jetcityimage

Funding Thesis

Preview

We initially coated Thermo Fisher Scientific (NYSE:TMO) in our article “Thermo Fisher Scientific: From Pandemic Increase To Extra Sustainable Progress Path” in March this 12 months. Our thesis was constructed on the corporate’s present trajectory of normalizing from its growth caused by the pandemic. We recognized its excessive debt and low cash-on-hand as elements to reckon with, given our expectation of progressively drifting decrease earnings forward. Since then, the corporate’s inventory has declined by as a lot as 20% however later bounced again. It’s now about solely 8% decrease than in March.

Updates

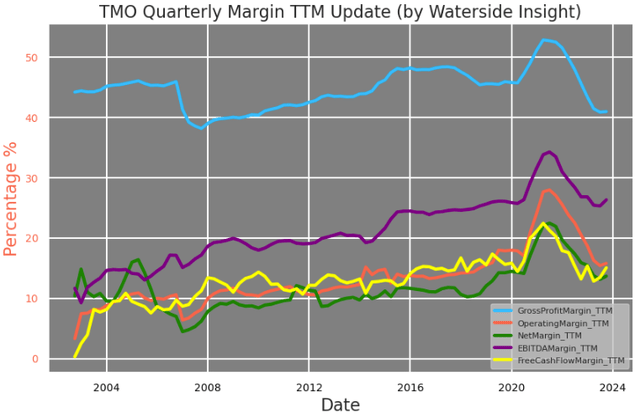

Though Thermo Fisher’s income continues to be at its all-time excessive ranges, its margins have indicated it’s principally again to pre-pandemic ranges. This confirmed the place we identified earlier than that it’s on a path to extra sustainable progress normalizing from the pandemic growth.

Thermo Fisher: Quarterly Margins Replace (Calculated and Charted by Waterside Perception with knowledge from firm)

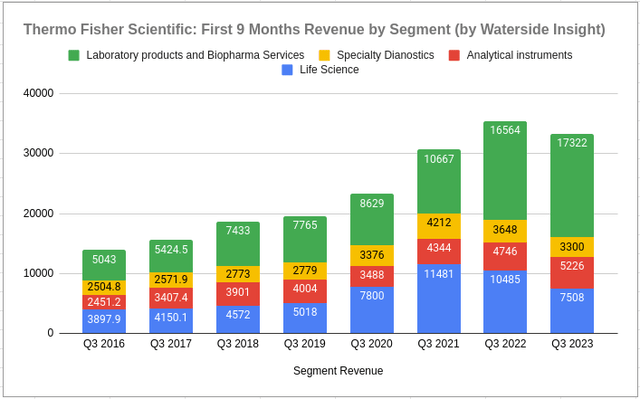

We beforehand anticipated the corporate to deal with its excessive debt stage and develop new progress patterns within the post-pandemic world. Within the up to date charts under, we are able to see the most important income slowdown is within the Life Science Resolution (LSS) section. The acquire for the Lab & Biopharma (LPBS), and Analytical Devices (AI) segments are exhibiting endurance. They each have continued to increase since 2020.

Thermo Fisher: First 9 Months Income by Phase (Calculated and Charted by Waterside Perception with knowledge from firm)

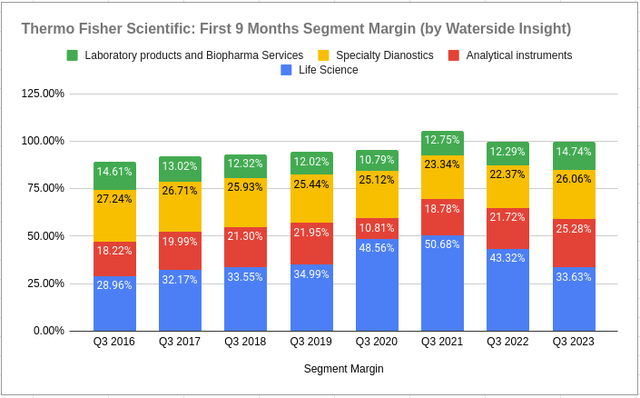

From every section margin’s perspective, most of them held up on a YoY foundation aside from Life Science Options (LSS) once more. However its margin was falling again to the place it was in 2019. All different three segments’ margins had been having regular progress in comparison with pre-pandemic.

Thermo Fisher: First 9 Months Phase Margin (Calculated and Charted by Waterside Perception with knowledge from firm)

The LSS section is crucial to Thermo Fisher, and the corporate has been taking actions geared toward strengthening its aggressive benefit. The corporate is increasing a strategic partnership with Flagship Pioneering to type new platform firms for all times science, and it did not cease there. It’s within the course of of constructing a $3.1 billion acquisition of Olink, a number one supplier of next-generation proteomics options. Olink is ready to grow to be a part of the Life Science Options section. In response to the acquisition announcement, Olink is anticipated to ship $200 million in income in ’24 and develop in mid-teen yearly. It’s also anticipated to ship $125 million of revenue by 12 months 5. So if we assume it grows 15% per 12 months, by 12 months 5, its income shall be $350 million, then the anticipated web revenue margin is 35.73% for Olink. It’s about the identical because the LLS section’s present margin, however the potential of proteomics has far larger implications for Thermo Fisher. Within the newest area of biopharma analysis, combining the proteomics method with genomics and bioinformatics gives a larger in-depth understanding of the data of the organic programs together with their illness alteration. That is extremely complementary to TF’s present mass spectrometry platforms and purposes.

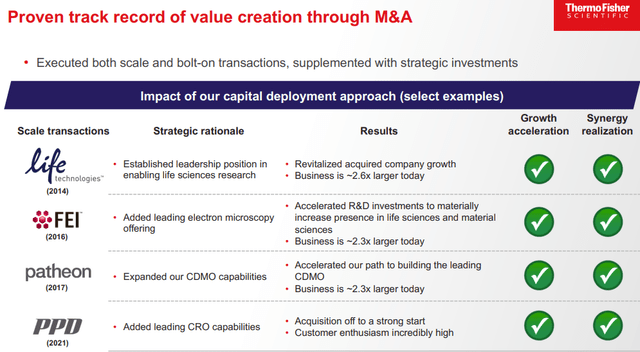

Thermo Fisher has a confirmed monitor report of profitable M&As. The acquisitions it made throughout the 5 years earlier than the pandemic have grown greater than 2x. Since then, in 2021 it acquired PPD for the Laboratory Merchandise and Companies Phase, which strengthened the drug improvement course of, and later modified the title of this section to Laboratory Merchandise and Biopharma. The LPBS section grew by 45% in income within the subsequent 12 months after this acquisition. Additionally by the tip of 2022, it acquired the Binding Website Group specializing in early analysis and monitoring through common testing in affected person care to boost the Specialty Diagnostics section, anticipating so as to add $0.07 EPS this 12 months. Since then, the SD section’s income has stayed flat within the first 9 months however its margin elevated by 16.5%. Acquisitions have at all times been an built-in a part of Thermo Fisher’s progress technique, however Traders must also take note of its goodwill, which is sitting at about $45 billion or 47% of its belongings, up from 42% earlier than the pandemic. From this angle, till it accumulates a bigger pile of money with sooner asset progress, its deal-making subsequent 12 months may very well be smaller.

Thermo Fisher: Document of M&A (Firm Presentation)

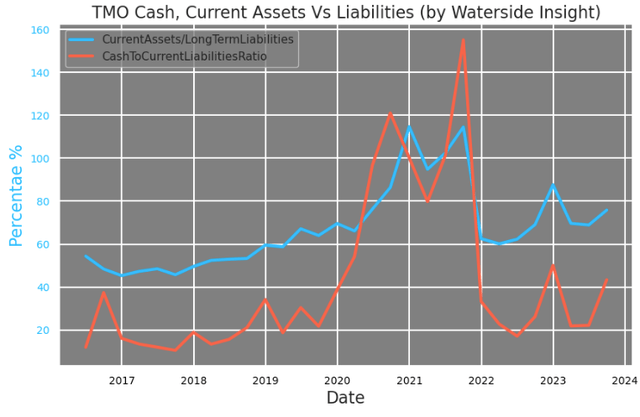

On the debt entrance, which is one other side that we beforehand needed to see enchancment on, Thermo Fisher has additionally made some progress. It repaid $2 billion or 5% of debt within the first 9 months of this 12 months, up from $375 million for a similar interval final 12 months, Its complete debt nonetheless grew by 2.3% this 12 months after this compensation. It paid about $1.9 billion of economic paper this 12 months however is at present within the technique of issuing one other $2.5 billion of notes. Its money and money equivalents cowl about 40% of its present liabilities, which was up from the 20% low earlier within the 12 months. The Olink acquisition requires about $143 million in money, and we count on this ratio will return all the way down to 20-30% once more. Its present belongings are overlaying about 80% of its long-term liabilities, a bit greater than pre-pandemic. Its leverage over its liquidity is throughout the norm, however there’s restricted room to go greater. We expect a minimum of for the subsequent three years, it might want to proceed decreasing its debt by an analogous measurement as this 12 months.

Thermo Fisher: Present Belongings vs Liabilities (Calculated and Charted by Waterside Perception with knowledge from firm)

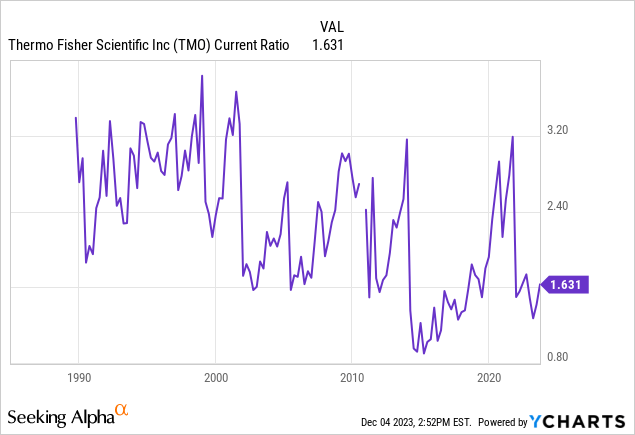

The corporate’s present ratio has improved by a tad to above 1.5x, and its common prior to now twenty years is about 2x. Thermo Fisher has additionally simply licensed $4 billion of share repurchase in November, changing its remaining $1 billion present authorization. It has made $3 billion in frequent inventory repurchases and a $387 million dividend payout within the first 9 months to date. However we expect the repurchase for subsequent 12 months may very well be smaller.

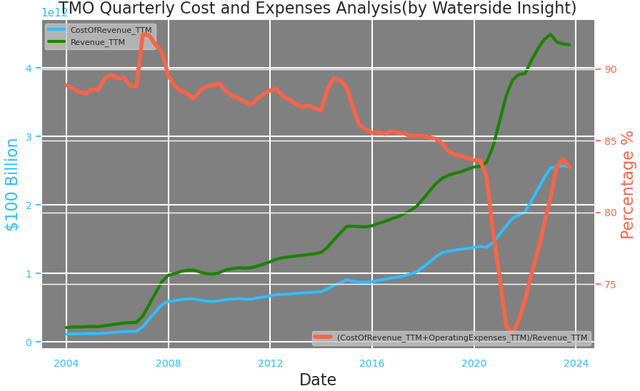

For execution in price discount and effectivity enchancment, Thermo Fisher executes a PPI system, quick for Sensible Course of Enchancment (PPI) enterprise system. On this system, the corporate deploys international sourcing initiatives, headcount discount, amenities consolidation, and low-cost area manufacturing methods to maintain prices and bills beneath management. Such a system helped it to navigate the part with provide chain constraints successfully prior to now two years. Now its prices and bills are again as much as the extent of 2020. With extra acquisitions achieved prior to now three years, together with the continued one in every of Olink, there’s room for the PPI system to be put to work with extra consolidation and maybe headcount discount as nicely with a purpose to keep the margins.

Thermo Fisher: Prices and Bills (Calculated and Charted by Waterside Perception with knowledge from firm)

Total, we see Thermo Fisher making progress within the areas that we had been involved about and our expectation of its normalization has principally materialized prior to now six months. The corporate has made one massive acquisition per 12 months of targets that may finest complement its present portfolio searching for long-term progress drivers. However the tempo or the dimensions may reasonable subsequent 12 months if it makes any acquisitions. To take a pause and consolidate its present holdings most likely would not be a nasty concept.

Monetary Overview & Valuation

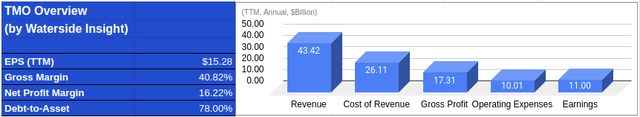

Thermo Fisher: Monetary Overview (Calculated and Charted by Waterside Perception with knowledge from firm)

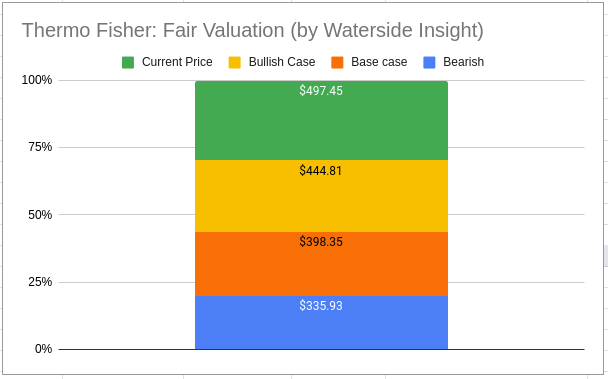

Thermo Fisher has drastically diminished its CapEx since early this 12 months, from over $500 million to now about $300 million quarterly. This has introduced the CapEx again all the way down to the place it was in 2020. We initially anticipated its free money stream would decline by about 15% this 12 months, however attributable to this discount, it is now on monitor to solely reduce by 5% YoY. Its CapEx is difficult to be diminished farther from right here. So for us, a free money stream slowdown continues to be to be anticipated in 2024 if web revenue does not enhance. And its rising debt stage has prompted us to extend the WACC to eight.4% from 6.77% beforehand, given the upper rate of interest surroundings. The up to date truthful worth evaluation has been revised down with present costs topping our bullish case.

Thermo Fisher: Honest Valuation (Calculated and Charted by Waterside Perception with knowledge from firm)

Conclusion

Amidst a normalization from the pandemic-induced growth, Thermo Fisher has continued to make progress on a number of fronts to maintain long-term progress intact, decreasing debt and strengthening its money reserve. However these efforts should not going to be one-off, and they’re going to must be saved up within the subsequent few quarters, whereas extra consolidation may very well be on the cardboard. The rising worth because the finish of October has taken the inventory above our revised truthful valuation. Though we’re optimistic about its long-term progress, we are going to suggest a promote primarily based on the wealthy premium embedded.