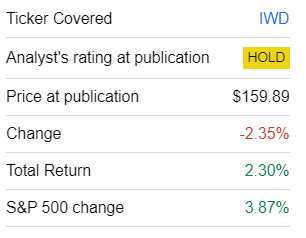

Persevering with my collection of sentiment and issue updates on exchange-traded funds, right now I wish to reassess the iShares Russell 1000 Worth ETF (NYSEARCA:IWD), which I beforehand coated in July 2021 with a Maintain ranking.

For me, as a high quality and value-focused investor (I actually recognize an sufficient dose of progress, however solely when different important components are properly balanced), the three details of concern have been 1) the simplicity of the fund’s technique, which made it liable to misinterpretations of a inventory’s worth profile, 2) a too-small share of firms with a sexy Looking for Alpha Quant Valuation ranking, and three) the considerably tender returns IWD delivered previously.

Since then, this portfolio has been recalibrated a number of instances, with about 8.5% of the holdings current within the July 2021 model eliminated. Although the fund was principally profitable in countering bearish forces in 2022, delivering a double-digit alpha, its returns this 12 months depart so much to be desired, so because the earlier be aware, it has underperformed the S&P 500.

Looking for Alpha

Right now’s article is meant to precise issues just like these summarized above however primarily based on recent information.

The technique’s simplicity hinders IWD from delivering a better-valued combine

Based on its web site, the premise of IWD’s technique is the Russell 1000 Worth Index, which it has been monitoring since its inception in Might 2000. As I mentioned within the earlier be aware, the methodology of this index is fairly the alternative of extremely selective. It does depend on a composite worth rating (as per the methodology doc obtainable on the LSEG web site), which could sound a bit refined upon cursory view. However as described within the prospectus:

The Underlying Index is a subset of the Russell 1000® Index… The Underlying Index measures the efficiency of fairness securities of Russell 1000 Index issuers with decrease price-to-book ratios, decrease sales-per share historic progress and decrease forecasted progress relative to all issuers whose securities are included within the Russell 1000 Index.

So this rating incorporates just one valuation ratio, Value/E book, additionally ignoring pure variations current between industries (i.e., financials are solidly cheaper than IT, and so forth.). I’m not snug with this simplicity. Let me illustrate why this strategy is susceptible with the instance of earnings yield and EV/EBITDA.

As of November 27, IWD had a portfolio of 848 equities, with financials being the highest sector with a 21.3% weight, in distinction to the IT-heavy iShares Russell 1000 ETF (IWB). As financials are likely to commerce at modest P/Es, IWD’s earnings yield of 5.6% doesn’t come as a shock; actually, this can be a strong consequence for a fund with a weighted-average market cap of $137.9 billion. It’s value noting that the yield I calculated is predicated on the web revenue and market capitalization, with destructive figures included. It appears the fund’s methodology is a bit totally different from mine, as its web site reveals a P/E of 15.45x, which interprets into an excellent stronger EY of 6.5%. On the similar time, IWB shows a P/E of twenty-two.2x (which means a 4.5% EY).

| Metric | 27-Nov |

| Market Cap | $137.94 billion |

| EY | 5.61% |

| P/S | 3.27 |

| EPS Fwd | 6.11% |

| Income Fwd | 6.22% |

| ROE | 16.05% |

| ROA | 5.97% |

Calculated by the creator utilizing information from Looking for Alpha and the fund. Based mostly on the monetary information as of November 28

Nevertheless, that is simply the tip of the iceberg. Allow us to take a look at what a distinct a number of, most fitted for capital-intensive and debt-heavy companies, can inform. The next desk compiles the trailing twelve twelve months Enterprise Worth/EBITDA ratios for all of the sectors IWD has publicity to apart from financials.

| Sector | Portfolio Median EV/EBITDA | Sector Median EV/EBITDA |

| Communication | 13.13 | 8.37 |

| Client Discretionary | 12.44 | 10.43 |

| Client Staples | 13.24 | 12.21 |

| Vitality | 9.83 | 5.69 |

| Well being Care | 12.45 | 14.17 |

| Industrials | 12.57 | 11.96 |

| Data Expertise | 12.76 | 15.28 |

| Supplies | 12.76 | 8.59 |

| Actual Property | 12.37 | 16.03 |

| Utilities | 13.04 | 12.02 |

Calculated utilizing information from Looking for Alpha and the fund

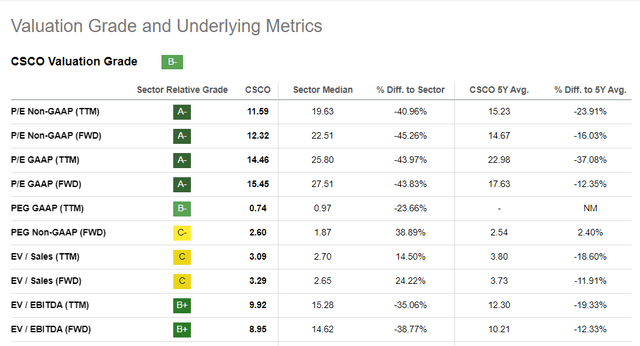

This desk basically ruins the speculation of IWD’s sturdy worth traits, because the medians for its holdings are principally above the precise sector medians, with the exception being solely IT, healthcare, and actual property. A pleasant instance is Cisco Programs (CSCO), the ETF’s largest place within the IT sector (1% weight), which has a 9.92x EV/EBITDA vs. the sector median of 15.28x.

Looking for Alpha

Subsequent, IWD’s valuation drawback is vividly illustrated by the truth that simply ~19.2% of its holdings have a B- Quant Valuation grade or higher; that is considerably decrease even in comparison with July 2021, when the share was about 32%. In the meantime, over 55% have a D+ ranking or worse.

The weighting schema helps high quality, however progress lags expectably

A number of feedback needs to be made on progress and high quality exposures. Because the index just isn’t supposed to focus on growthier shares (it does fairly the opposite), each ahead income and earnings per share progress charges are solely modest, within the mid-single-digits.

Curiously, the fund nonetheless holds a number of notable gross sales progress tales, predominantly from the buyer discretionary sector, with probably the most exceptional listed beneath:

| Image | Weight | Sector | Income FWD |

| Rivian Automotive (RIVN) | 0.06% | Client Discretionary | 386.32% |

| Lucid Group (LCID) | 0.02% | Client Discretionary | 271.34% |

| Norwegian Cruise Line (NCLH) | 0.02% | Client Discretionary | 143.04% |

| Carnival Company & plc (CCL) | 0.08% | Client Discretionary | 133.24% |

| Royal Caribbean Cruises (RCL) | 0.09% | Client Discretionary | 117.45% |

Knowledge from Looking for Alpha and the fund

IWD’s high quality can be removed from phenomenal, however there may be not a lot to criticize harshly nonetheless. Because the Russell 1000 doesn’t require income to be delivered to turn out to be a constituent (not like the S&P 500), about 7.2% of IWD’s holdings are loss-making firms. This additionally makes its 16% Return on Fairness, along with publicity to debt-heavy companies, a lot much less dependable. Concerning Return on Property, I see a principally acceptable however nonetheless clearly not splendid determine. Nevertheless, the silver lining right here is that 89% of the holdings have a B- Quant Profitability ranking or stronger, which makes me conclude that high quality traits are usually sound regardless of a number of disappointments.

Combined efficiency

Launched on the very starting of the dot-com bubble burst, IWD was nonetheless a gross success story within the aughts because it outperformed the Russell 1000 ETF in addition to the iShares Core S&P 500 ETF (IVV) from 2000 to 2006, almost definitely owing to its smaller publicity to growthier shares that have been decimated amid the market droop. So its comparatively sturdy annualized complete return (on par with IVV and IWD) delivered throughout the June 2000-October 2023 interval is principally the consequence of that.

| Portfolio | IVV | IWD | IWB |

| Preliminary Steadiness | $10,000 | $10,000 | $10,000 |

| Remaining Steadiness | $45,443 | $43,920 | $46,642 |

| CAGR | 6.68% | 6.52% | 6.80% |

| Stdev | 15.28% | 15.38% | 15.57% |

| Finest Yr | 32.30% | 32.09% | 32.78% |

| Worst Yr | -37.02% | -36.47% | -37.40% |

| Max. Drawdown | -50.78% | -55.38% | -51.04% |

| Sharpe Ratio | 0.4 | 0.39 | 0.4 |

| Sortino Ratio | 0.57 | 0.55 | 0.57 |

| Market Correlation | 0.99 | 0.95 | 1 |

Knowledge from Portfolio Visualizer

Curiously, over that interval, it captured considerably much less upside than IWB, but it was additionally not that susceptible to bears as its draw back seize ratio was additionally decrease.

| Metric | IVV | IWD | IWB |

| Upside Seize Ratio (%) | 95.51 | 89.98 | 97.53 |

| Draw back Seize Ratio (%) | 96.1 | 90.68 | 97.84 |

Knowledge from Portfolio Visualizer

A ten-year interval (November 2013-October 2023) was much less profitable for the technique, because it not solely materially underperformed each IVV and IWB but additionally had a steeper max drawdown and the very best normal deviation.

| Portfolio | IVV | IWD | IWB |

| Preliminary Steadiness | $10,000 | $10,000 | $10,000 |

| Remaining Steadiness | $28,712 | $20,423 | $27,706 |

| CAGR | 11.12% | 7.40% | 10.73% |

| Stdev | 14.94% | 15.16% | 15.15% |

| Finest Yr | 31.25% | 26.13% | 31.06% |

| Worst Yr | -18.16% | -8.42% | -19.19% |

| Max. Drawdown | -23.93% | -26.73% | -24.57% |

| Sharpe Ratio | 0.7 | 0.47 | 0.67 |

| Sortino Ratio | 1.08 | 0.69 | 1.03 |

| Market Correlation | 1 | 0.95 | 1 |

Knowledge from Portfolio Visualizer

Remaining ideas

IWD gives publicity to a barely better-valued portion of the Russell 1000, however it’s actually not a maximalist technique. Owing to its underlying index’s methodological intricacies, it could have an overlap with the iShares Russell 1000 Development ETF (IWF); in the mean time, the overlap is roughly 26.7%, as per my calculations.

After dissecting the portfolio for the second time, I nonetheless don’t see an element combine engaging sufficient. At this juncture, IWD has a powerful 5.6% earnings yield, however the issue is that it’s unappealing from different angles.

I see a mixture that will be neither completely match for betting on the tech/progress rally to achieve momentum, thus basically anticipating an rate of interest reduce sooner in 2024, nor appropriate for expressing an reverse view and getting ready for the higher-for-longer atmosphere. There might be no ranking improve, and IWB stays a Maintain at finest.