In a major milestone for the burgeoning Indian shares, India is now host to over 500 firms with billion-dollar market capitalisation, reflecting the transformation of a market from its humble beginnings below a banyan tree to the fourth-largest place globally, now.

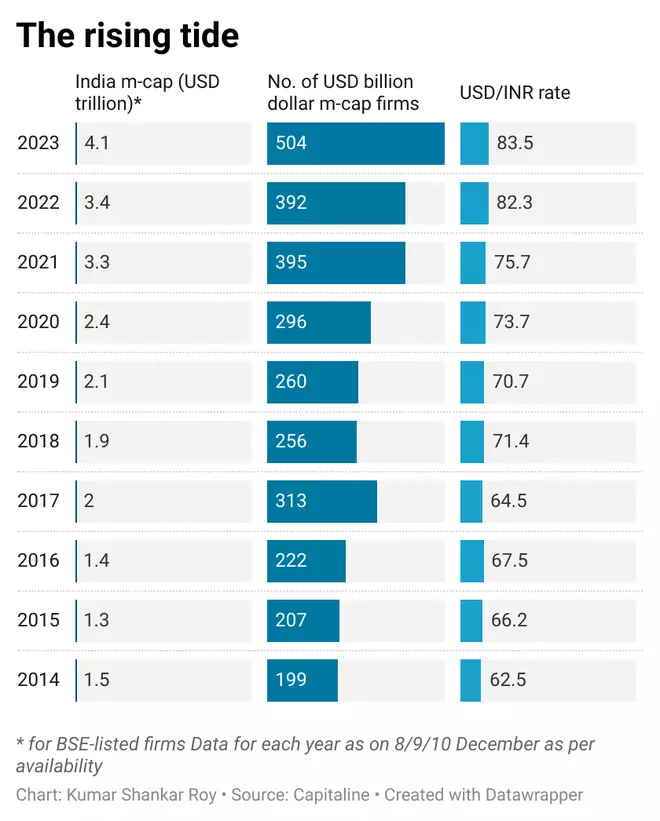

In only a 12 months, the variety of billion-dollar listed corporations on the BSE has surged from 392 to 504, a powerful improve of 112. This marks essentially the most substantial rise within the final decade.

Over the previous ten years, the billion-dollar agency membership has expanded 2.5 occasions in sync with the inventory market’s wealth ascent.

Already, 2023 has been marked by milestones for Indian markets and the economic system, with the market now ranked fourth on the planet, boasting an fairness market capitalisation exceeding $4 trillion. This positions it behind the US, China (together with Hong Kong), and Japan.

Topping the 500-mark for this thriving ecosystem of billion-dollar firms in India is an accomplishment pushed by components such because the sturdy fairness rally through the Narendra Modi authorities’s tenure, high-value IPO listings, and elevated wealth beneficial properties for mid- and small-cap shares.

Deciphering drivers

The resounding long-term rally in Indian shares, which commenced in late 2013, has performed a vital function in boosting the billion-dollar membership from the standard RIL, TCS, HDFC Financial institution, and many others., to the likes of Caplin Level, India Cements, KRBL, VIP Industries, ION Change, JK Tyres, and MedPlus. Beginning just under 200 in December 2014, the rely progressed to over 300 by December 2017 as markets rose by over 50 per cent throughout this era.

Nevertheless, the correction in 2018 noticed the billion-dollar membership shrink to 256 in December 2018. The quantity remained virtually stagnant at lower than 400 for 2 successive years — 2021 and 2022 — however the rebound in home equities from late March 2023 helped the tally ultimately cross the psychologically essential 500-mark (see chart). One other contributing issue to the enlargement of the billion-dollar firm circle is the rising variety of IPO listings, with a lot of them being high-value on the again of supportive insurance policies and a vibrant entrepreneurial ecosystem.

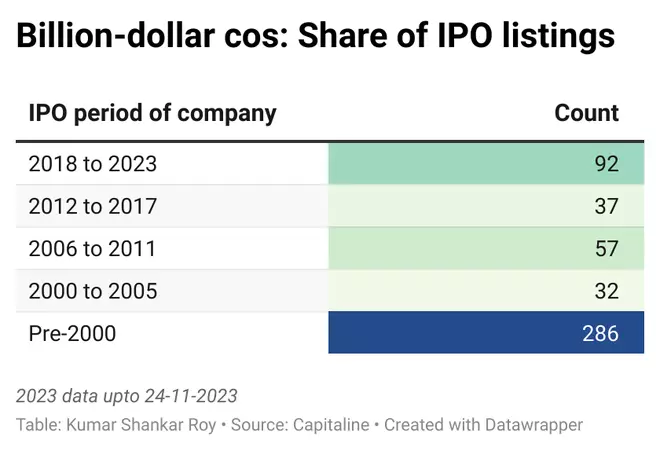

Of the 180 firms which have listed within the final 5 years, over 90 reminiscent of Tata Tech., JSW Infra, Mankind Pharma, LIC, Latent View, Zomato, and CAMS, at the moment maintain billion-dollar market capitalisation standing.

The brand new listings account for practically 20 per cent share of the general 504-strong membership. Personal sector enterprise teams (excluding the highest ones) account for 36 per cent of the billion-dollar membership as we speak, in comparison with 17 per cent in 2014. Rising wealth beneficial properties for mid- and small-cap shares have performed a job in rising the billion-dollar fraternity.

Mid- & small-cap beneficial properties

For example, within the final 12 months, BSE Largecap index market capitalisation has risen by round 12 per cent, however the identical is far larger at 28 per cent for BSE Mid-cap and 37 per cent for BSE Small-cap. This development extends over longer durations, reminiscent of 5 and 10 years, too.

Alongside the way in which, the billion-dollar membership confronted market corrections, however essentially the most important hurdle might be the depreciating rupee. From round ₹62 to the greenback in 2014 to over ₹83 at the moment in 2023, the foreign money impression on the billion-dollar membership is unmistakable. Hypothetically, if the US greenback was at 2014 ranges as we speak, the membership can be a lot larger, near 600 as we speak.

Whereas the 504 billion-dollar firms in India come from quite a few sectors, a lot of the elite members are predominantly from Finance (47), Capital Items (33), IT and Pharma (30 every), Banks (29), Auto and Auto Ancillaries (25), Chemical compounds (23), Metal (16), FMCG (15), and many others.